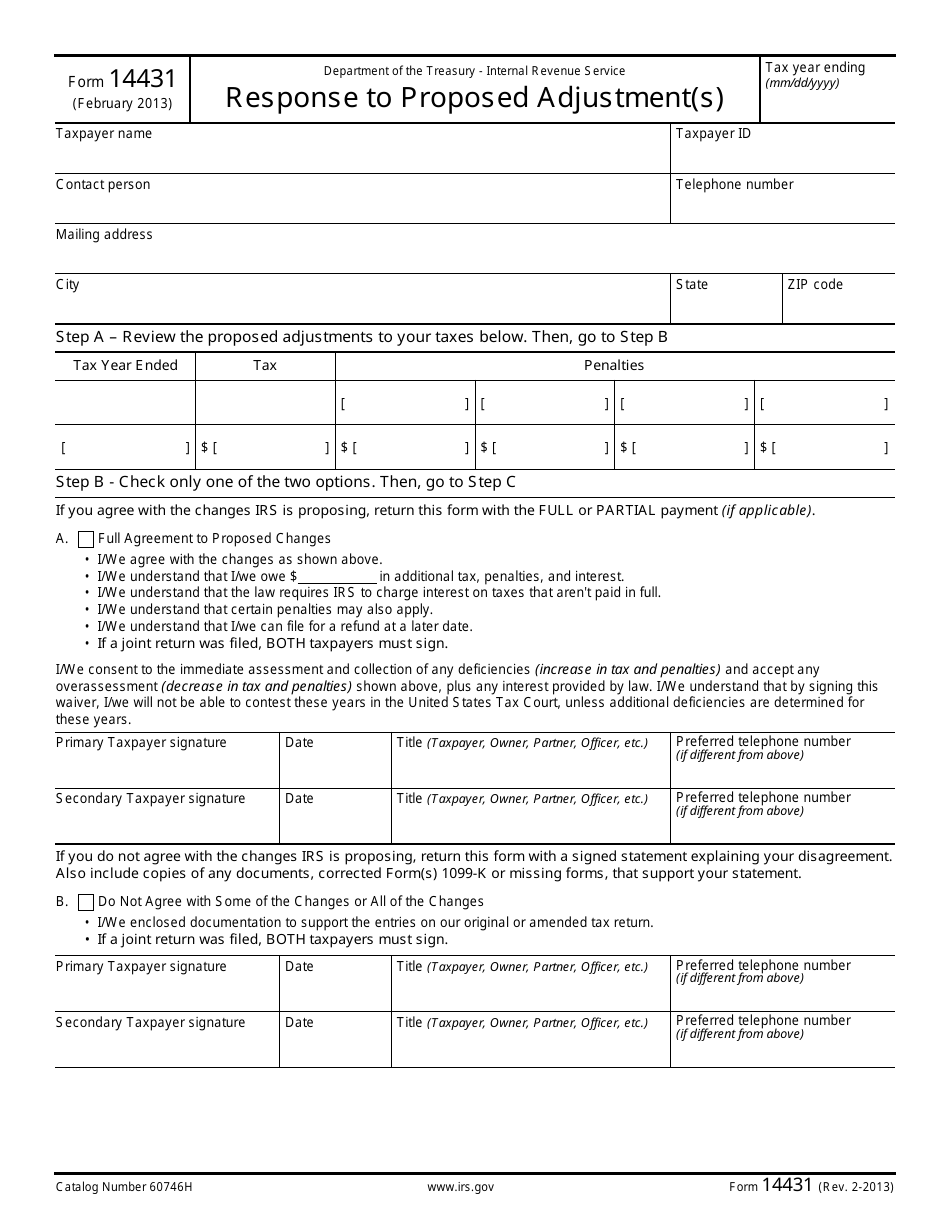

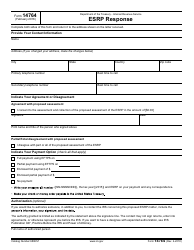

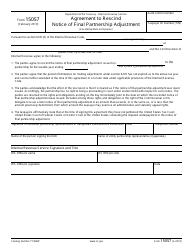

IRS Form 14431 Response to Proposed Adjustment(S)

What Is IRS Form 14431?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2013. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14431?

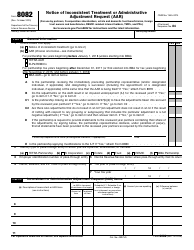

A: IRS Form 14431 is a form used to respond to proposed adjustments made by the Internal Revenue Service (IRS).

Q: When would I need to use IRS Form 14431?

A: You would need to use IRS Form 14431 if you received a notice from the IRS proposing adjustments to your tax return and you want to provide a response.

Q: What is the purpose of IRS Form 14431?

A: The purpose of IRS Form 14431 is to allow taxpayers to respond to proposed adjustments made by the IRS and provide additional information or arguments in support of their position.

Q: How do I fill out IRS Form 14431?

A: To fill out IRS Form 14431, you will need to follow the instructions provided in the form and provide the requested information, including your taxpayer identification number, the tax period in question, and a detailed explanation of your response to the proposed adjustments.

Form Details:

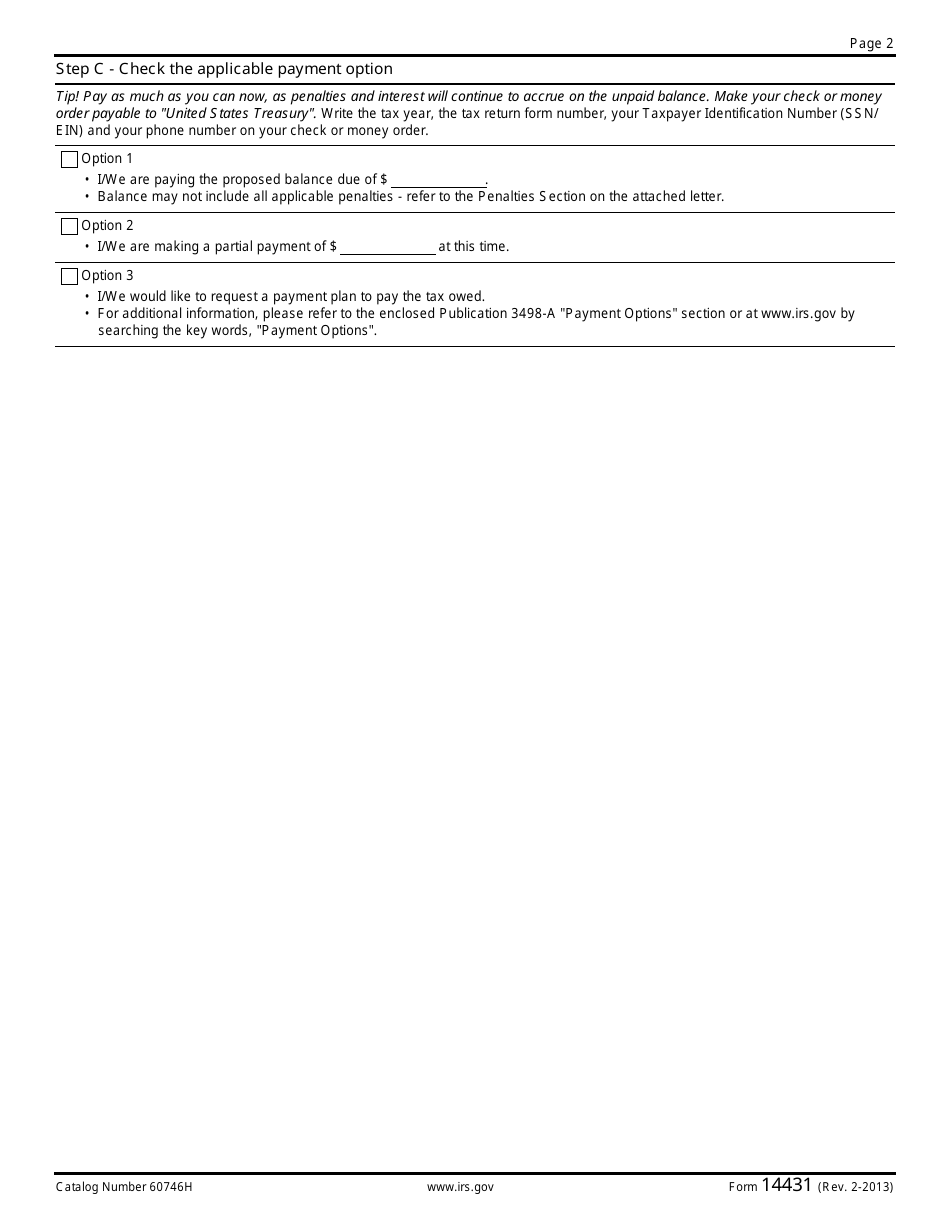

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14431 through the link below or browse more documents in our library of IRS Forms.