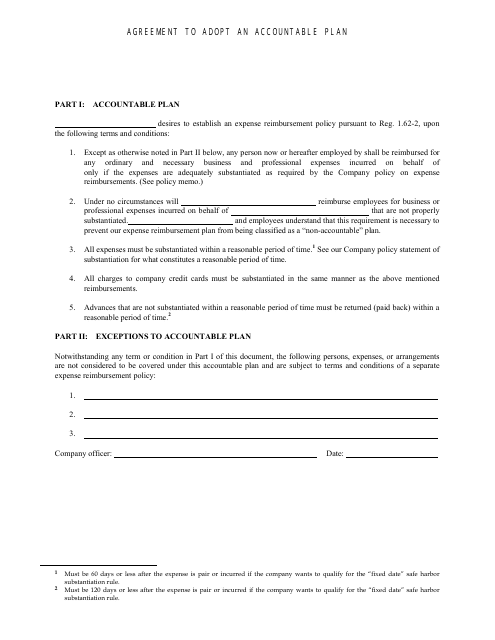

Agreement to Adopt an Accountable Plan

An Agreement to Adopt an Accountable Plan is used to establish a framework for reimbursing employees for business expenses incurred on behalf of their employer. It outlines the rules and guidelines for the reimbursement process, ensuring that expenses are properly documented and substantiated.

The employer or company files the Agreement to Adopt an Accountable Plan.

FAQ

Q: What is an accountable plan?

A: An accountable plan is an arrangement that allows an employer to reimburse employees for business expenses in a tax-free manner.

Q: Why is an accountable plan important?

A: An accountable plan is important because it helps both employers and employees save on taxes by ensuring that business expenses are properly documented and reimbursed.

Q: What are the criteria for an accountable plan?

A: The criteria for an accountable plan include having a business connection for the expenses, adequate substantiation of expenses, and returning any excess reimbursements within a reasonable time.

Q: What expenses can be reimbursed under an accountable plan?

A: Under an accountable plan, various business expenses such as travel, meals, and entertainment expenses can be reimbursed.

Q: How should employees document their expenses under an accountable plan?

A: Employees should keep records and receipts that provide detailed information about each business expense, including the date, amount, and business purpose.

Q: What happens if an employer fails to meet the requirements of an accountable plan?

A: If an employer fails to meet the requirements of an accountable plan, the reimbursements made to employees may be treated as taxable income.

Q: Is it mandatory for companies to adopt an accountable plan?

A: No, it is not mandatory for companies to adopt an accountable plan. However, having an accountable plan can provide tax benefits for both employers and employees.

Q: Can an employer choose to reimburse expenses without an accountable plan?

A: Yes, an employer can choose to reimburse expenses without an accountable plan. However, in this case, the reimbursements may be subject to taxation.

Q: Can an accountable plan be modified or terminated?

A: Yes, an accountable plan can be modified or terminated by the employer with proper notice to the employees.