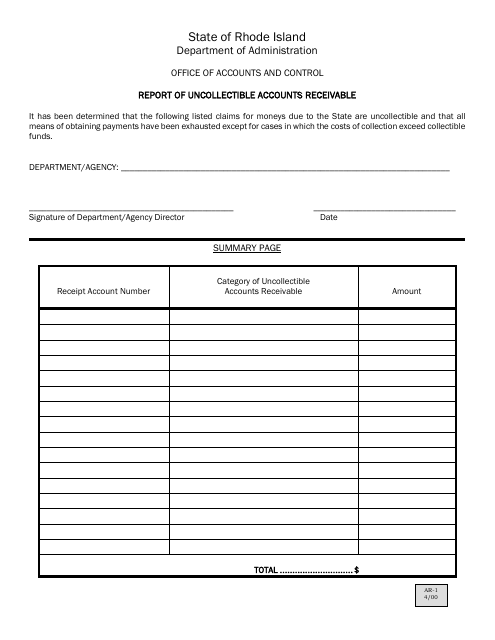

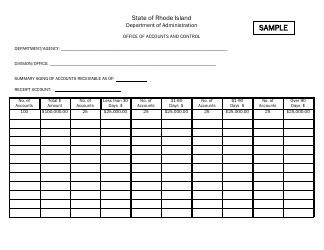

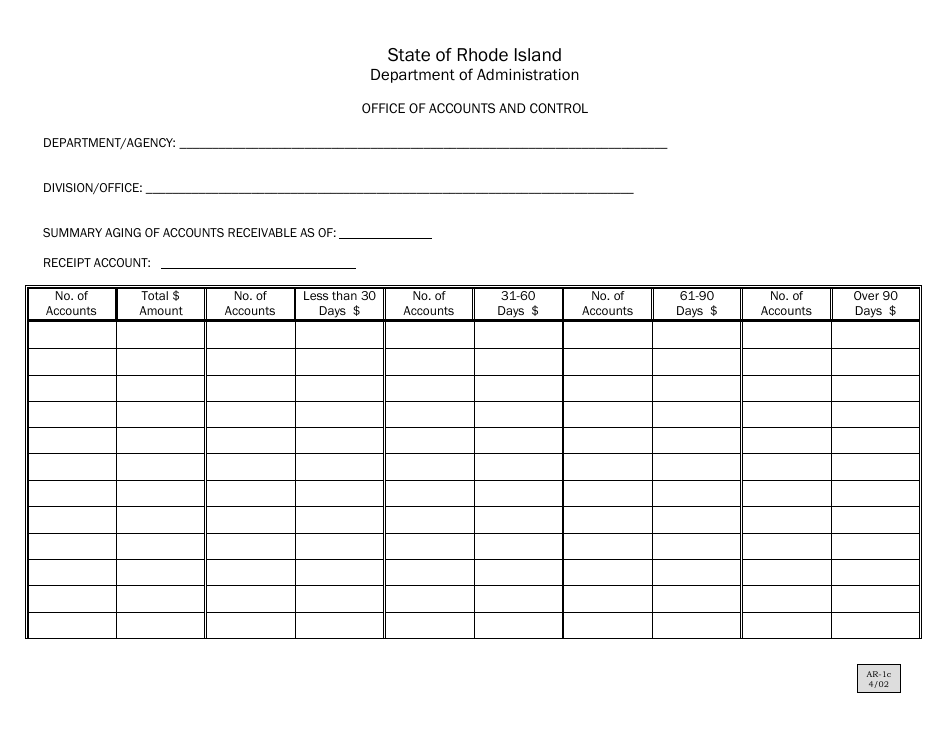

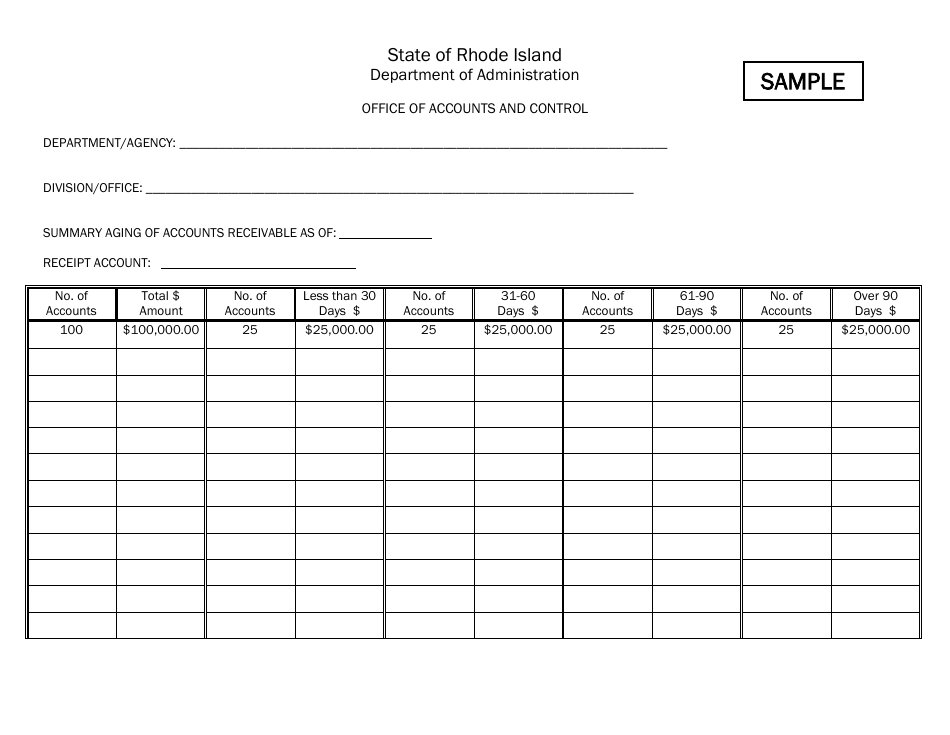

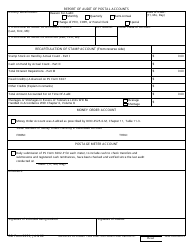

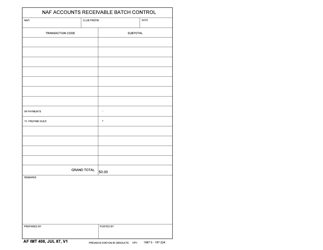

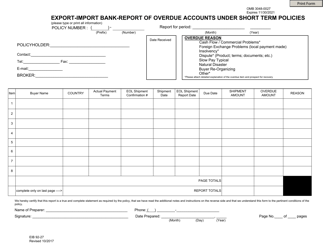

Form AR-1 Report of Uncollectible Accounts Receivable - Rhode Island

What Is Form AR-1?

This is a legal form that was released by the Rhode Island Department of Administration - Office of Accounts and Control - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

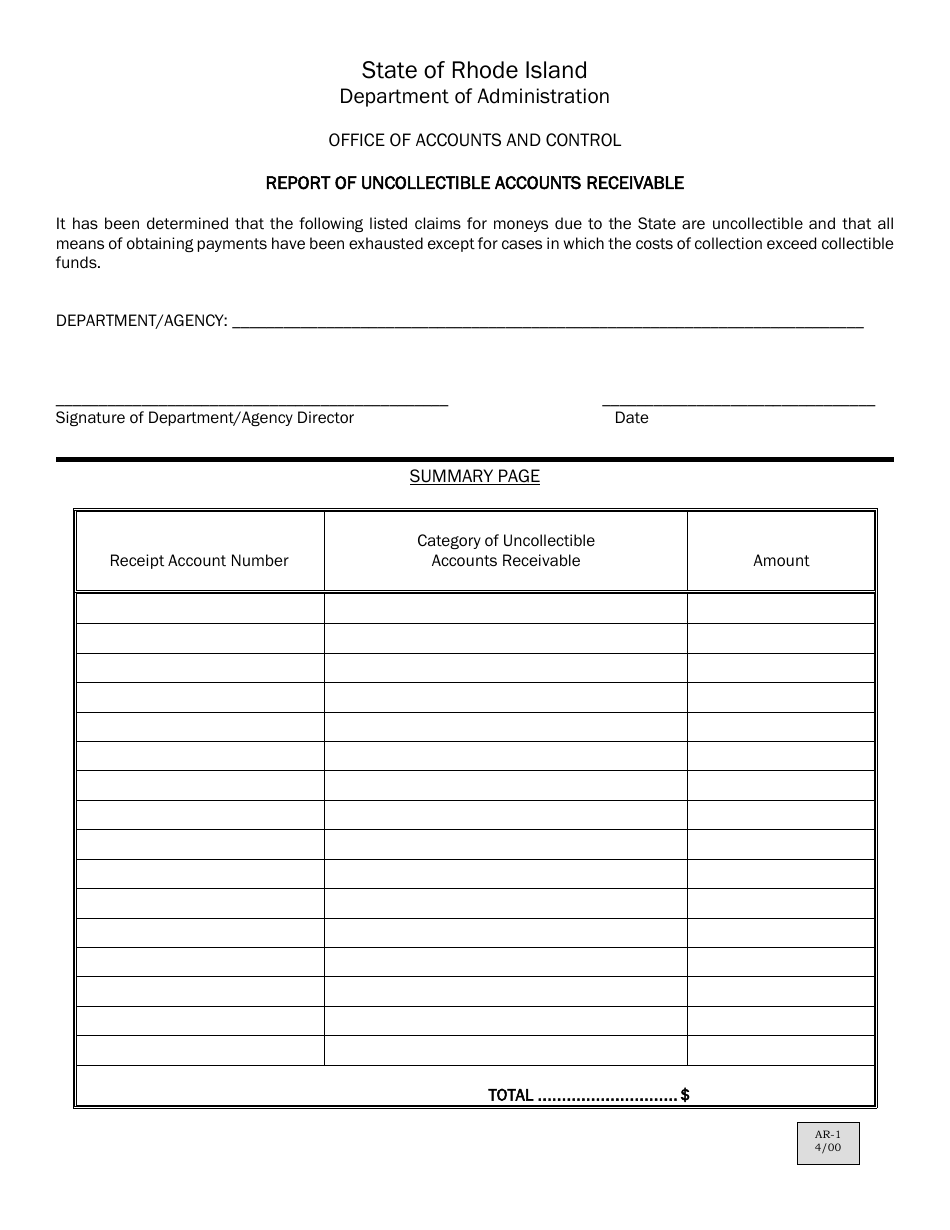

Q: What is Form AR-1?

A: Form AR-1 is the Report of Uncollectible Accounts Receivable.

Q: Who needs to file Form AR-1?

A: Businesses in Rhode Island that have uncollectible accounts receivable need to file Form AR-1.

Q: What is the purpose of Form AR-1?

A: The purpose of Form AR-1 is to report uncollectible accounts receivable and claim a deduction for them on your Rhode Island state tax return.

Q: When is Form AR-1 due?

A: Form AR-1 is due on or before the fifteenth day of the fourth month following the close of your tax year.

Q: Is there a fee for filing Form AR-1?

A: No, there is no fee for filing Form AR-1.

Q: Can I e-file Form AR-1?

A: No, Form AR-1 cannot be e-filed. It must be filed by mail or in person.

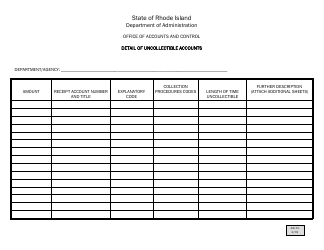

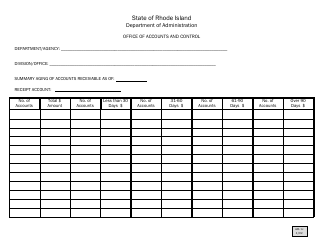

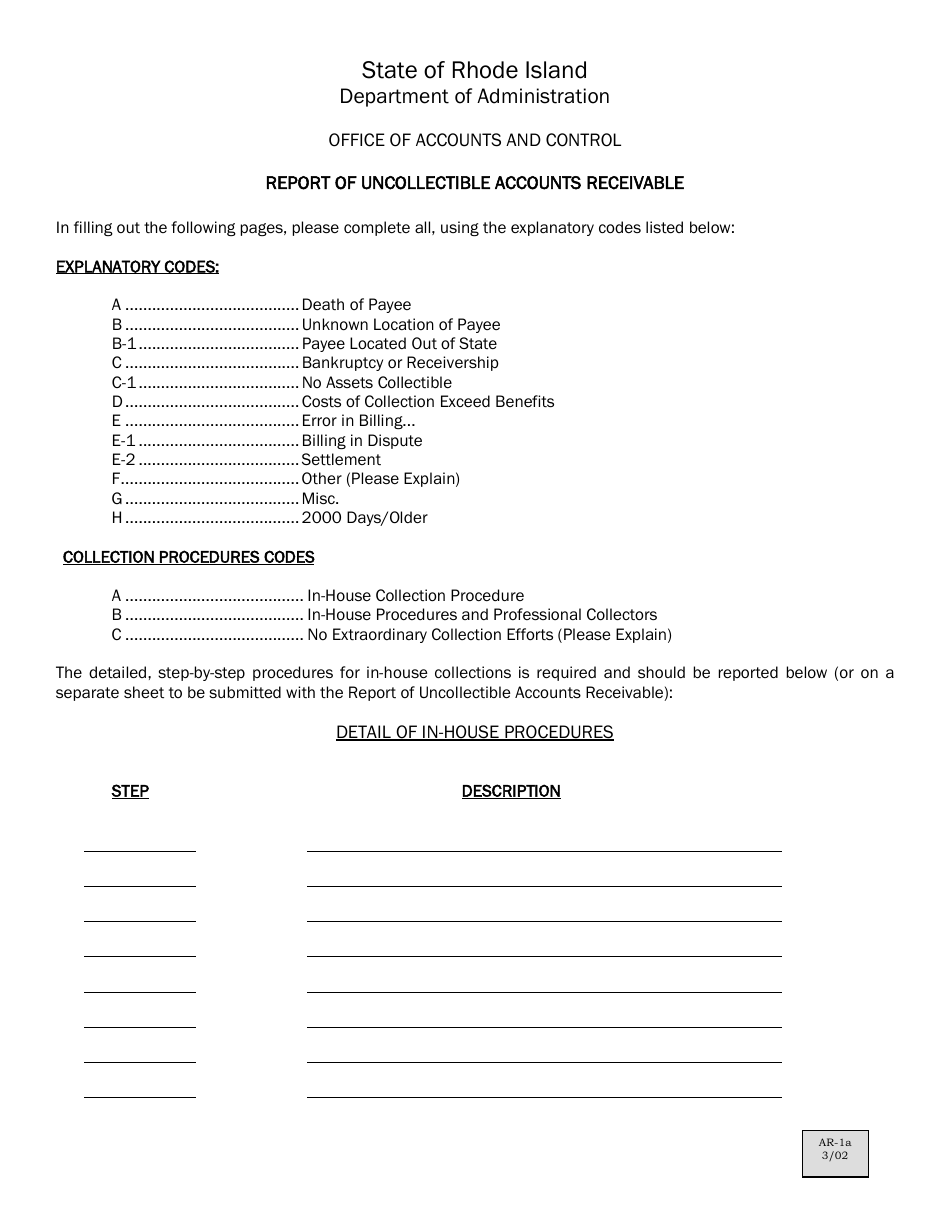

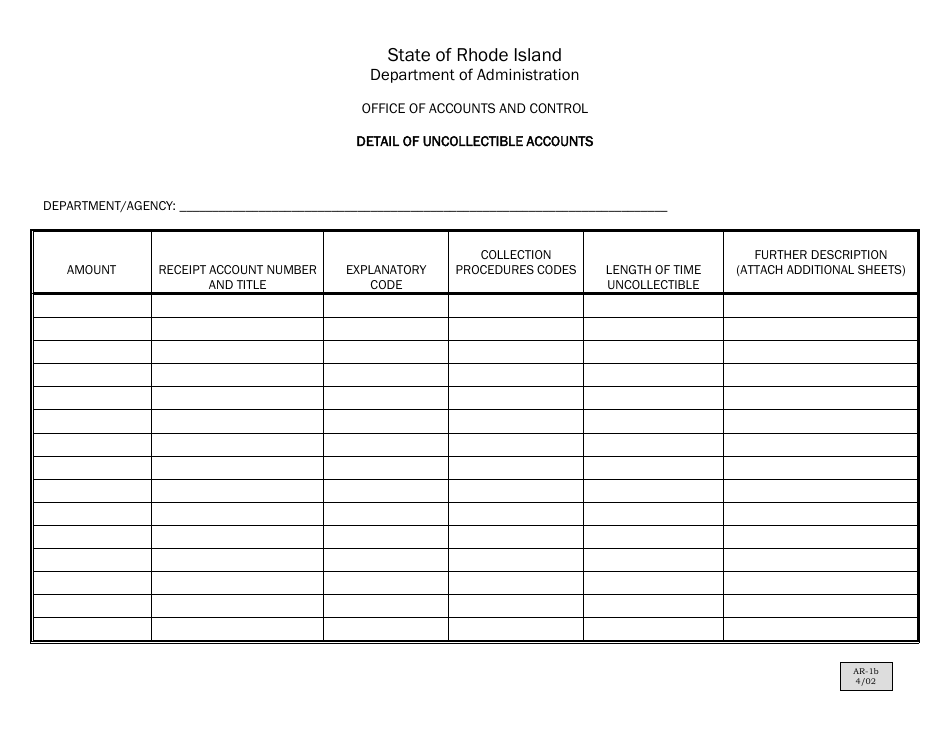

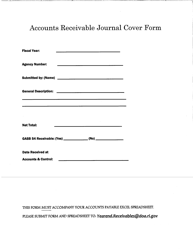

Q: What should I include with Form AR-1?

A: You should include a schedule detailing the uncollectible accounts receivable and supporting documentation.

Q: Can I claim a deduction for all of my uncollectible accounts receivable?

A: No, you can only claim a deduction for uncollectible accounts receivable that meet certain criteria.

Q: What happens if I don't file Form AR-1?

A: If you don't file Form AR-1 or if you file it late, you may face penalties and interest on the amount of uncollectible accounts receivable.

Q: Can I amend my Form AR-1 if I made a mistake?

A: Yes, you can amend your Form AR-1 by filing an amended form and explaining the changes.

Form Details:

- Released on April 1, 2002;

- The latest edition provided by the Rhode Island Department of Administration - Office of Accounts and Control;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR-1 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Administration - Office of Accounts and Control.