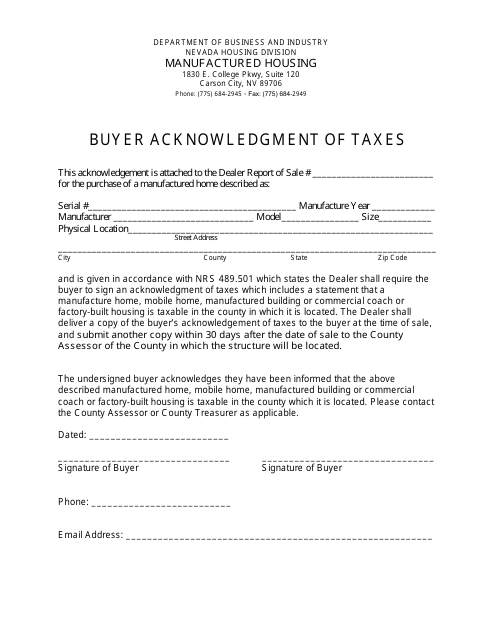

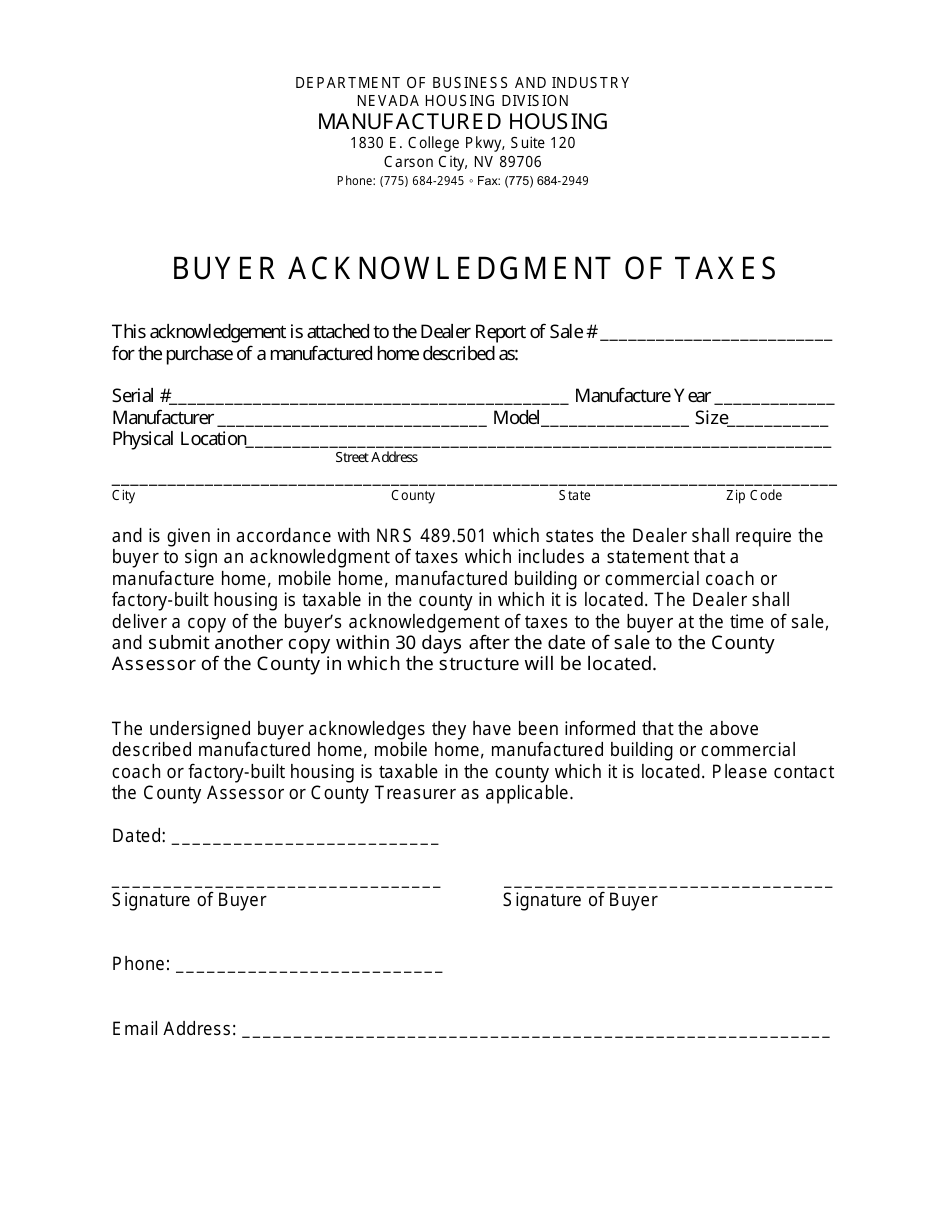

Buyer Acknowledgment of Taxes - Nevada

Buyer Acknowledgment of Taxes is a legal document that was released by the Nevada Department of Business and Industry - a government authority operating within Nevada.

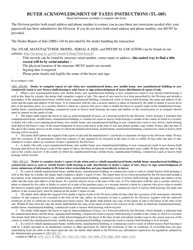

FAQ

Q: What taxes are applicable to buyers in Nevada?

A: Buyers in Nevada may be subject to sales tax, use tax, and other local taxes depending on the purchase.

Q: What is sales tax?

A: Sales tax is a tax imposed on the sale of goods and certain services.

Q: What is use tax?

A: Use tax is a tax on the use, storage, or consumption of goods or services that were purchased without paying sales tax.

Q: Who is responsible for paying sales tax in Nevada?

A: Buyers are generally responsible for paying sales tax in Nevada.

Q: Are there any exemptions from sales tax in Nevada?

A: Yes, certain purchases, such as groceries and prescription drugs, may be exempt from sales tax in Nevada.

Q: What are other local taxes that buyers may be subject to in Nevada?

A: Buyers in Nevada may also be subject to additional local taxes, such as lodging tax or vehicle registration tax depending on the purchase.

Form Details:

- The latest edition currently provided by the Nevada Department of Business and Industry;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry.