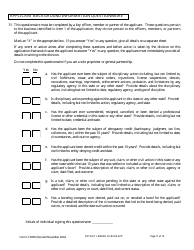

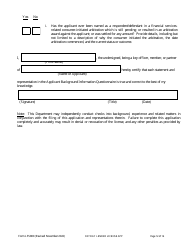

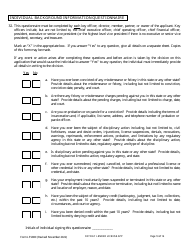

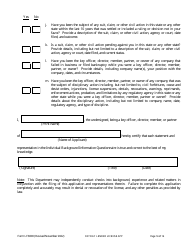

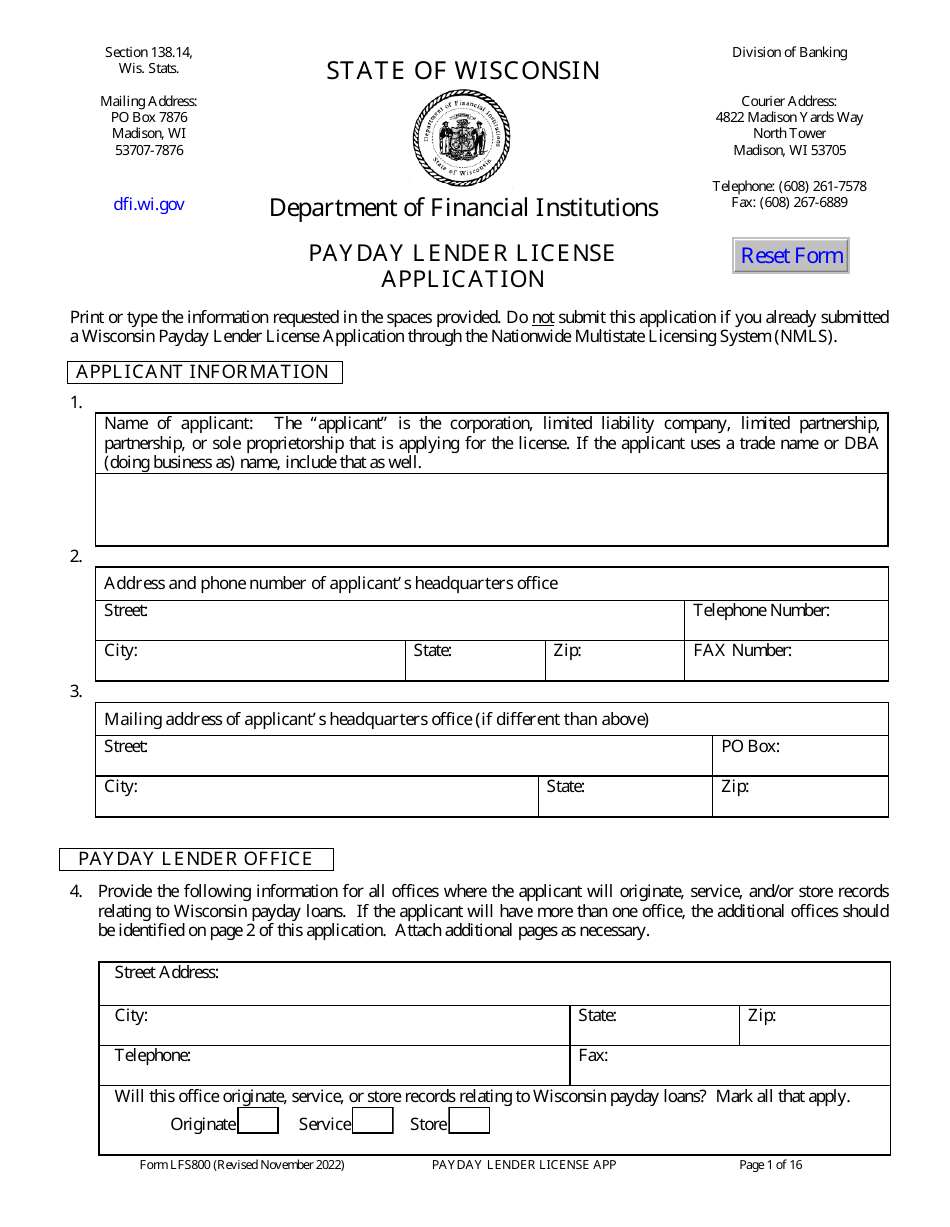

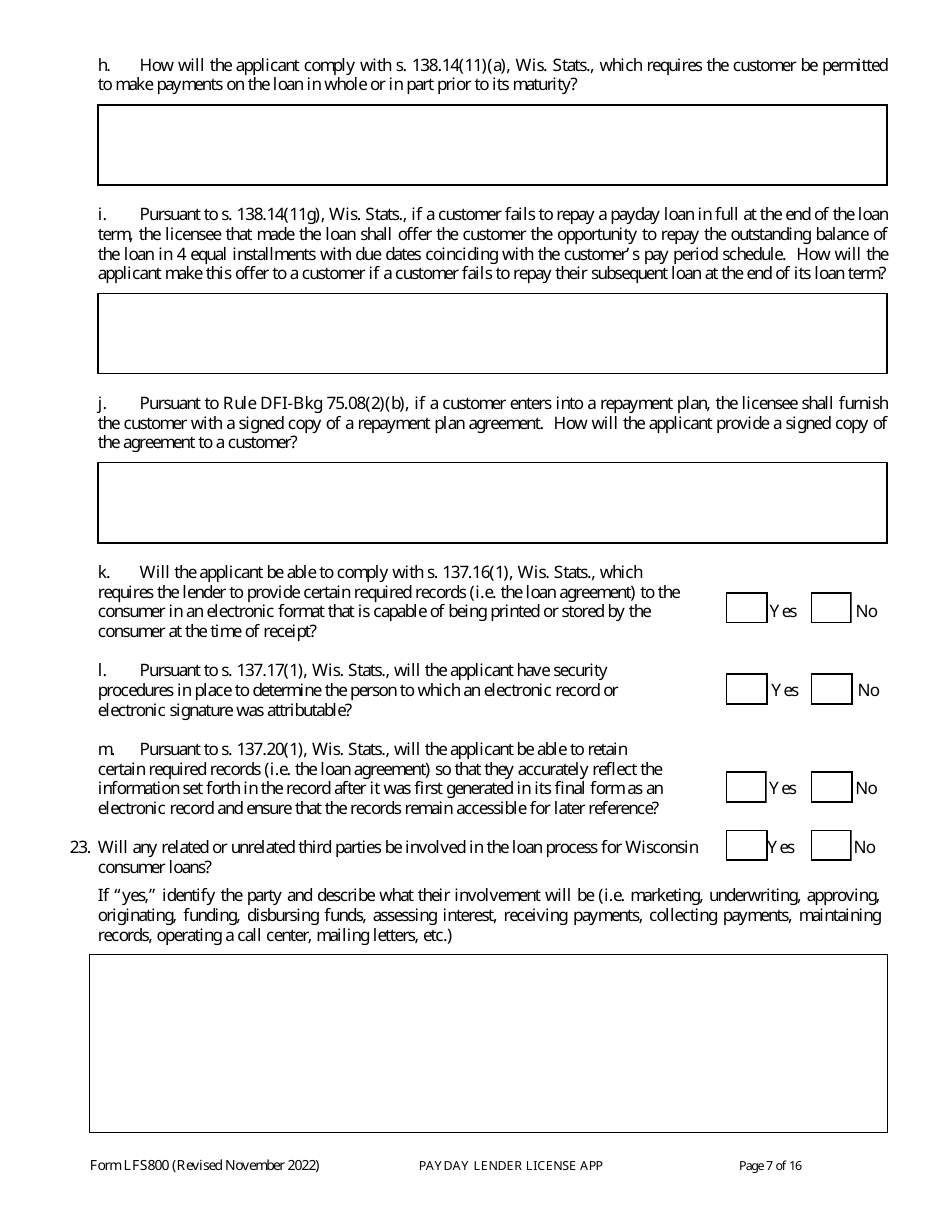

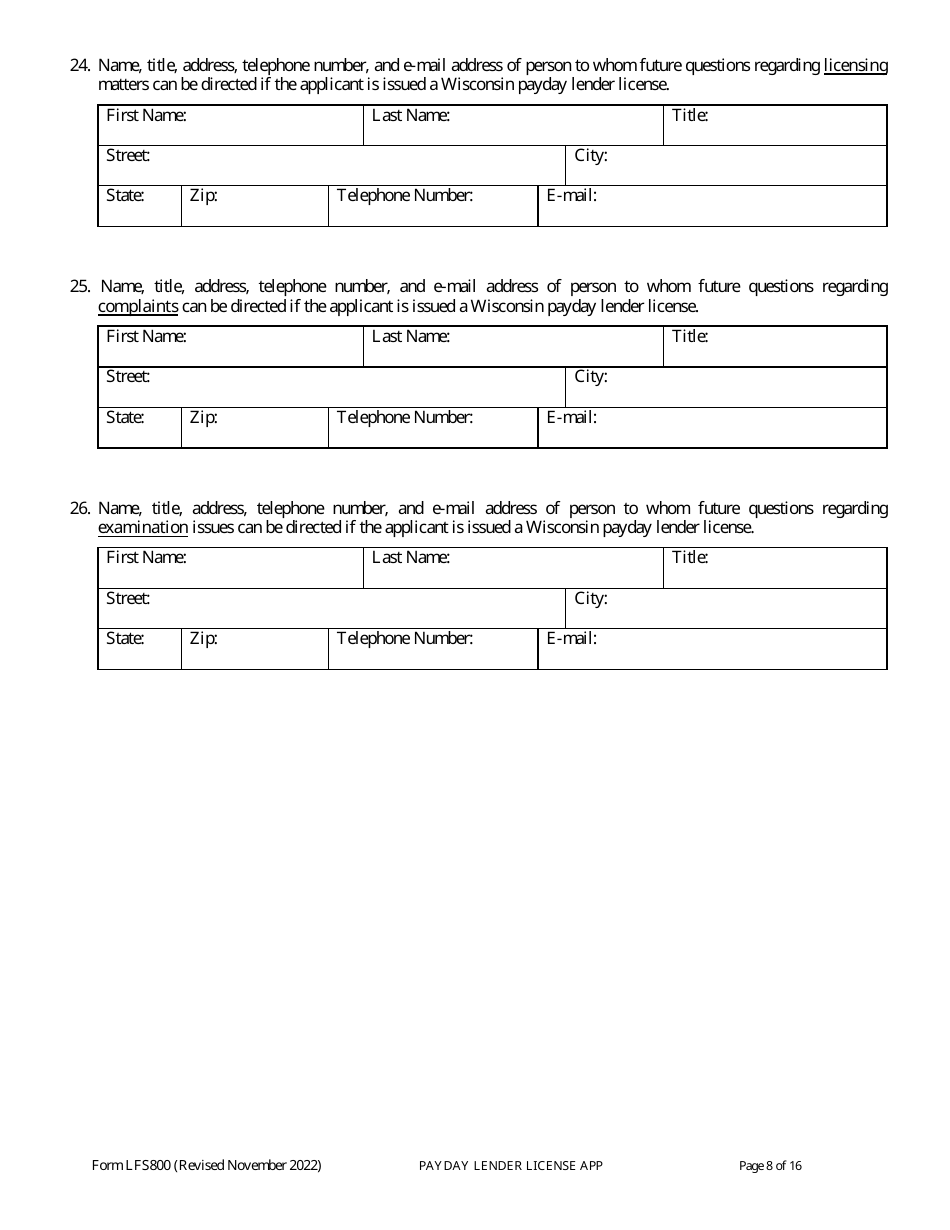

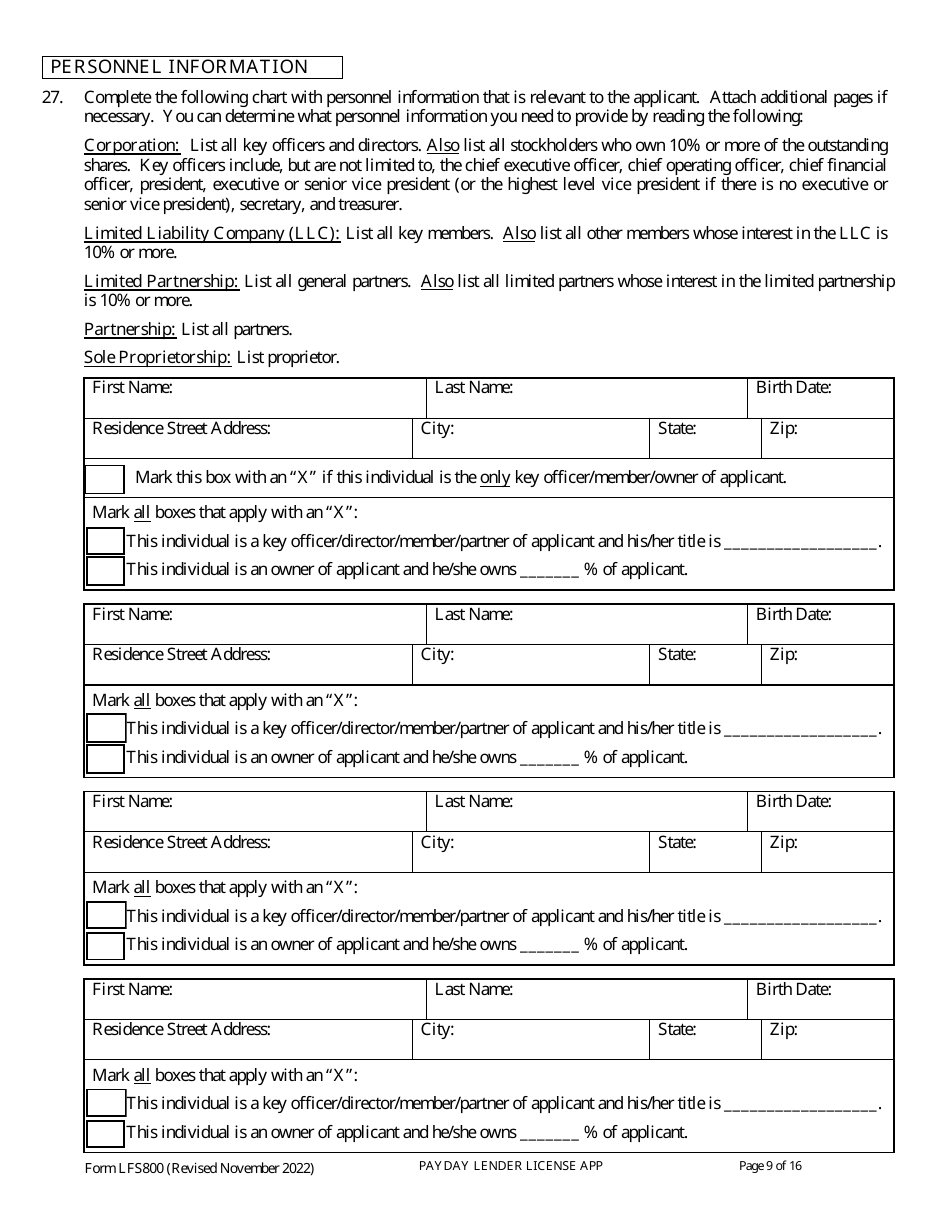

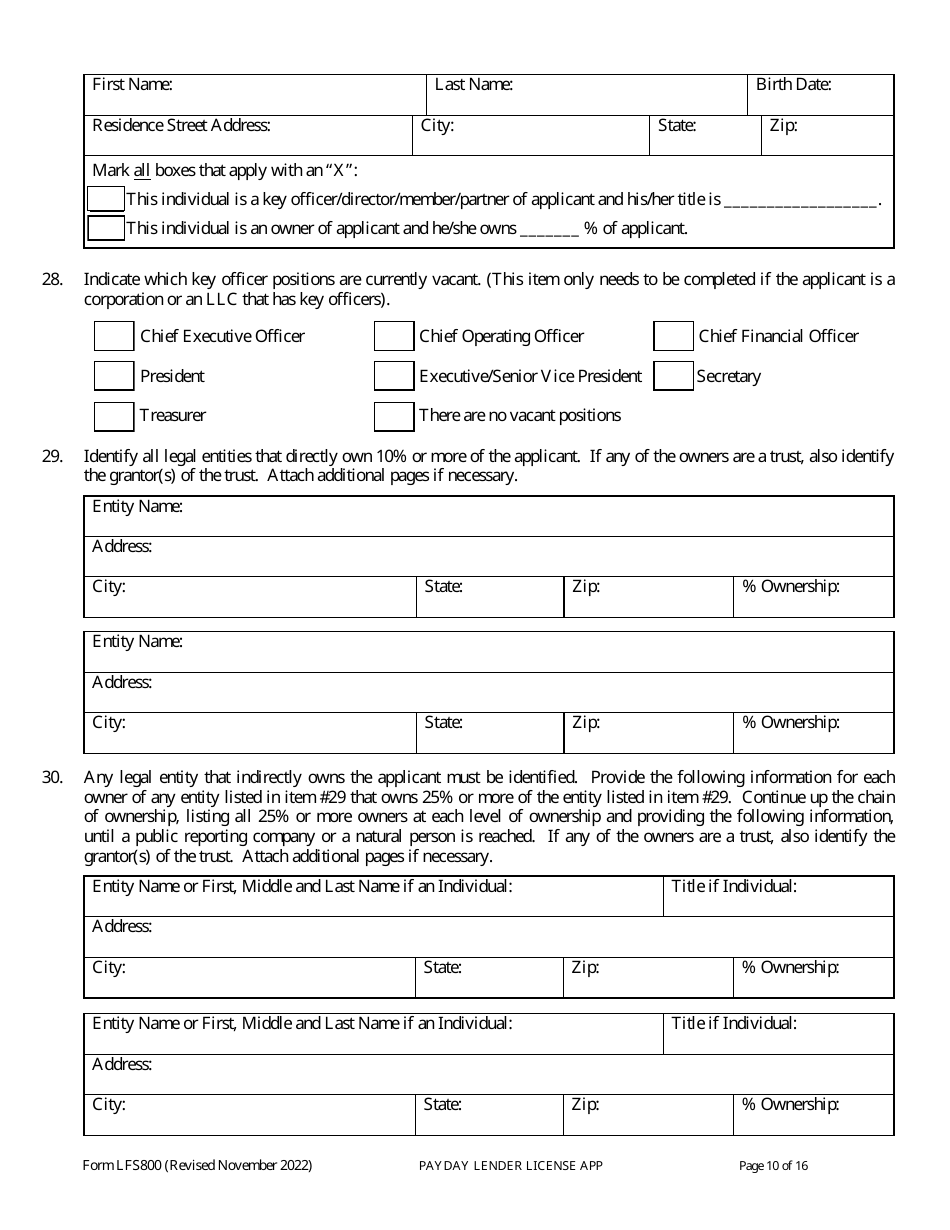

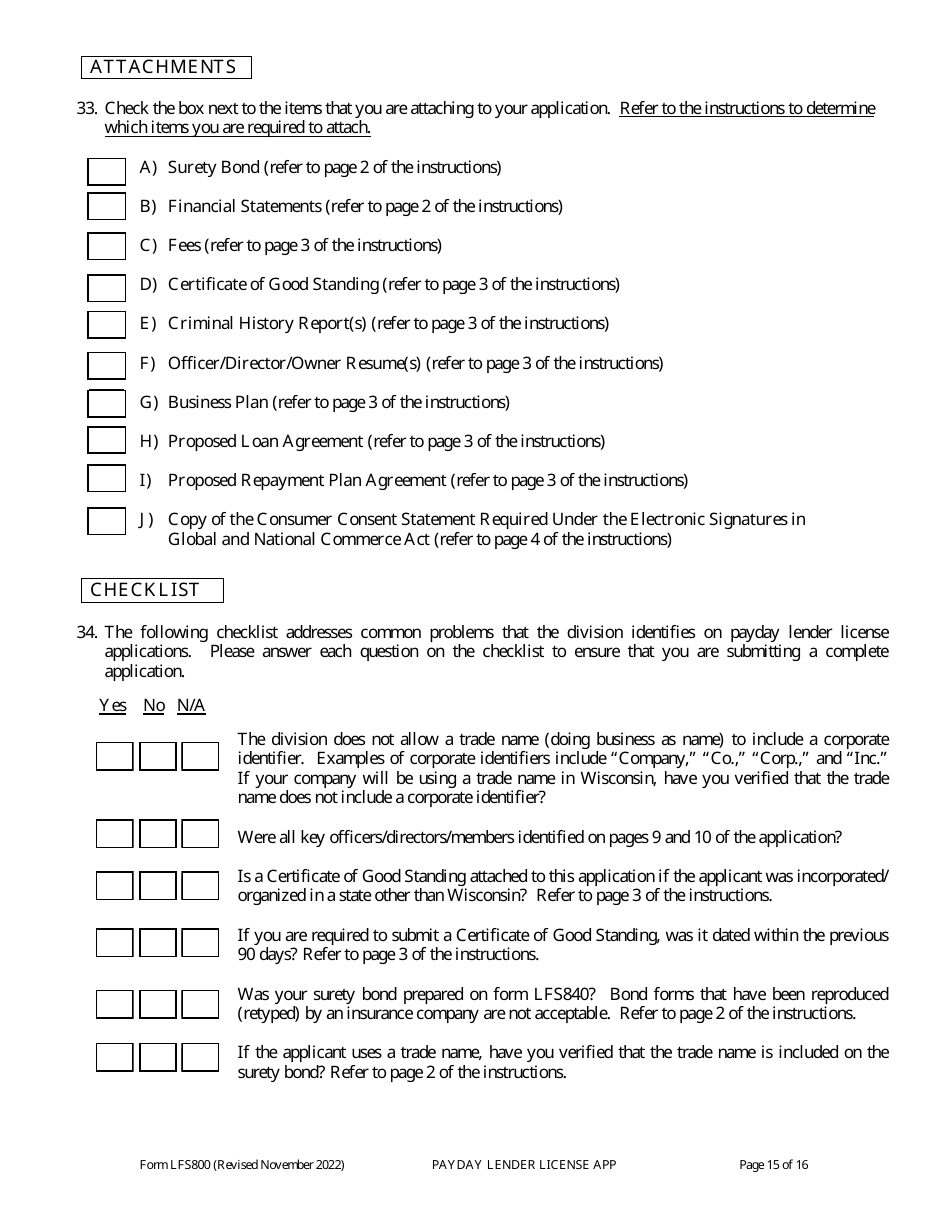

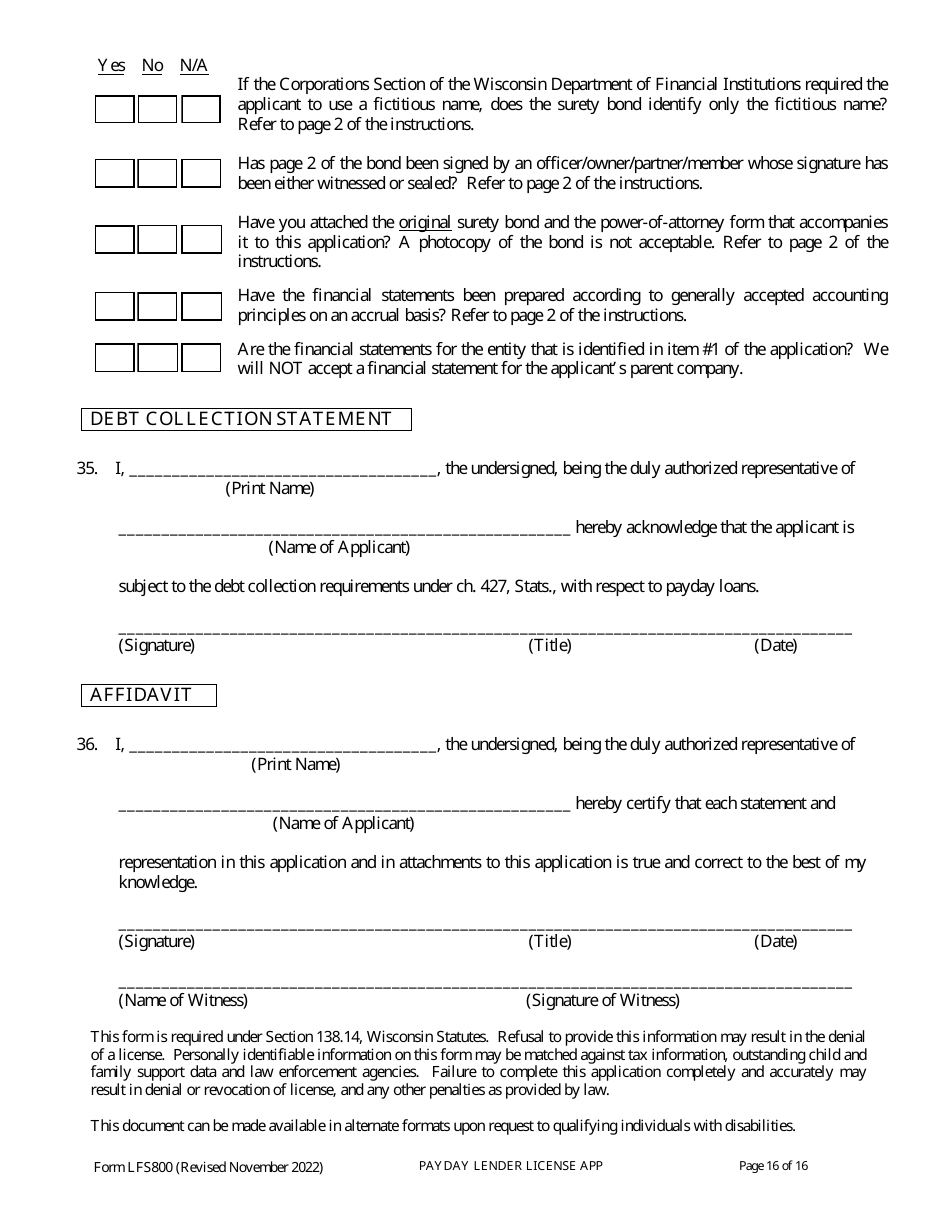

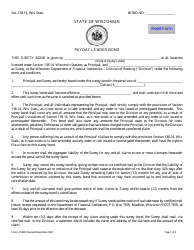

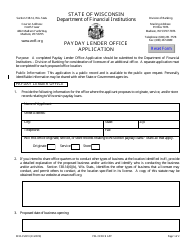

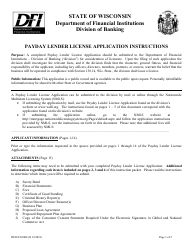

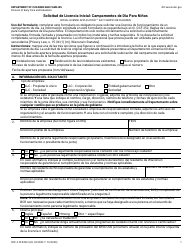

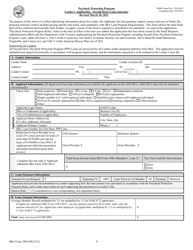

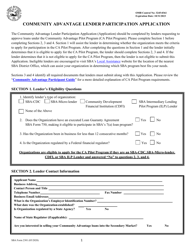

Form LFS800 Payday Lender License Application - Wisconsin

What Is Form LFS800?

This is a legal form that was released by the Wisconsin Department of Financial Institutions - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LFS800?

A: Form LFS800 is the payday lender license application for the state of Wisconsin.

Q: What is a payday lender license?

A: A payday lender license is a permit that allows a lender to offer payday loans in the state of Wisconsin.

Q: Who needs to complete Form LFS800?

A: Any lender intending to operate as a payday lender in Wisconsin needs to complete Form LFS800.

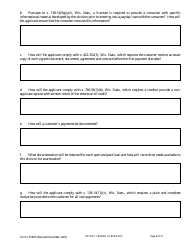

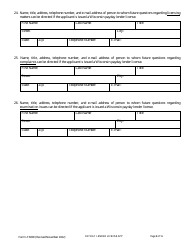

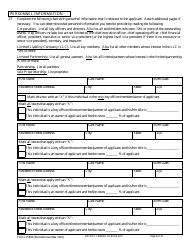

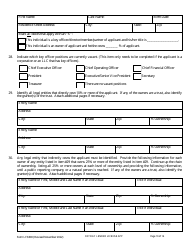

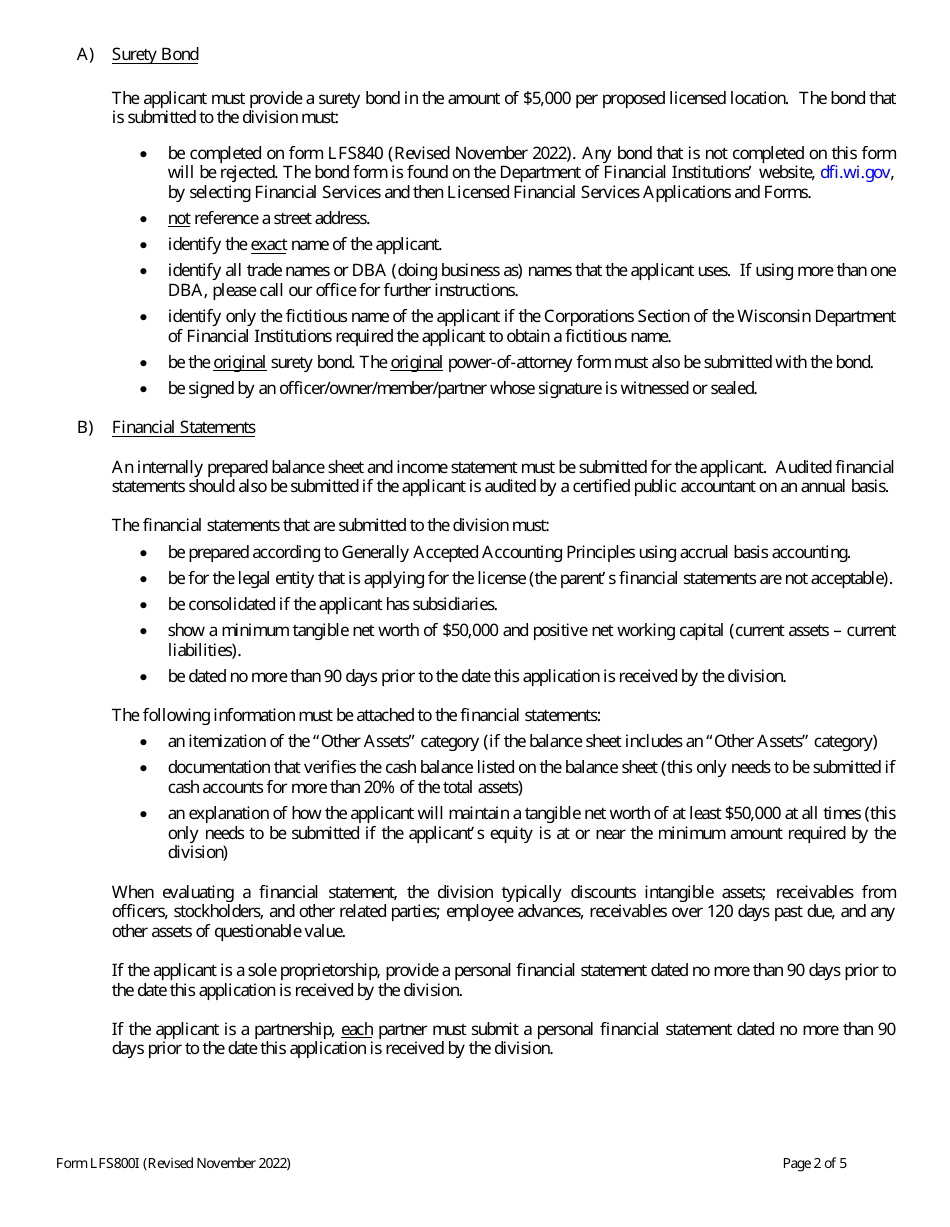

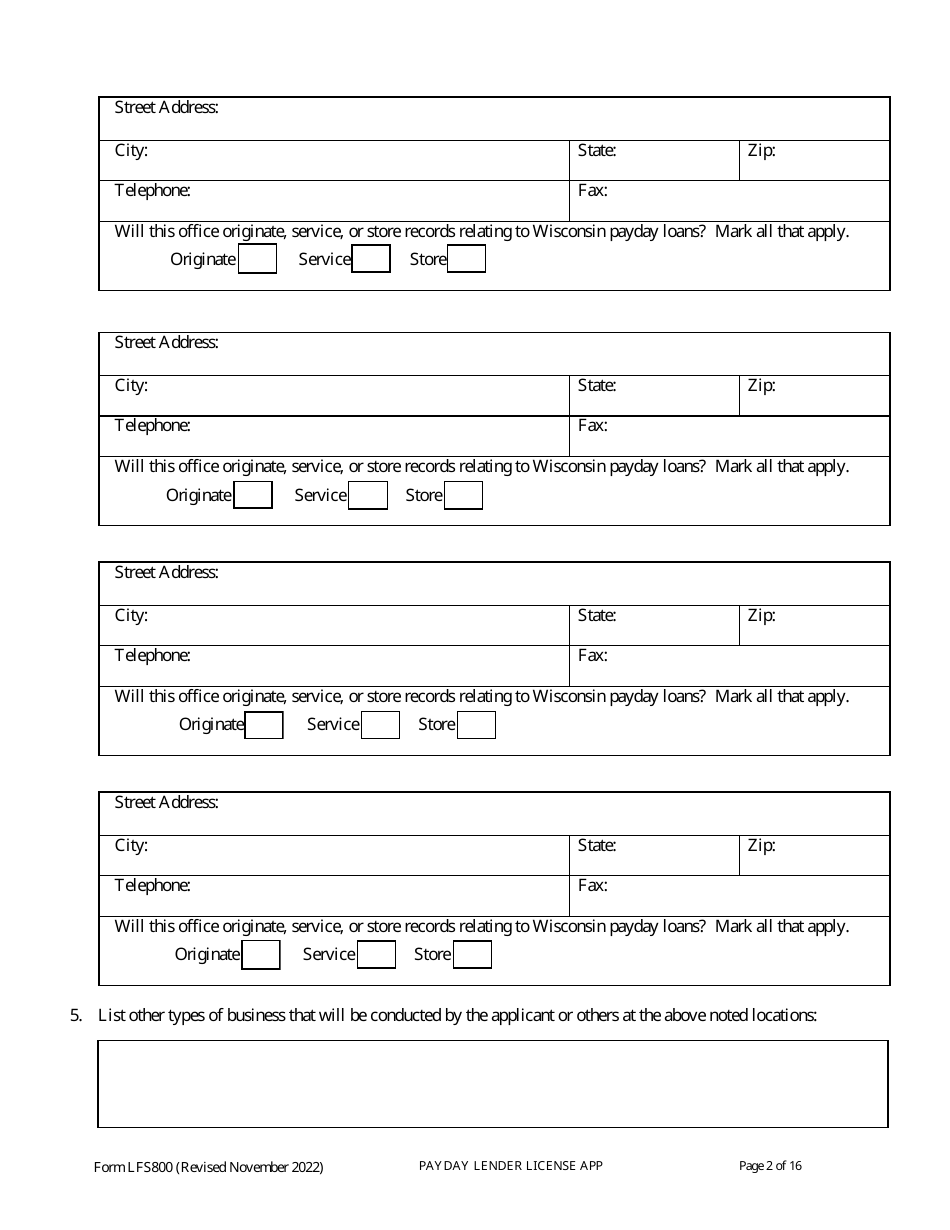

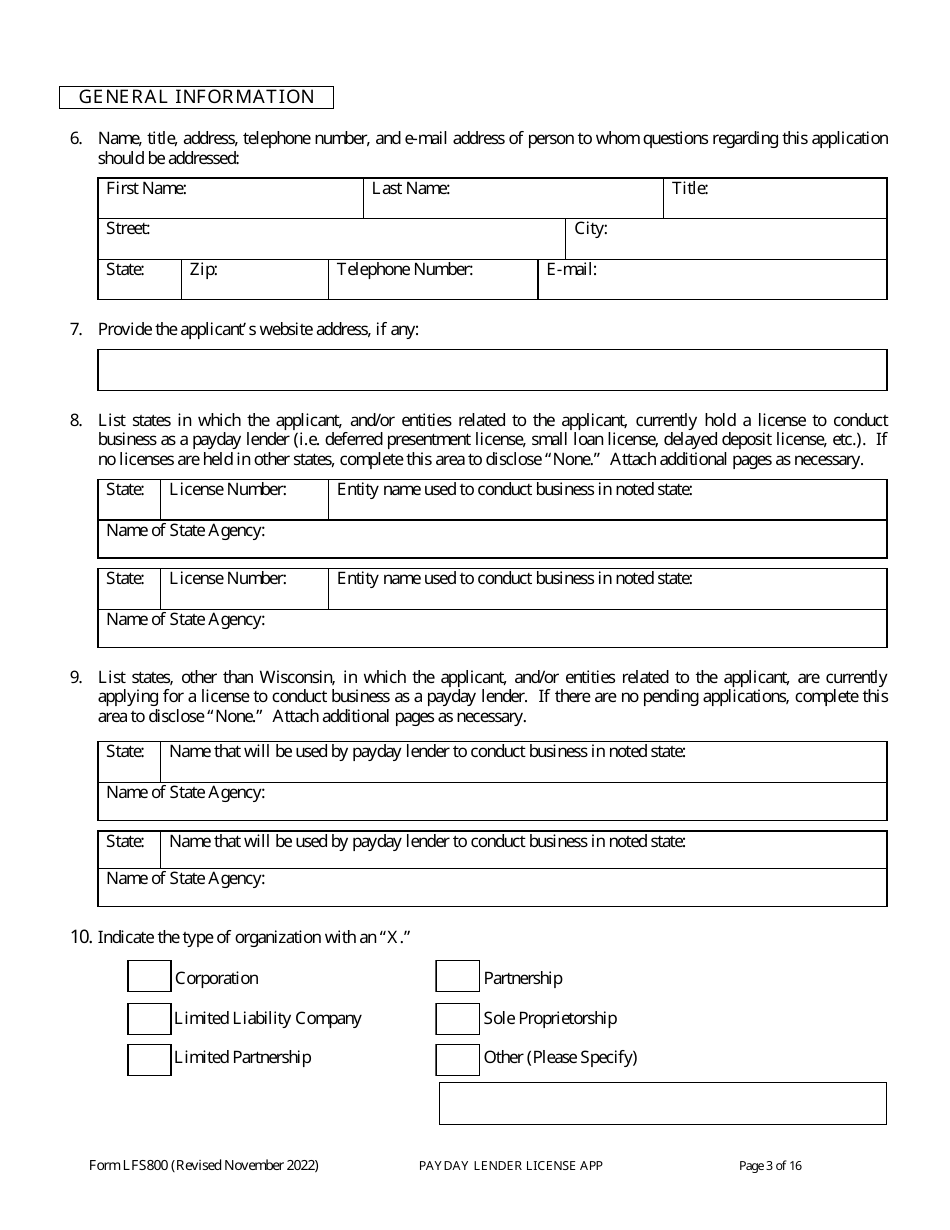

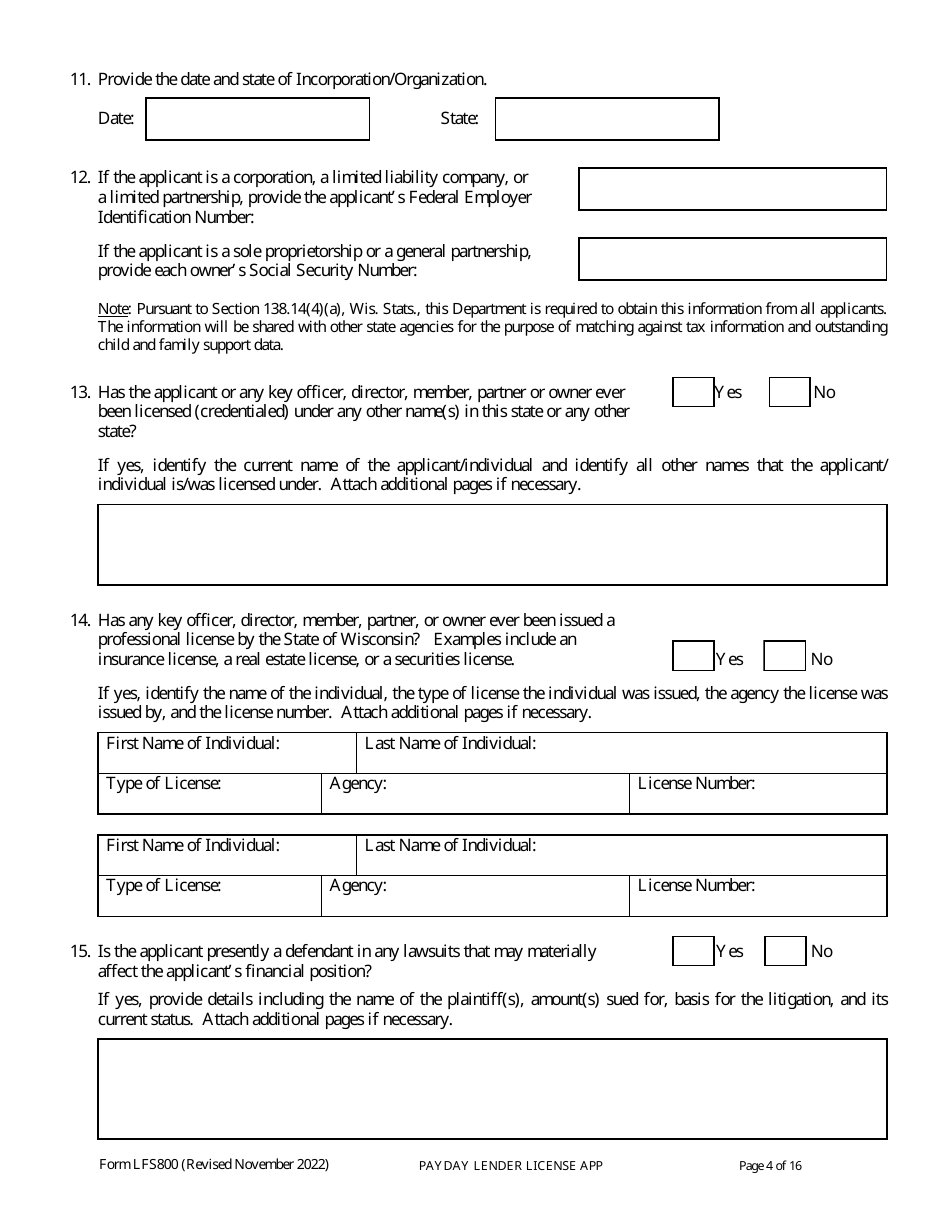

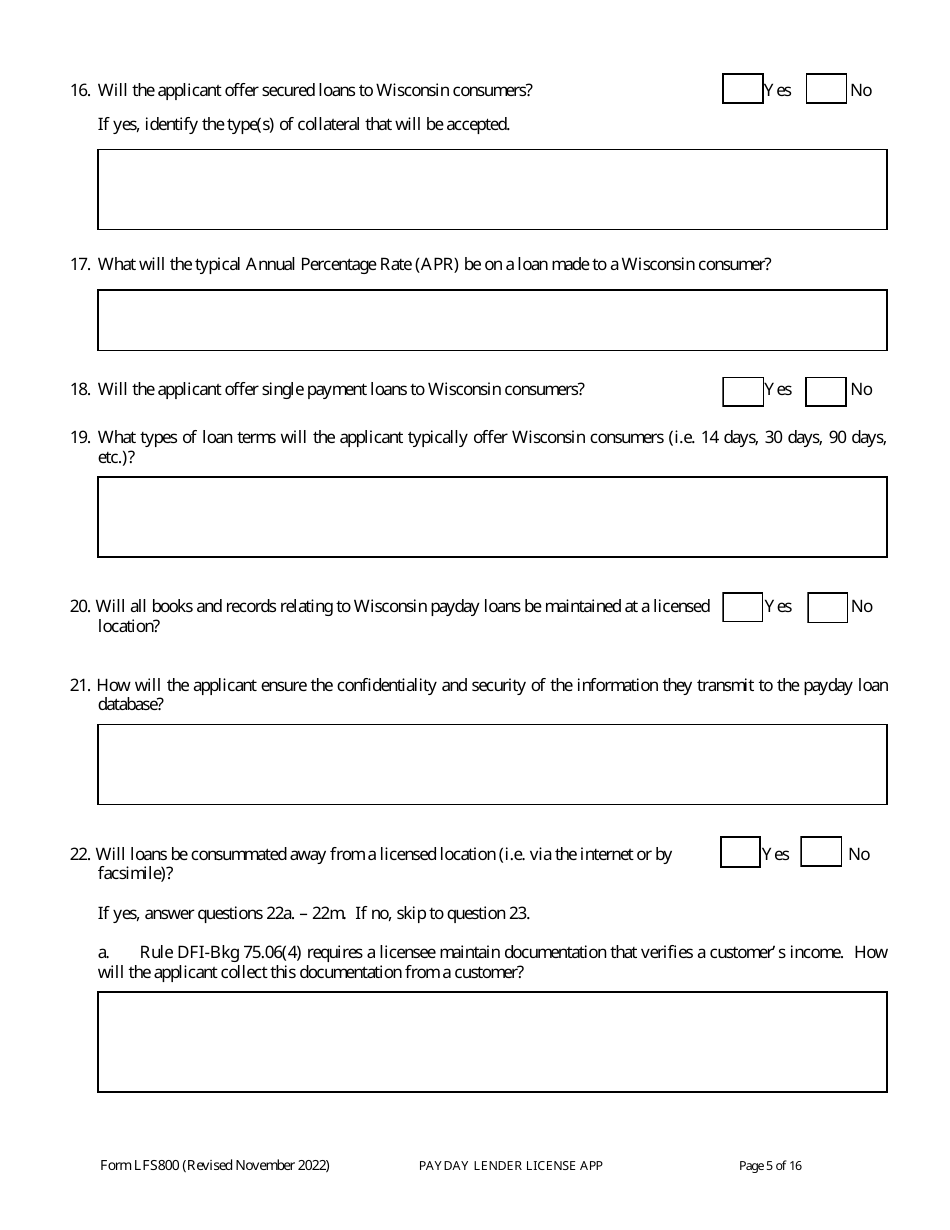

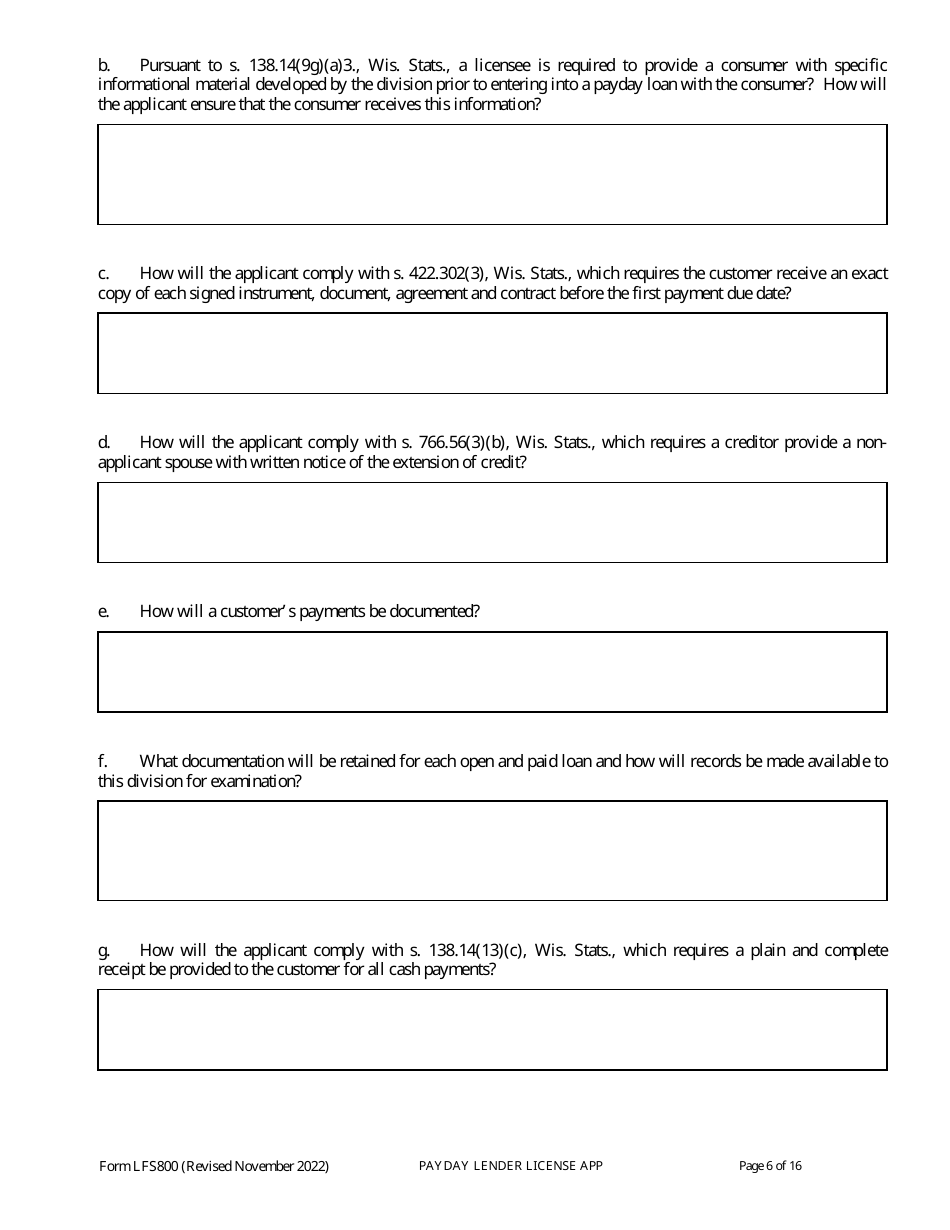

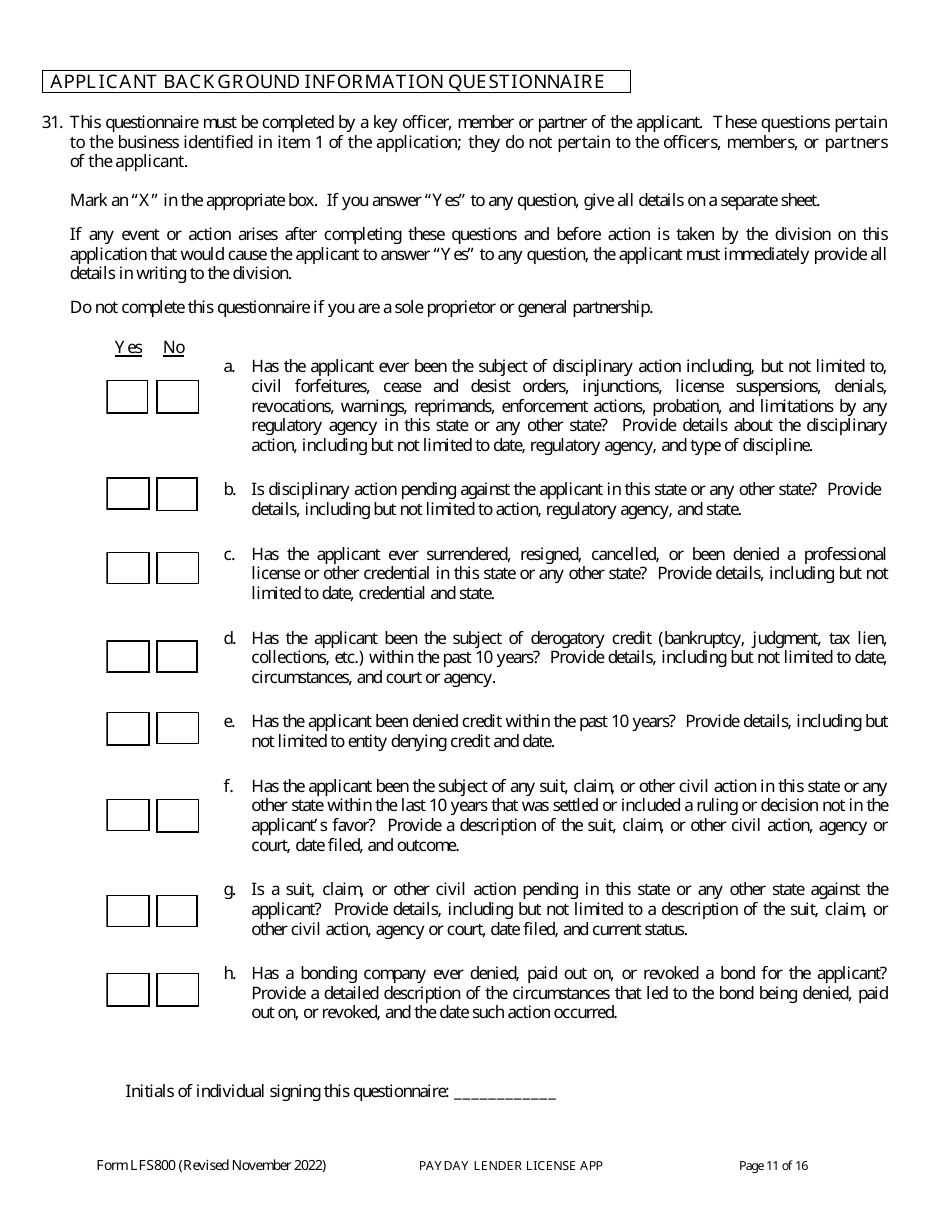

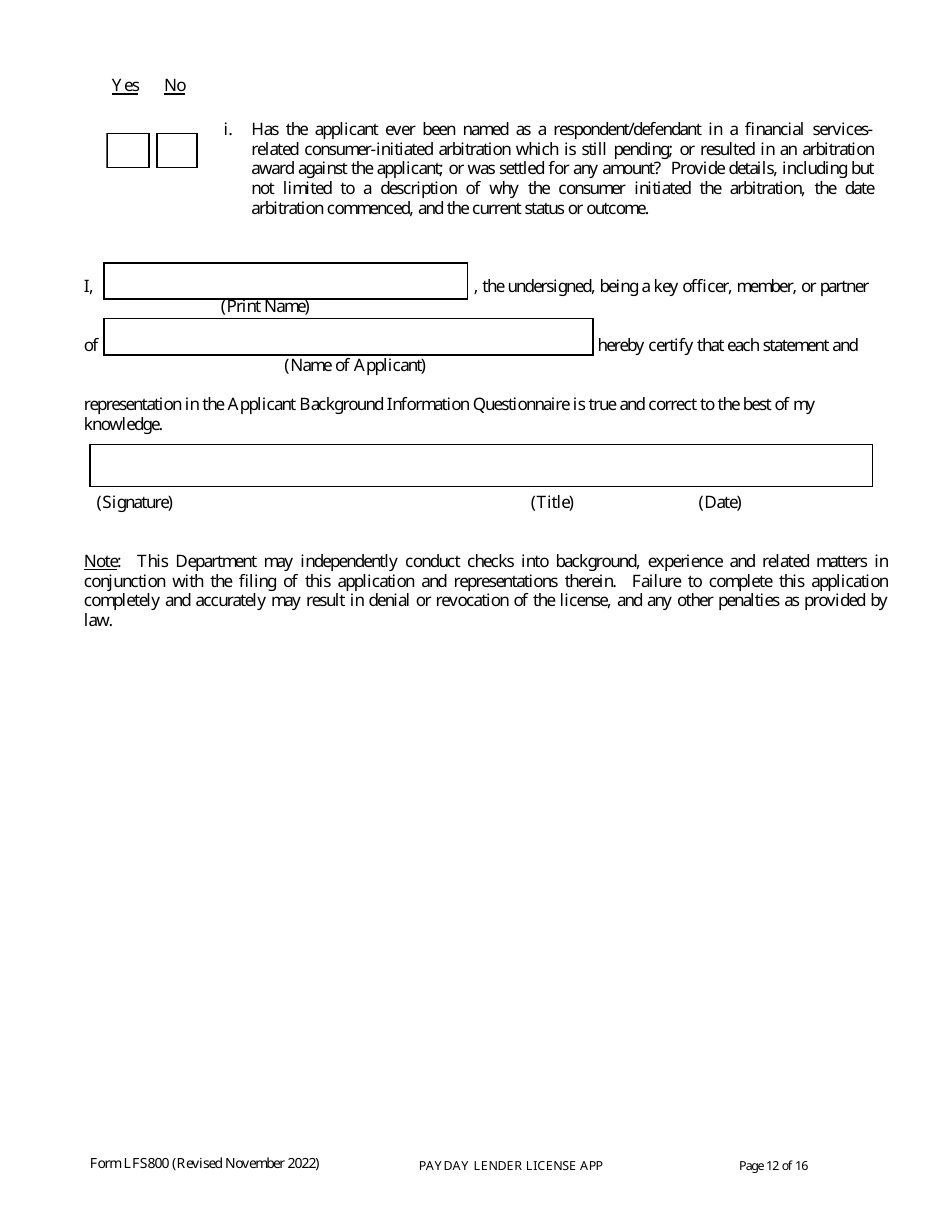

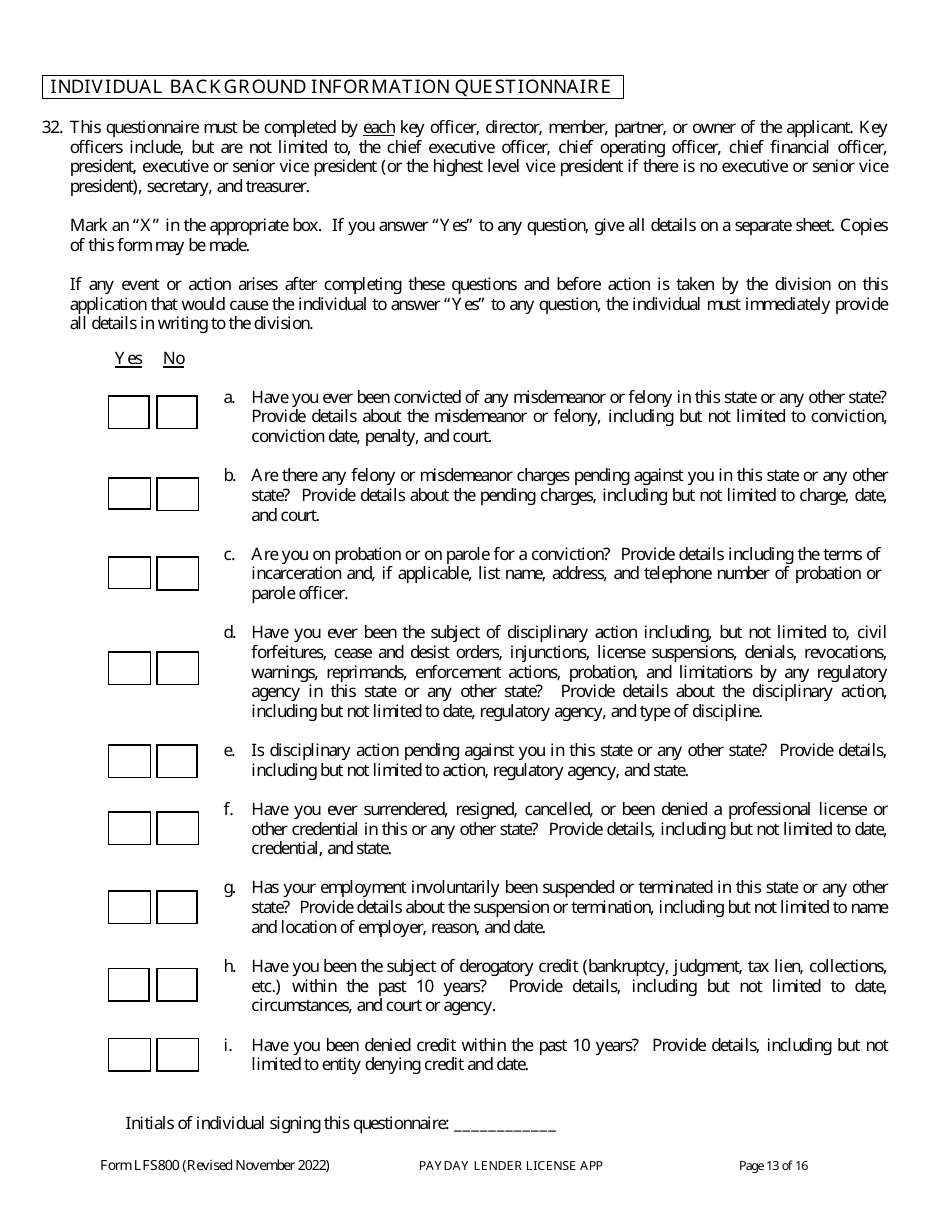

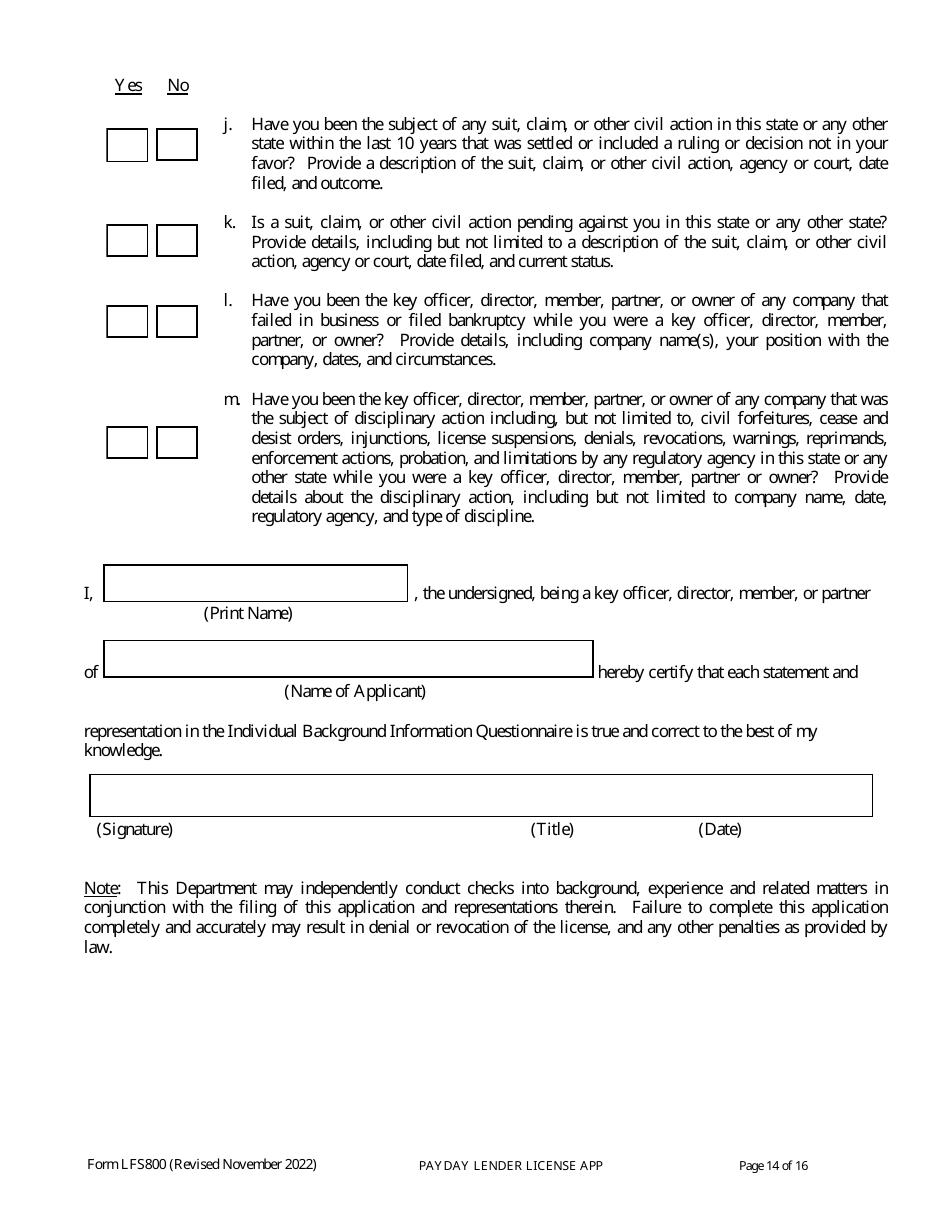

Q: What information is required on Form LFS800?

A: Form LFS800 requires information such as the lender's contact details, business information, and financial statements.

Q: Are there any fees associated with applying for a payday lender license?

A: Yes, there are fees associated with applying for a payday lender license in Wisconsin. The fees vary depending on the size of the business.

Q: Are there any specific requirements to be eligible for a payday lender license?

A: Yes, there are specific requirements to be eligible for a payday lender license in Wisconsin. These include having a physical location and meeting certain financial requirements.

Q: How long does it take to process the payday lender license application?

A: The processing time for the payday lender license application can vary, but it generally takes several weeks to months.

Q: Is there a renewal requirement for the payday lender license?

A: Yes, the payday lender license needs to be renewed annually.

Q: What happens if a lender operates as a payday lender without a license?

A: Operating as a payday lender without a license in Wisconsin is illegal and can result in penalties and legal consequences.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Wisconsin Department of Financial Institutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LFS800 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Financial Institutions.