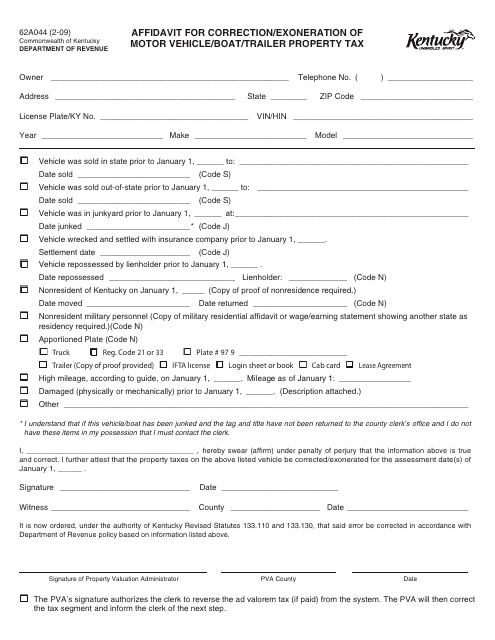

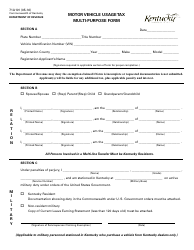

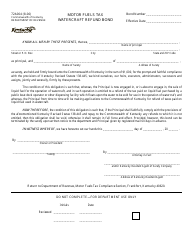

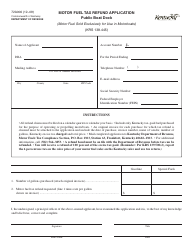

Form 62A044 Affidavit for Correction / Exoneration of Motor Vehicle / Boat / Trailer Property Tax - Kentucky

What Is Form 62A044?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 62A044?

A: Form 62A044 is an affidavit used in Kentucky to request correction or exoneration of property tax on a motor vehicle, boat, or trailer.

Q: How do I use Form 62A044?

A: You can use Form 62A044 if you believe there is an error on your property tax assessment for a motor vehicle, boat, or trailer, or if you believe you are eligible for an exemption or exoneration from paying property tax.

Q: What information do I need to provide on Form 62A044?

A: You will need to provide your personal information, vehicle/boat/trailer details, reason for requesting correction or exoneration, and any supporting documentation.

Q: Is there a deadline to submit Form 62A044?

A: Yes, you must submit Form 62A044 within 45 days of the tax bill's due date.

Q: What happens after I submit Form 62A044?

A: The county clerk will review your request and make a determination. You will be notified of the decision in writing.

Q: Can I appeal the decision made based on Form 62A044?

A: Yes, if you disagree with the decision, you can file an appeal with the Kentucky Department of Revenue within 30 days of receiving the decision.

Q: Are there any fees associated with submitting Form 62A044?

A: There are no fees for submitting Form 62A044.

Form Details:

- Released on February 1, 2009;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 62A044 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.