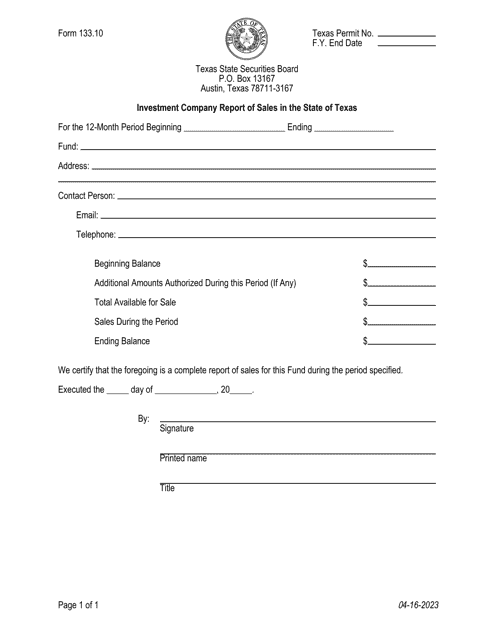

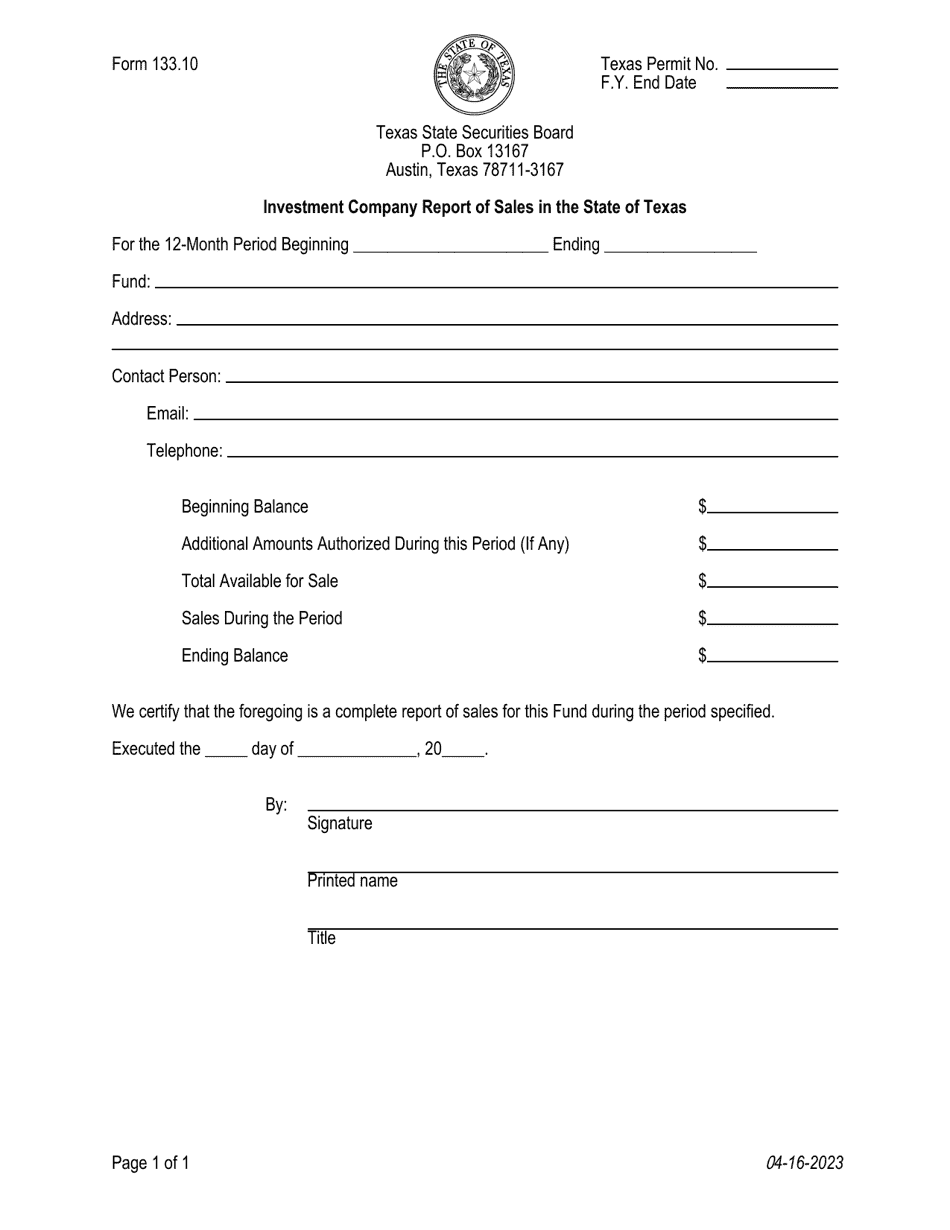

Form 133.10 Investment Company Report of Sales in the State of Texas - Texas

What Is Form 133.10?

This is a legal form that was released by the Texas State Securities Board - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 133.10?

A: Form 133.10 is an Investment Company Report of Sales in the State of Texas.

Q: Who needs to file Form 133.10?

A: Investment companies that have made sales in the State of Texas.

Q: What is the purpose of Form 133.10?

A: Form 133.10 is used to report sales made by investment companies in the State of Texas.

Q: How often do you need to file Form 133.10?

A: Form 133.10 is filed semi-annually.

Q: Are there any fees associated with filing Form 133.10?

A: Yes, there is a filing fee for Form 133.10. The fee amount may vary.

Q: Are there any penalties for late filing of Form 133.10?

A: Yes, late filing of Form 133.10 may result in penalties.

Form Details:

- Released on April 16, 2023;

- The latest edition provided by the Texas State Securities Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 133.10 by clicking the link below or browse more documents and templates provided by the Texas State Securities Board.