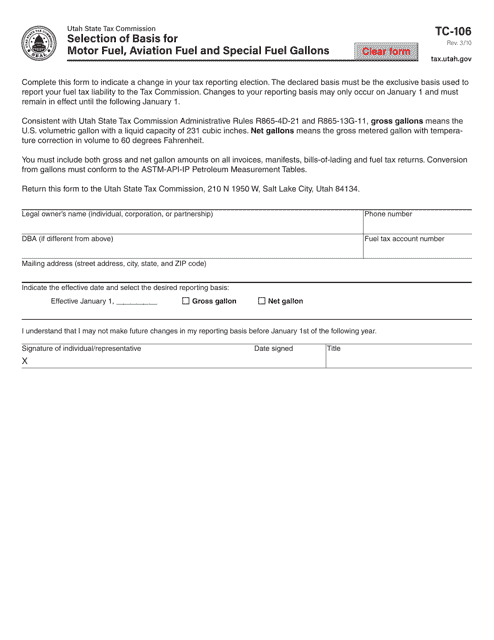

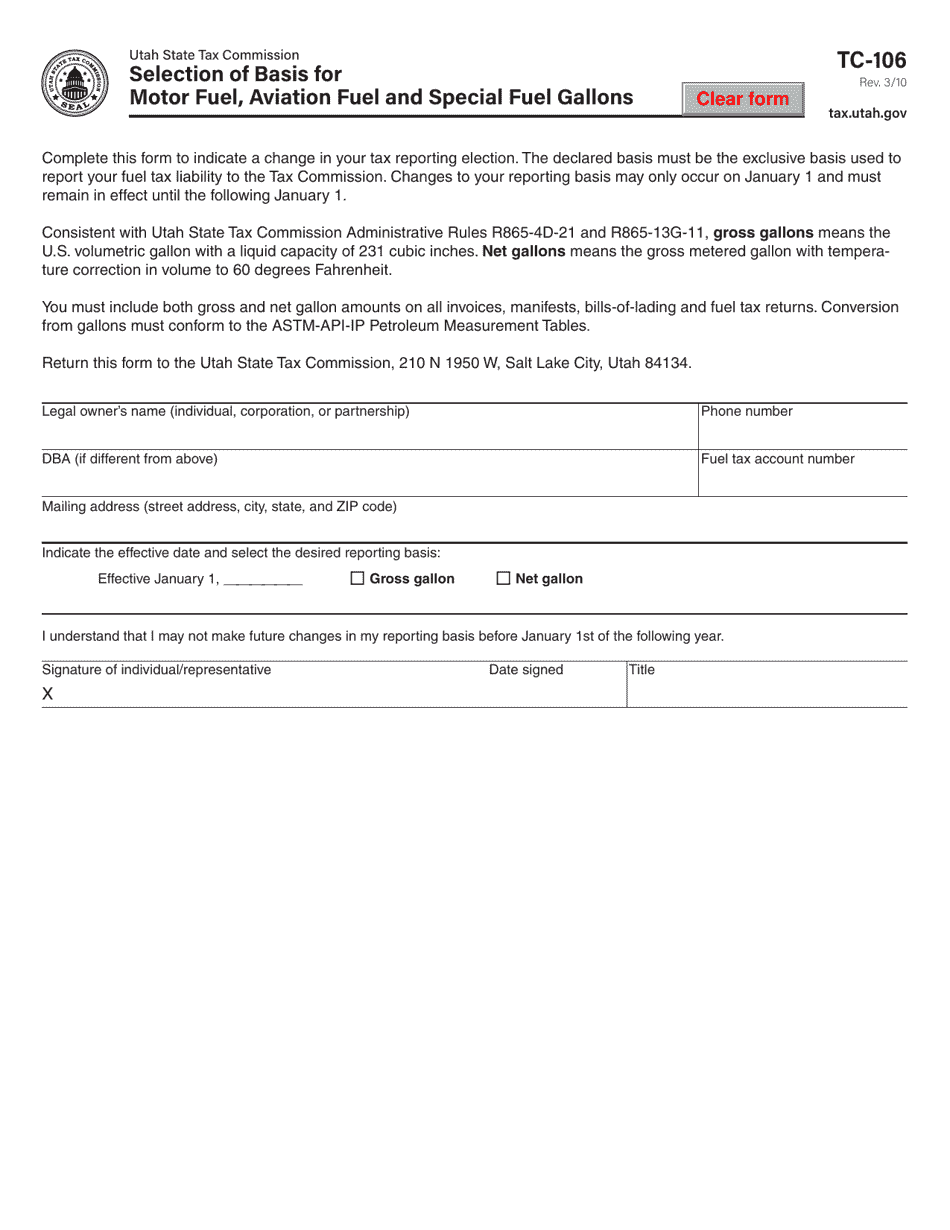

Form TC-106 Selection of Reporting Basis for Motor Fuel, Aviation Fuel and Special Fuel Gallons - Utah

What Is Form TC-106?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TC-106 Form?

A: TC-106 Form is the Selection of Reporting Basis for Motor Fuel, Aviation Fuel and Special Fuel Gallons form in Utah.

Q: What does the TC-106 Form do?

A: The TC-106 Form allows businesses to choose their reporting basis for motor fuel, aviation fuel, and special fuel gallons in Utah.

Q: Who needs to file the TC-106 Form?

A: Businesses that deal with motor fuel, aviation fuel, and special fuel in Utah need to file the TC-106 Form.

Q: When is the deadline for filing the TC-106 Form?

A: The deadline for filing the TC-106 Form depends on the reporting period chosen by the business. It is usually due on a quarterly basis.

Q: What happens if I don't file the TC-106 Form?

A: Failure to file the TC-106 Form or to report accurate information may result in penalties and fines.

Q: Can I change my reporting basis after filing the TC-106 Form?

A: Yes, you can request a change in your reporting basis by submitting a new TC-106 Form.

Q: Are there any exemptions or credits available for motor fuel, aviation fuel, and special fuel?

A: Yes, there are exemptions and credits available. You should consult the TC-106 Form instructions or contact the Utah Department of Transportation for more information.

Form Details:

- Released on March 1, 2010;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-106 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.