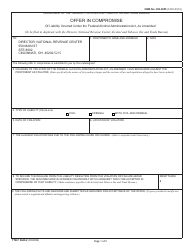

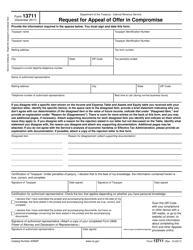

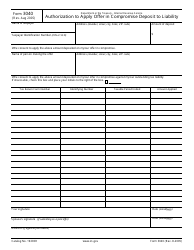

Maryland Form 656 Offer in Compromise - Maryland

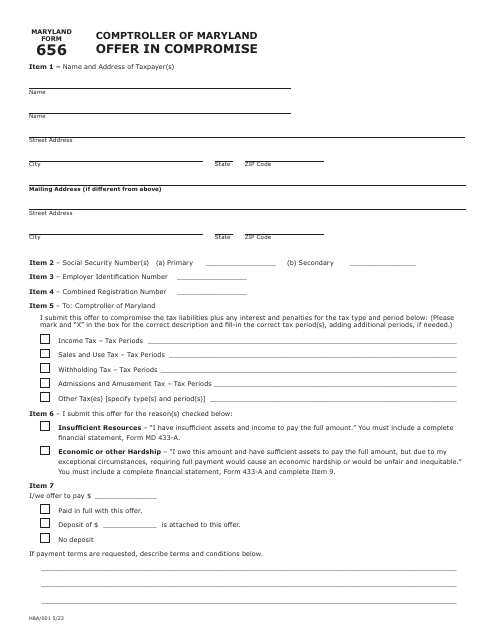

What Is Maryland Form 656?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form 656?

A: Maryland Form 656 is an Offer in Compromise form used by residents of Maryland to propose a settlement for their unpaid tax liabilities.

Q: What is an Offer in Compromise?

A: An Offer in Compromise is a program through which taxpayers can settle their tax debts with the government for less than the full amount.

Q: Who can use Maryland Form 656?

A: Residents of Maryland who owe state taxes can use Maryland Form 656 to propose an Offer in Compromise to the state.

Q: What is the purpose of Maryland Form 656?

A: The purpose of Maryland Form 656 is to allow taxpayers to propose a settlement amount to the state for their unpaid tax liabilities.

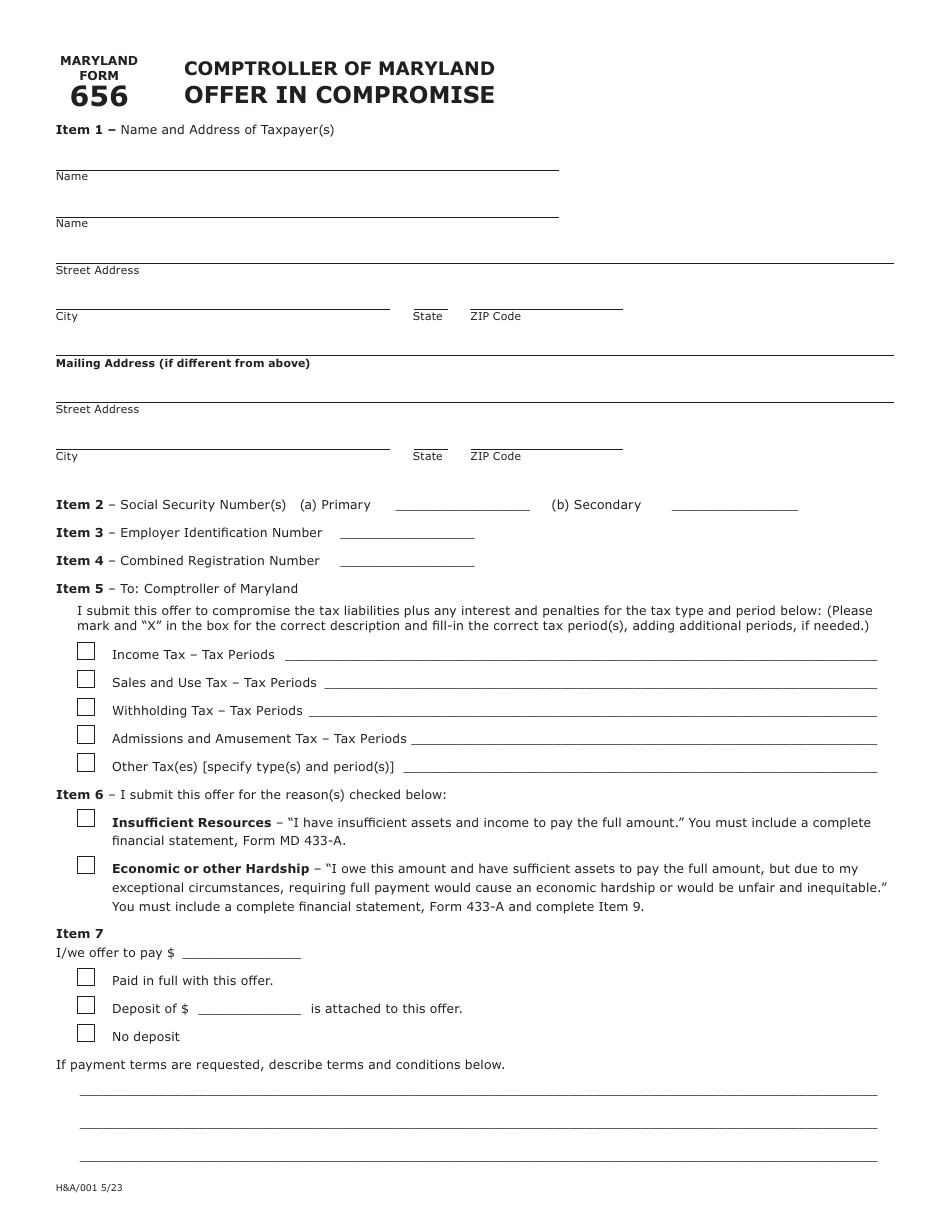

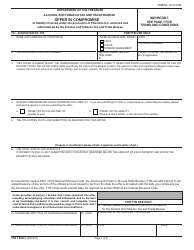

Q: What information is required on Maryland Form 656?

A: Maryland Form 656 requires taxpayers to provide their personal information, details of their tax liabilities, financial information, and proposed settlement amount.

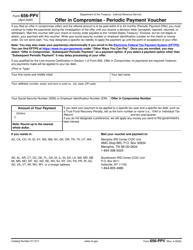

Q: Are there any fees associated with filing Maryland Form 656?

A: Yes, there is a non-refundable application fee of $50 for filing Maryland Form 656.

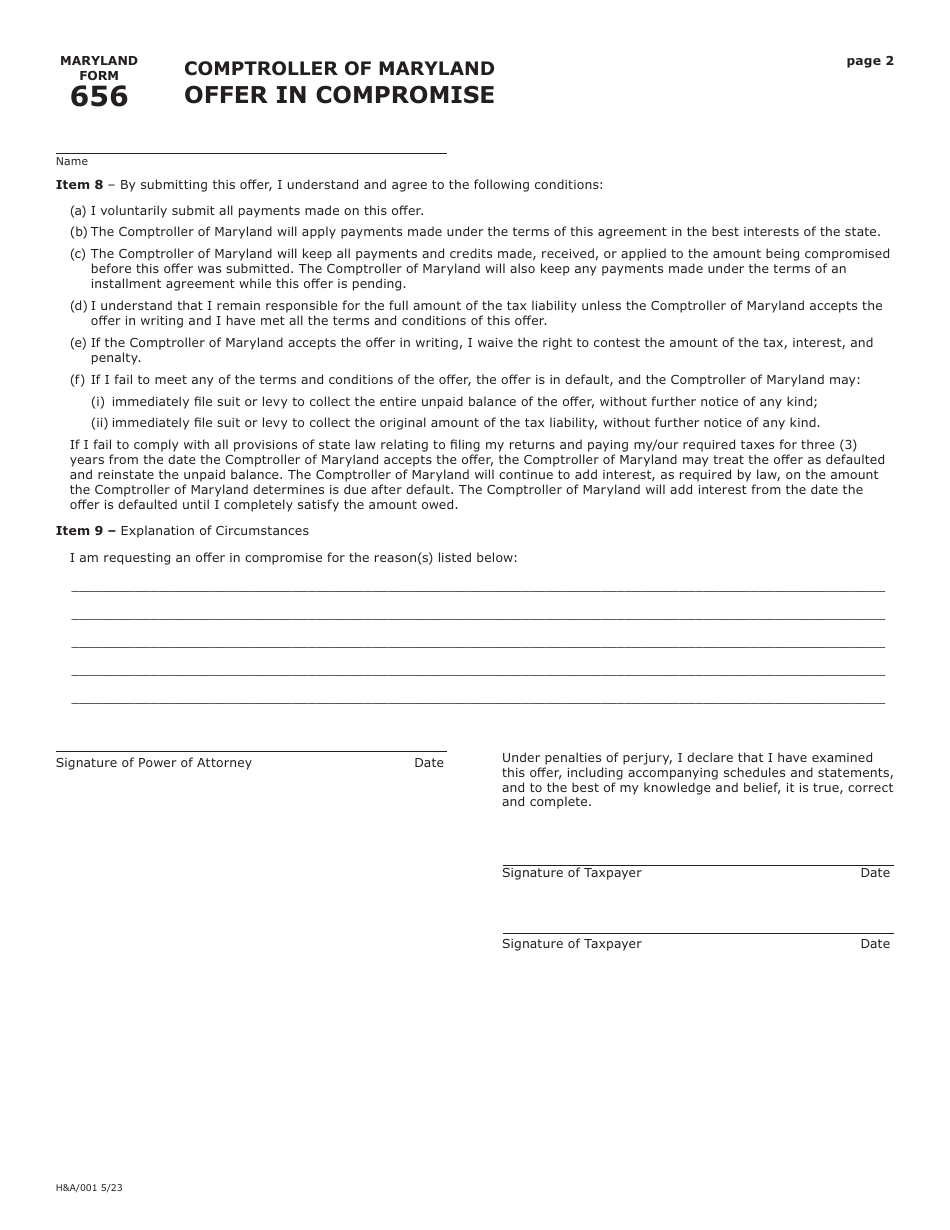

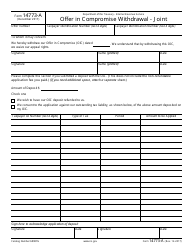

Q: What happens after I submit Maryland Form 656?

A: After submitting Maryland Form 656, the state will review your offer and may accept, reject, or request additional information before making a decision.

Q: Can I negotiate the settlement amount with the state?

A: Yes, taxpayers can negotiate the settlement amount with the state during the review process of their Offer in Compromise.

Q: What if my Offer in Compromise is accepted?

A: If your Offer in Compromise is accepted, you will be required to fulfill the terms of the agreement, which typically include making the proposed settlement payment and staying current on your future tax obligations.

Form Details:

- Released on May 1, 2023;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 656 by clicking the link below or browse more documents and templates provided by the Maryland Taxes.