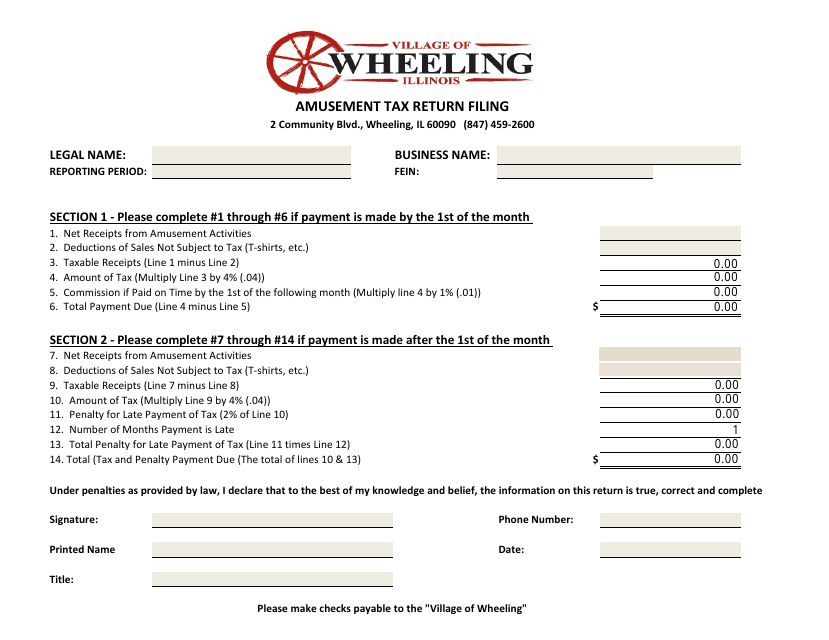

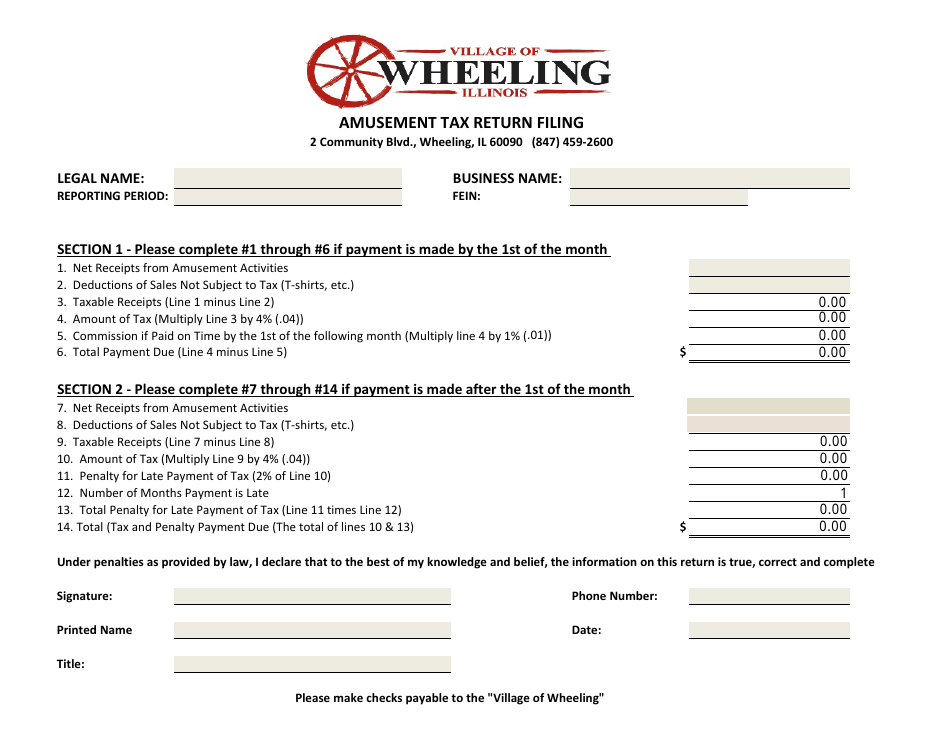

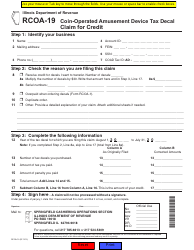

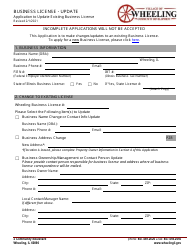

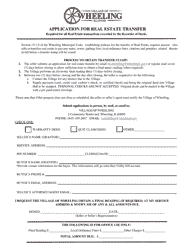

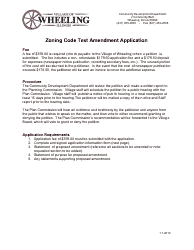

Amusement Tax Return - Village of Wheeling, Illinois

Amusement Tax Return is a legal document that was released by the Finance Department - Village of Wheeling, Illinois - a government authority operating within Illinois. The form may be used strictly within Village of Wheeling.

FAQ

Q: What is the Amusement Tax Return?

A: The Amusement Tax Return is a form that needs to be filled out and submitted to the Village of Wheeling, Illinois.

Q: Who needs to file the Amusement Tax Return?

A: Any business or individual that operates an amusement establishment in the Village of Wheeling, Illinois is required to file the Amusement Tax Return.

Q: What is considered an amusement establishment?

A: An amusement establishment is any place or event that provides amusement or entertainment for a fee, such as arcades, movie theaters, and live performances.

Q: How often do I need to file the Amusement Tax Return?

A: The Amusement Tax Return must be filed on a monthly basis.

Q: What is the due date for filing the Amusement Tax Return?

A: The Amusement Tax Return is due on or before the 20th day of the month following the reporting period.

Q: What information do I need to include in the Amusement Tax Return?

A: You need to provide details of the gross receipts received from amusement activities during the reporting period.

Q: Are there any exemptions or deductions available for the Amusement Tax?

A: Yes, certain exemptions and deductions are available. It is recommended to consult the official guidelines or contact the Village of Wheeling, Illinois for more information.

Q: What are the consequences for not filing or paying the Amusement Tax?

A: Failure to file or pay the Amusement Tax may result in penalties, interest, and legal action by the Village of Wheeling, Illinois.

Form Details:

- The latest edition currently provided by the Finance Department - Village of Wheeling, Illinois;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - Village of Wheeling, Illinois.