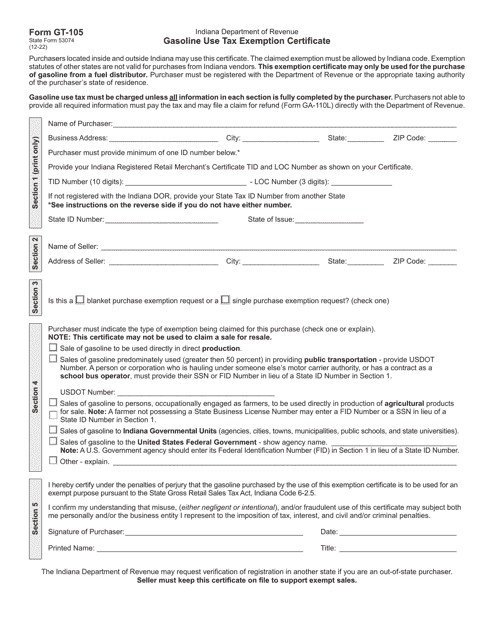

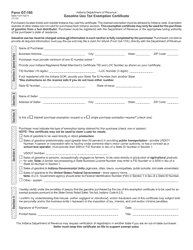

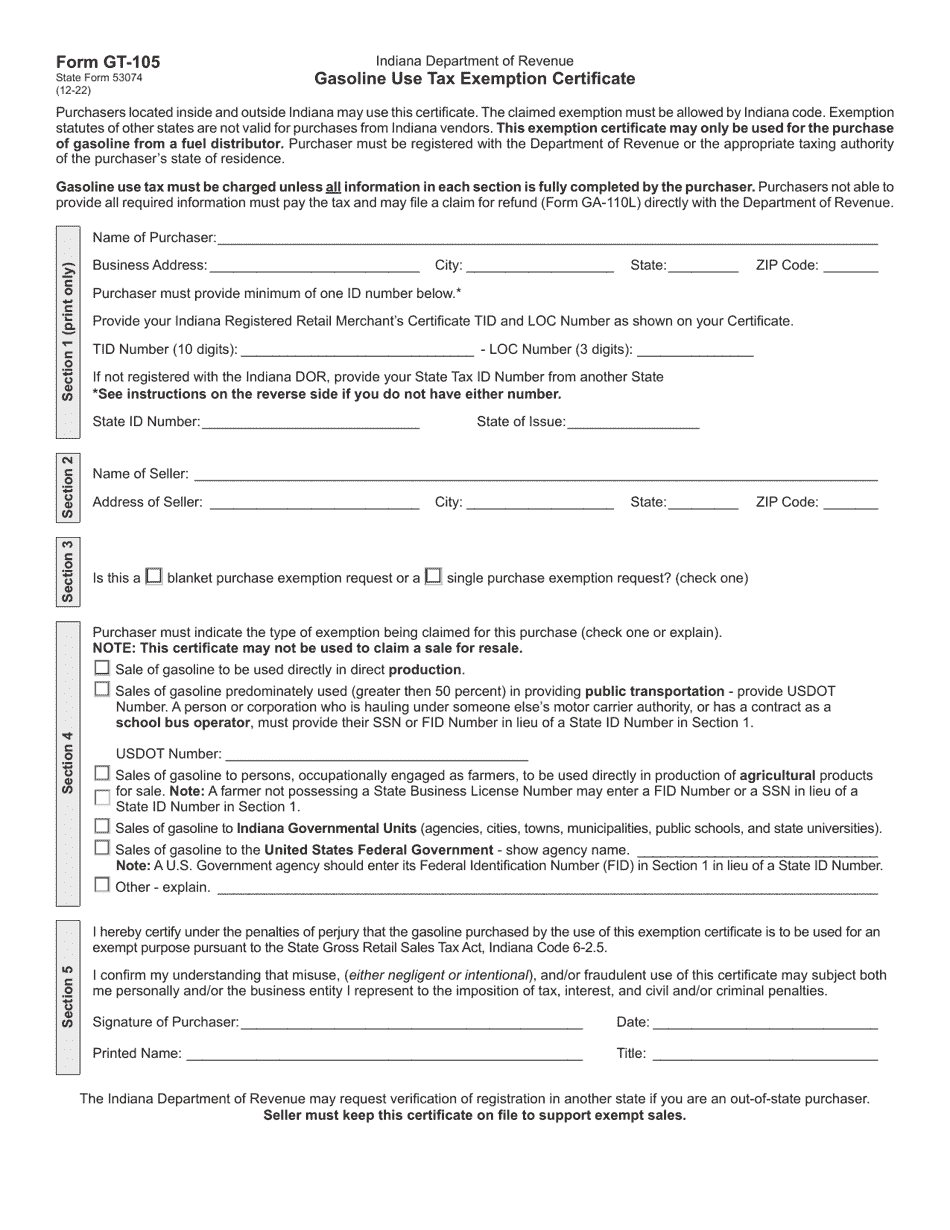

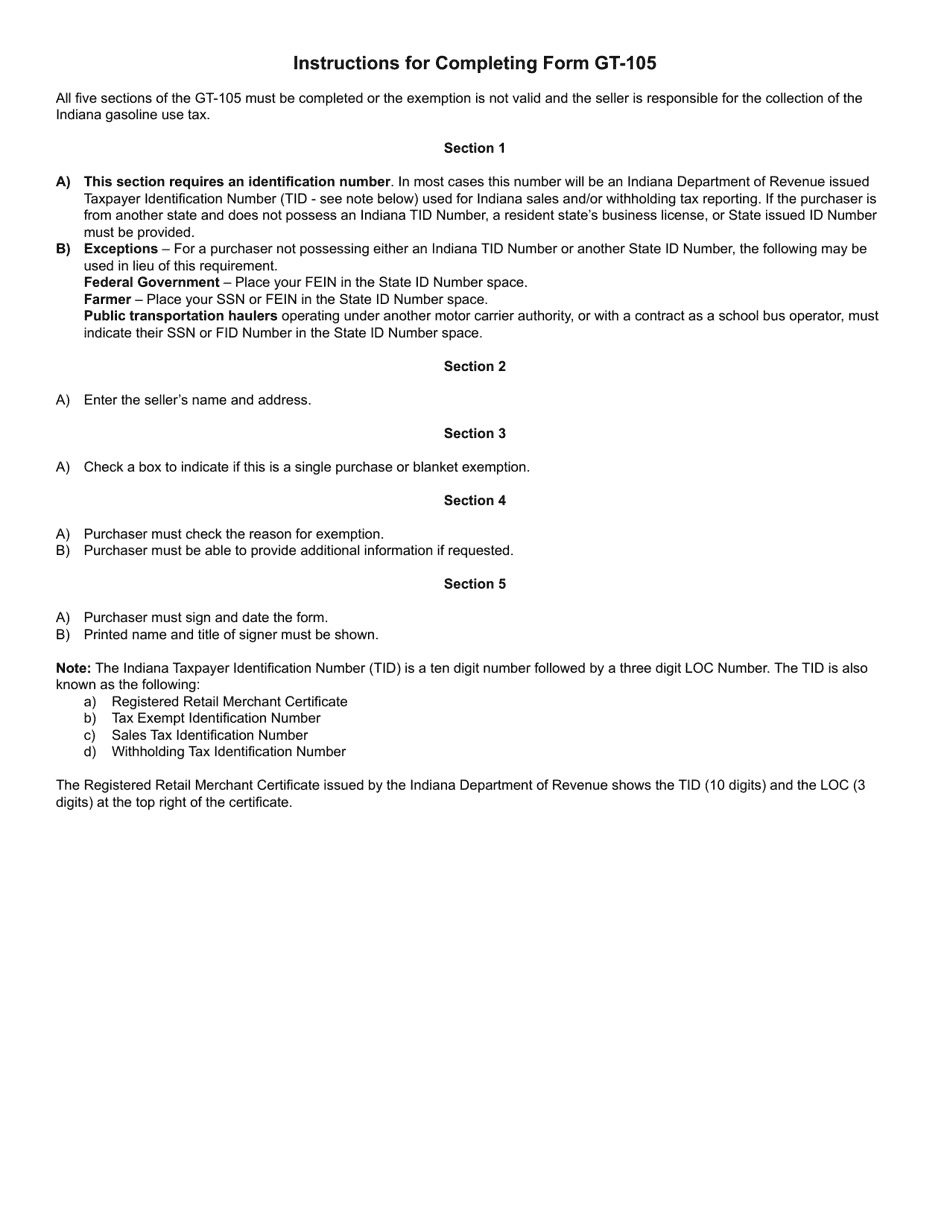

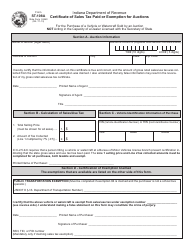

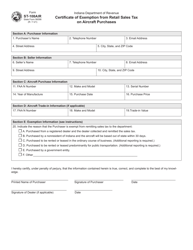

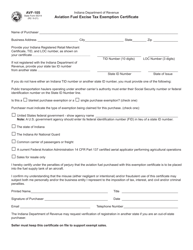

Form GT-105 (State Form 53074) Gasoline Use Tax Exemption Certificate - Indiana

What Is Form GT-105 (State Form 53074)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GT-105?

A: Form GT-105 is a Gasoline Use Tax Exemption Certificate in Indiana.

Q: What is the purpose of Form GT-105?

A: The purpose of Form GT-105 is to claim exemption from the gasoline use tax in Indiana.

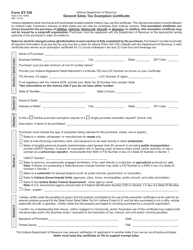

Q: Who should use Form GT-105?

A: Anyone who is eligible to claim exemption from the gasoline use tax in Indiana can use Form GT-105.

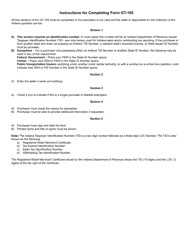

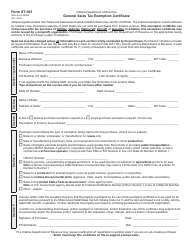

Q: How do I fill out Form GT-105?

A: You need to provide your business information, the reason for the exemption, and the vehicle information on Form GT-105.

Q: Is there a deadline for submitting Form GT-105?

A: There is no specific deadline for submitting Form GT-105. You should submit it whenever you are claiming exemption from the gasoline use tax.

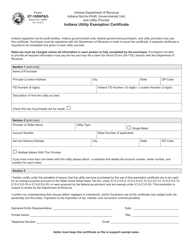

Q: Can I submit Form GT-105 electronically?

A: No, you cannot submit Form GT-105 electronically. You need to print and mail the completed form to the Indiana Department of Revenue.

Q: What should I do after submitting Form GT-105?

A: After submitting Form GT-105, keep a copy for your records and make sure to comply with all other applicable tax laws and regulations.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GT-105 (State Form 53074) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.