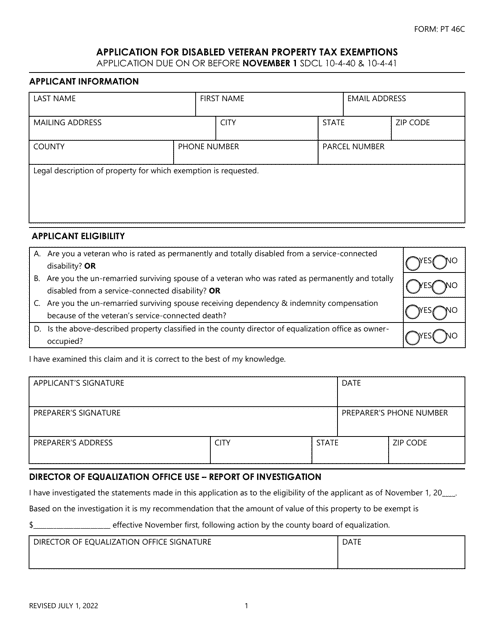

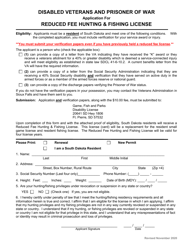

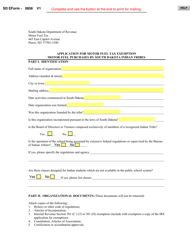

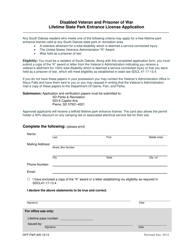

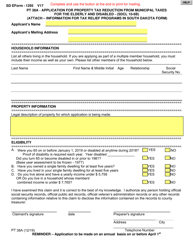

Form PT46C Application for Disabled Veteran Property Tax Exemptions - South Dakota

What Is Form PT46C?

This is a legal form that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT46C?

A: Form PT46C is an application for Disabled Veteran Property Tax Exemptions in South Dakota.

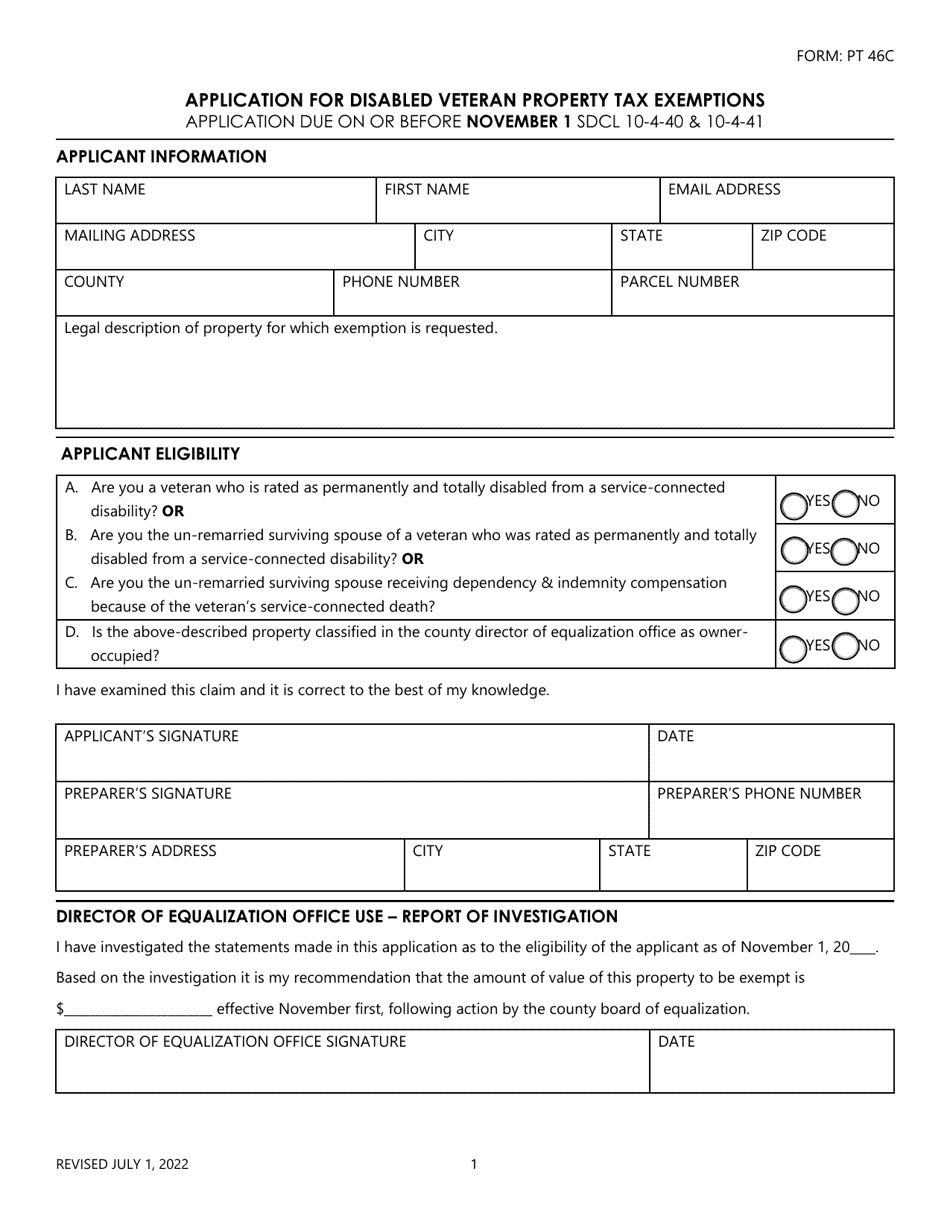

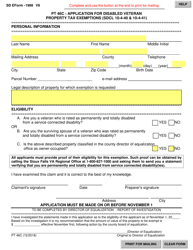

Q: Who can apply for the Disabled Veteran Property Tax Exemption?

A: Disabled veterans who meet certain criteria can apply for the exemption.

Q: What are the eligibility criteria for the exemption?

A: To be eligible, a veteran must be permanently and totally disabled as a result of military service or have a service-connected disability rating of at least 40%.

Q: What does the application process involve?

A: The application requires the veteran to provide proof of disability and other necessary documents.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be submitted to the county treasurer's office by March 15th of the year for which the exemption is sought.

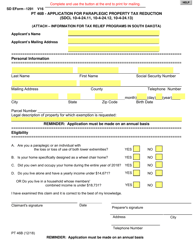

Q: What benefits does the Disabled Veteran Property Tax Exemption provide?

A: The exemption allows qualifying disabled veterans to receive a reduction in their property taxes.

Q: Are there any income restrictions for the exemption?

A: No, there are no income restrictions for the Disabled Veteran Property Tax Exemption in South Dakota.

Q: Can I apply for multiple exemptions as a disabled veteran?

A: Yes, disabled veterans can apply for multiple exemptions, such as the Homestead Exemption and the Disabled Veteran Property Tax Exemption.

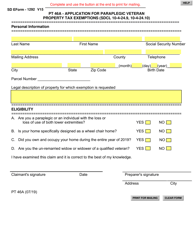

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the South Dakota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT46C by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.