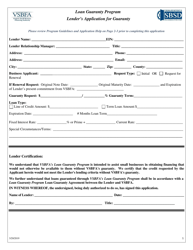

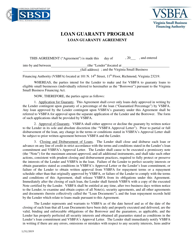

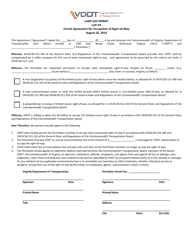

Loan Guaranty Program Agreement - Virginia

Loan Guaranty Program Agreement is a legal document that was released by the Virginia Department of Small Business and Supplier Diversity - a government authority operating within Virginia.

FAQ

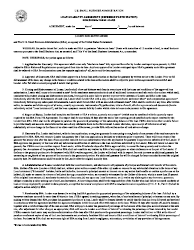

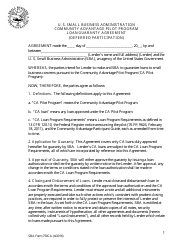

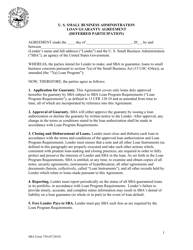

Q: What is a Loan Guaranty Program Agreement?

A: A Loan Guaranty Program Agreement is a contract between a lender and a guarantor, often a government agency, that provides a guarantee for a loan made by the lender to a borrower.

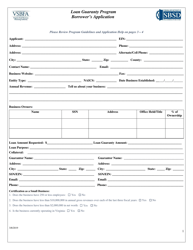

Q: Who is involved in a Loan Guaranty Program Agreement?

A: The parties involved in a Loan Guaranty Program Agreement are the lender, the borrower, and the guarantor.

Q: What is the purpose of a Loan Guaranty Program Agreement?

A: The purpose of a Loan Guaranty Program Agreement is to provide assurance to the lender that if the borrower fails to repay the loan, the guarantor will fulfill the borrower's obligations.

Q: How does a Loan Guaranty Program Agreement work?

A: Under a Loan Guaranty Program Agreement, the lender provides a loan to the borrower, and the guarantor agrees to repay the lender a certain percentage of the loan amount if the borrower defaults. The borrower is still responsible for repayment.

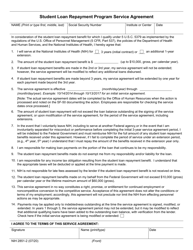

Q: Is a Loan Guaranty Program Agreement available in Virginia?

A: Yes, a Loan Guaranty Program Agreement is available in Virginia.

Q: What are the benefits of entering into a Loan Guaranty Program Agreement?

A: The benefits of entering into a Loan Guaranty Program Agreement include increased access to financing for the borrower and reduced risk for the lender.

Q: Are there any eligibility requirements to qualify for a Loan Guaranty Program Agreement?

A: Yes, there may be eligibility requirements set by the guarantor, such as creditworthiness or industry-specific criteria.

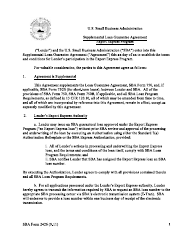

Form Details:

- The latest edition currently provided by the Virginia Department of Small Business and Supplier Diversity;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Small Business and Supplier Diversity.