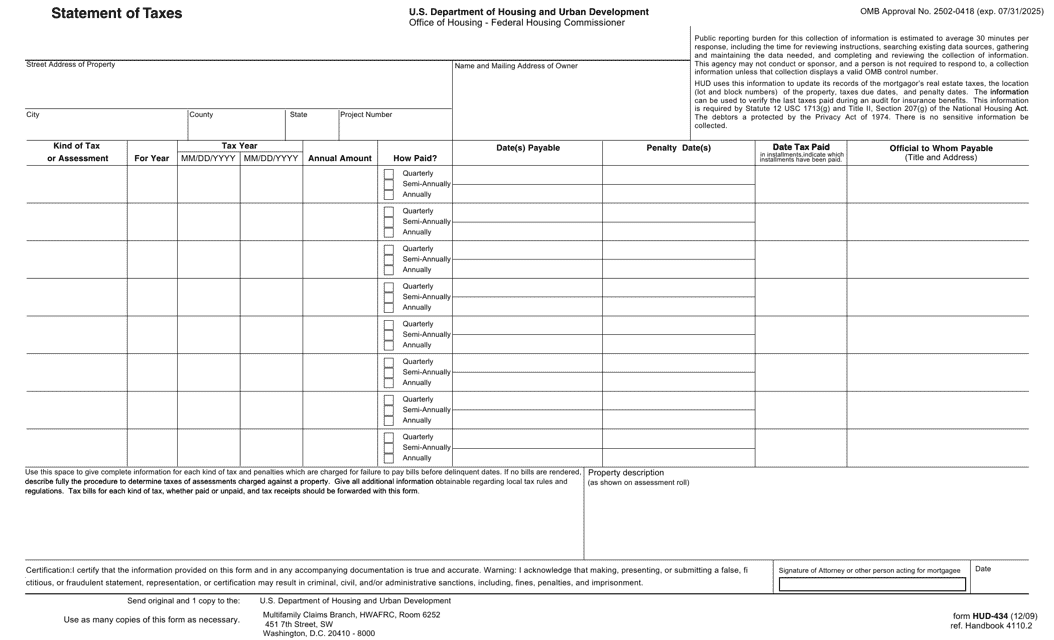

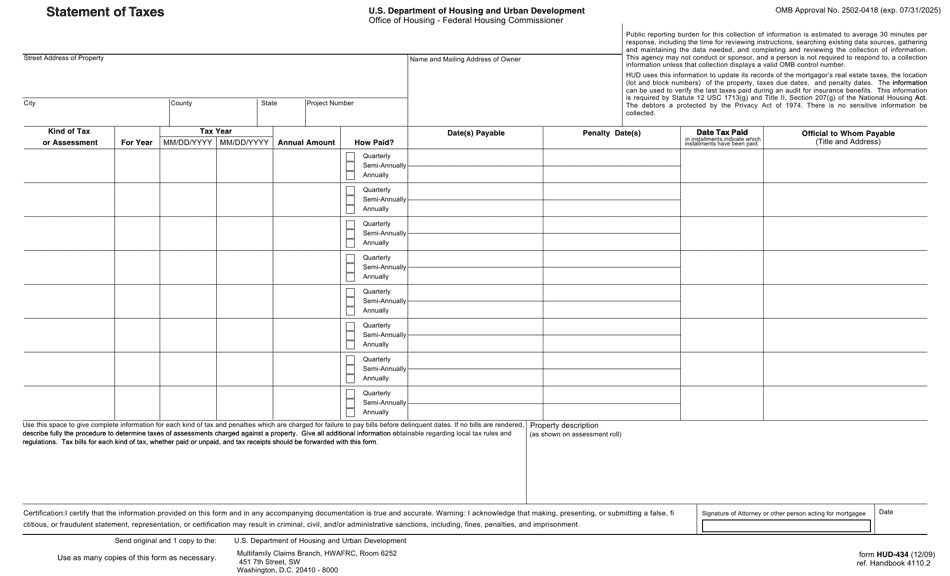

Form HUD-434 Statement of Taxes

What Is Form HUD-434?

This is a legal form that was released by the U.S. Department of Housing and Urban Development on December 1, 2009 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HUD-434?

A: Form HUD-434 is the Statement of Taxes form.

Q: Who should use Form HUD-434?

A: Form HUD-434 should be used by individuals or entities that own or manage HUD-assisted multifamily properties.

Q: What is the purpose of Form HUD-434?

A: The purpose of Form HUD-434 is to collect and report information on the taxes paid by owners or managers of HUD-assisted multifamily properties.

Q: What information is required on Form HUD-434?

A: Form HUD-434 requires information such as the property address, employer identification number (EIN), tax year, and details about the property's tax liabilities.

Q: When is Form HUD-434 due?

A: Form HUD-434 is typically due on or before January 31st of the year following the tax year being reported.

Q: What happens if Form HUD-434 is not filed?

A: Failure to file Form HUD-434 or providing false information may result in penalties or sanctions.

Q: Are there any fees associated with filing Form HUD-434?

A: No, there are no fees associated with filing Form HUD-434.

Q: Can I amend a previously filed Form HUD-434?

A: Yes, you can amend a previously filed Form HUD-434 by submitting a corrected form to HUD.

Form Details:

- Released on December 1, 2009;

- The latest available edition released by the U.S. Department of Housing and Urban Development;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HUD-434 by clicking the link below or browse more documents and templates provided by the U.S. Department of Housing and Urban Development.