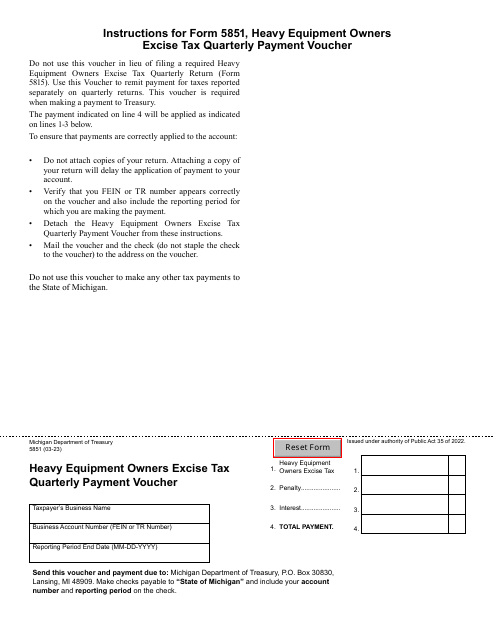

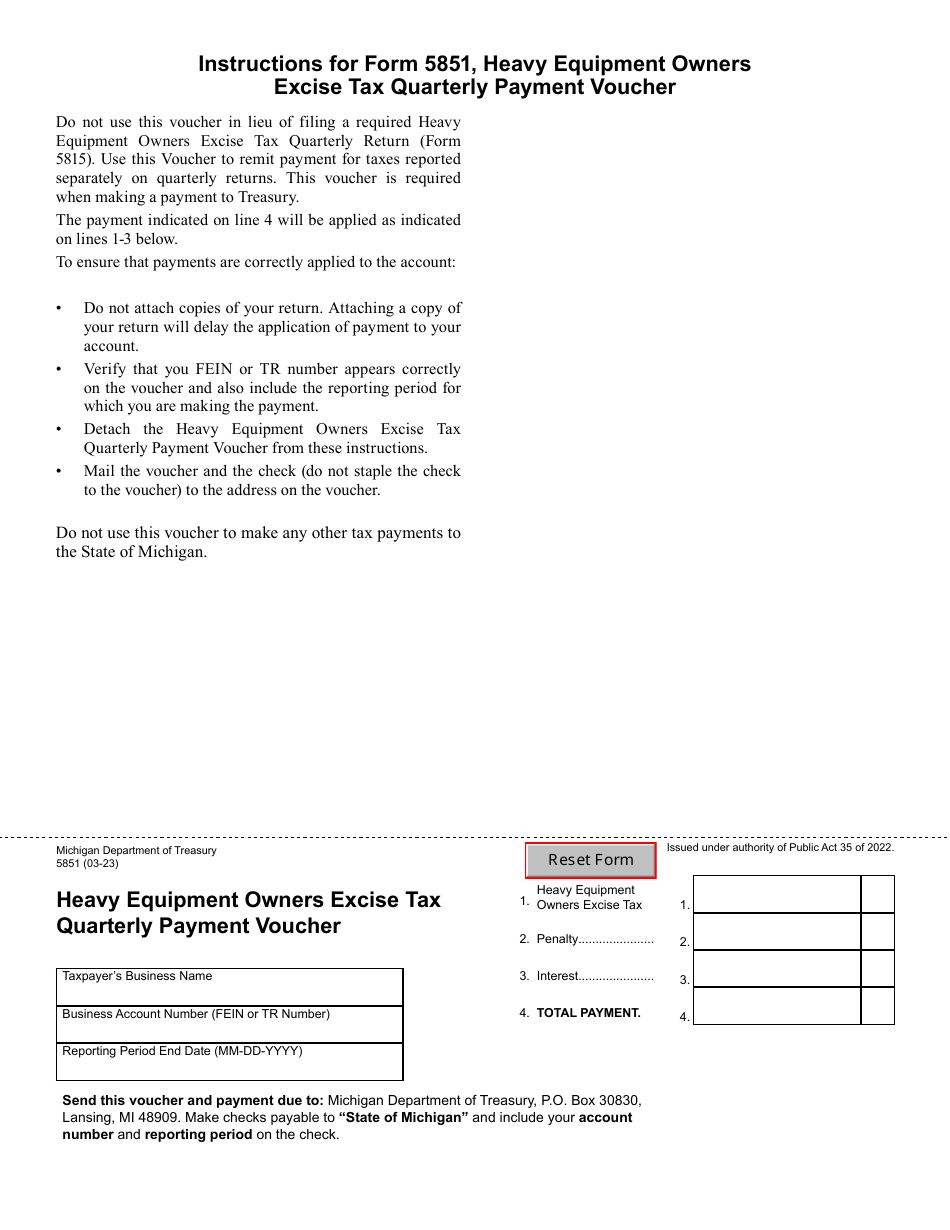

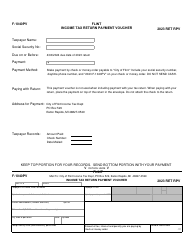

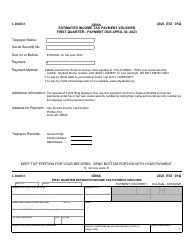

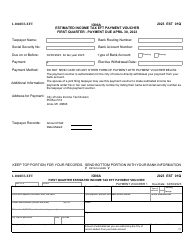

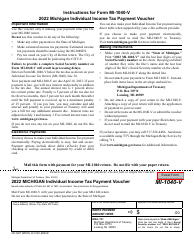

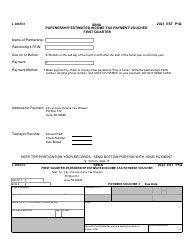

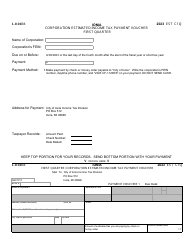

Form 5851 Heavy Equipment Owners Excise Tax Quarterly Payment Voucher - Michigan

What Is Form 5851?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5851?

A: Form 5851 is the Heavy Equipment Owners Excise Tax Quarterly Payment Voucher for Michigan.

Q: Who needs to file Form 5851?

A: Owners of heavy equipment in Michigan need to file Form 5851.

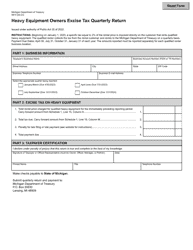

Q: What is the Heavy Equipment Owners Excise Tax?

A: The Heavy Equipment Owners Excise Tax is a tax imposed on owners of heavy equipment in Michigan.

Q: What is the purpose of Form 5851?

A: Form 5851 is used to report and pay the Heavy Equipment Owners Excise Tax on a quarterly basis.

Q: When is Form 5851 due?

A: Form 5851 is due on a quarterly basis. The due dates are listed on the form.

Q: Can I file Form 5851 electronically?

A: Yes, you can file Form 5851 electronically through the Michigan Department of Treasury's e-services.

Q: What happens if I don't file Form 5851?

A: Failure to file Form 5851 or pay the Heavy Equipment Owners Excise Tax may result in penalties and interest.

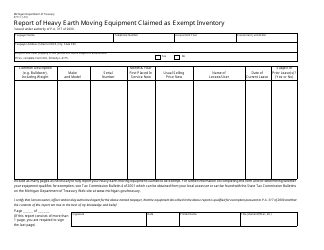

Q: Are there any exemptions to the Heavy Equipment Owners Excise Tax?

A: Yes, there are some exemptions available. Refer to the instructions on Form 5851 for more information.

Q: Can I get a refund if I overpaid the Heavy Equipment Owners Excise Tax?

A: Yes, you can request a refund for overpaid taxes by filing an amended return using Form 5851.

Form Details:

- Released on March 1, 2023;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5851 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.