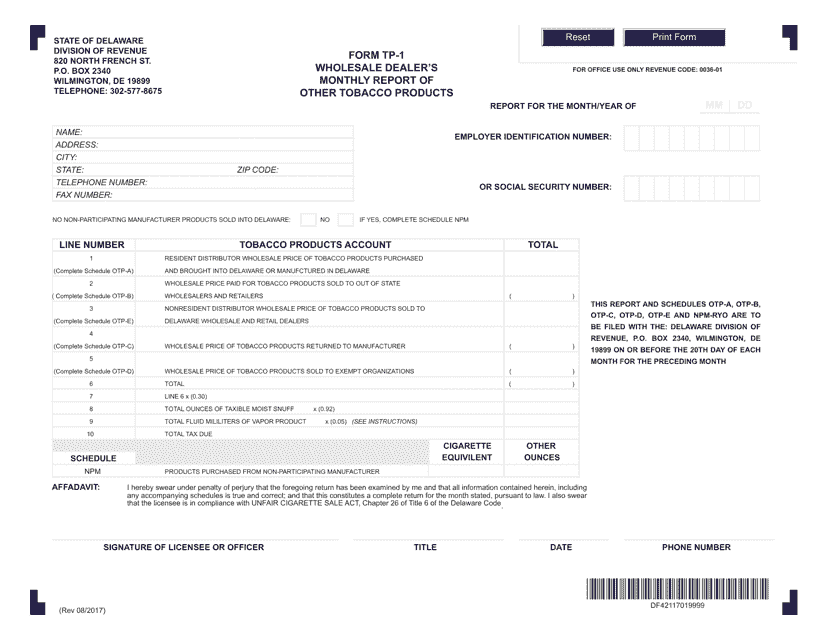

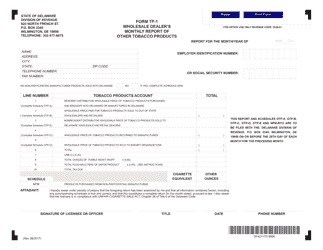

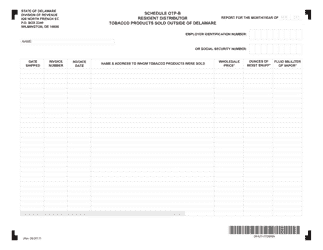

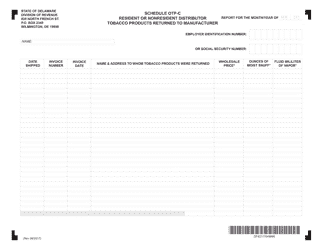

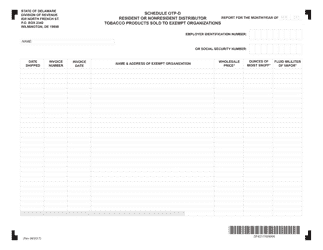

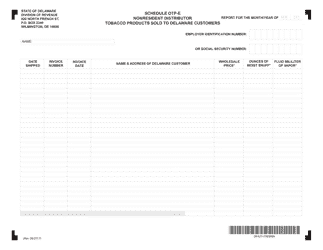

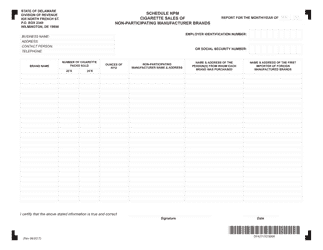

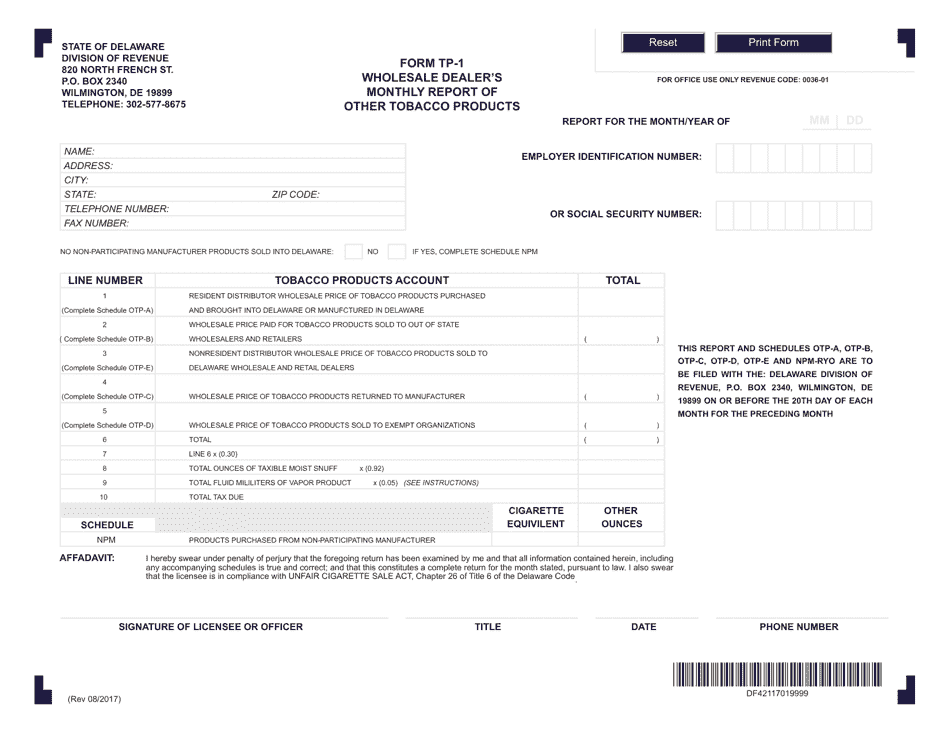

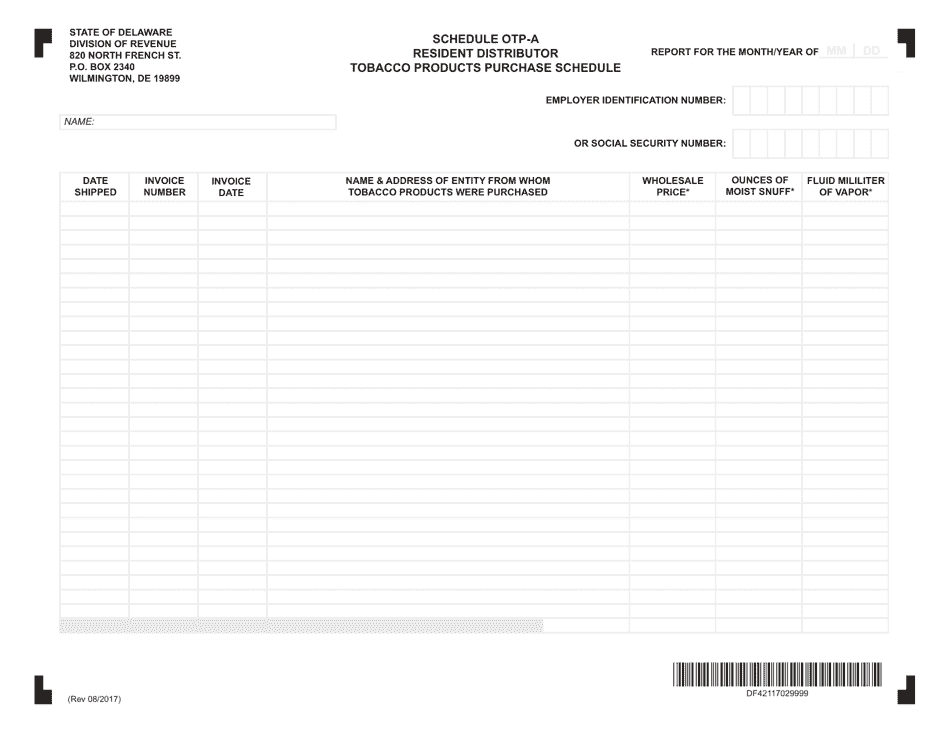

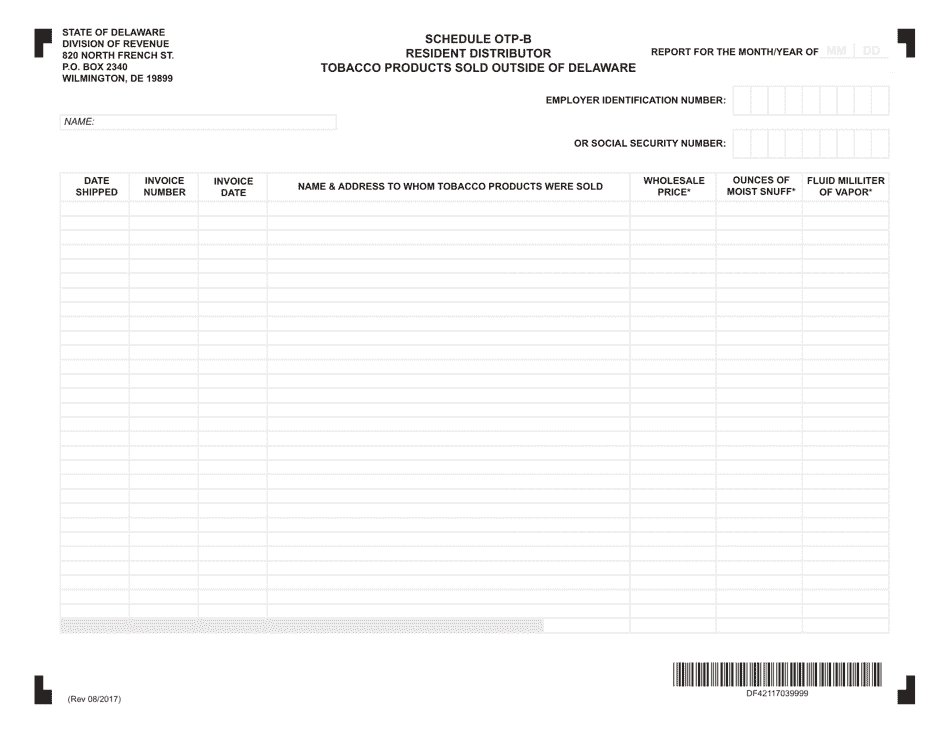

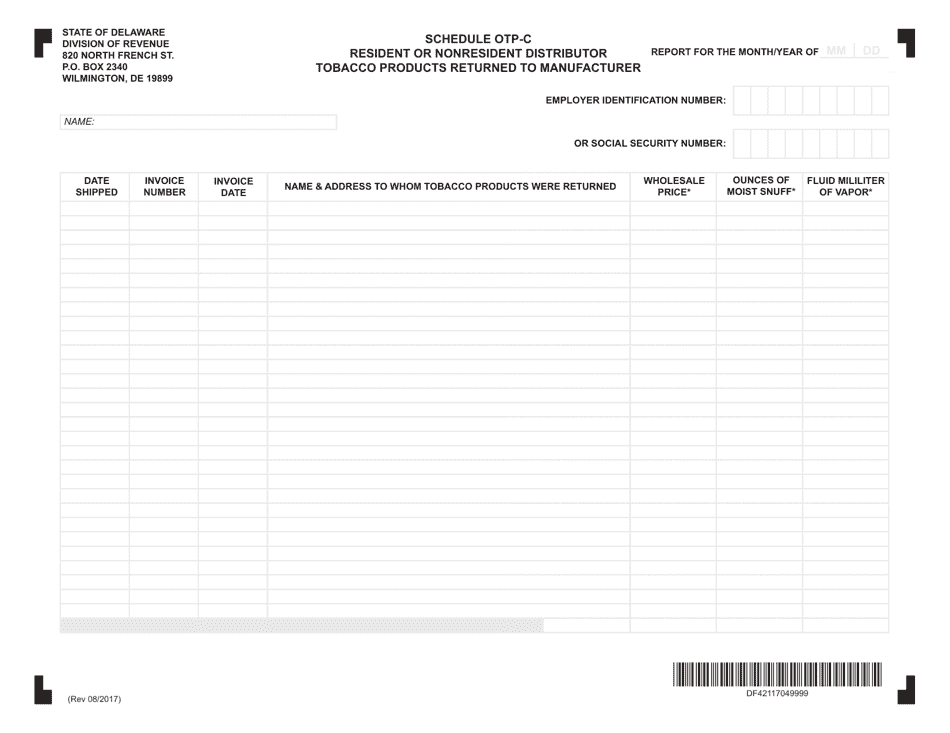

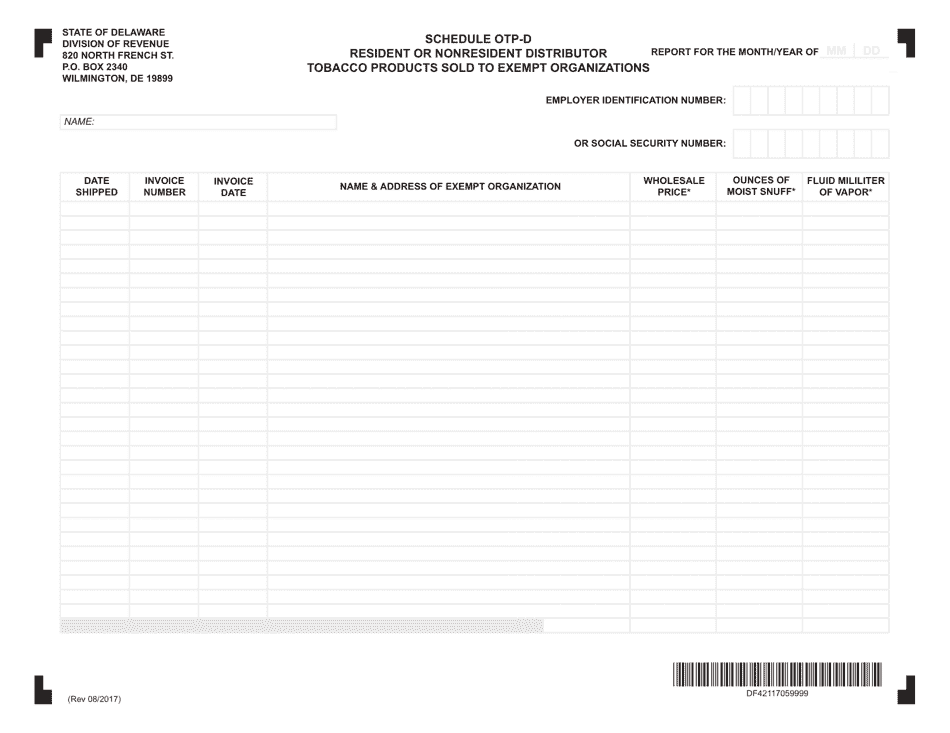

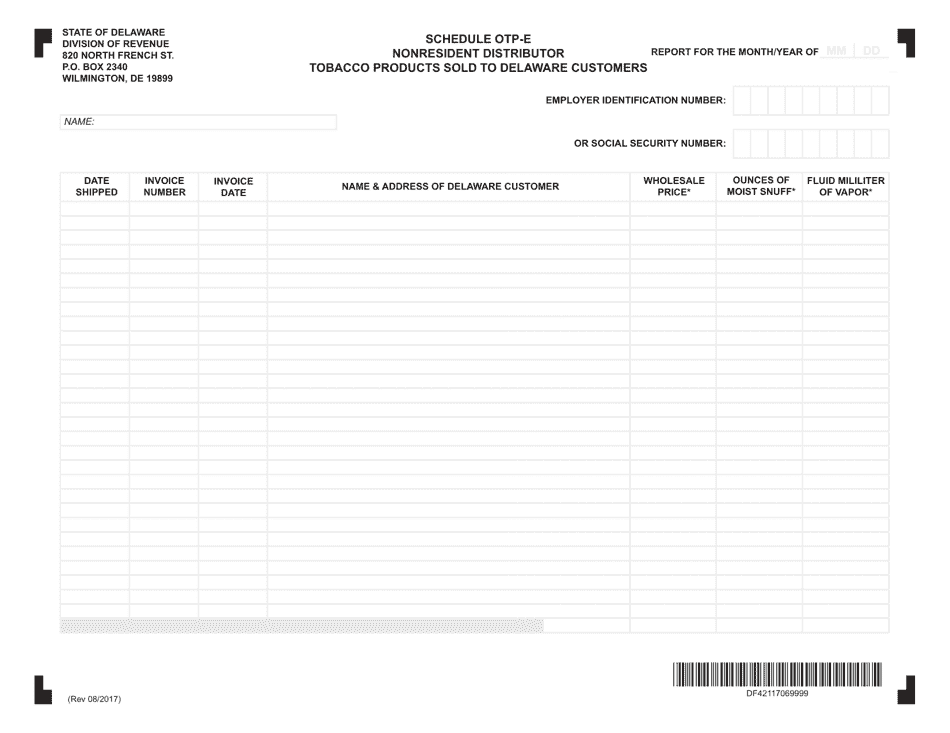

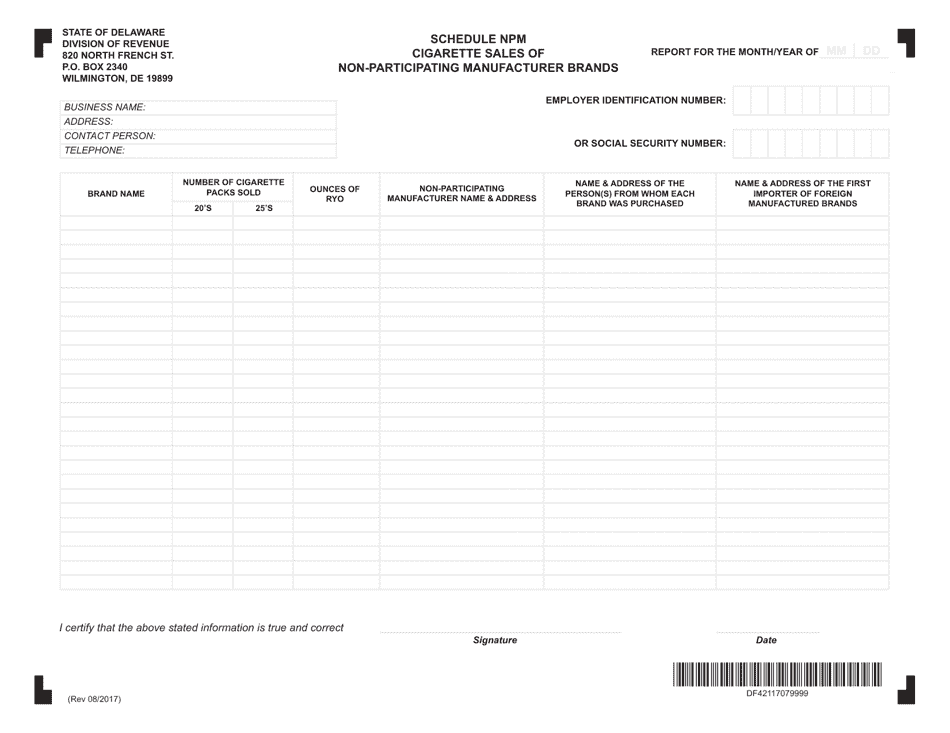

Form TP-1 Wholesale Dealer's Monthly Report of Other Tobacco Products - Delaware

What Is Form TP-1?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form TP-1?

A: Form TP-1 is the Wholesale Dealer's Monthly Report of Other Tobacco Products in Delaware.

Q: Who needs to file Form TP-1?

A: Wholesale dealers of other tobacco products in Delaware need to file Form TP-1.

Q: What is considered other tobacco products?

A: Other tobacco products include cigars, chewing tobacco, pipe tobacco, snuff, and any other tobacco products that are not cigarettes.

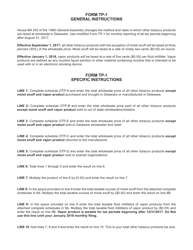

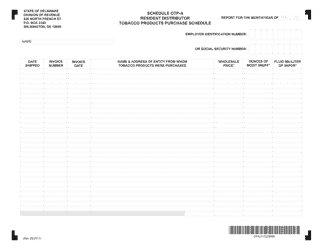

Q: What information needs to be reported on Form TP-1?

A: Form TP-1 requires reporting of the quantity and wholesale cost of other tobacco products received, sold, and remaining in inventory.

Q: When is Form TP-1 due?

A: Form TP-1 must be filed and the tax paid on or before the 20th day of the month following the month being reported.

Q: Are there any penalties for not filing Form TP-1?

A: Yes, there may be penalties for failing to file Form TP-1, including late filing penalties and interest on any overdue tax payments.

Q: Can I file Form TP-1 electronically?

A: Yes, Delaware allows for electronic filing of Form TP-1 through the DELTAP-1 system.

Q: Is there a minimum threshold for reporting on Form TP-1?

A: Yes, wholesale dealers are required to file Form TP-1 if they have received or have on hand over $1,000 worth of other tobacco products during a reporting period.

Q: What if I have multiple wholesale dealer locations?

A: If you have multiple wholesale dealer locations in Delaware, you must file a separate Form TP-1 for each location.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TP-1 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.