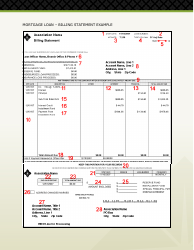

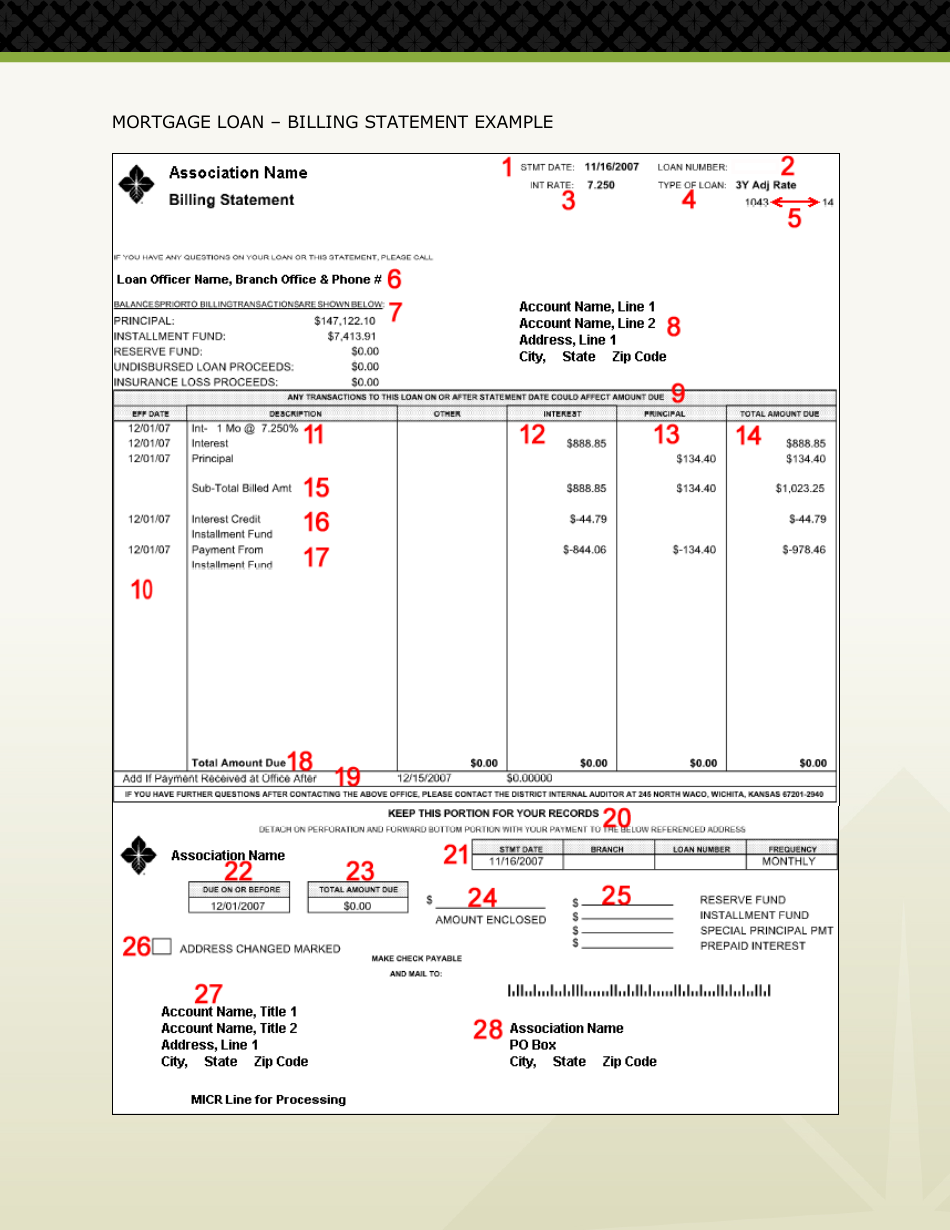

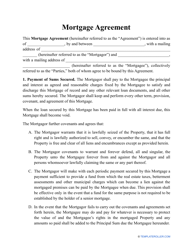

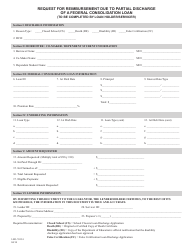

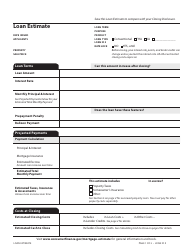

Sample Mortgage Loan Billing Statement

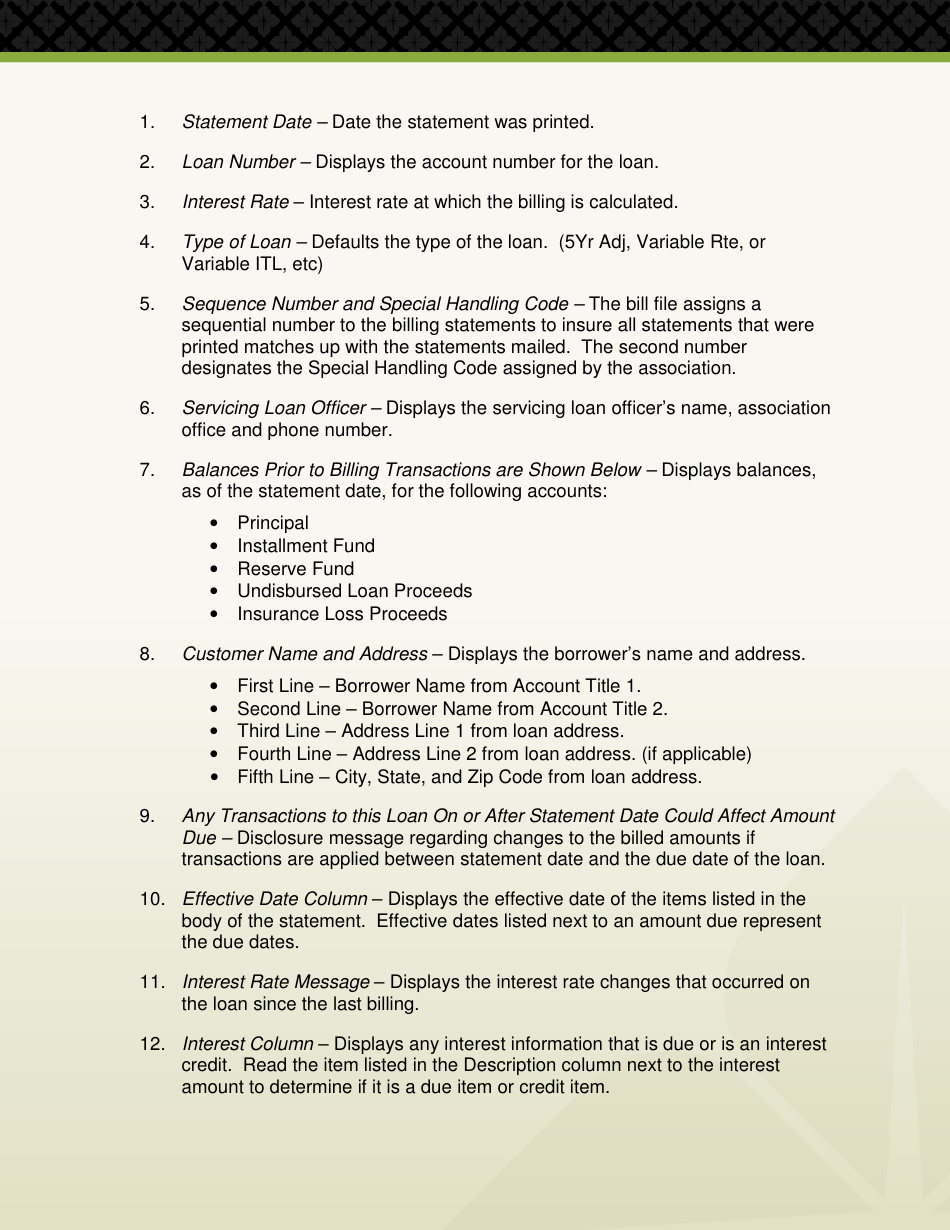

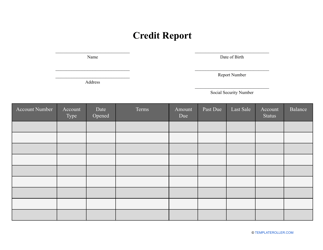

A sample mortgage loanbilling statement is a document that provides a breakdown of your monthly mortgage payments. It includes important information such as the amount due, due date, and a summary of your payment history. It is used to keep track of your mortgage payments and ensure that you are staying on top of your loan obligations.

The sample mortgage loan billing statement is typically filed by the mortgage lender or servicer.

FAQ

Q: What is a mortgage loan billing statement?

A: A mortgage loan billing statement is a document that provides you with details about your monthly mortgage payments and any other charges related to your mortgage loan.

Q: What information is included in a mortgage loan billing statement?

A: A mortgage loan billing statement typically includes information about your monthly payment amount, the due date, the remaining loan balance, the interest rate, and any escrow payments for property taxes and insurance.

Q: Why is a mortgage loan billing statement important?

A: A mortgage loan billing statement is important because it helps you keep track of your mortgage payments and ensures that you are aware of any changes or additional charges related to your loan.

Q: How often do I receive a mortgage loan billing statement?

A: You typically receive a mortgage loan billing statement on a monthly basis, although some lenders may provide statements quarterly or annually.

Q: What should I do if I have questions or concerns about my mortgage loan billing statement?

A: If you have questions or concerns about your mortgage loan billing statement, you should contact your lender or loan servicer directly for clarification or assistance.