This version of the form is not currently in use and is provided for reference only. Download this version of

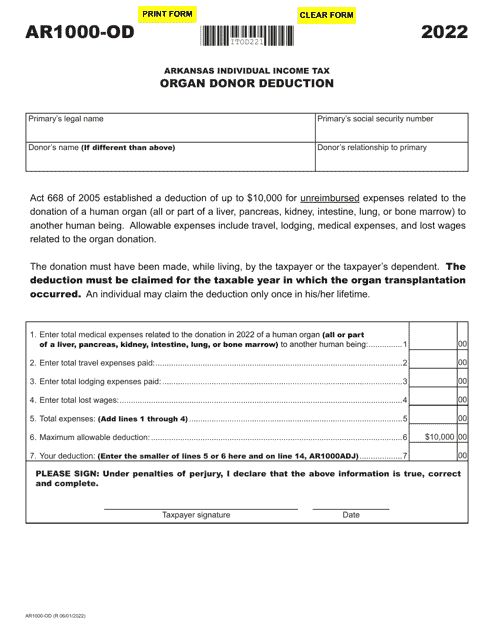

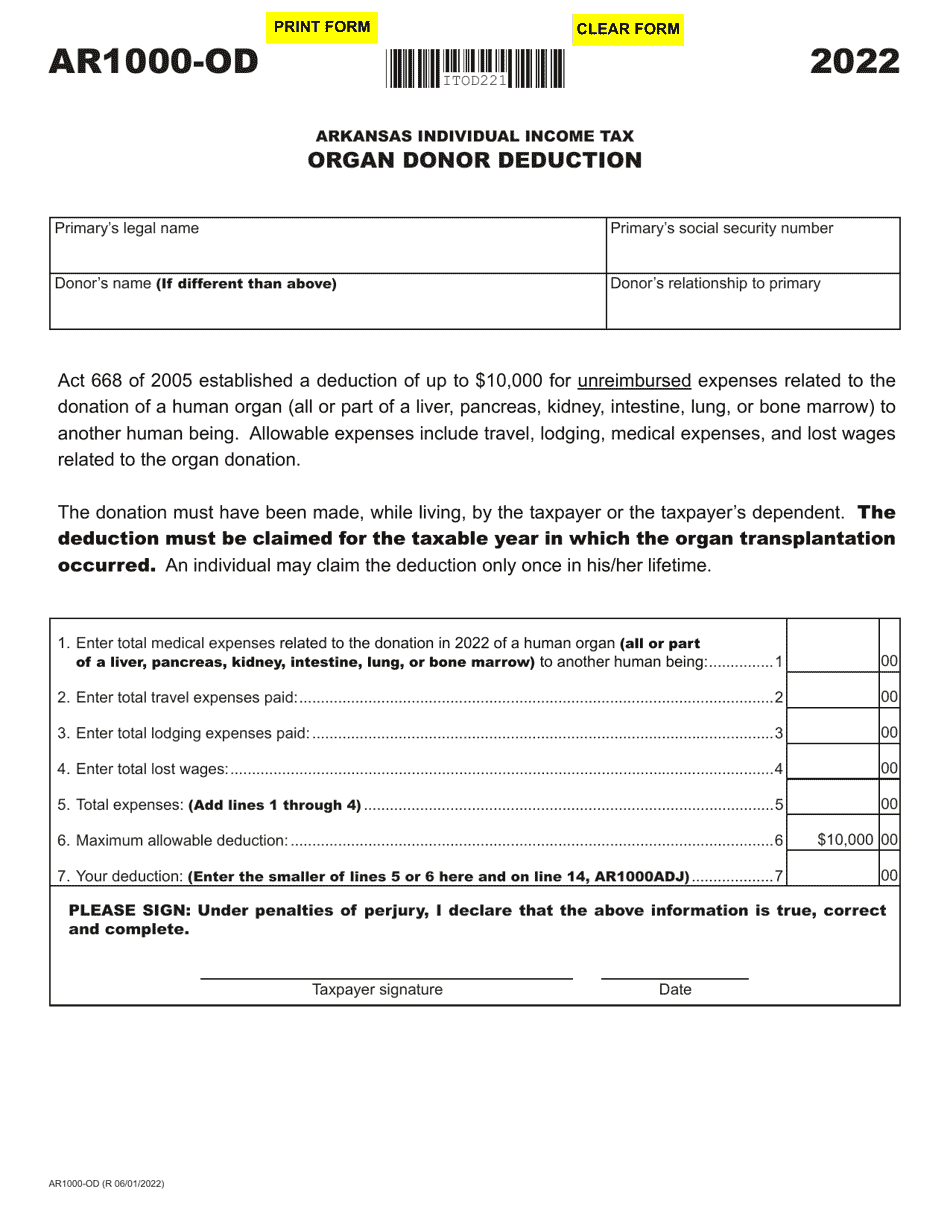

Form AR1000-OD

for the current year.

Form AR1000-OD Organ Donor Deduction - Arkansas

What Is Form AR1000-OD?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR1000-OD?

A: Form AR1000-OD is a tax form used in Arkansas to claim the Organ Donor Deduction.

Q: What is the Organ Donor Deduction?

A: The Organ Donor Deduction is a deduction on your taxes for expenses related to organ donation.

Q: Who is eligible for the Organ Donor Deduction?

A: Arkansas residents who have incurred expenses related to organ donation are eligible for the deduction.

Q: What expenses can be deducted?

A: Qualifying expenses include medical and travel expenses related to organ donation.

Q: How do I claim the Organ Donor Deduction?

A: To claim the deduction, you must file Form AR1000-OD and provide supporting documentation.

Q: Is there a deadline to file Form AR1000-OD?

A: Yes, Form AR1000-OD must be filed by the tax filing deadline, which is usually April 15th.

Q: Can I claim the Organ Donor Deduction if I donated an organ outside of Arkansas?

A: No, the Organ Donor Deduction is only available for expenses incurred in Arkansas.

Q: Can I claim the deduction more than once?

A: No, the deduction can only be claimed once per tax year.

Q: Are there any income limits for the Organ Donor Deduction?

A: No, there are no income limits for claiming the Organ Donor Deduction in Arkansas.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1000-OD by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.