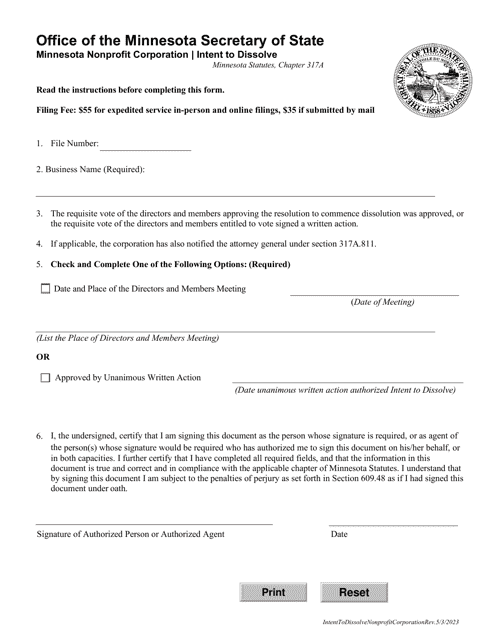

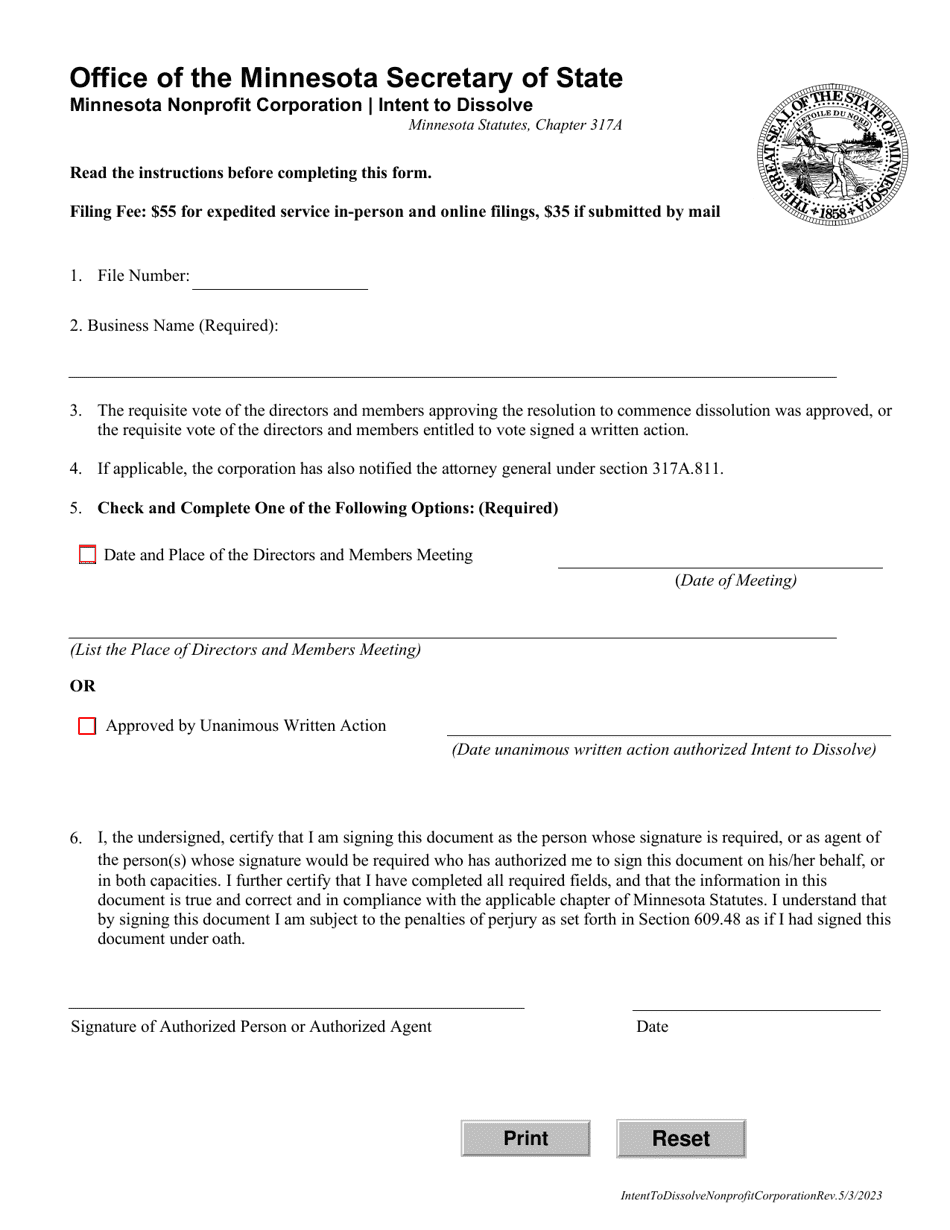

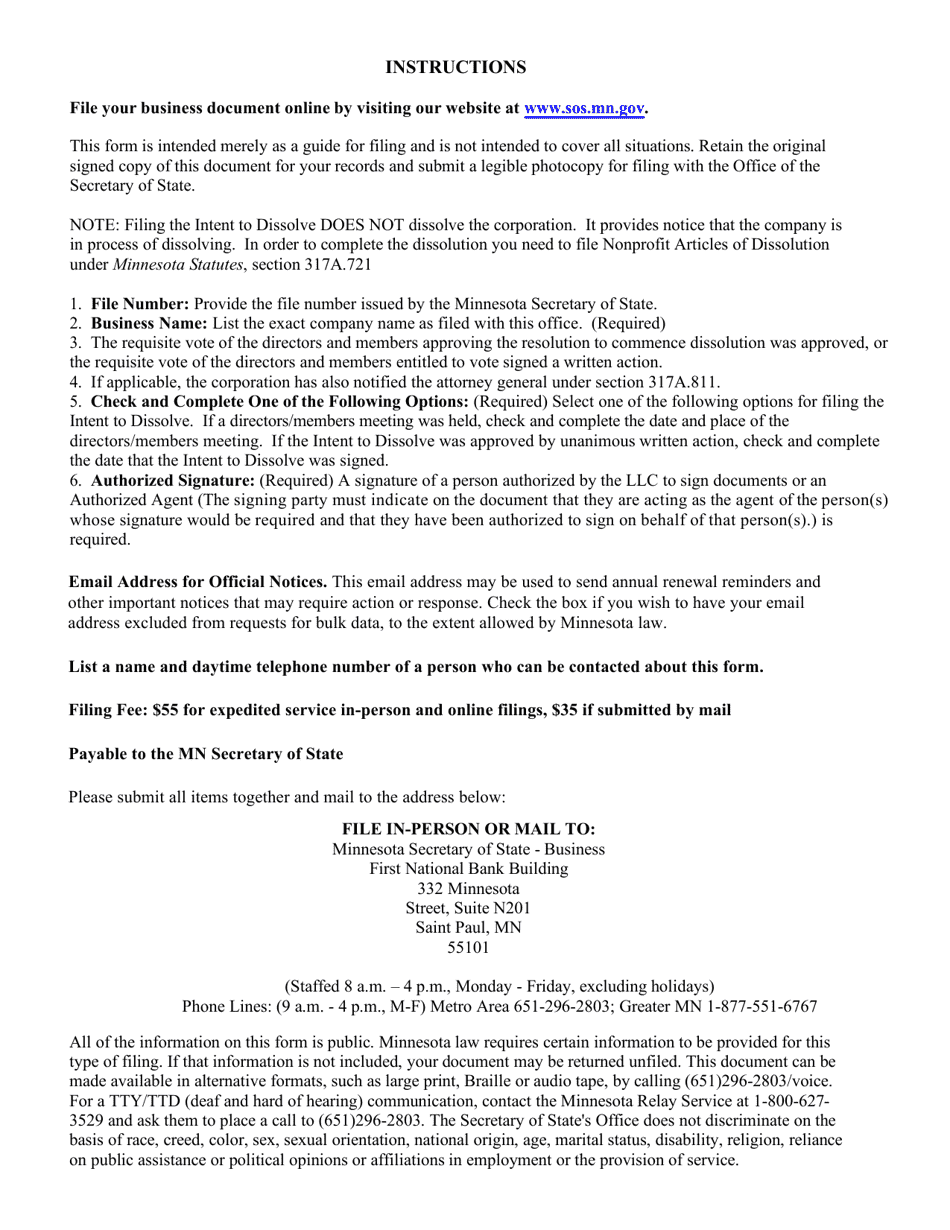

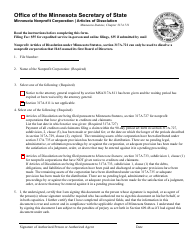

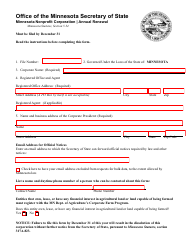

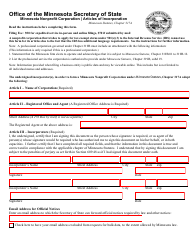

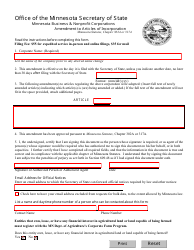

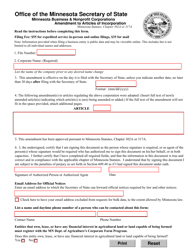

Minnesota Nonprofit Corporation Intent to Dissolve - Minnesota

Minnesota Nonprofit Corporation Intent to Dissolve is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

Q: What is a nonprofit corporation?

A: A nonprofit corporation is an organization that is formed for charitable, educational, religious, or other similar purposes, and does not operate for the benefit of individual shareholders or owners.

Q: What is the 'Intent to Dissolve' for a nonprofit corporation?

A: The 'Intent to Dissolve' is a formal notice filed by a nonprofit corporation indicating its intention to terminate its legal existence as an organization.

Q: Why would a nonprofit corporation want to dissolve?

A: There can be several reasons why a nonprofit corporation would want to dissolve, such as accomplishing its mission, lack of funding, changes in leadership, or other strategic reasons.

Q: What is the process for dissolving a nonprofit corporation in Minnesota?

A: The process for dissolving a nonprofit corporation in Minnesota involves filing a formal 'Intent to Dissolve' document with the Secretary of State and following certain legal requirements, such as settling the organization's debts and notifying stakeholders.

Q: Can a nonprofit corporation distribute its assets to its members upon dissolution?

A: No, a nonprofit corporation cannot distribute its assets to its members upon dissolution. Instead, any remaining assets must be distributed to another nonprofit organization or for a charitable purpose.

Q: What happens after a nonprofit corporation is dissolved?

A: After a nonprofit corporation is dissolved, it ceases to exist as a legal entity. Its assets are distributed according to state laws and its remaining legal obligations are settled.

Q: Can a dissolved nonprofit corporation be revived?

A: In some cases, a dissolved nonprofit corporation may be able to be revived or reinstated by following certain legal procedures. This would depend on the specific laws and regulations of the state.

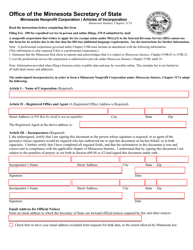

Form Details:

- Released on May 3, 2023;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.