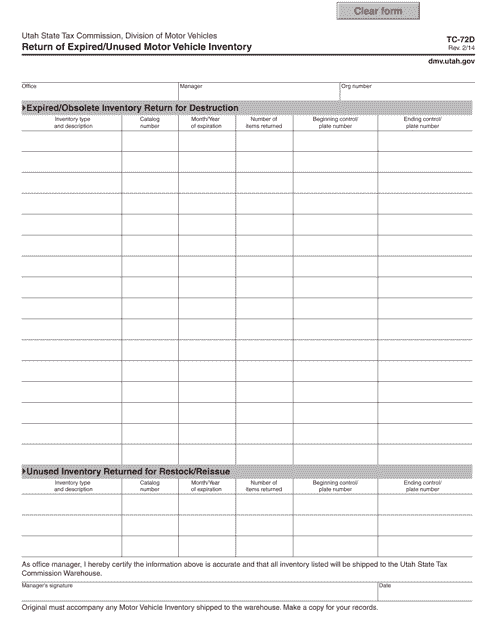

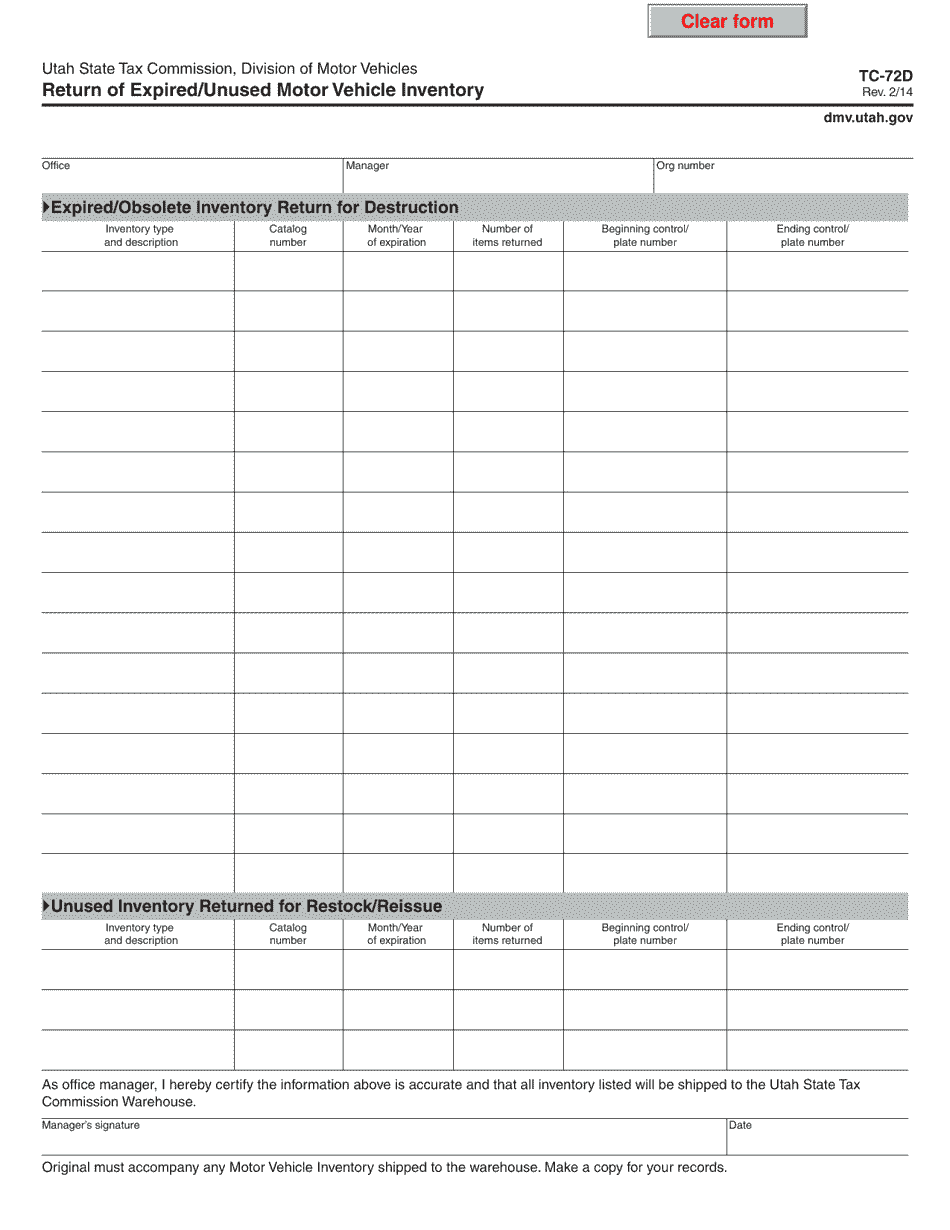

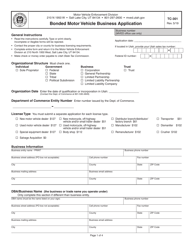

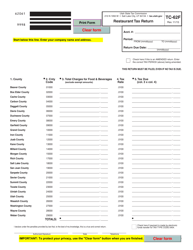

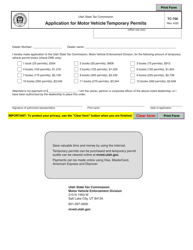

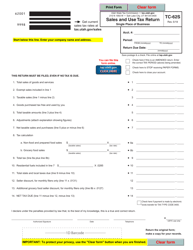

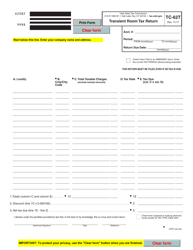

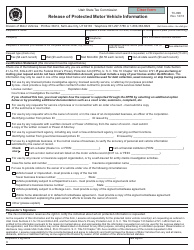

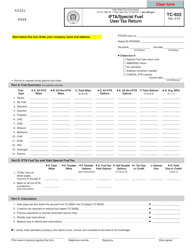

Form TC-72D Return of Expired / Unused Motor Vehicle Inventory - Utah

What Is Form TC-72D?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-72D?

A: Form TC-72D is the Return of Expired/Unused Motor Vehicle Inventory form in Utah.

Q: What is the purpose of Form TC-72D?

A: The purpose of Form TC-72D is to report and return expired or unused motor vehicle inventory in Utah.

Q: Who needs to file Form TC-72D?

A: Car dealerships and other businesses that have expired or unused motor vehicle inventory in Utah need to file Form TC-72D.

Q: When is Form TC-72D due?

A: Form TC-72D is due by the 20th day of the month following the end of the calendar quarter.

Q: Are there any penalties for not filing Form TC-72D?

A: Yes, failure to file Form TC-72D or filing it late may result in penalties and interest.

Form Details:

- Released on February 1, 2014;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-72D by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.