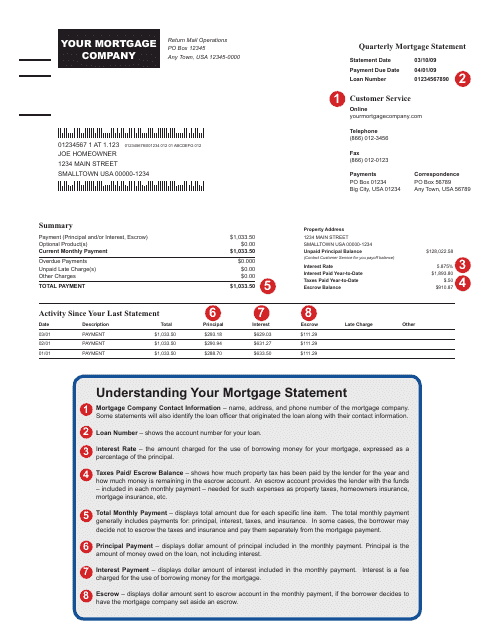

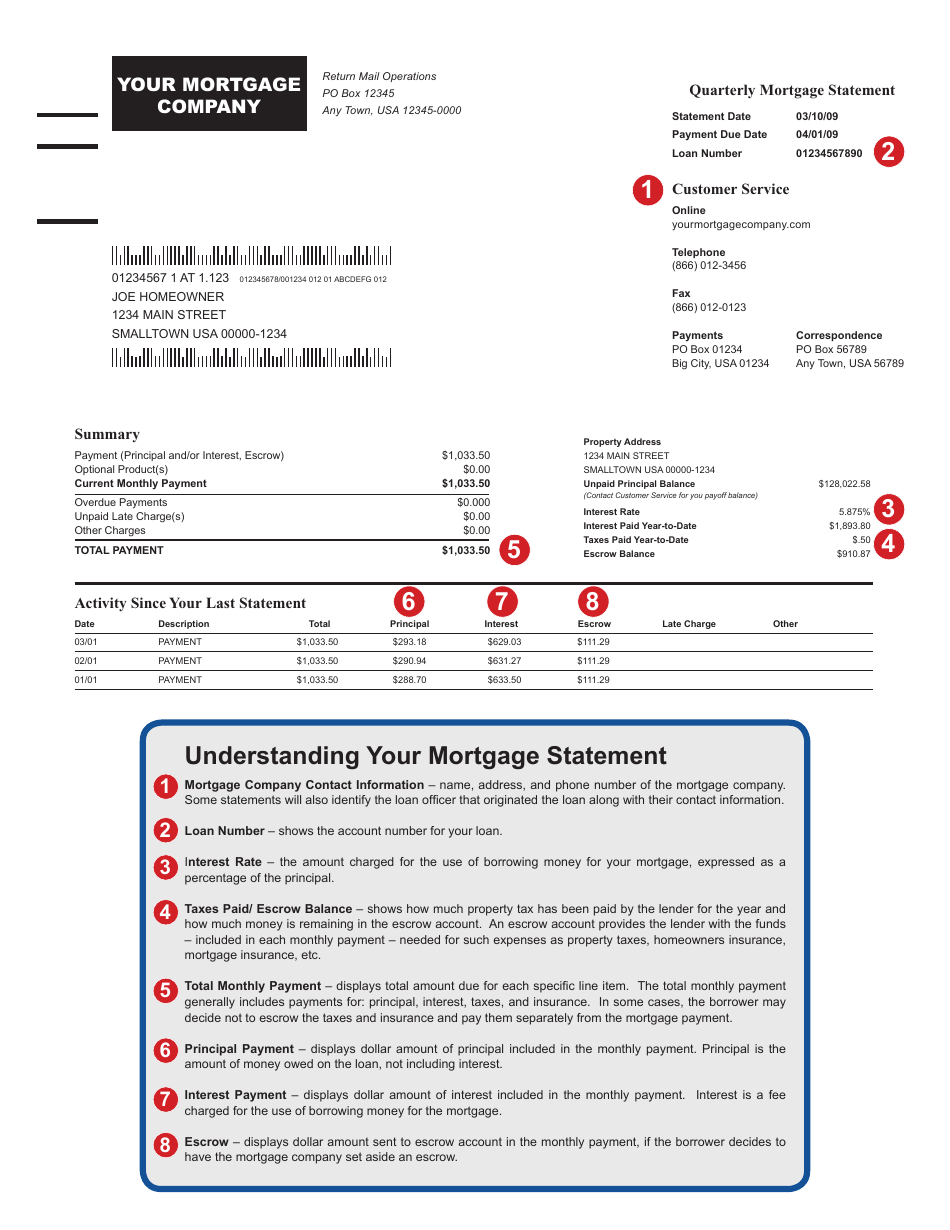

Sample Quarterly Mortgage Statement

A Sample Quarterly Mortgage Statement is a document that provides information about your mortgage loan, such as the amount owed, interest rate, and monthly payment. It helps you keep track of your mortgage payments and understand the breakdown of principal and interest.

The lender or mortgage servicer typically files the sample quarterly mortgage statement.

FAQ

Q: What is a quarterly mortgage statement?

A: A quarterly mortgage statement is a document provided by your mortgage lender that outlines the details of your mortgage loan for a specific three-month period.

Q: What information does a quarterly mortgage statement include?

A: A quarterly mortgage statement typically includes information about your loan balance, interest rate, monthly payment amount, payment due date, and any recent transactions or changes to your account.

Q: Why do I receive a quarterly mortgage statement?

A: You receive a quarterly mortgage statement to keep you informed about the status of your mortgage loan and to provide transparency regarding your payment history and current loan details.

Q: How do I read a quarterly mortgage statement?

A: To read a quarterly mortgage statement, review the sections that provide information about your loan balance, payment amount, interest rate, and any recent transactions. Make sure to check for any discrepancies or errors and contact your lender if necessary.

Q: Can I make changes to my mortgage loan based on the information in a quarterly mortgage statement?

A: You can discuss potential changes to your mortgage loan, such as refinancing or modifying the terms, with your lender based on the information provided in a quarterly mortgage statement.