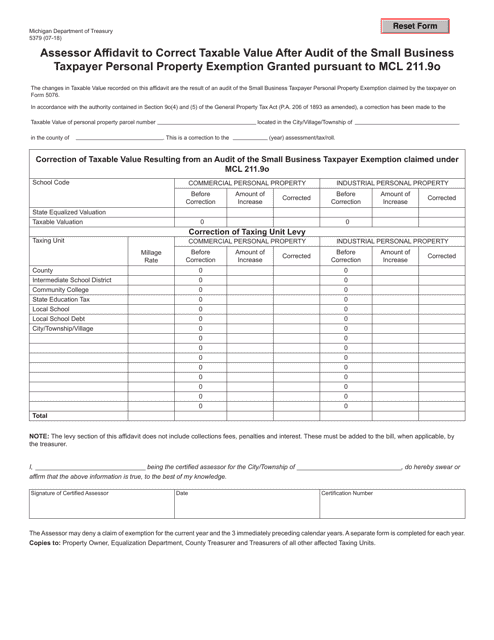

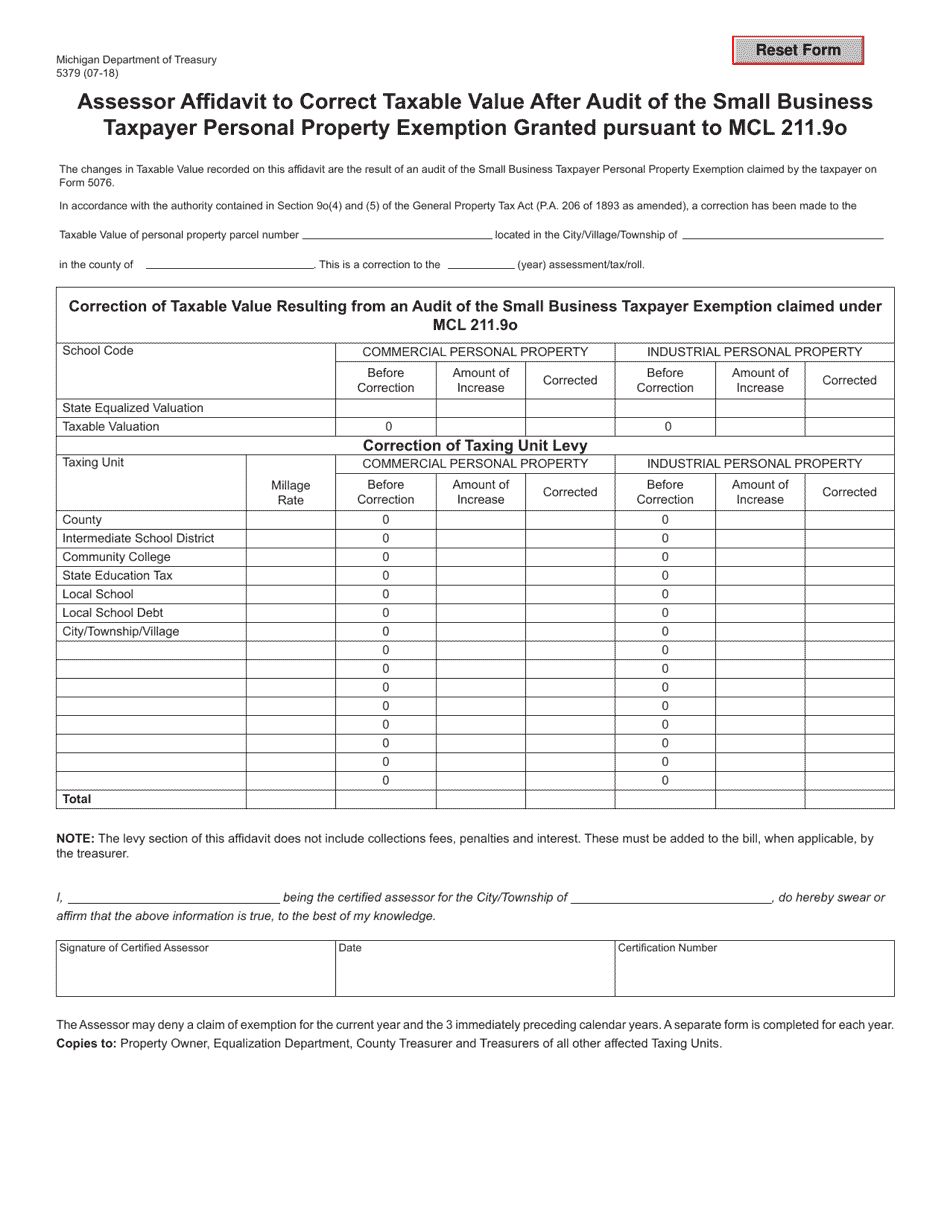

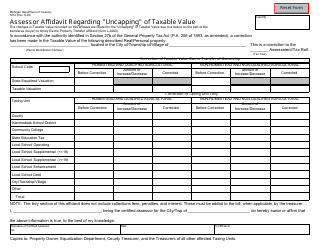

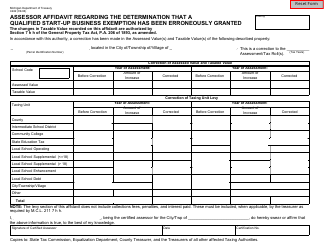

Form 5379 Assessor Affidavit to Correct Taxable Value After Audit of the Small Business Taxpayer Personal Property Exemption Granted Pursuant to Mcl 211.9o - Michigan

What Is Form 5379?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5379?

A: Form 5379 is the Assessor Affidavit to Correct Taxable Value after Audit of the Small Business Taxpayer Personal Property Exemption Granted Pursuant to MCL 211.9o in Michigan.

Q: What does Form 5379 do?

A: Form 5379 is used by assessors to correct the taxable value of a small business taxpayer's personal property after an audit of their exemption.

Q: What is the Small Business Taxpayer Personal Property Exemption?

A: The Small Business Taxpayer Personal Property Exemption is a tax exemption granted to small businesses in Michigan.

Q: What is MCL 211.9o?

A: MCL 211.9o is a section of the Michigan Compiled Laws that governs the small business taxpayer personal property exemption.

Q: Who should use Form 5379?

A: Assessors in Michigan should use Form 5379 to correct the taxable value of a small business taxpayer's personal property after an audit.

Q: Is completing Form 5379 mandatory?

A: Yes, assessors are required to complete Form 5379 when correcting the taxable value of a small business taxpayer's personal property after an audit.

Q: Are there any fees associated with Form 5379?

A: No, there are no fees associated with Form 5379.

Q: What happens after Form 5379 is completed?

A: After completing Form 5379, the assessors will use the corrected taxable value to determine the appropriate taxes owed by the small business taxpayer.

Q: Can a small business taxpayer appeal the corrected taxable value?

A: Yes, a small business taxpayer has the right to appeal the corrected taxable value if they disagree with the assessment.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5379 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.