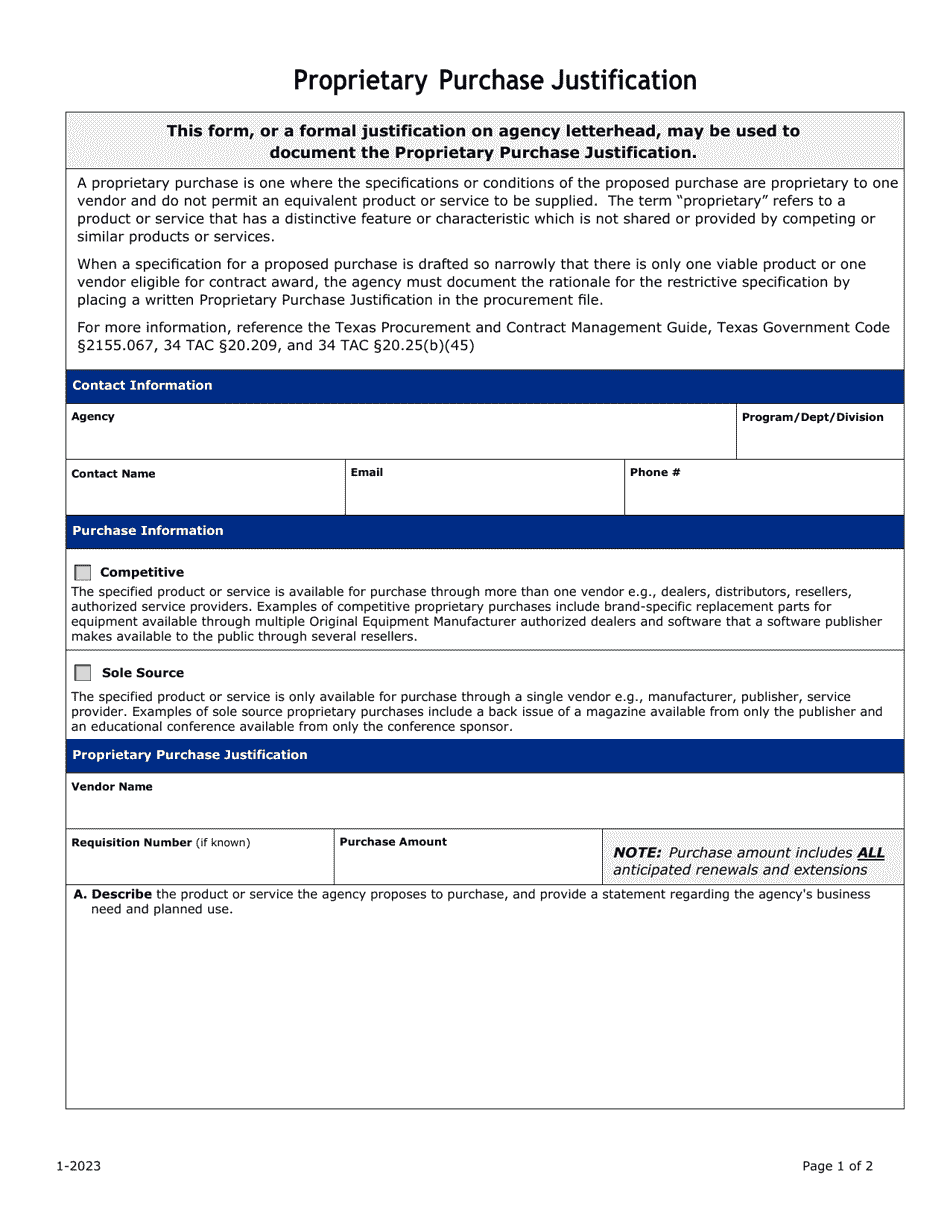

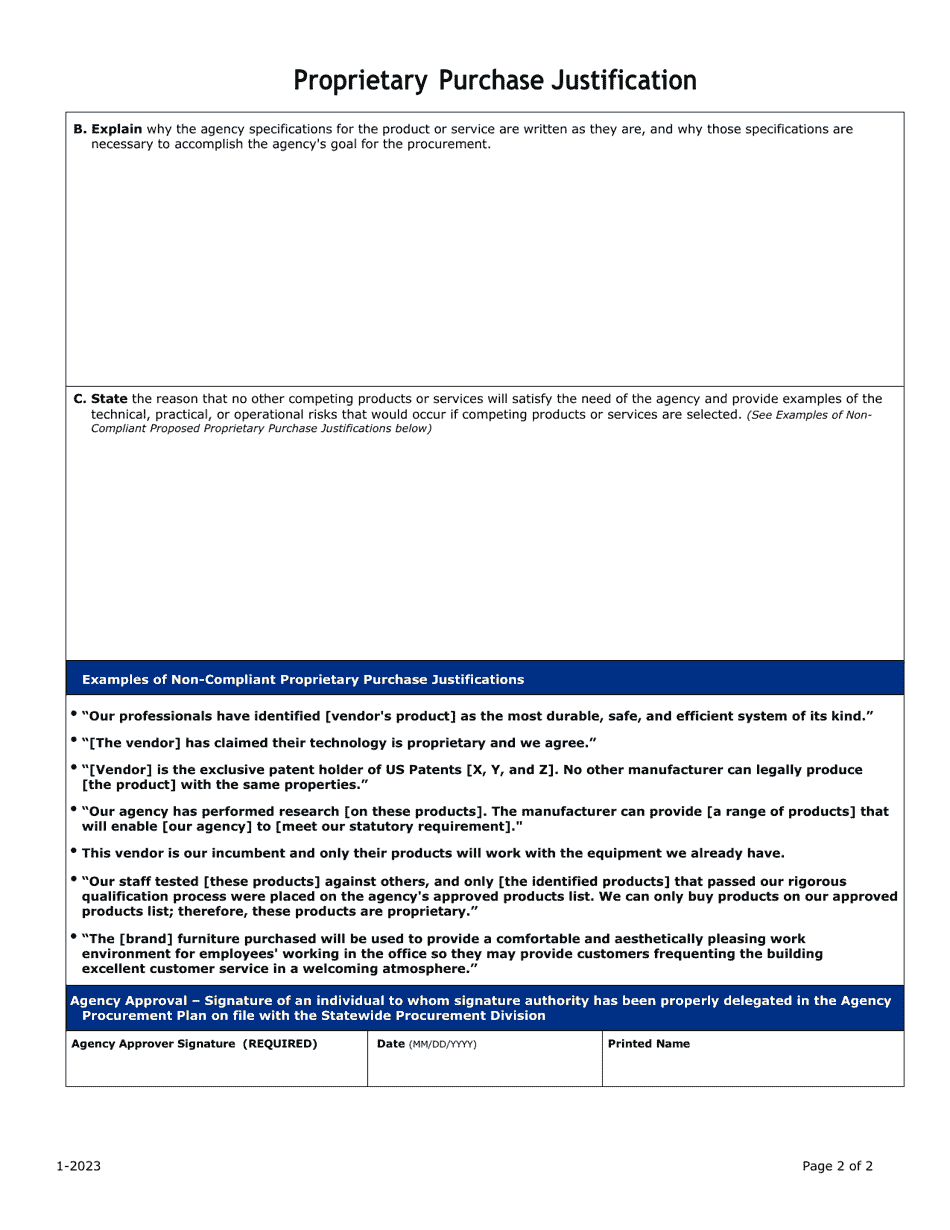

Proprietary Purchase Justification - Texas

Proprietary Purchase Justification is a legal document that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas.

FAQ

Q: What is a proprietary purchase?

A: A proprietary purchase refers to buying goods or services from a specific vendor or manufacturer.

Q: What is a purchase justification?

A: A purchase justification is a document that explains the reasons for making a certain purchase.

Q: Why would someone need a proprietary purchase justification?

A: A proprietary purchase justification is required when buying from a specific vendor to ensure transparency and accountability.

Q: Is a proprietary purchase justification only relevant in Texas?

A: No, a proprietary purchase justification can be required in any state, not just Texas.

Q: What should be included in a proprietary purchase justification?

A: A proprietary purchase justification should include a clear description of the need, cost comparison, and explanation of why the chosen vendor is the best option.

Q: Who typically approves a proprietary purchase?

A: Approval for a proprietary purchase is usually obtained from the purchasing department or a designated authority within the organization.

Q: Is a proprietary purchase justification mandatory?

A: The requirement for a proprietary purchase justification may vary depending on the organization's policies or the cost of the purchase.

Q: Can a purchase be made without a proprietary purchase justification?

A: In some cases, a purchase can be made without a proprietary purchase justification, especially for low-cost items or in emergency situations.

Q: How long should a proprietary purchase justification be kept on record?

A: It is advisable to keep a copy of the proprietary purchase justification on record for a reasonable period of time, usually as per organizational policies.

Q: Are there any restrictions on making a proprietary purchase?

A: Yes, restrictions may include budget limitations, specific vendor contracts, or procurement guidelines set by the organization.

Form Details:

- Released on January 1, 2023;

- The latest edition currently provided by the Texas Comptroller of Public Accounts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.