This version of the form is not currently in use and is provided for reference only. Download this version of

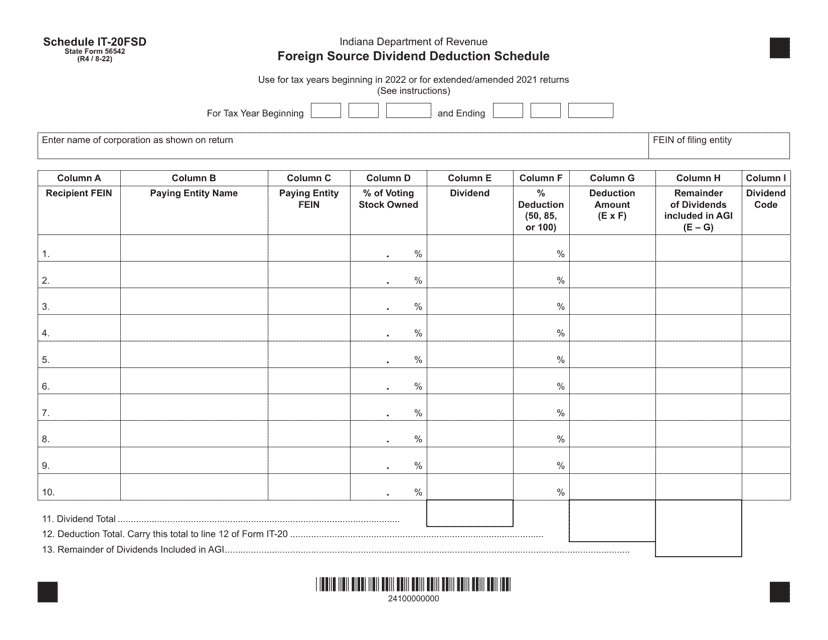

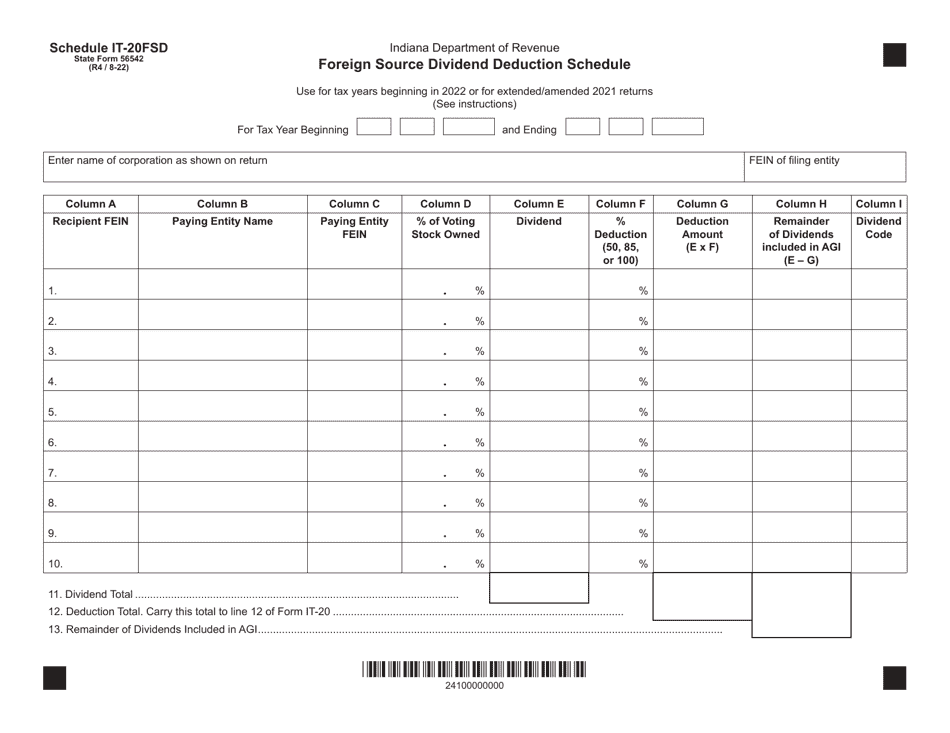

State Form 56542 Schedule IT-20FSD

for the current year.

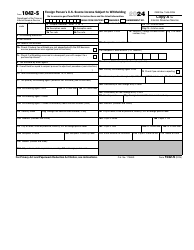

State Form 56542 Schedule IT-20FSD Foreign Source Dividend Deduction Schedule - Indiana

What Is State Form 56542 Schedule IT-20FSD?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 56542 Schedule IT-20FSD?

A: State Form 56542 Schedule IT-20FSD is a form used in Indiana to report the Foreign Source Dividend Deduction.

Q: What is the purpose of Schedule IT-20FSD?

A: The purpose of Schedule IT-20FSD is to calculate and claim the Foreign Source Dividend Deduction on your Indiana tax return.

Q: Who needs to file Schedule IT-20FSD?

A: You need to file Schedule IT-20FSD if you received foreign source dividends and want to claim the deduction on your Indiana tax return.

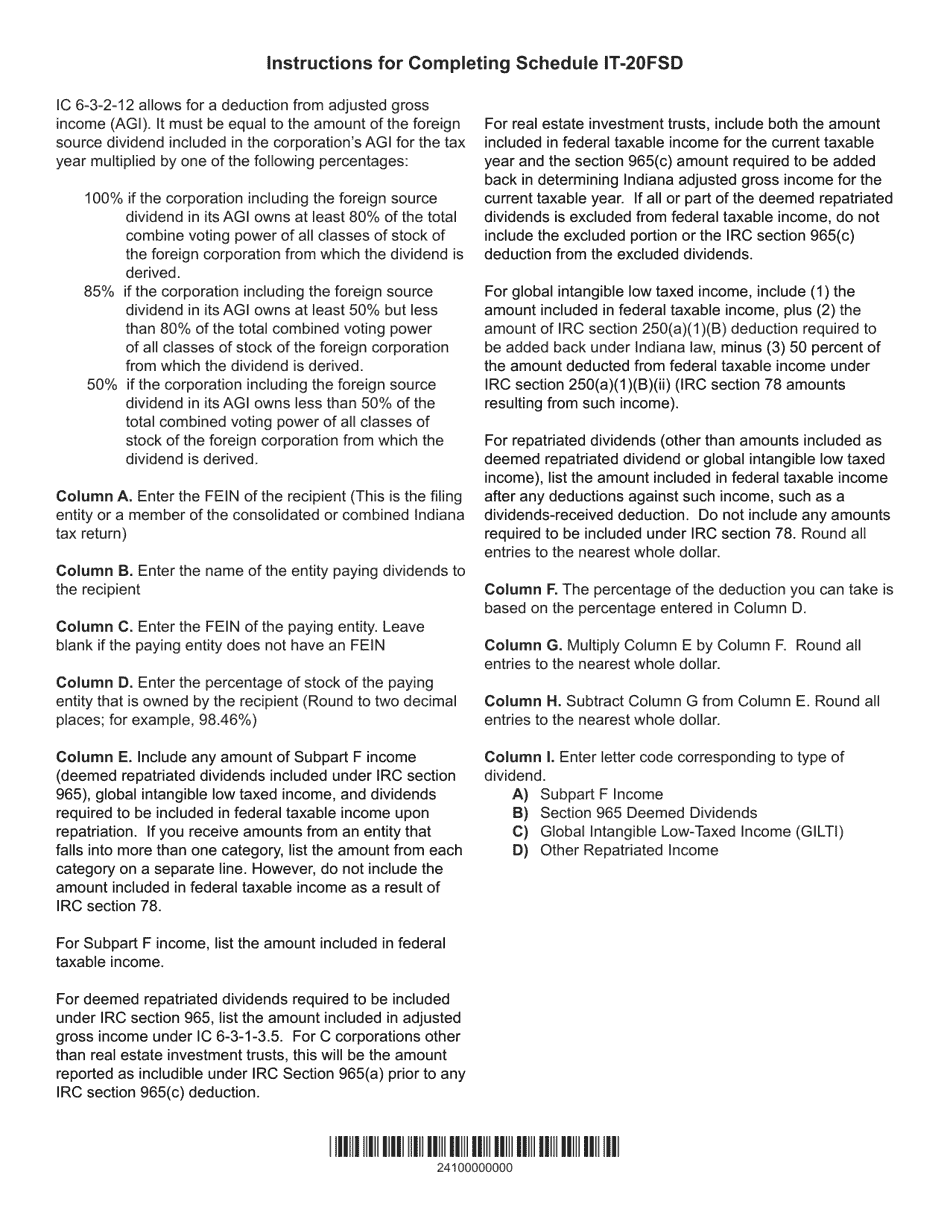

Q: What information is required on Schedule IT-20FSD?

A: Schedule IT-20FSD requires you to provide details about the foreign source dividends you received, including the country of origin, the amount, and any taxes paid.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 56542 Schedule IT-20FSD by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.