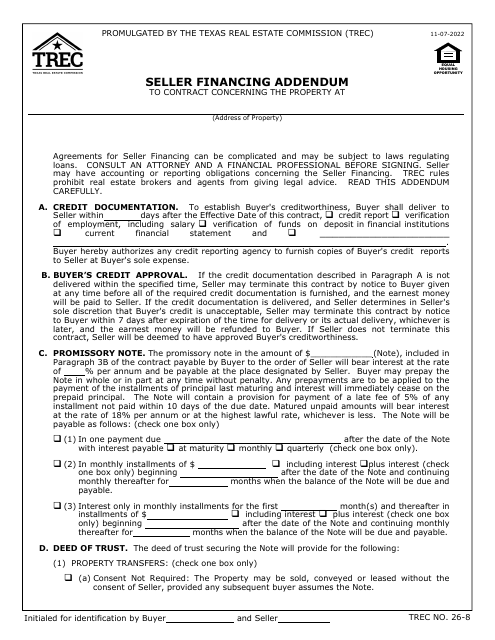

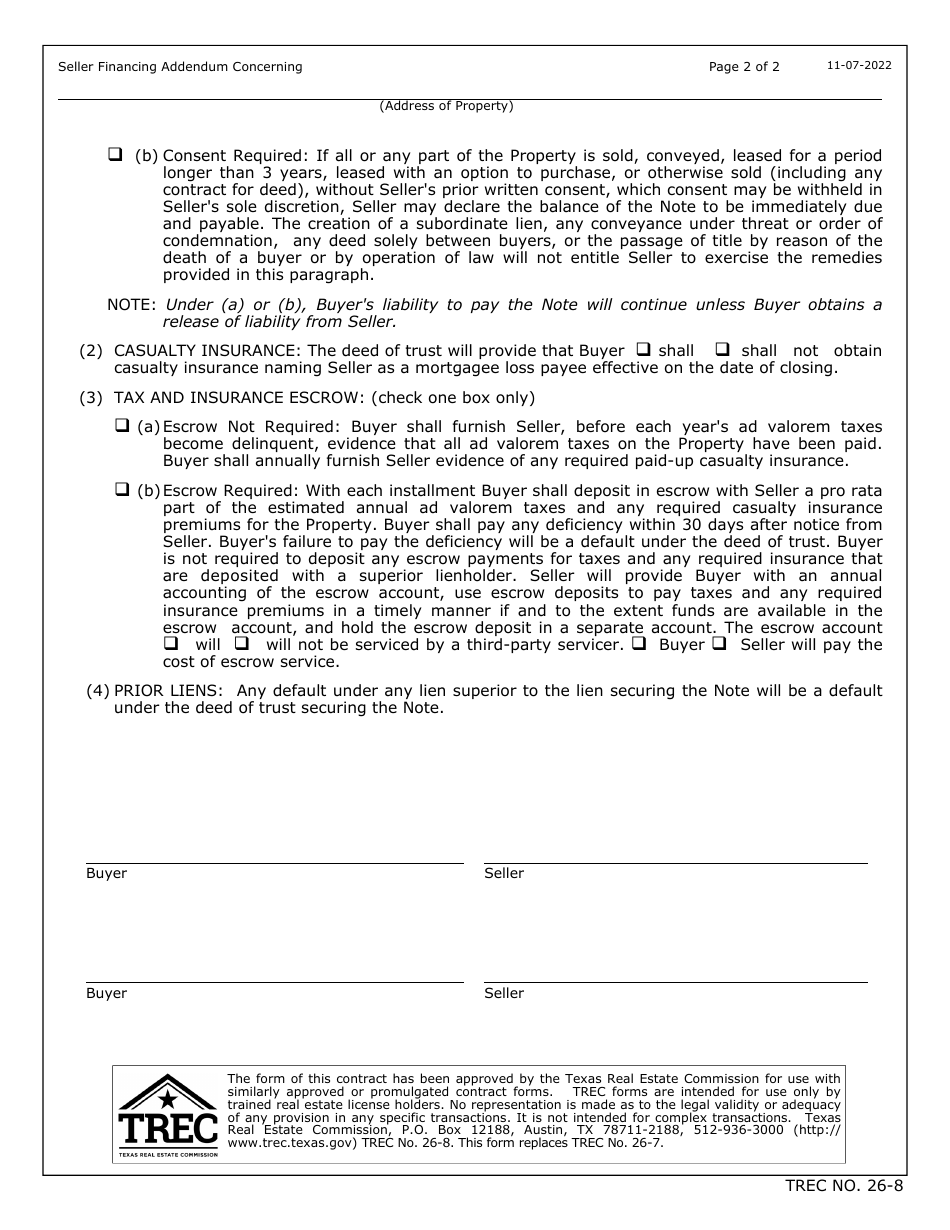

Form 26-8 Seller Financing Addendum - Texas

What Is Form 26-8?

This is a legal form that was released by the Texas Real Estate Commission - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 26-8 Seller Financing Addendum?

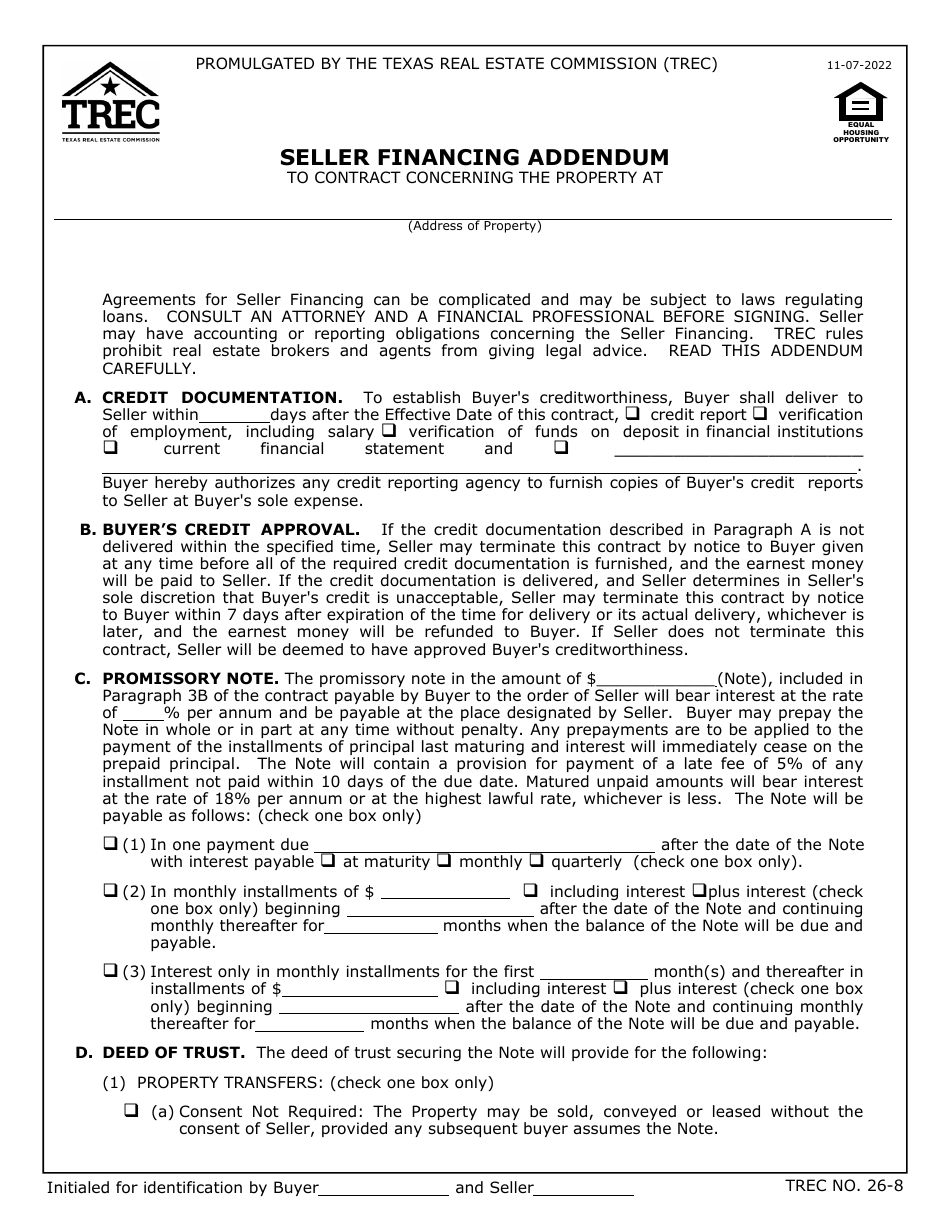

A: Form 26-8 Seller Financing Addendum is a legal document used in Texas real estate transactions where the seller provides financing to the buyer instead of the buyer obtaining a traditional mortgage from a bank.

Q: Why would a seller choose to provide financing to the buyer?

A: A seller may choose to provide financing to the buyer to make the purchase more attractive or to sell the property quickly. It can also be a useful option in situations where the buyer has difficulty obtaining a mortgage from a bank.

Q: What information is typically included in Form 26-8 Seller Financing Addendum?

A: Form 26-8 Seller Financing Addendum typically includes details of the financing terms, such as the loan amount, interest rate, repayment terms, and any conditions or contingencies.

Q: Is Form 26-8 Seller Financing Addendum legally binding?

A: Yes, Form 26-8 Seller Financing Addendum is a legally binding document once both the buyer and seller have signed it. It becomes part of the purchase agreement between the parties.

Q: Are there any risks involved in seller financing?

A: Yes, there are potential risks involved in seller financing. The buyer may default on the loan, and the seller may need to foreclose on the property. It is important for both parties to carefully consider the terms and potential risks before entering into a seller financing agreement.

Form Details:

- Released on November 7, 2022;

- The latest edition provided by the Texas Real Estate Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 26-8 by clicking the link below or browse more documents and templates provided by the Texas Real Estate Commission.