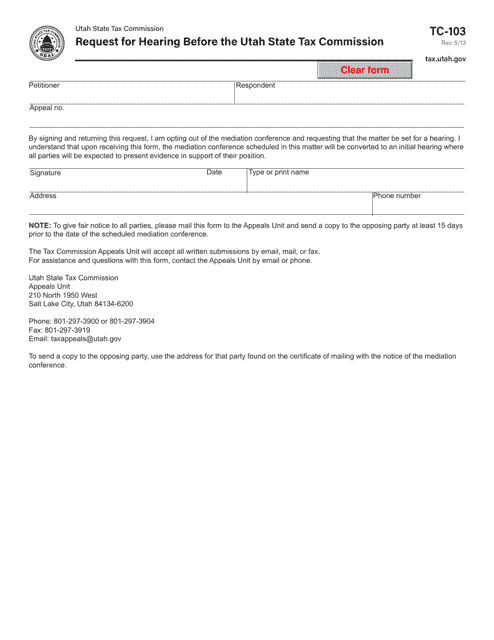

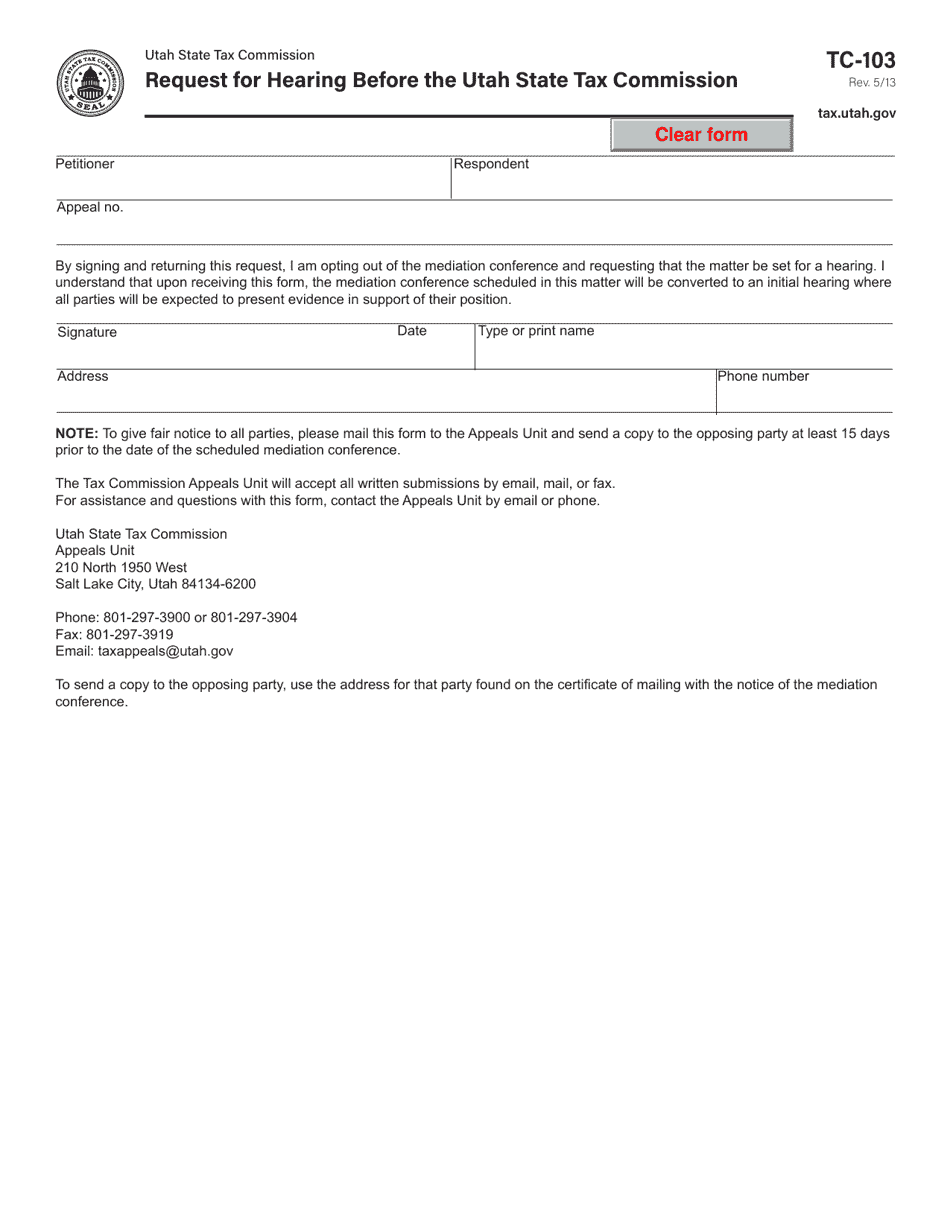

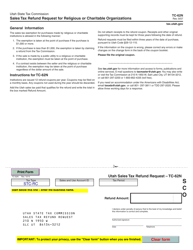

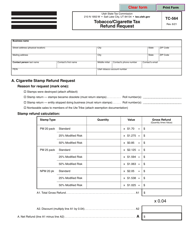

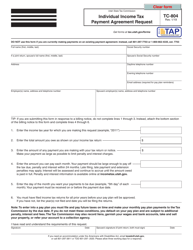

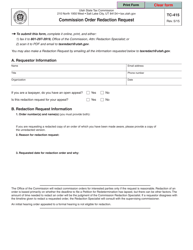

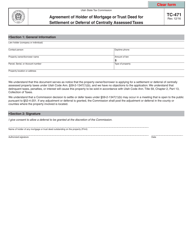

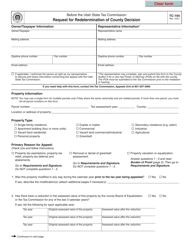

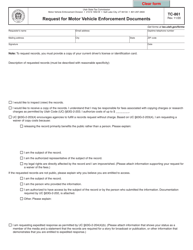

Form TC-103 Request for Hearing Before the Utah State Tax Commission - Utah

What Is Form TC-103?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-103?

A: Form TC-103 is a request for hearing before the Utah State Tax Commission.

Q: When should I use Form TC-103?

A: You should use Form TC-103 when you want to request a hearing regarding a tax matter with the Utah State Tax Commission.

Q: What information is required on Form TC-103?

A: Form TC-103 requires information such as your name, contact information, tax account number, and a detailed explanation of the issue you want to discuss in the hearing.

Q: Is there a deadline to submit Form TC-103?

A: Yes, there is a deadline to submit Form TC-103. The specific deadline will be mentioned on the notice or letter you received from the Utah State Tax Commission.

Q: What should I do after submitting Form TC-103?

A: After submitting Form TC-103, you should wait for a response from the Utah State Tax Commission regarding the scheduling of the hearing.

Form Details:

- Released on May 1, 2013;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-103 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.