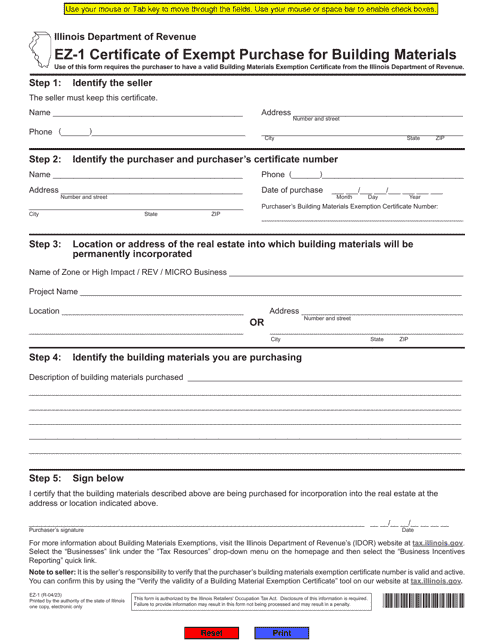

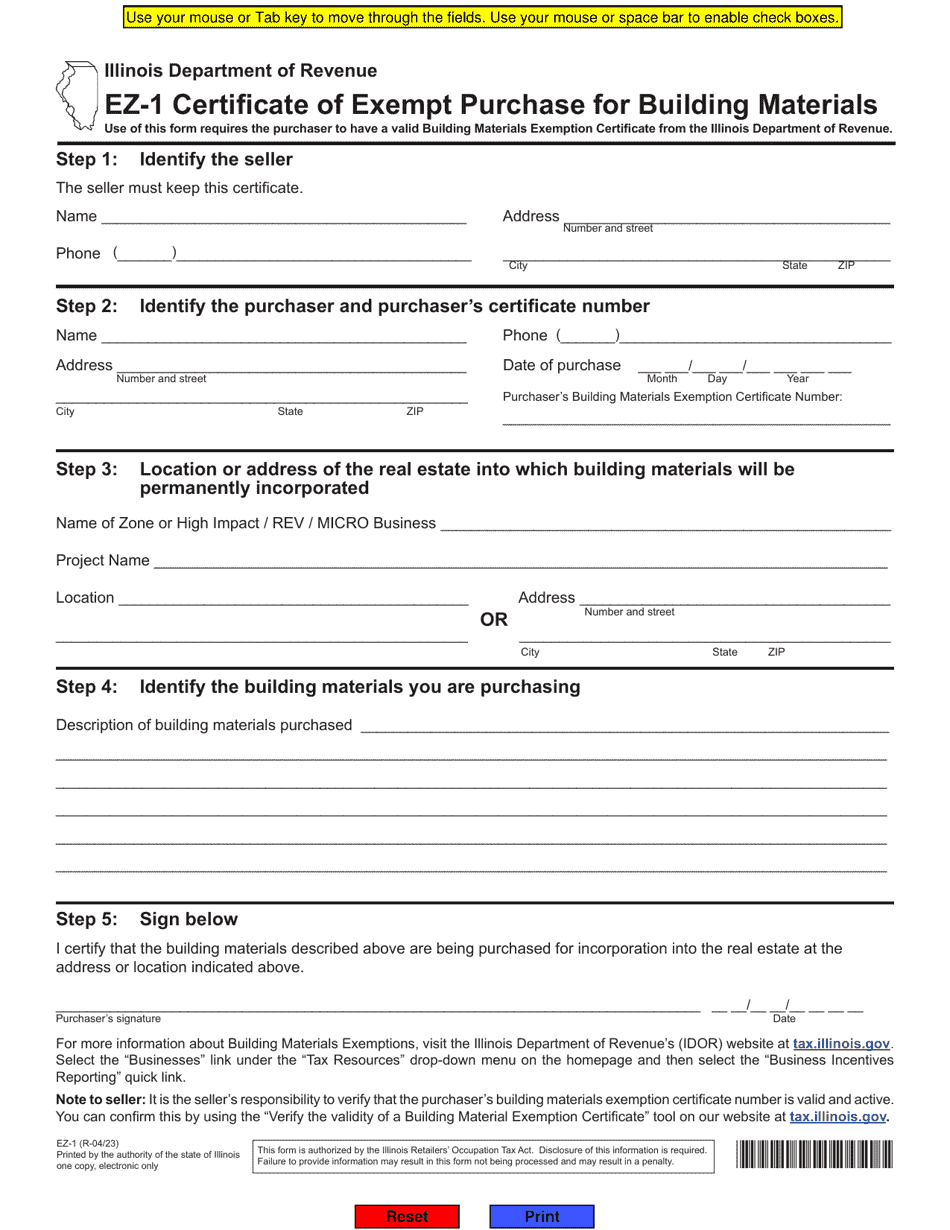

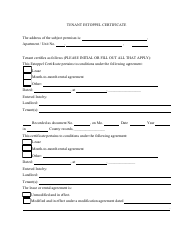

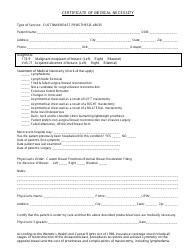

Form EZ-1 Certificate of Exempt Purchase for Building Materials - Illinois

What Is Form EZ-1?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EZ-1?

A: Form EZ-1 is a Certificate of Exempt Purchase for Building Materials.

Q: What is the purpose of Form EZ-1?

A: The purpose of Form EZ-1 is to certify that a purchase of building materials is exempt from sales tax.

Q: Who should use Form EZ-1?

A: Form EZ-1 should be used by contractors, subcontractors, or builders who are purchasing building materials for a construction project.

Q: What is the requirement for using Form EZ-1?

A: To use Form EZ-1, the construction project must be exempt from sales tax, such as government-owned projects or certain non-profit organizations.

Q: What information is required on Form EZ-1?

A: Form EZ-1 requires information about the purchaser, seller, project location, and details of the purchase.

Q: What should I do with Form EZ-1 after completion?

A: After completing Form EZ-1, you should give a copy to the seller and keep a copy for your records.

Q: Can Form EZ-1 be used for all construction projects?

A: No, Form EZ-1 can only be used for projects that are exempt from sales tax as specified by the Illinois Department of Revenue.

Q: Are there any penalties for fraudulent use of Form EZ-1?

A: Yes, there are penalties for fraudulent use of Form EZ-1, including fines and possible criminal charges.

Form Details:

- Released on April 1, 2023;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EZ-1 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.