This version of the form is not currently in use and is provided for reference only. Download this version of

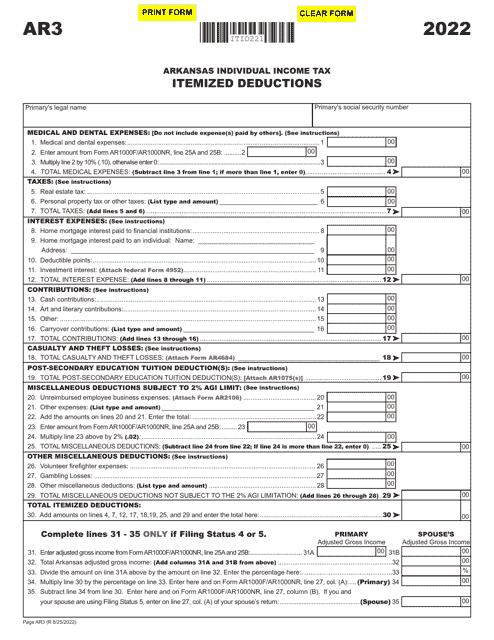

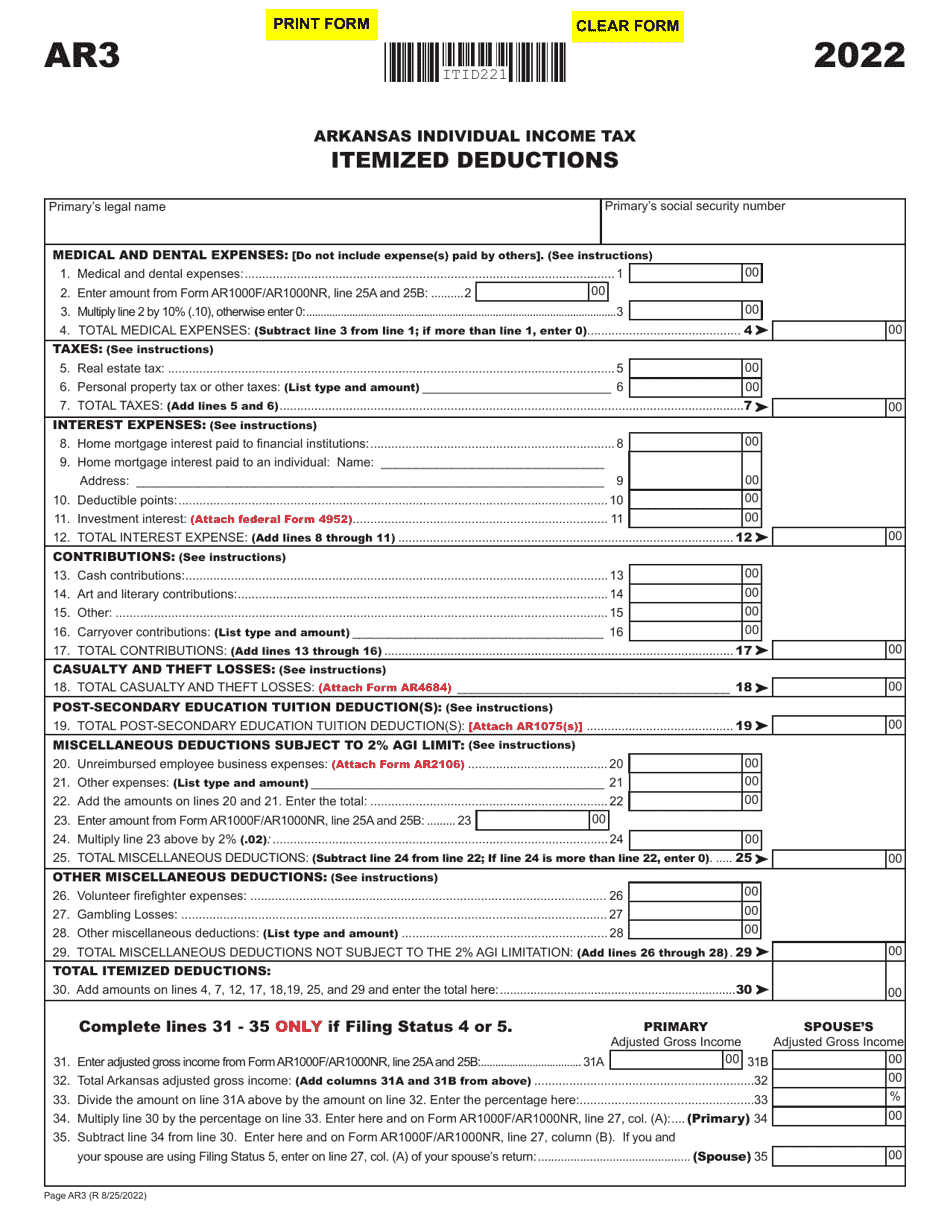

Form AR3

for the current year.

Form AR3 Itemized Deductions - Arkansas

What Is Form AR3?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR3?

A: Form AR3 is a tax form used to itemize deductions on your Arkansas state tax return.

Q: What are itemized deductions?

A: Itemized deductions are expenses that you can subtract from your taxable income to reduce your overall tax liability.

Q: Why would I use Form AR3?

A: You would use Form AR3 if you have expenses that qualify as itemized deductions and if the total amount of those deductions is greater than the standard deduction.

Q: What types of expenses can be itemized deductions?

A: Some common types of itemized deductions include medical expenses, state and local taxes paid, mortgage interest, and charitable contributions.

Q: Are there any limitations on itemized deductions?

A: Yes, there are certain limitations on itemized deductions, such as the deduction for state and local taxes being limited to $10,000.

Q: How do I fill out Form AR3?

A: You will need to gather documentation for your itemized deductions and then fill out the appropriate sections of Form AR3, following the instructions provided.

Q: Can I claim both the standard deduction and itemized deductions?

A: No, you can only claim either the standard deduction or itemized deductions. You should choose the option that gives you the larger tax benefit.

Q: Is Form AR3 only for residents of Arkansas?

A: Yes, Form AR3 is specific to Arkansas state taxes. Residents of other states should use the appropriate tax forms for their state.

Q: When is the deadline to file Form AR3?

A: The deadline to file Form AR3 is generally April 15th, or the same date as the federal income tax deadline.

Form Details:

- Released on August 25, 2022;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR3 by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.