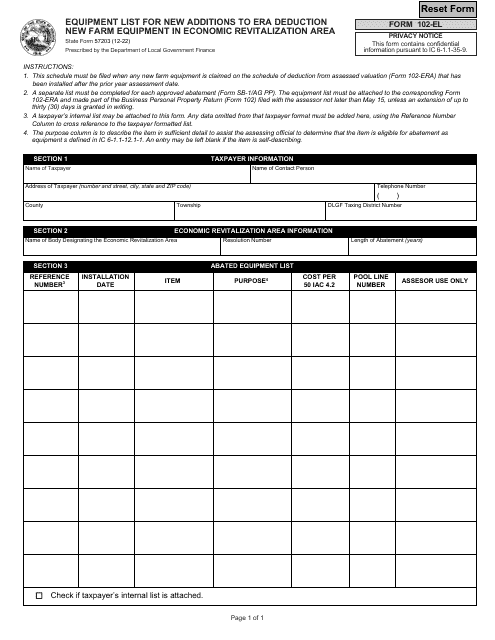

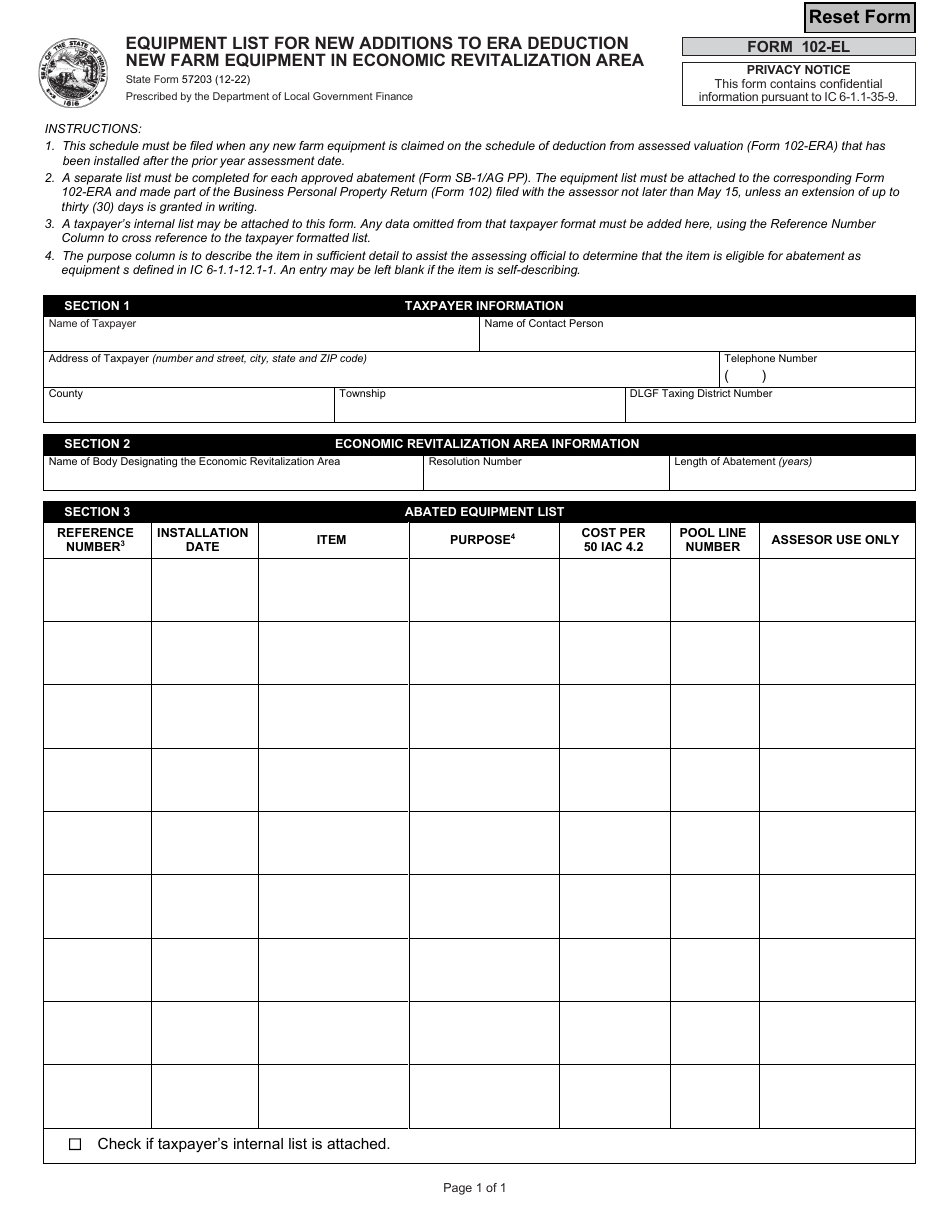

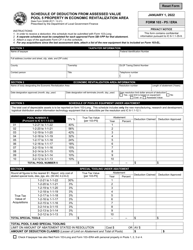

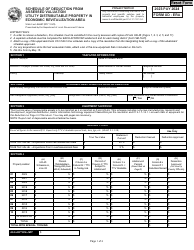

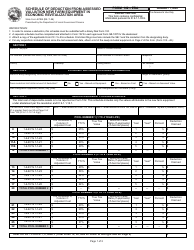

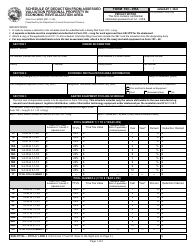

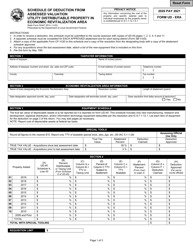

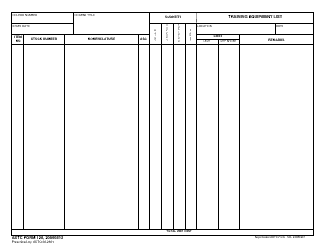

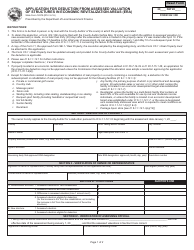

State Form 57203 (102-EL) Equipment List for New Additions to Era Deduction New Farm Equipment in Economic Revitalization Area - Indiana

What Is State Form 57203 (102-EL)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 57203?

A: State Form 57203 is a form used in Indiana for listing new additions to era deduction new farm equipment in an Economic Revitalization Area.

Q: What is the purpose of State Form 57203?

A: The purpose of State Form 57203 is to document and list new farm equipment additions in an Economic Revitalization Area in Indiana.

Q: When is State Form 57203 used?

A: State Form 57203 is used when adding new farm equipment in an Economic Revitalization Area in Indiana.

Q: What is an Economic Revitalization Area?

A: An Economic Revitalization Area is a designated area where certain economic incentives and tax deductions are provided to encourage economic development and investment.

Q: What is the era deduction for new farm equipment?

A: The era deduction for new farm equipment is a tax deduction provided for eligible farm equipment purchased or added in an Economic Revitalization Area.

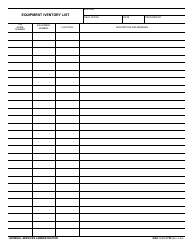

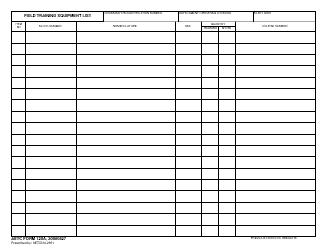

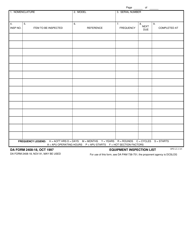

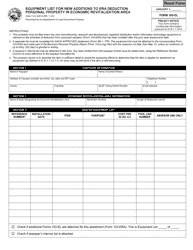

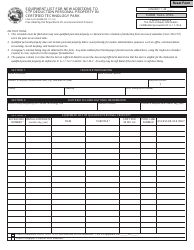

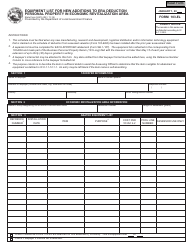

Q: What information is required to be listed on State Form 57203?

A: State Form 57203 requires information such as the description of the new farm equipment, its purchase date, cost, and other relevant details.

Q: Do I need to submit State Form 57203 with my tax return?

A: In most cases, you will need to submit State Form 57203 along with your tax return if you are claiming the era deduction for new farm equipment in an Economic Revitalization Area.

Q: Can I claim the era deduction for new farm equipment in any part of Indiana?

A: No, the era deduction for new farm equipment is only applicable to eligible equipment purchased or added in designated Economic Revitalization Areas in Indiana.

Q: Are there any specific eligibility criteria for claiming the era deduction?

A: Yes, there are specific eligibility criteria such as the type of farm equipment, the location of the equipment, and compliance with other requirements set by the Indiana Department of Revenue.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 57203 (102-EL) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.