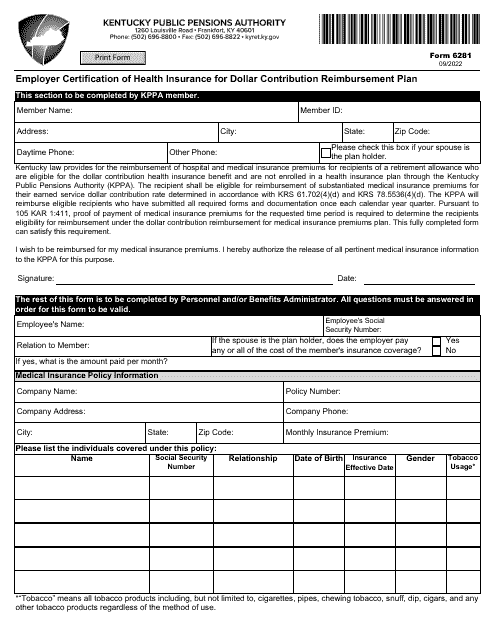

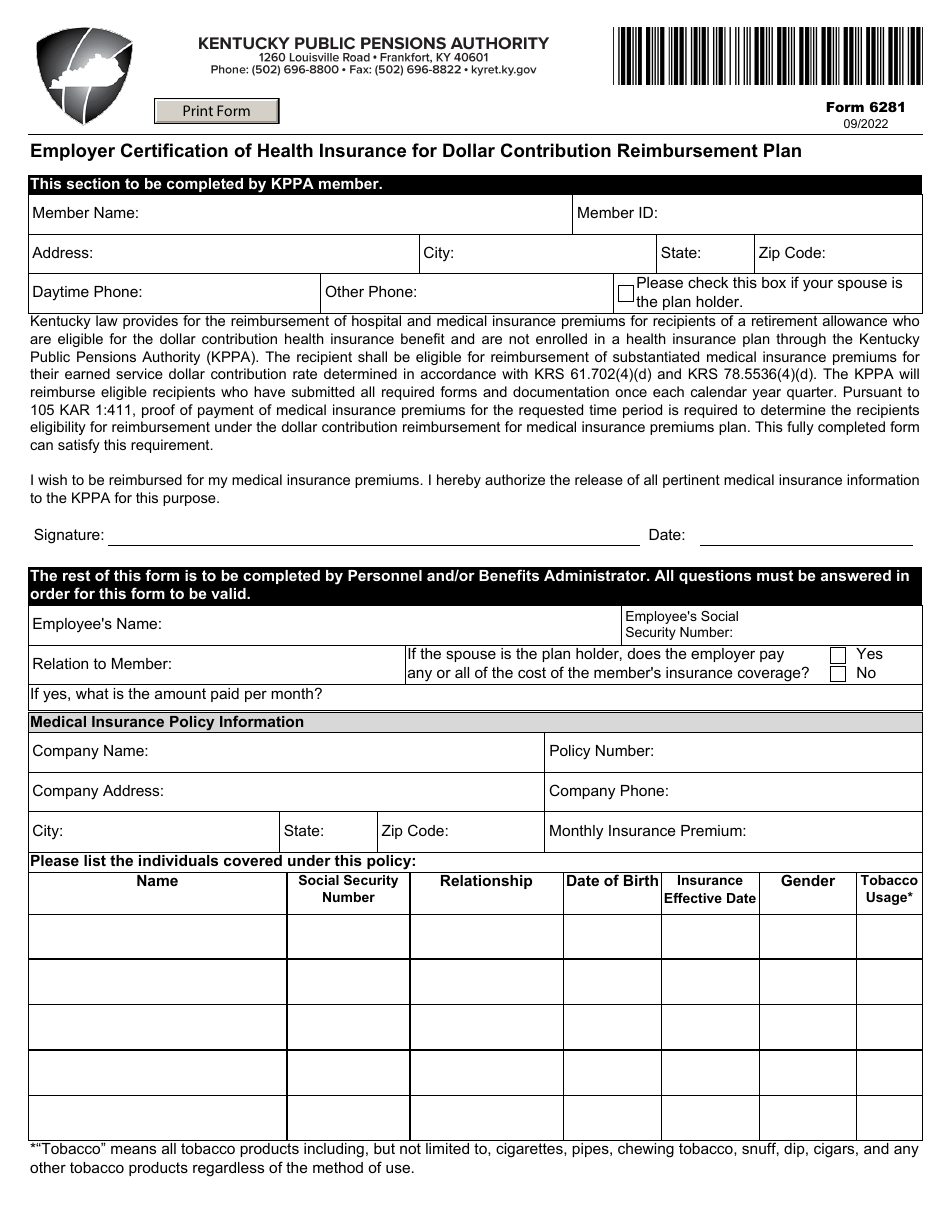

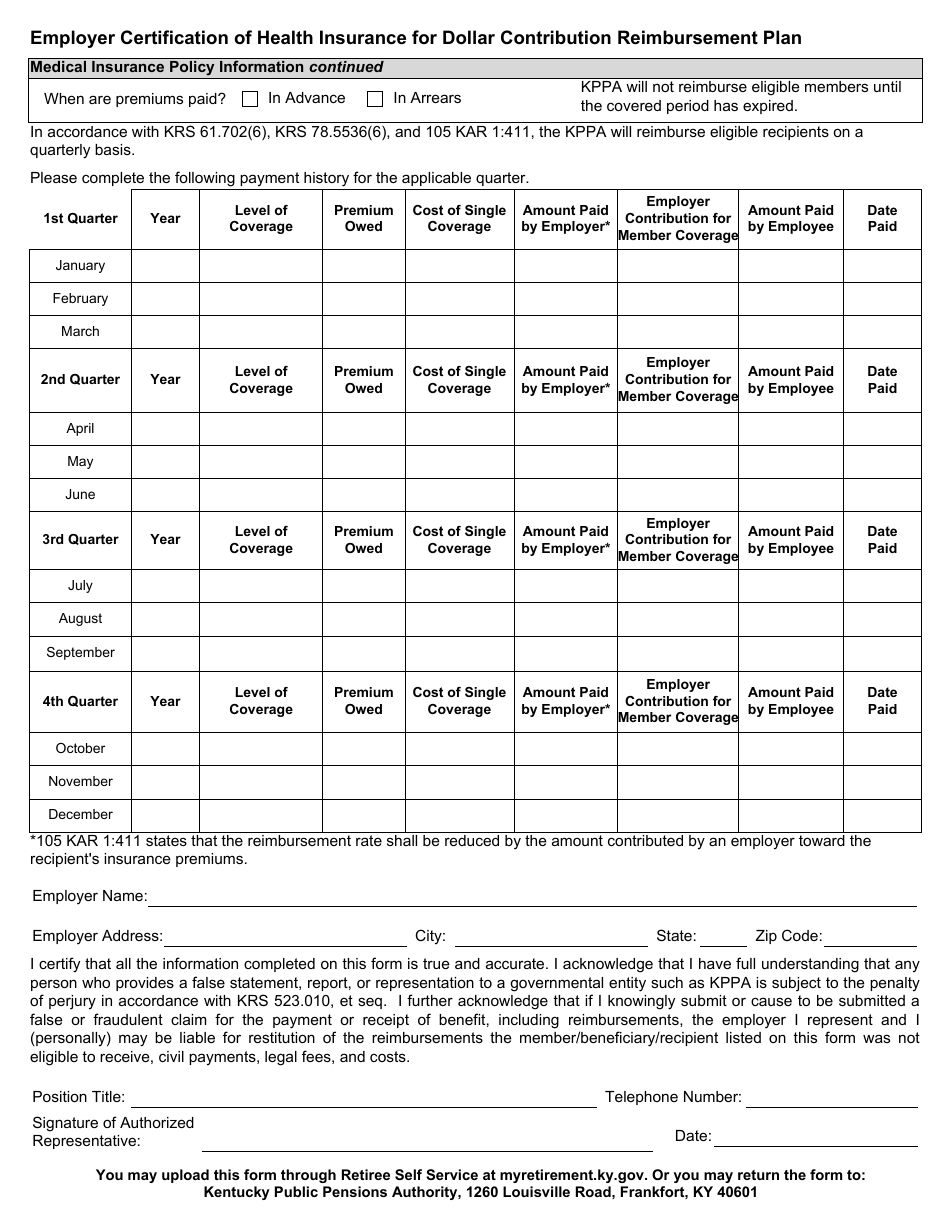

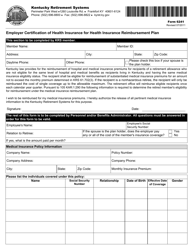

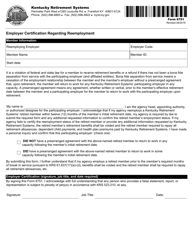

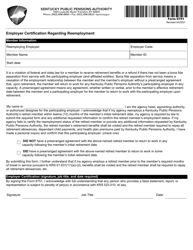

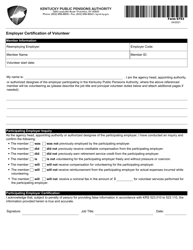

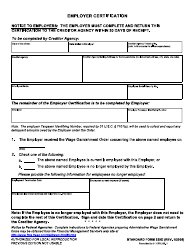

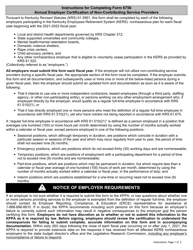

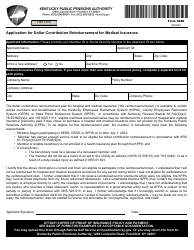

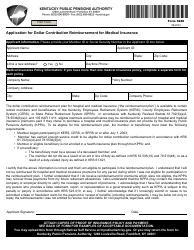

Form 6281 Employer Certification of Health Insurance for Dollar Contribution Reimbursement Plan - Kentucky

What Is Form 6281?

This is a legal form that was released by the Kentucky Public Pensions Authority - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 6281?

A: Form 6281 is the Employer Certification of Health Insurance for Dollar Contribution Reimbursement Plan.

Q: Who needs to use Form 6281?

A: Employers in Kentucky who have a Dollar Contribution Reimbursement Plan need to use Form 6281.

Q: What is the purpose of Form 6281?

A: The purpose of Form 6281 is for employers to certify the health insurance coverage provided to employees under a Dollar Contribution Reimbursement Plan.

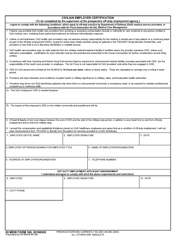

Q: How is Form 6281 used?

A: Employers need to complete and file Form 6281 to report the health insurance coverage provided to employees under a Dollar Contribution Reimbursement Plan.

Q: Is Form 6281 specific to Kentucky?

A: Yes, Form 6281 is specific to Kentucky and is used for reporting health insurance coverage under a Dollar Contribution Reimbursement Plan in the state.

Q: Are there any filing deadlines for Form 6281?

A: Yes, employers are required to file Form 6281 by January 31st of the year following the calendar year in which the health insurance coverage was provided.

Q: What happens if I don't file Form 6281?

A: Failure to file Form 6281 or providing false information on the form may result in penalties and fines.

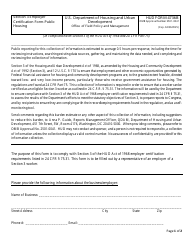

Q: Can Form 6281 be filed electronically?

A: Yes, Form 6281 can be filed electronically through the Kentucky Department of Revenue's e-file system.

Q: Is there a fee for filing Form 6281?

A: No, there is no fee for filing Form 6281.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Kentucky Public Pensions Authority;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 6281 by clicking the link below or browse more documents and templates provided by the Kentucky Public Pensions Authority.