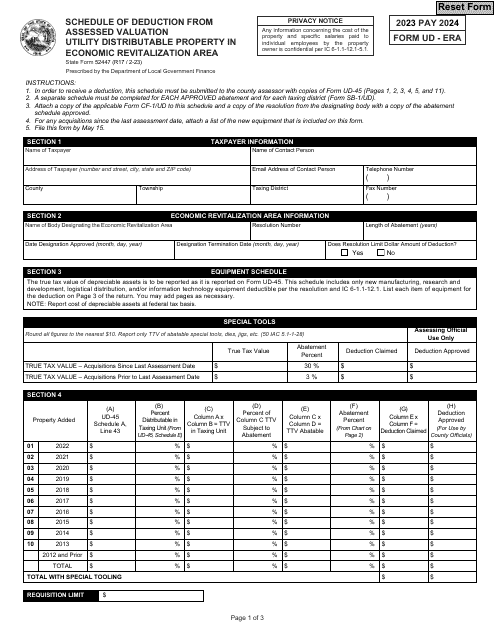

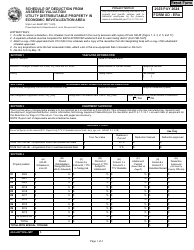

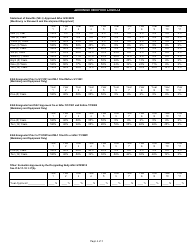

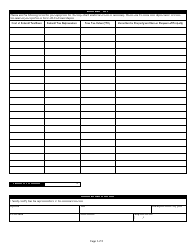

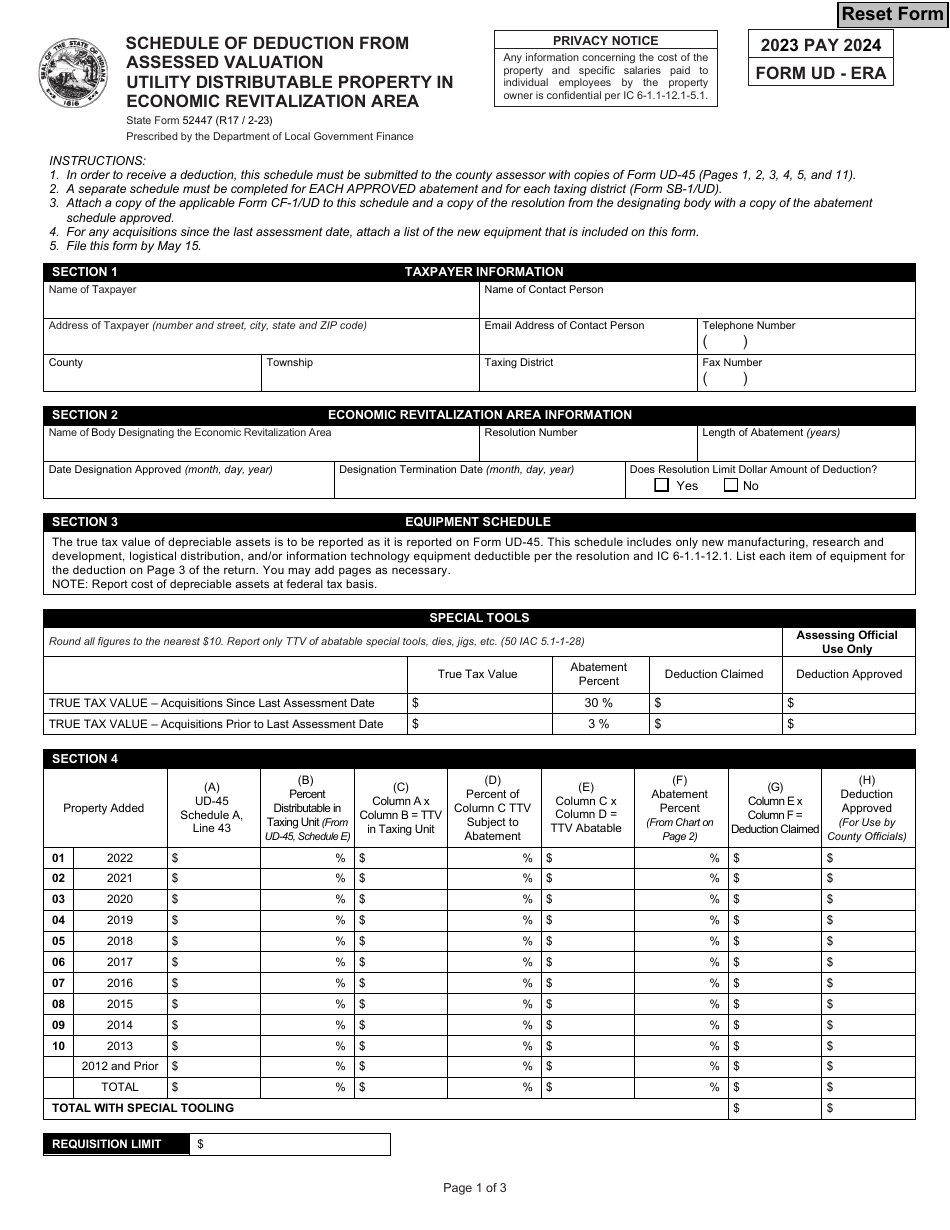

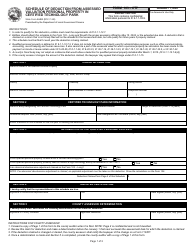

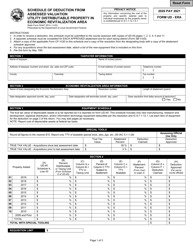

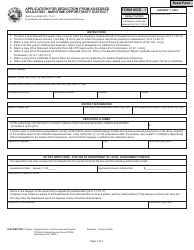

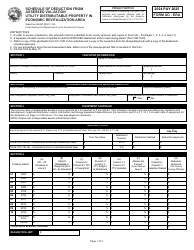

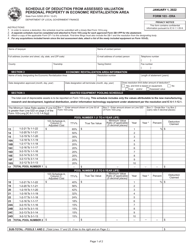

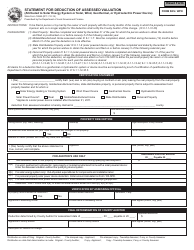

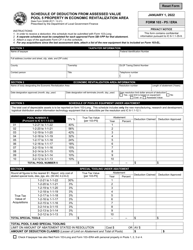

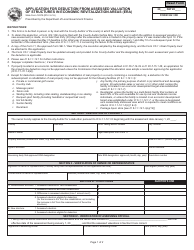

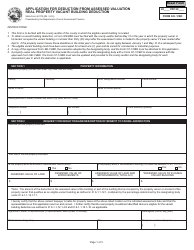

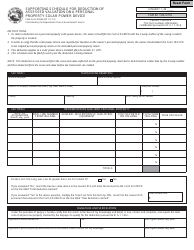

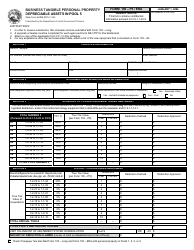

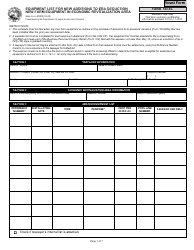

State Form 52447 (UD-ERA) Schedule of Deduction From Assessed Valuation Utility Distributable Property in Economic Revitalization Area - Indiana

What Is State Form 52447 (UD-ERA)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 52447?

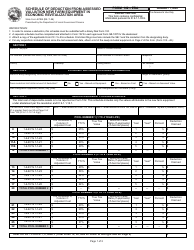

A: State Form 52447 is the form used in Indiana for reporting a Schedule of Deduction from Assessed Valuation for Utility Distributable Property in an Economic Revitalization Area.

Q: What is the purpose of State Form 52447?

A: The purpose of State Form 52447 is to provide a schedule of deductions from the assessed valuation of utility distributable property in an economic revitalization area in Indiana.

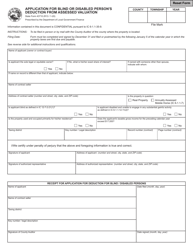

Q: Who uses State Form 52447?

A: State Form 52447 is used by entities in Indiana that have utility distributable property in an economic revitalization area.

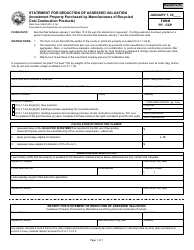

Q: What is utility distributable property?

A: Utility distributable property refers to property used for the distribution of utility services, such as electric, gas, or water, to consumers.

Q: What is an economic revitalization area?

A: An economic revitalization area is a designated area in Indiana where economic development is encouraged through various incentives and benefits.

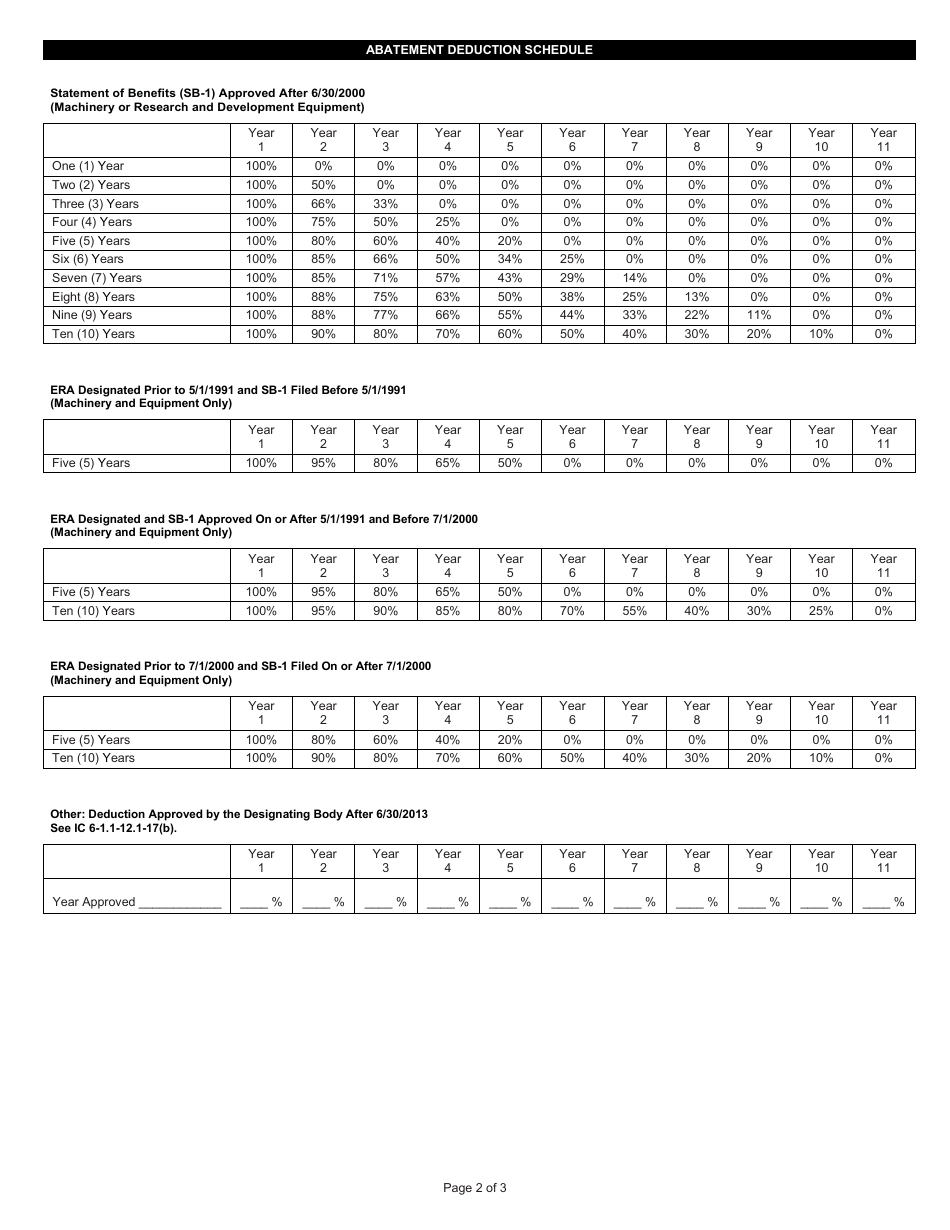

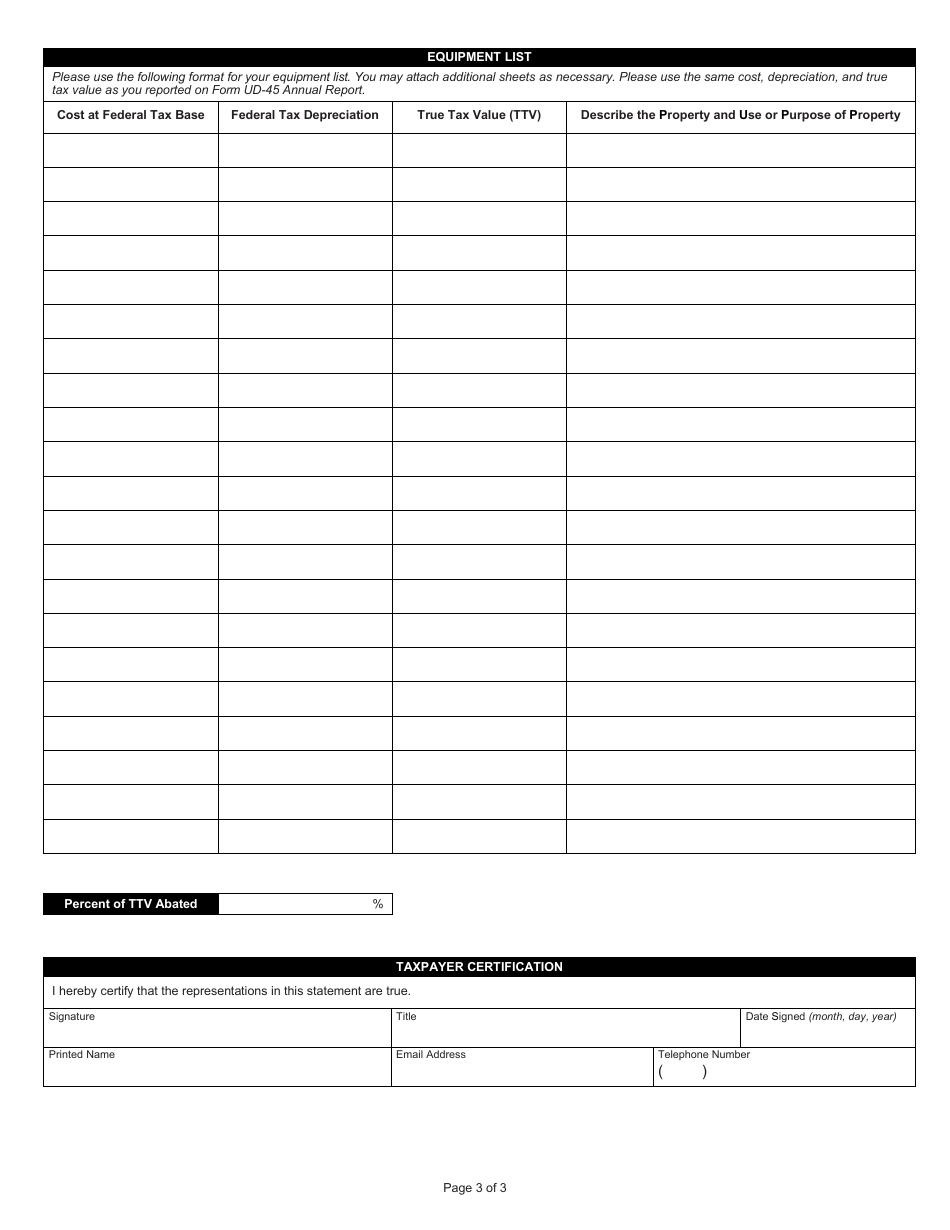

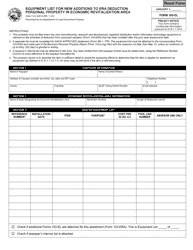

Q: What deductions are reported on State Form 52447?

A: State Form 52447 reports deductions from the assessed valuation of utility distributable property, which may include exemptions, abatements, or other types of deductions.

Q: Is State Form 52447 required to be filed annually?

A: Yes, State Form 52447 is typically required to be filed annually to report any changes or updates to the deductions from the assessed valuation of utility distributable property.

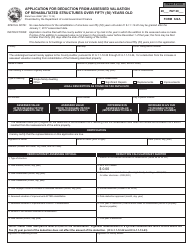

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 52447 (UD-ERA) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.