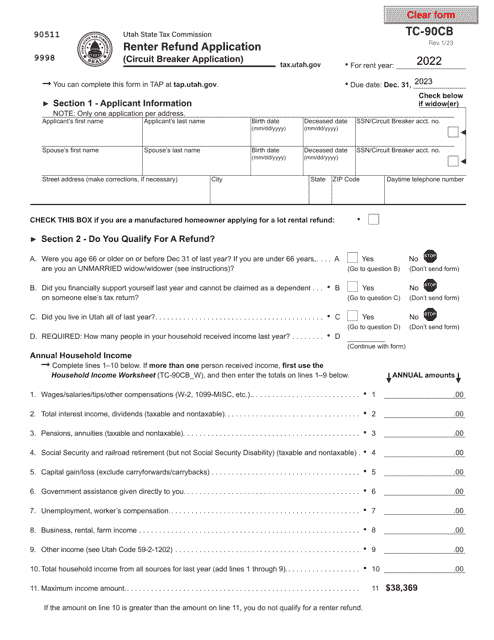

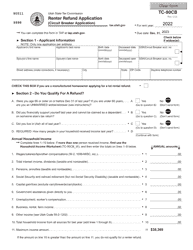

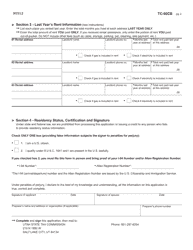

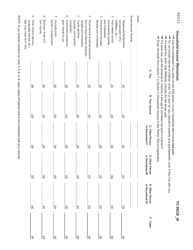

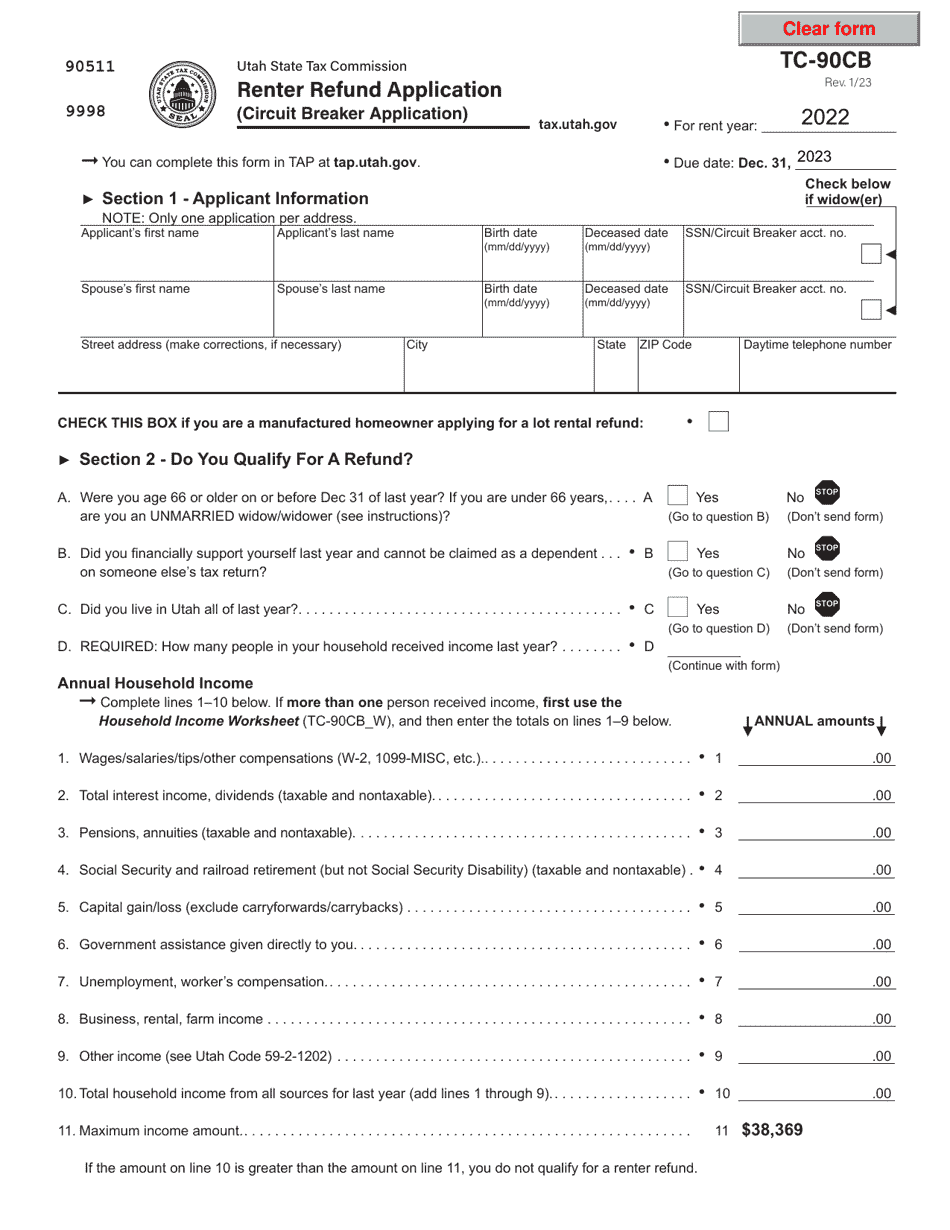

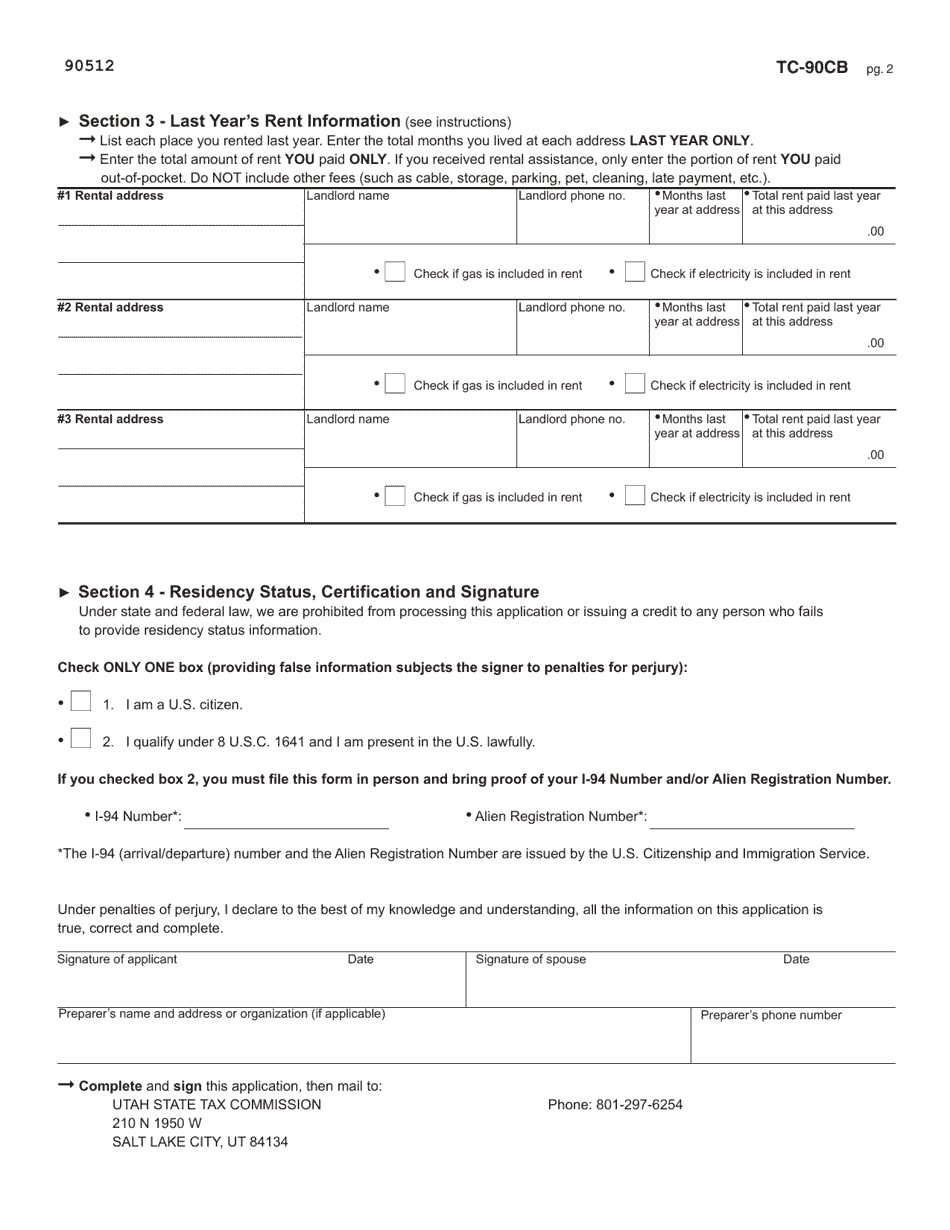

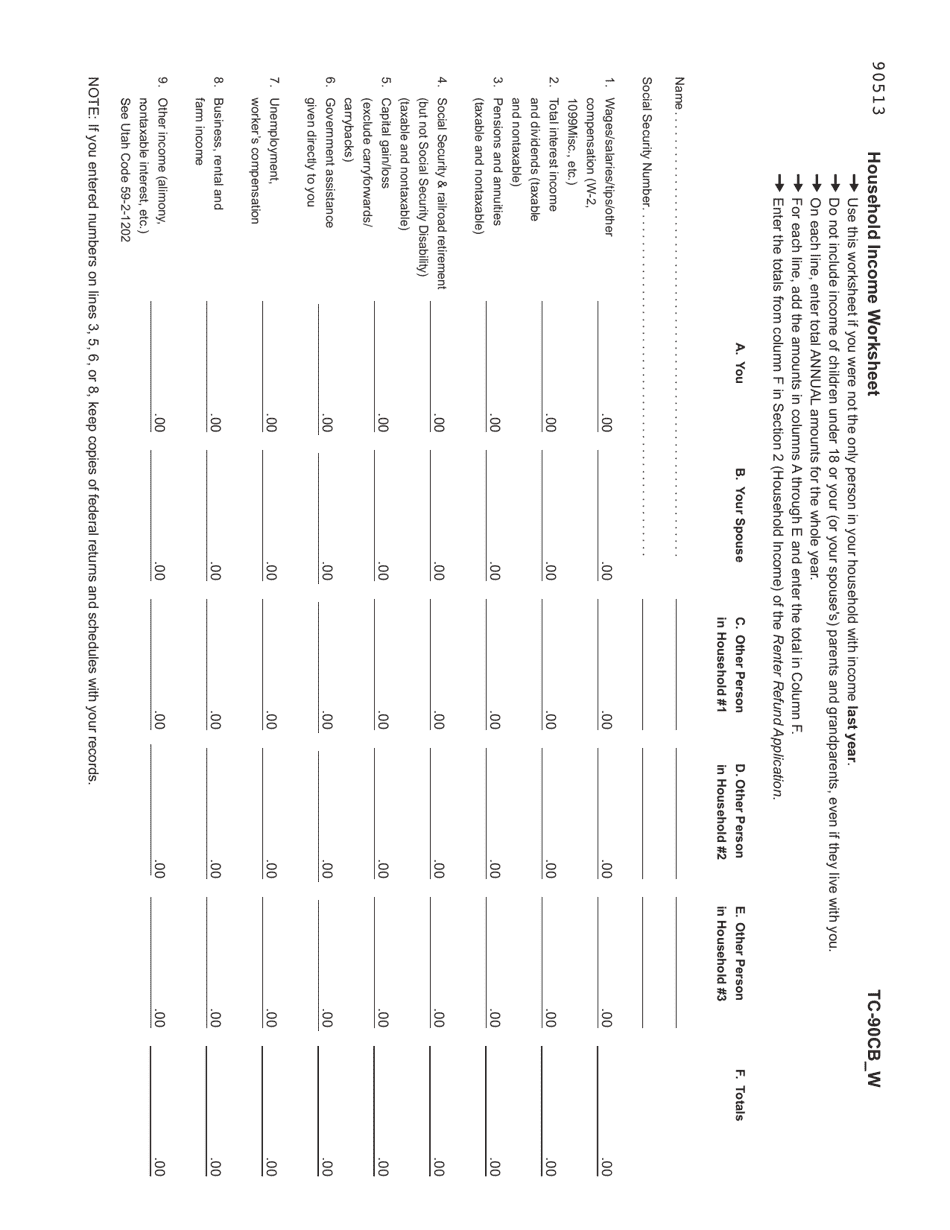

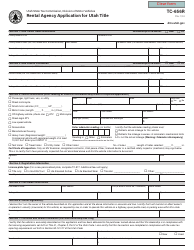

Form TC-90CB Renter Refund Application - Utah

What Is Form TC-90CB?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-90CB?

A: Form TC-90CB is the Renter Refund Application for Utah.

Q: Who can use Form TC-90CB?

A: Form TC-90CB can be used by renters in Utah who meet the eligibility criteria.

Q: What is the purpose of Form TC-90CB?

A: The purpose of Form TC-90CB is to apply for a refund of rent paid in Utah.

Q: How do I qualify for a renter refund?

A: To qualify for a renter refund, you must meet certain income and residency requirements set by the state of Utah.

Q: What documents do I need to attach to Form TC-90CB?

A: You may need to attach documents such as proof of rent paid and proof of income with your completed Form TC-90CB.

Q: When is the deadline to file Form TC-90CB?

A: The deadline to file Form TC-90CB is determined by the Utah State Tax Commission and may vary from year to year.

Q: How long does it take to receive a refund?

A: The processing time for a renter refund application can vary, but it typically takes several weeks to process and issue a refund.

Q: Is there a fee to file Form TC-90CB?

A: There is no fee to file Form TC-90CB.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-90CB by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.