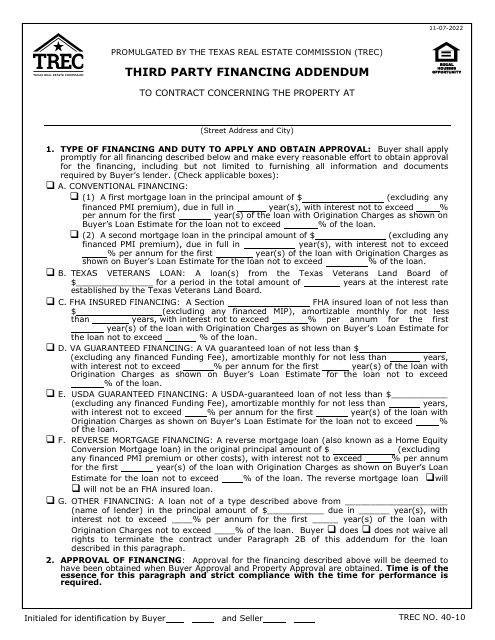

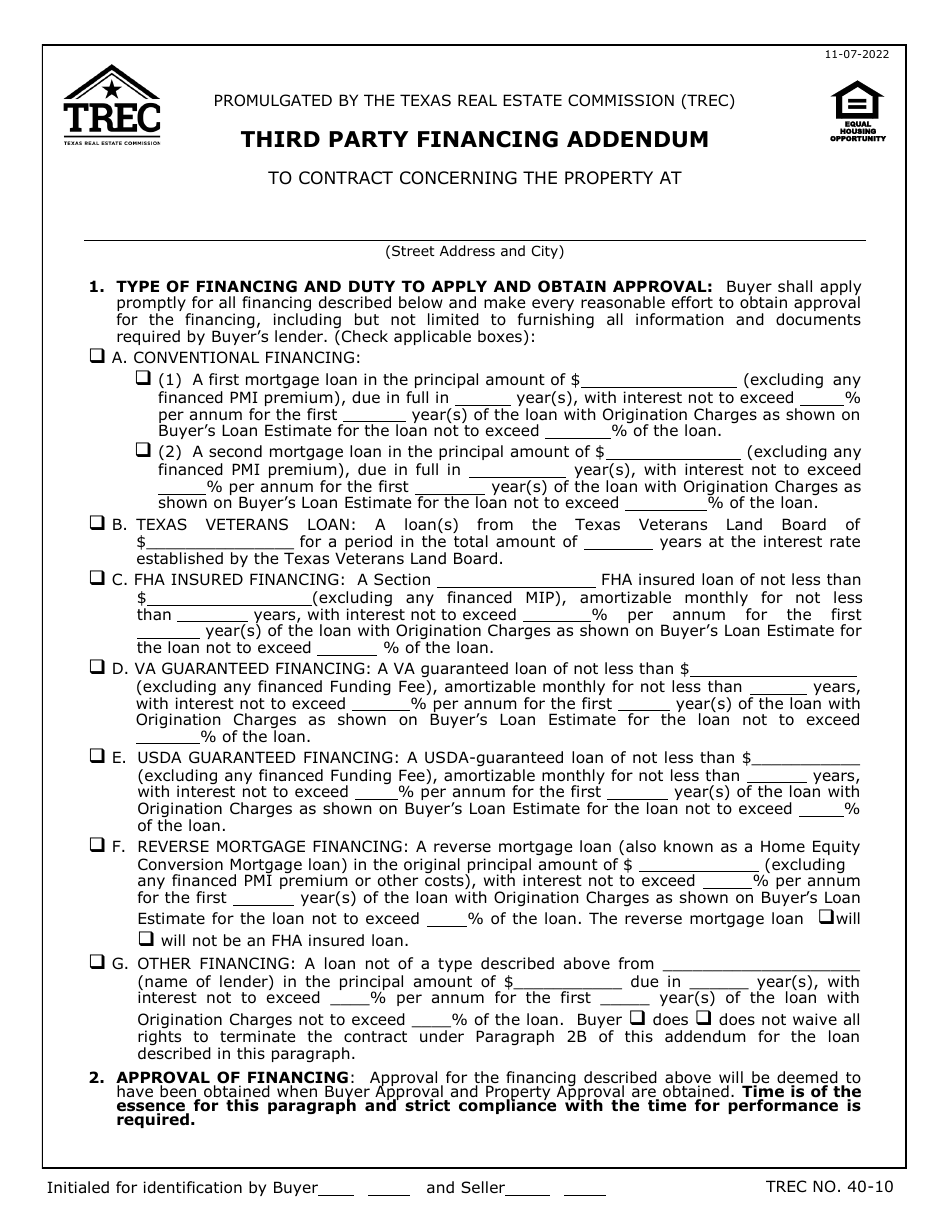

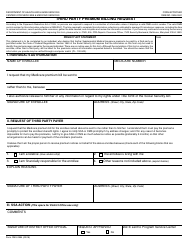

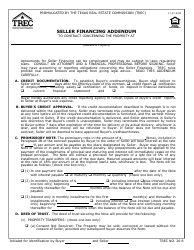

TREC Form 40-10 Third Party Financing Addendum - Texas

What Is TREC Form 40-10?

This is a legal form that was released by the Texas Real Estate Commission - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the TREC Form 40-10?

A: The TREC Form 40-10 is the Third Party Financing Addendum for real estate transactions in Texas.

Q: What is the purpose of the Third Party Financing Addendum?

A: The Third Party Financing Addendum is used to specify the terms and conditions of financing for the purchase of a property.

Q: Who fills out the TREC Form 40-10?

A: The form is typically filled out by the buyer's agent in consultation with the buyer.

Q: What information is included in the Third Party Financing Addendum?

A: The addendum includes details about the financing terms, such as the loan amount, interest rate, lender information, and any contingencies related to the financing.

Q: Is the Third Party Financing Addendum mandatory in Texas?

A: No, it is not mandatory, but it is commonly used in real estate transactions involving third-party financing.

Q: Can the financing terms be negotiated after signing the addendum?

A: Yes, the financing terms can be negotiated between the buyer and the lender after signing the addendum.

Q: What happens if the buyer is unable to secure financing?

A: If the buyer is unable to secure financing, there may be provisions in the addendum that allow the buyer to terminate the contract without penalty.

Q: Can the seller cancel the contract if the buyer doesn't obtain financing?

A: Yes, if the buyer fails to obtain financing within the specified timeframe, the seller may have the right to cancel the contract.

Form Details:

- Released on November 7, 2022;

- The latest edition provided by the Texas Real Estate Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TREC Form 40-10 by clicking the link below or browse more documents and templates provided by the Texas Real Estate Commission.