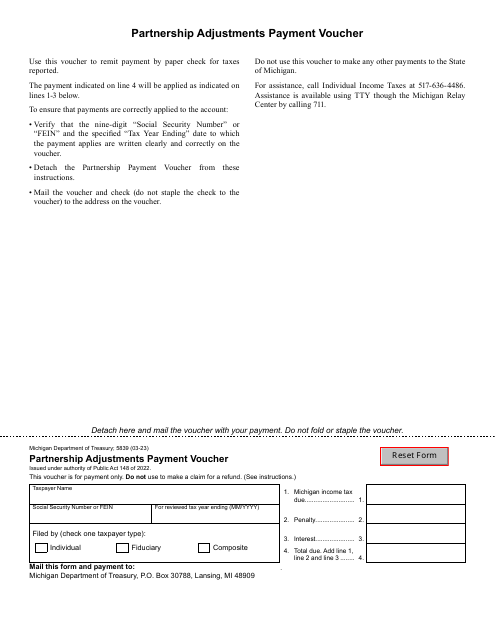

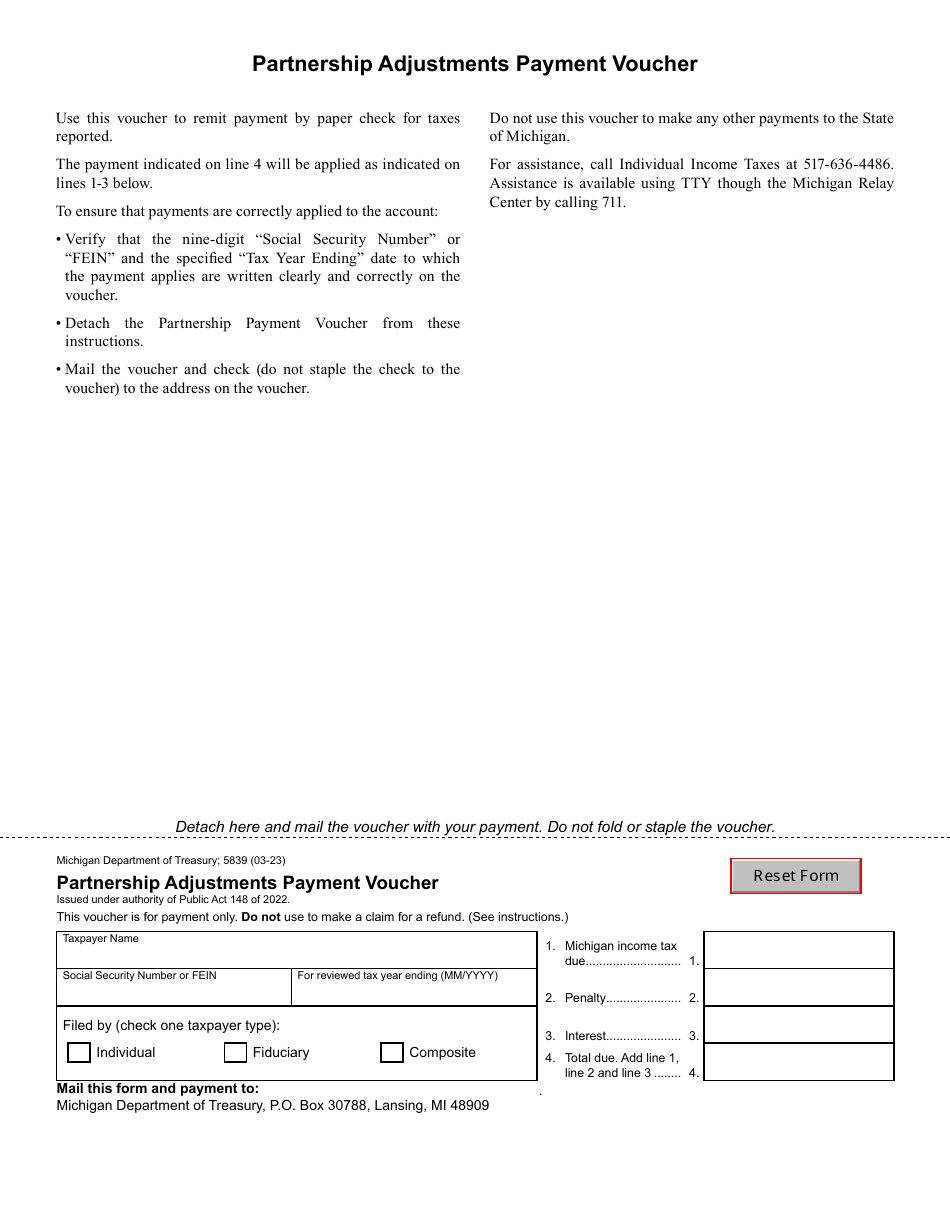

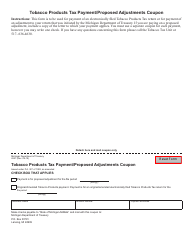

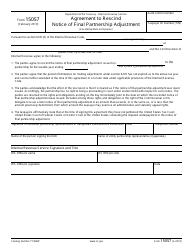

Form 5839 Partnership Adjustments Payment Voucher - Michigan

What Is Form 5839?

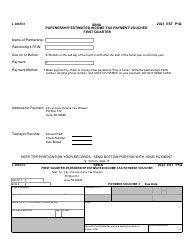

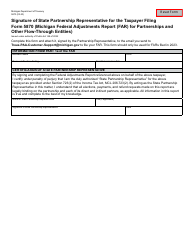

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5839?

A: Form 5839 is the Partnership Adjustments Payment Voucher.

Q: What is the purpose of Form 5839?

A: The purpose of Form 5839 is to make payments for partnership adjustments.

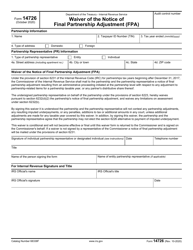

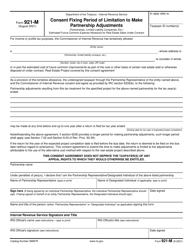

Q: Who needs to file Form 5839?

A: Partnerships that have made adjustments on their federal income tax return must file Form 5839.

Q: When is Form 5839 due?

A: Form 5839 is due on or before the due date of the partnership return, including extensions.

Q: Is there a penalty for not filing Form 5839?

A: Yes, there can be penalties for failing to file Form 5839 or for filing it late.

Q: Are there any special instructions for completing Form 5839?

A: Yes, you should carefully follow the instructions provided by the IRS when completing Form 5839.

Form Details:

- Released on March 1, 2023;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5839 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.