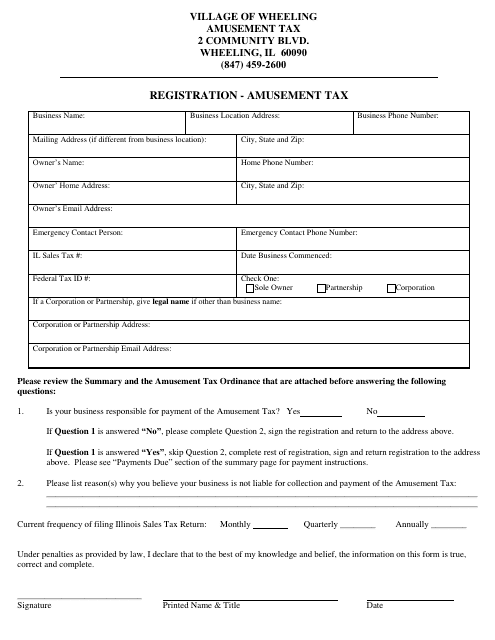

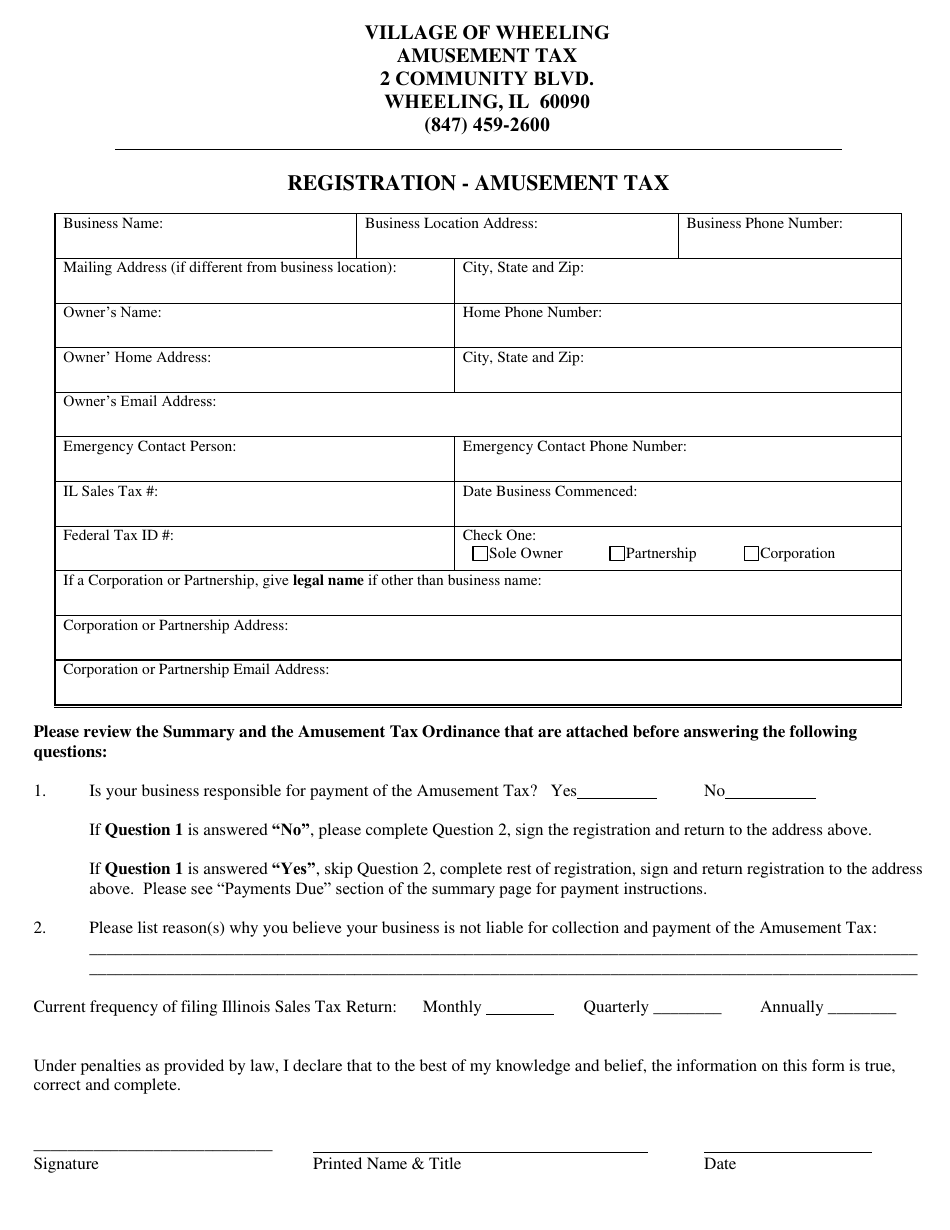

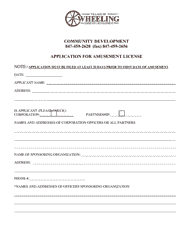

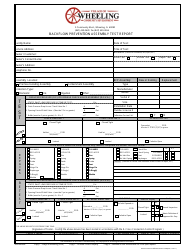

Registration - Amusement Tax - Village of Wheeling, Illinois

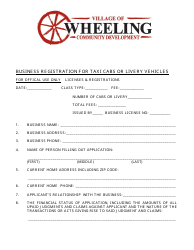

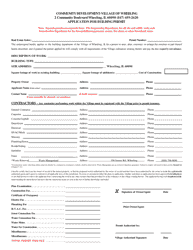

Registration - Amusement Tax is a legal document that was released by the Finance Department - Village of Wheeling, Illinois - a government authority operating within Illinois. The form may be used strictly within Village of Wheeling.

FAQ

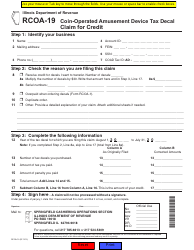

Q: What is the amusement tax in Village of Wheeling, Illinois?

A: The amusement tax in Village of Wheeling, Illinois is a tax levied on certain forms of entertainment or amusement activities.

Q: What is the purpose of the amusement tax?

A: The purpose of the amusement tax is to generate revenue for the Village of Wheeling.

Q: Which activities are subject to the amusement tax?

A: Activities such as admission fees to live performances, concerts, sporting events, and amusement rides are subject to the amusement tax.

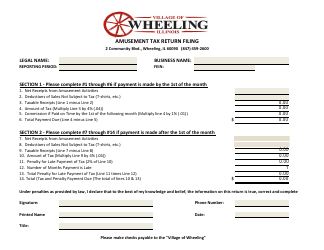

Q: How is the amusement tax calculated?

A: The amusement tax is usually calculated as a percentage of the admission fee or ticket price.

Q: Who is responsible for paying the amusement tax?

A: The event organizers or amusement providers are responsible for paying the amusement tax.

Q: Are there any exemptions to the amusement tax?

A: There may be some exemptions for certain non-profit organizations or educational events, but it is best to check with the Village of Wheeling for specific details.

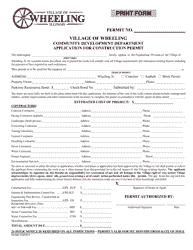

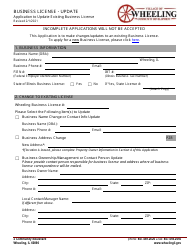

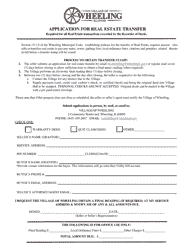

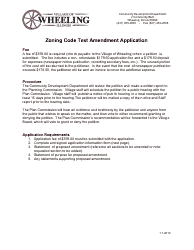

Form Details:

- The latest edition currently provided by the Finance Department - Village of Wheeling, Illinois;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - Village of Wheeling, Illinois.