This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form PIT-NON

for the current year.

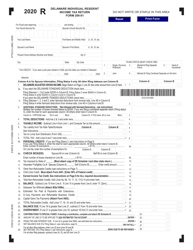

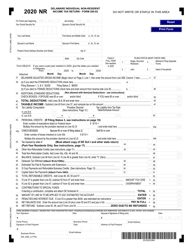

Instructions for Form PIT-NON Delaware Individual Non-resident Income Tax Return - Delaware

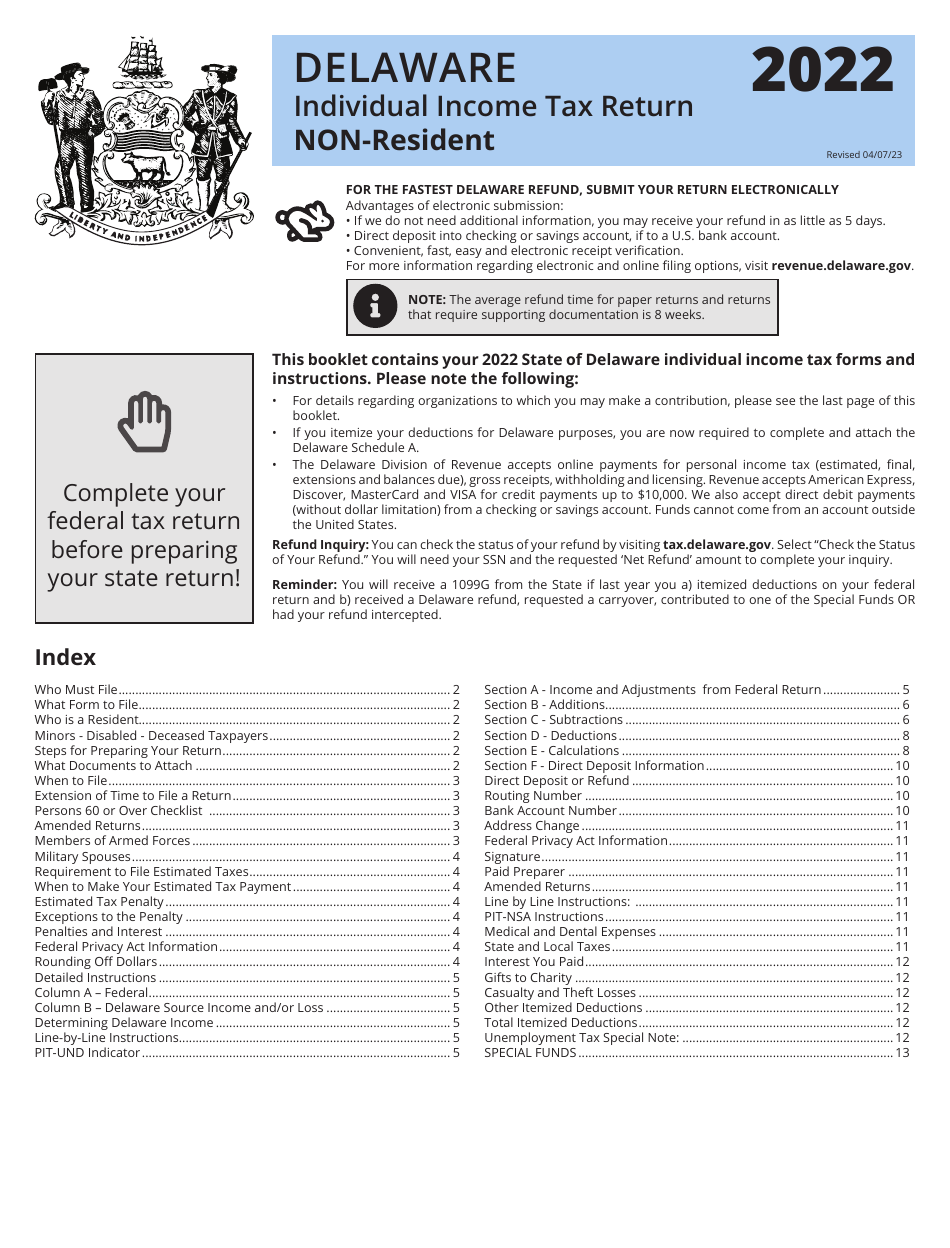

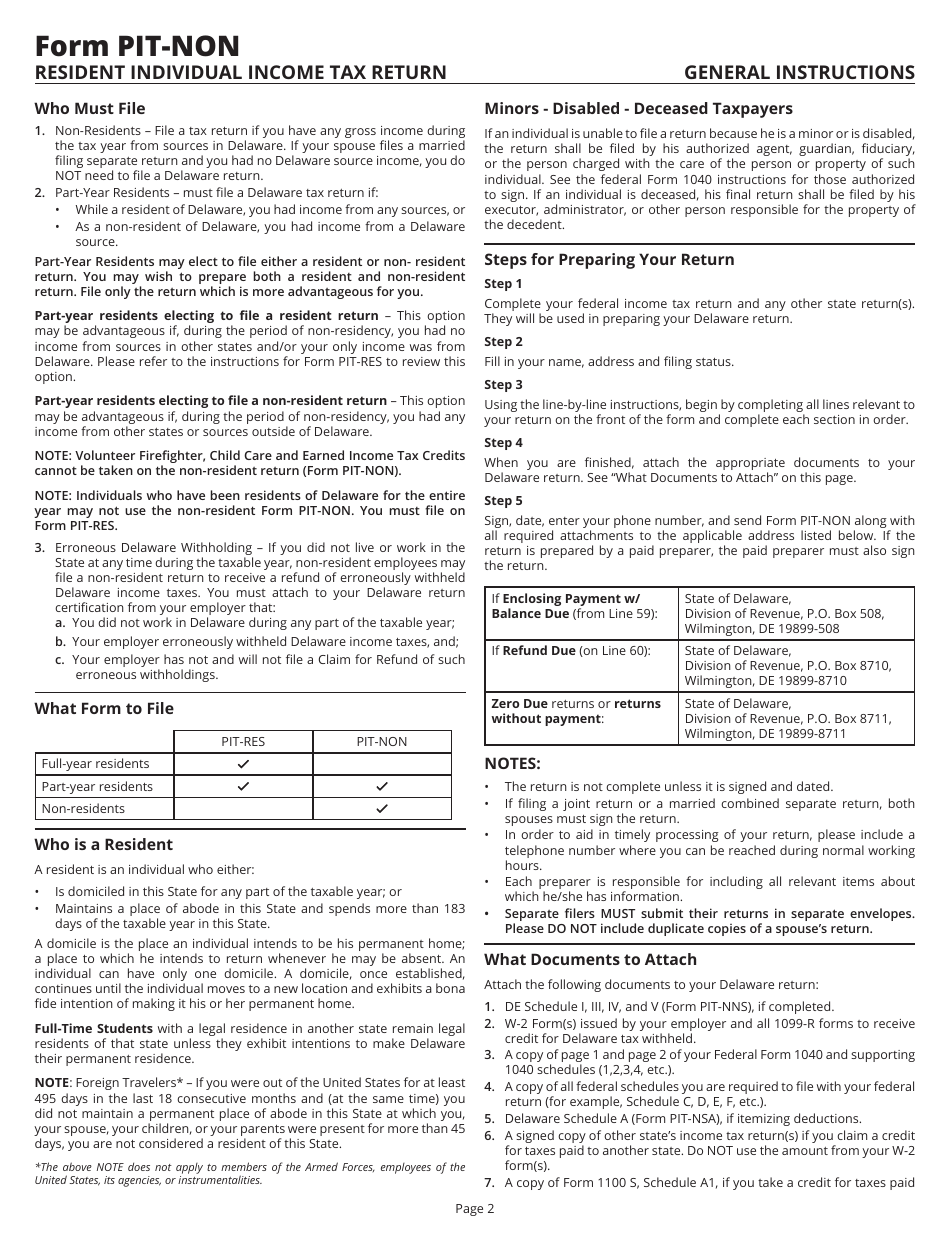

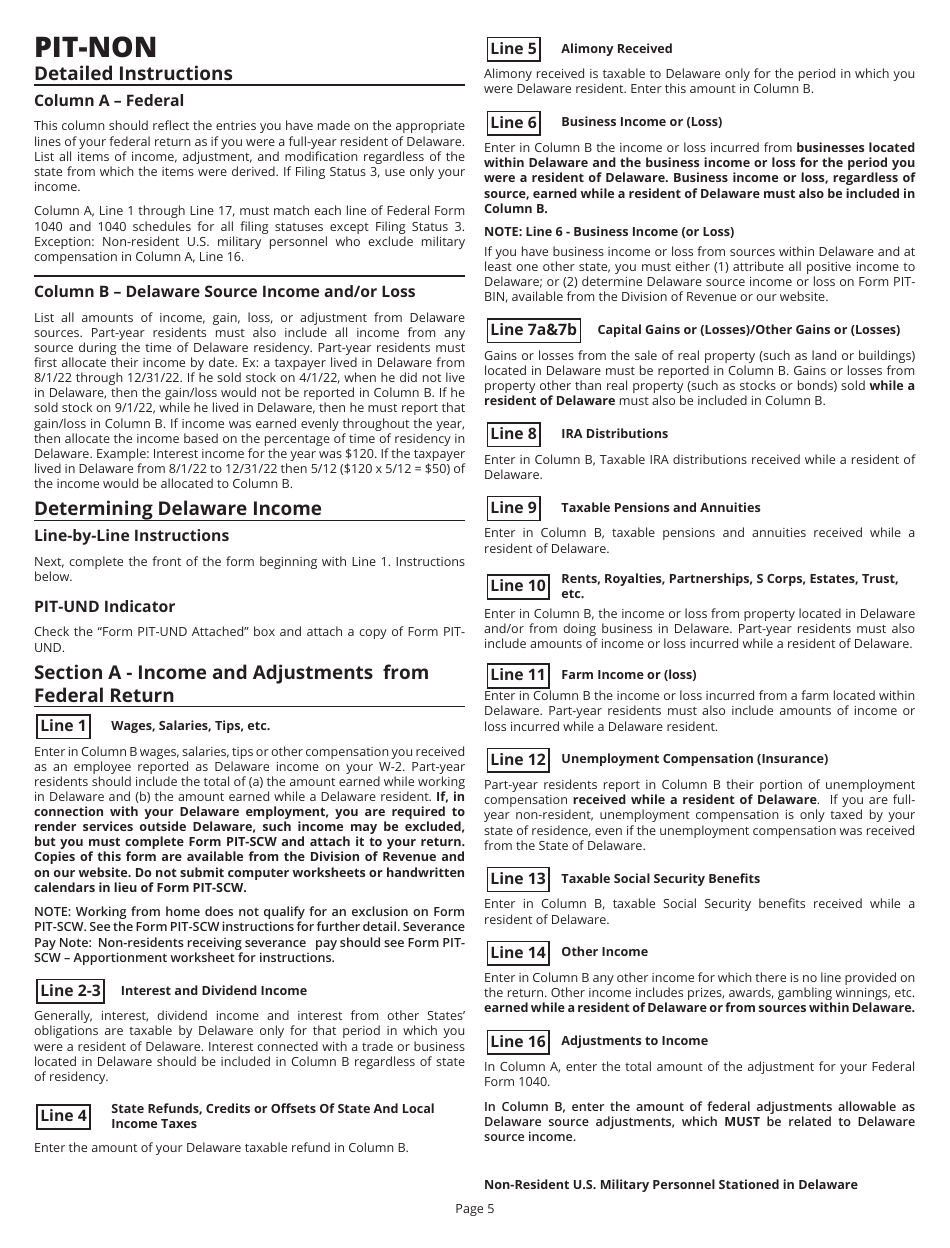

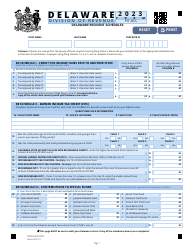

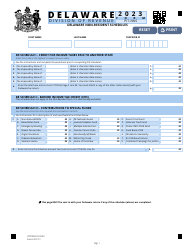

The Instructions for Form PIT-NON - Delaware Individual Non-resident Income Tax Return is a guide provided by the state of Delaware. It's intended to help non-resident individuals accurately fill out their Delaware State Income Tax Return form. These instructions guide through the process of calculating income earned in Delaware by individuals who don't live in the state but has earned income from Delaware sources during the tax year. The document outlines what type of income is taxable, what credits and deductions can be claimed, how to calculate the tax amount, and where and when to file the tax return.

The Instructions for Form PIT-NON Delaware Individual Non-resident Income Tax Return - Delaware is typically filed by non-residents who have earned income within the state of Delaware during the taxable year. This could include individuals who live out-of-state but work in Delaware, or have business operations or rental properties in the state. It’s important to consult with a tax professional or the state tax agency to understand specific filing requirements.

FAQ

Q: What is Form PIT-NON in Delaware?

A: Form PIT-NON is the Delaware Individual Non-resident Income Tax Return form. It is used by individuals who are not residents of Delaware but have earned income in the state during the tax year.

Q: Who should file a Delaware PIT-NON form?

A: The Delaware PIT-NON form should be filed by non-residents who have earned income in Delaware during the tax year.

Q: When is the deadline to file Form PIT-NON

A: The deadline to file Form PIT-NON in Delaware is typically April 15, unless it falls on a weekend or holiday. In such case, the deadline is the next business day.

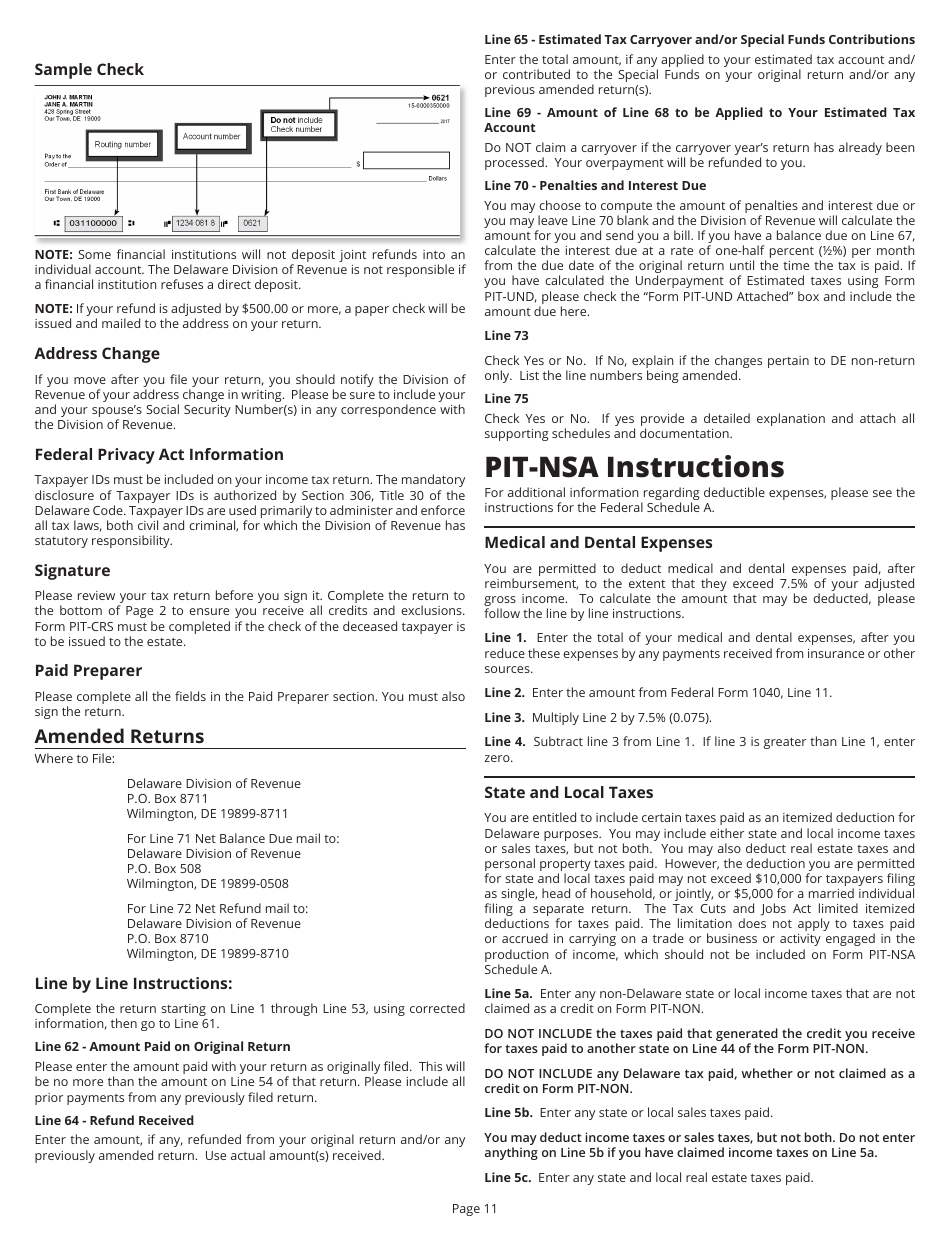

Q: How to fill out Form PIT-NON for Delaware?

A: To fill out Form PIT-NON, you'll need to provide details about your income earned within Delaware, deductions, tax credits, and tax payments. Detailed instructions for completing the form can be found on the form itself or on the Delaware Division of Revenue's website.

Q: What type of income should be reported on Form PIT-NON

A: On Form PIT-NON, you should report all income sources earned in Delaware including wages, commissions, interest, dividends, rental income, business income, and any other form of payment.

Q: Do I need to file a state tax return in Delaware if I am a non-resident?

A: Yes, if you are a non-resident but have earned income in Delaware during the tax year, you are required to file a state income tax return using Form PIT-NON.