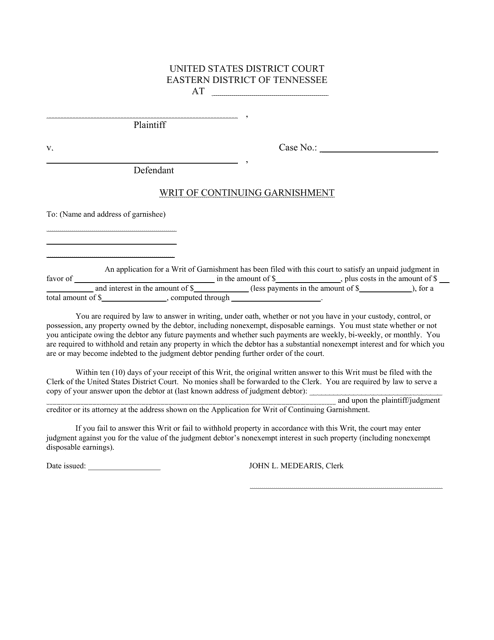

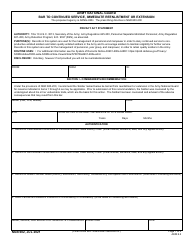

Writ of Continuing Garnishment - Wisconsin

Writ of Continuing Garnishment is a legal document that was released by the U.S. Bankruptcy Court - Eastern District of Wisconsin - a government authority operating within Wisconsin.

FAQ

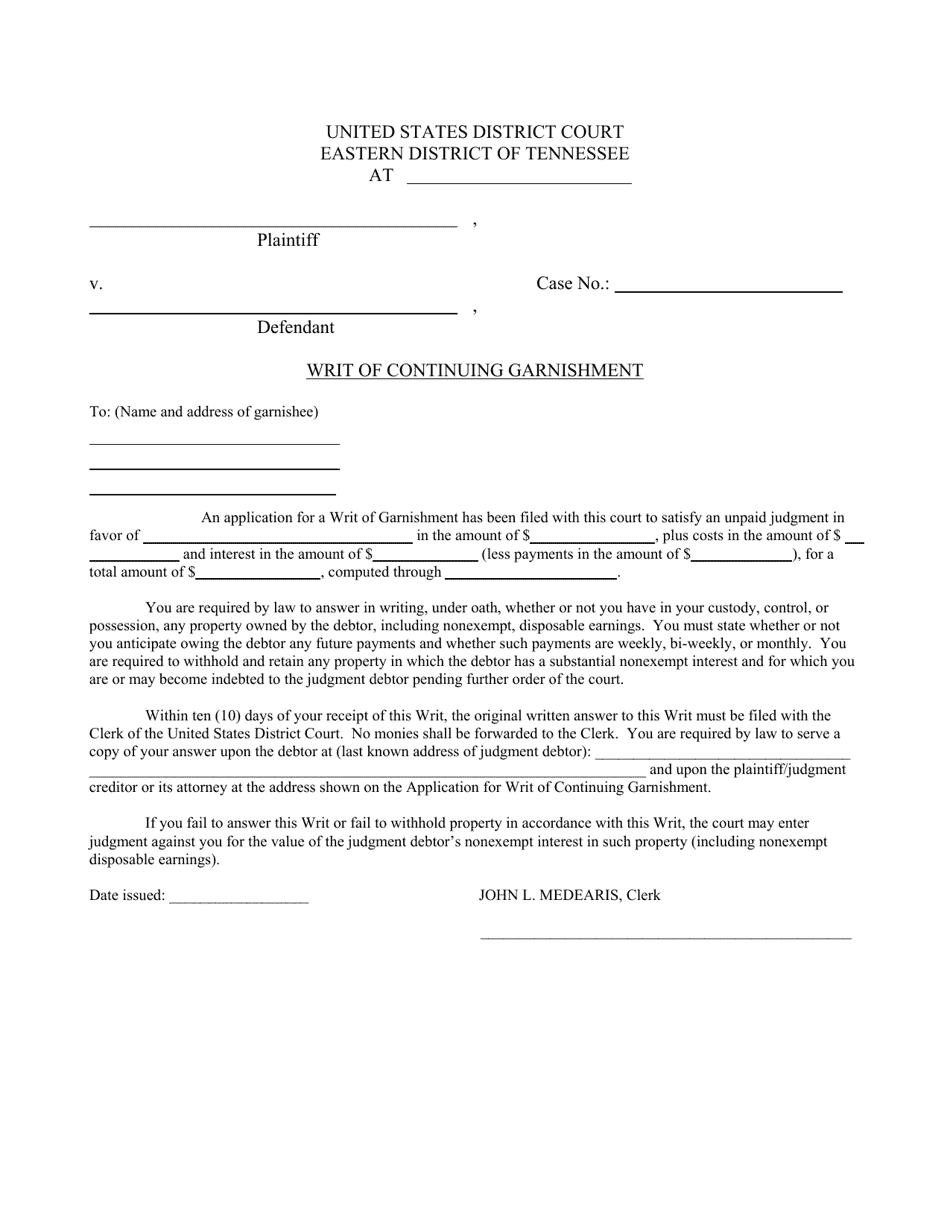

Q: What is a Writ of Continuing Garnishment?

A: A Writ of Continuing Garnishment is a legal document that allows a creditor to collect a debt by requesting that money be taken directly from a debtor's wages or bank account.

Q: How does a Writ of Continuing Garnishment work in Wisconsin?

A: In Wisconsin, a Writ of Continuing Garnishment is issued by a court after a judgment has been obtained. The creditor then serves the writ on the debtor's employer or financial institution, who is required to withhold a portion of the debtor's wages or funds to be applied towards the outstanding debt.

Q: What types of debts can be collected through a Writ of Continuing Garnishment?

A: A Writ of Continuing Garnishment can be used to collect various types of debts, including unpaid court judgments, child support arrears, and delinquent taxes.

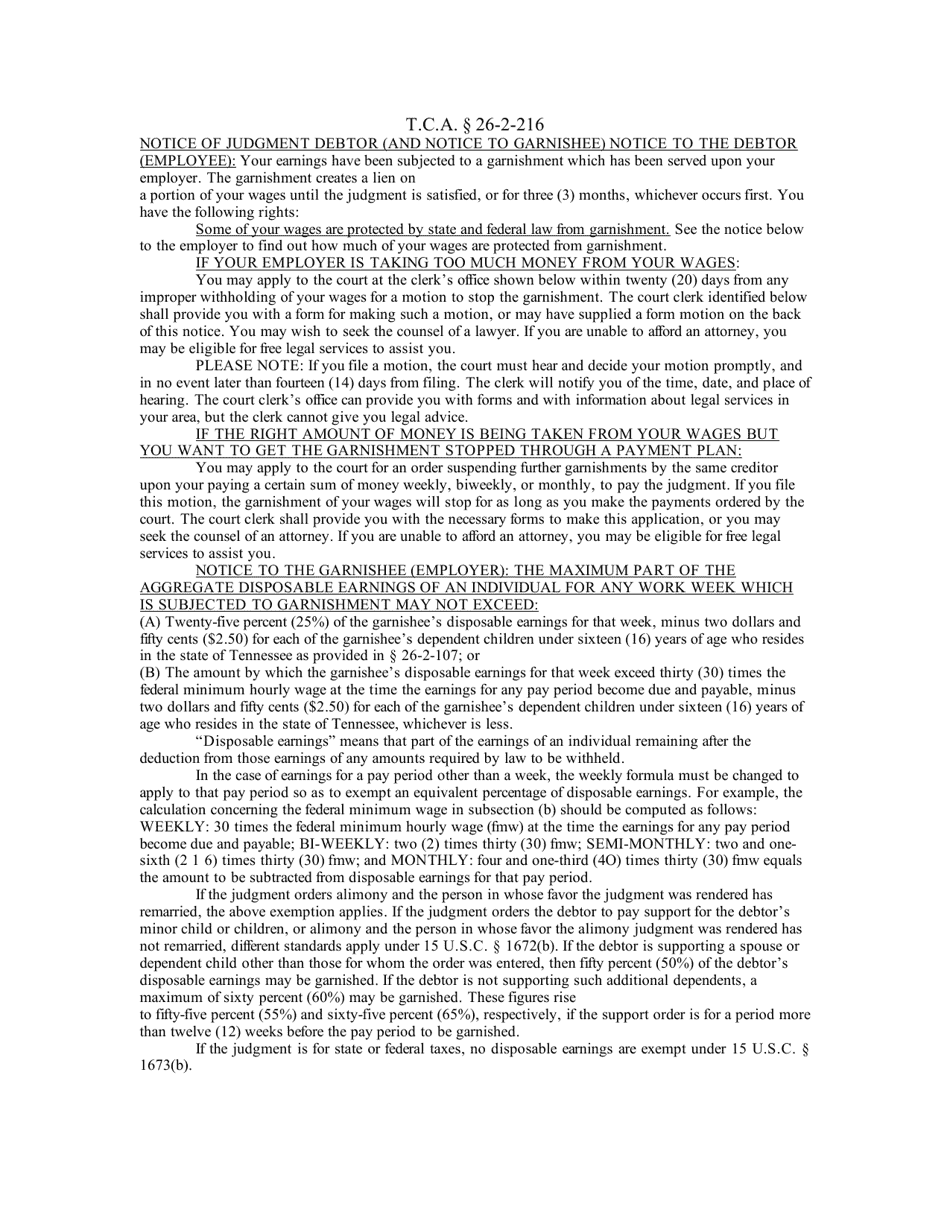

Q: How much of the debtor's wages can be garnished in Wisconsin?

A: In Wisconsin, the maximum amount that can be garnished from a debtor's wages is 20% of their disposable earnings, or the amount by which their disposable earnings exceed 30 times the federal minimum wage, whichever is less.

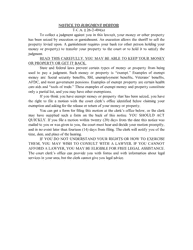

Q: Can a debtor challenge a Writ of Continuing Garnishment in Wisconsin?

A: Yes, a debtor has the right to challenge a Writ of Continuing Garnishment in Wisconsin. They can dispute the validity of the debt, claim exemptions, or request a reduction in the amount being garnished.

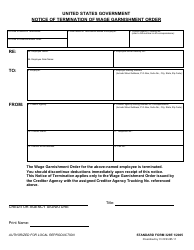

Q: What happens if the debtor changes jobs or banks?

A: If the debtor changes jobs or banks, the creditor must obtain a new writ and serve it on the new employer or financial institution in order to continue the garnishment.

Q: Is a Writ of Continuing Garnishment the same as wage garnishment?

A: Yes, a Writ of Continuing Garnishment is a type of wage garnishment, as it involves the withholding of a debtor's wages to satisfy a debt.

Q: Can a creditor garnish a debtor's Social Security or retirement benefits?

A: In general, Social Security and retirement benefits are protected from garnishment. However, there are certain circumstances where these benefits can be garnished to satisfy specific types of debts.

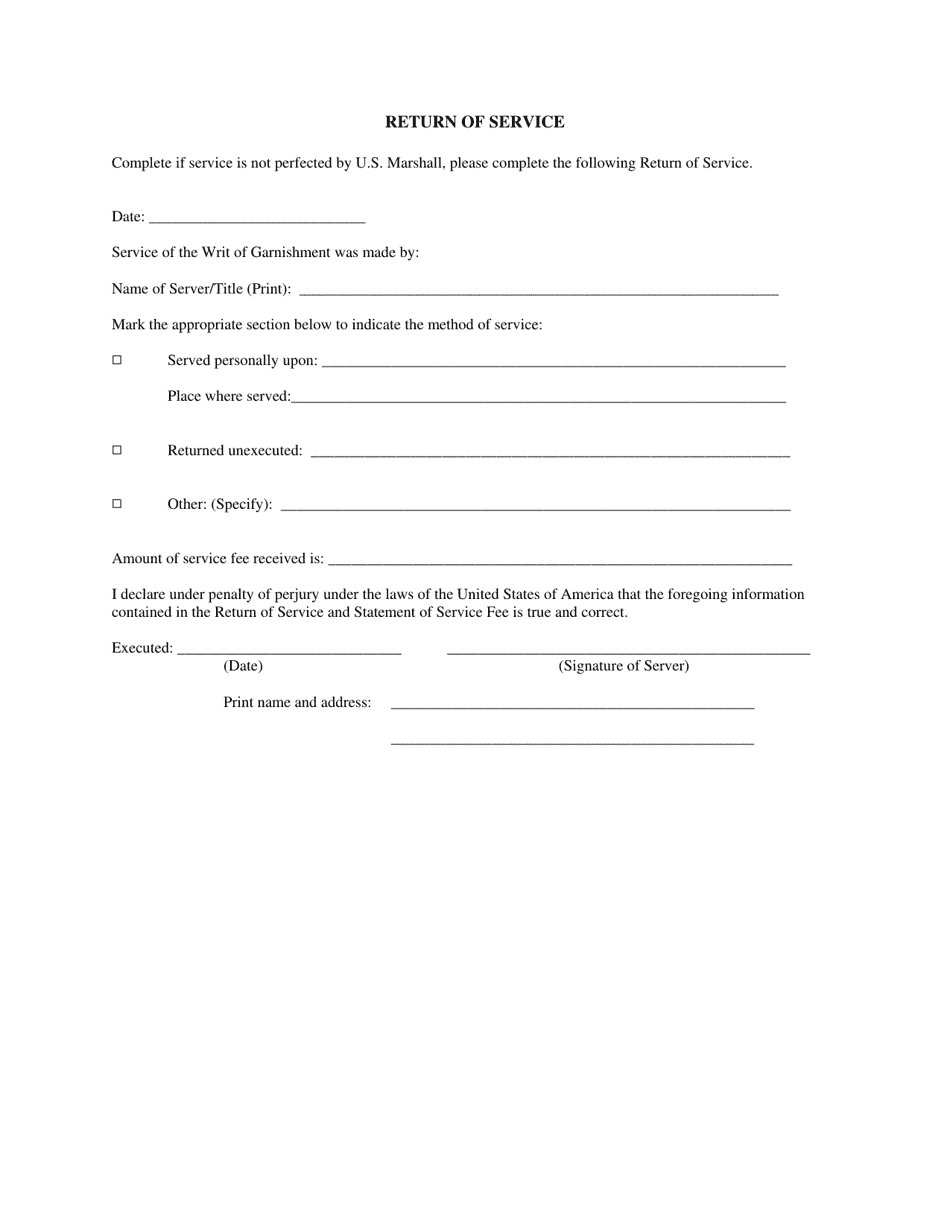

Form Details:

- The latest edition currently provided by the U.S. Bankruptcy Court - Eastern District of Wisconsin;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the U.S. Bankruptcy Court - Eastern District of Wisconsin.