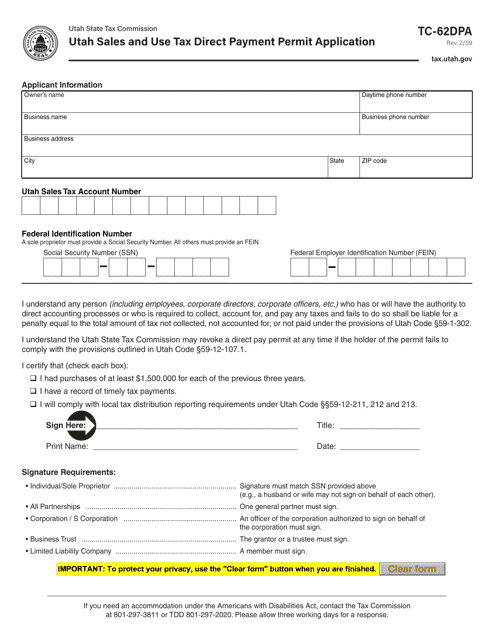

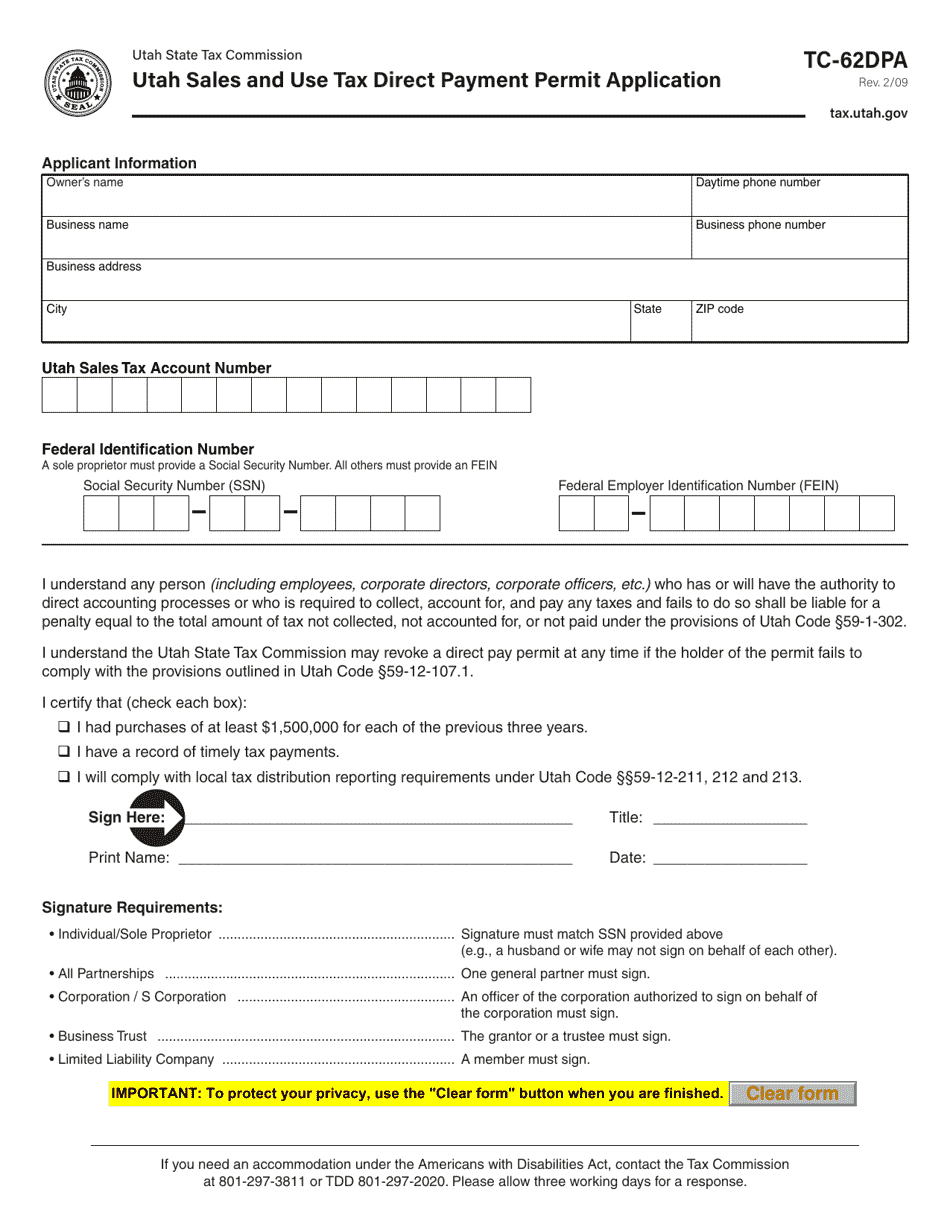

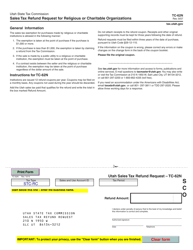

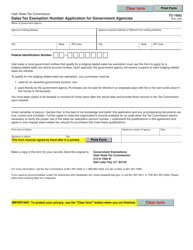

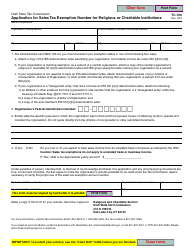

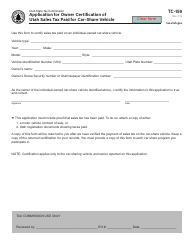

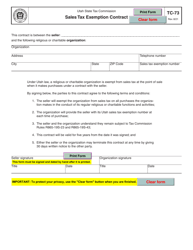

Form TC-62DPA Utah Sales and Use Tax Direct Payment Permit Application - Utah

What Is Form TC-62DPA?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

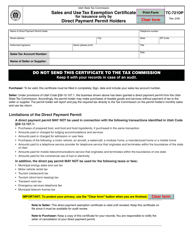

Q: What is the Form TC-62DPA?

A: The Form TC-62DPA is the Utah Sales and Use TaxDirect Payment Permit Application.

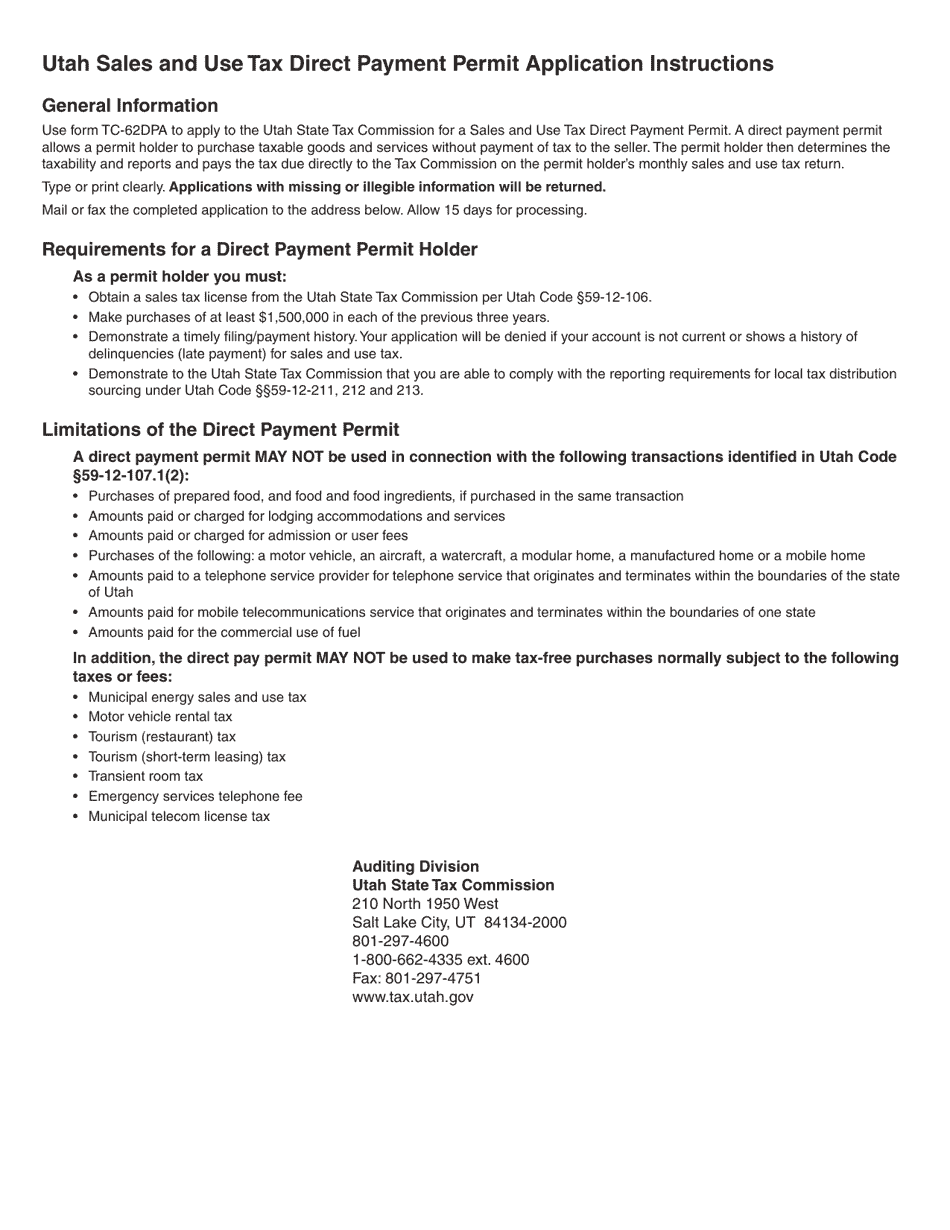

Q: What is the purpose of the Form TC-62DPA?

A: The purpose of the Form TC-62DPA is to apply for a Utah Sales and Use Tax Direct Payment Permit.

Q: What is a Sales and Use Tax Direct Payment Permit?

A: A Sales and Use Tax Direct Payment Permit allows a taxpayer to pay sales and use taxes directly to the state of Utah instead of paying them to the vendor.

Q: Who needs to file the Form TC-62DPA?

A: Taxpayers who want to apply for a Sales and Use Tax Direct Payment Permit in Utah need to file the Form TC-62DPA.

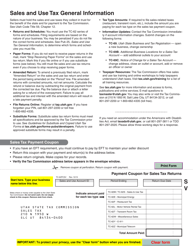

Form Details:

- Released on February 1, 2009;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-62DPA by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.