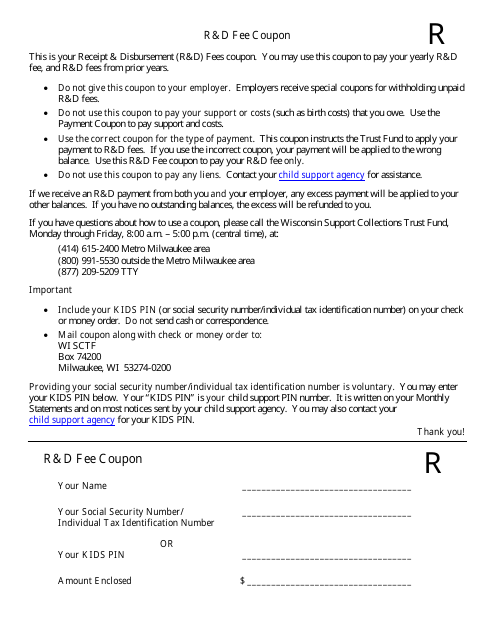

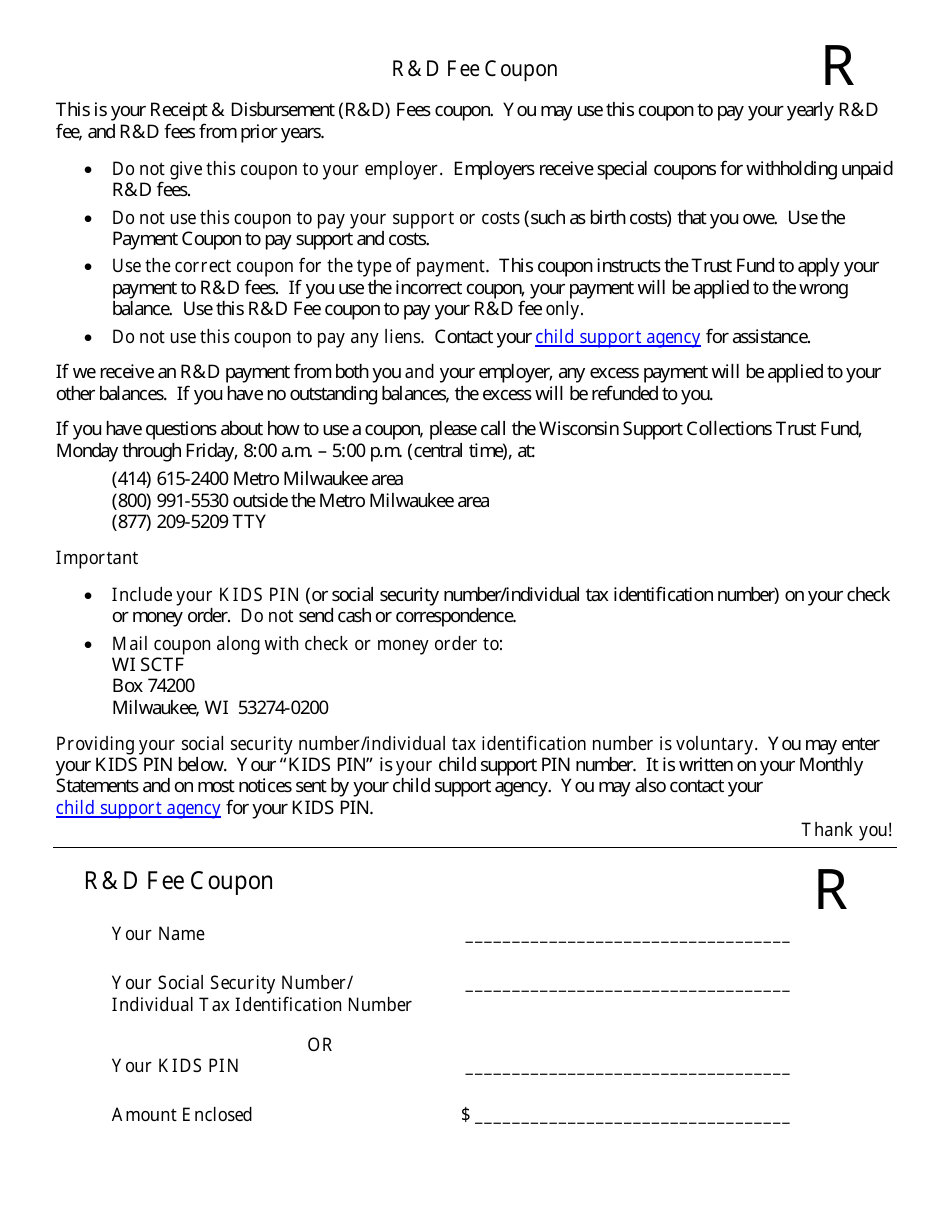

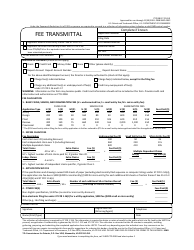

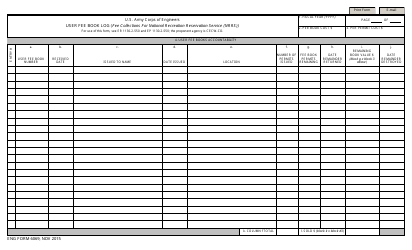

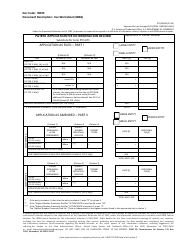

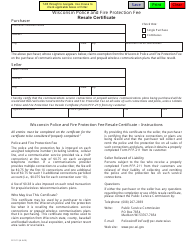

R&d Fee Coupon - Wisconsin

R&d Fee Coupon is a legal document that was released by the Wisconsin Department of Children and Families - a government authority operating within Wisconsin.

FAQ

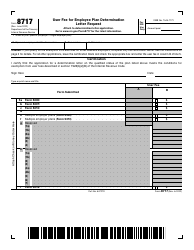

Q: What is an R&D Fee Coupon?

A: An R&D Fee Coupon is a document used in Wisconsin to claim a research and development (R&D) tax credit.

Q: What is the purpose of an R&D Fee Coupon?

A: The purpose of an R&D Fee Coupon is to provide proof of qualified research expenses incurred by a company in Wisconsin.

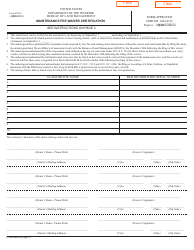

Q: Who is eligible to use an R&D Fee Coupon?

A: Any business that has incurred qualified research expenses in Wisconsin may be eligible to use an R&D Fee Coupon.

Q: How do I obtain an R&D Fee Coupon?

A: You can obtain an R&D Fee Coupon by contacting the Wisconsin Department of Revenue.

Q: What expenses can be claimed with an R&D Fee Coupon?

A: Qualified research expenses related to research and development activities conducted in Wisconsin can be claimed with an R&D Fee Coupon.

Q: Is there a deadline to submit an R&D Fee Coupon?

A: Yes, there is a deadline to submit an R&D Fee Coupon. The specific deadline can vary, so it is important to check with the Wisconsin Department of Revenue for the current deadline.

Q: What are the benefits of using an R&D Fee Coupon?

A: Using an R&D Fee Coupon may allow businesses to claim a tax credit for qualified research expenses, reducing their overall tax liability.

Q: Are there any limitations to using an R&D Fee Coupon?

A: There may be limitations on the amount of the tax credit that can be claimed with an R&D Fee Coupon. It is important to review the specific guidelines provided by the Wisconsin Department of Revenue.

Q: Can an R&D Fee Coupon be used for past expenses?

A: No, an R&D Fee Coupon can only be used for qualified research expenses incurred during the current tax year.

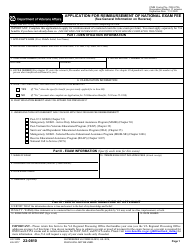

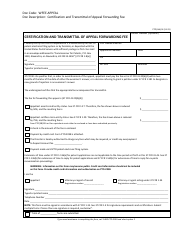

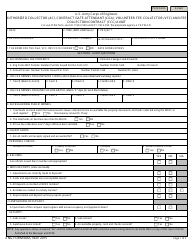

Form Details:

- The latest edition currently provided by the Wisconsin Department of Children and Families;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Children and Families.