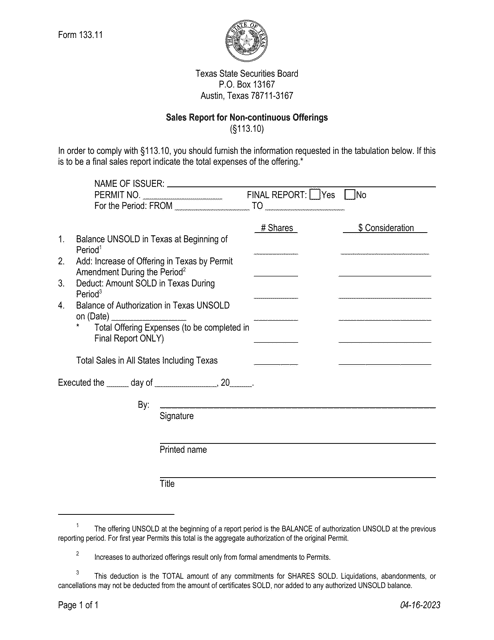

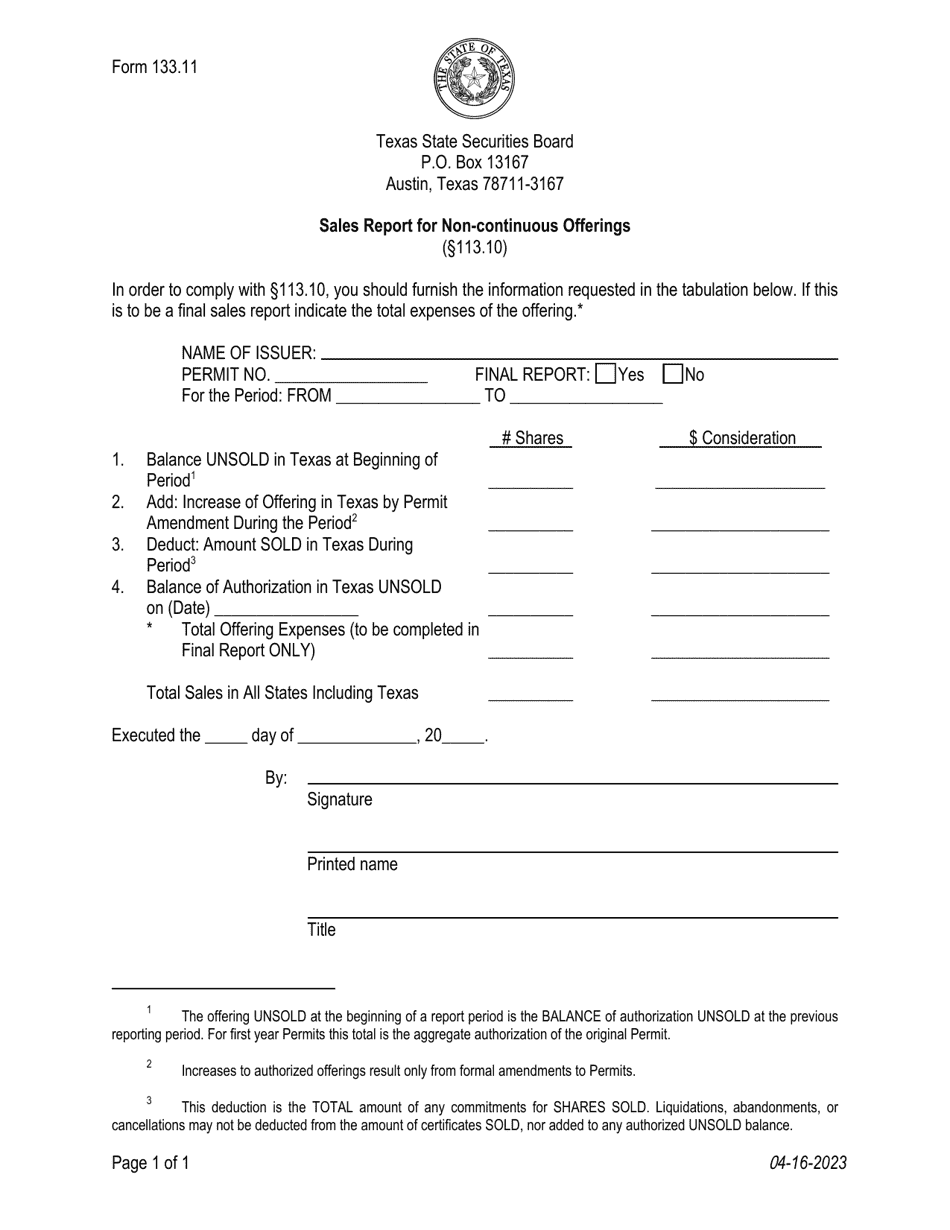

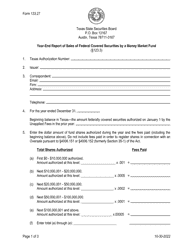

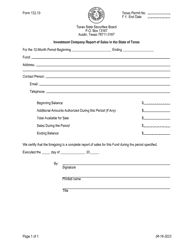

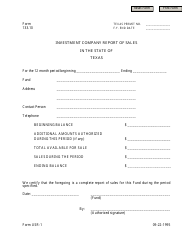

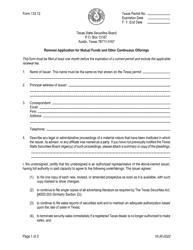

Form 133.11 Sales Report for Non-continuous Offerings - Texas

What Is Form 133.11?

This is a legal form that was released by the Texas State Securities Board - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 133.11?

A: Form 133.11 is a Sales Report for Non-continuous Offerings in Texas.

Q: Who needs to file Form 133.11?

A: Anyone who is offering items for sale in Texas on a non-continuous basis needs to file Form 133.11.

Q: What is considered a non-continuous offering?

A: A non-continuous offering refers to the sale of items that are not consistently or regularly available for purchase in Texas.

Q: What information do I need to provide in Form 133.11?

A: Form 133.11 requires you to provide details about the items being sold, the method of sale, and the locations where the items are being offered.

Q: How often do I need to file Form 133.11?

A: Form 133.11 needs to be filed on a quarterly basis, with the due date falling on the last day of the month following the end of each quarter.

Q: Are there any penalties for not filing Form 133.11?

A: Yes, failure to file Form 133.11 or filing it late can result in penalties and fines imposed by the Texas Comptroller of Public Accounts.

Form Details:

- Released on April 16, 2023;

- The latest edition provided by the Texas State Securities Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 133.11 by clicking the link below or browse more documents and templates provided by the Texas State Securities Board.