Form 5014-S11 Schedule NU(S11) Nunavut Tuition, Education, and Textbook Amounts (Large Print) - Canada

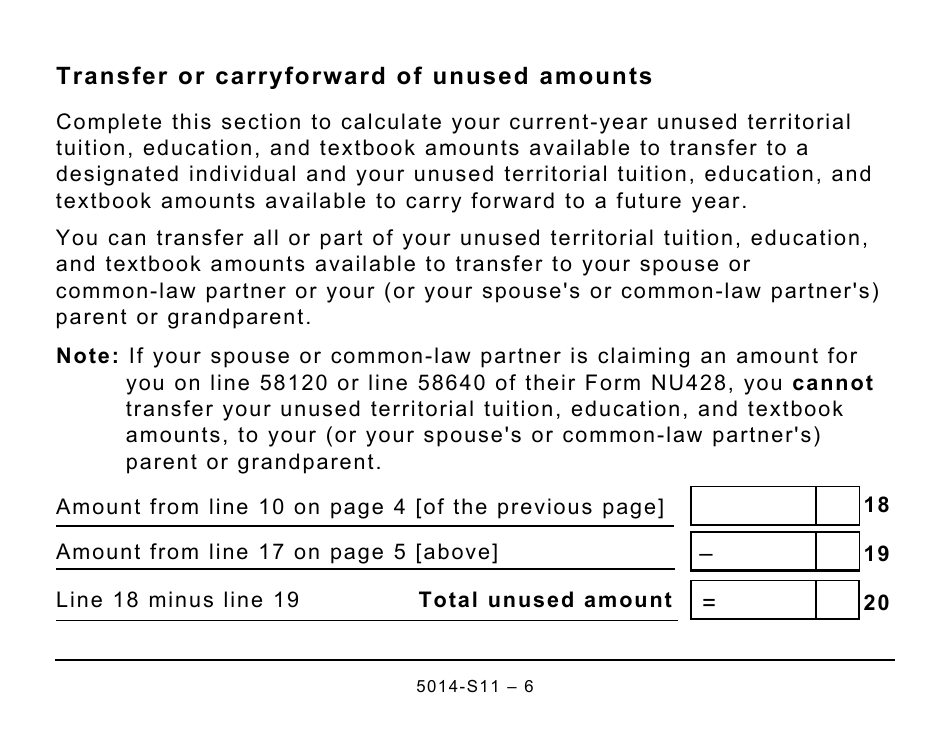

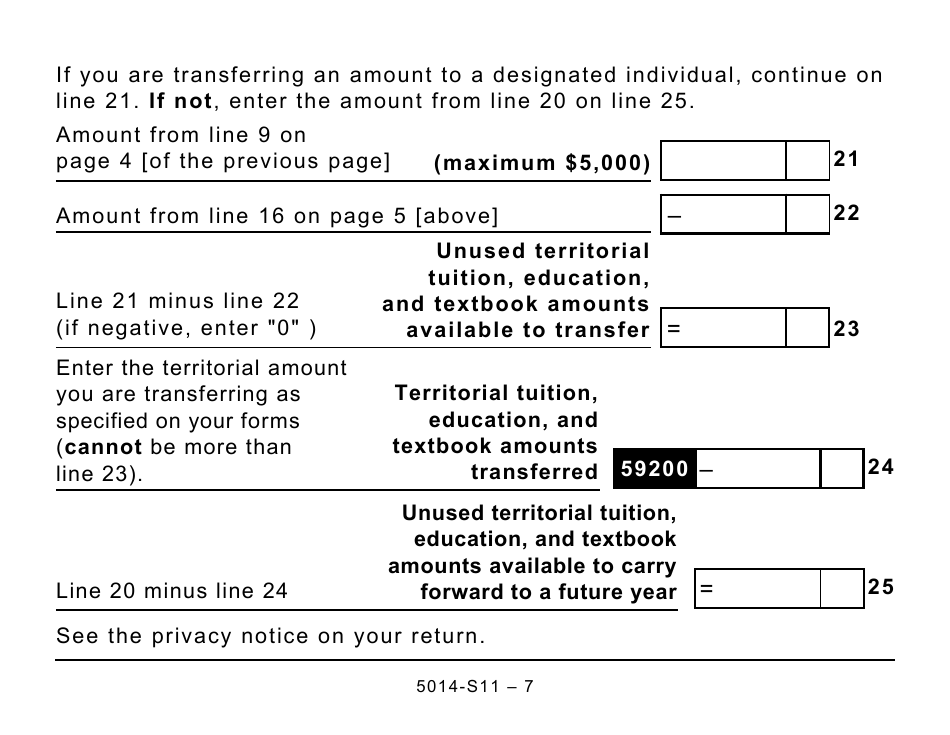

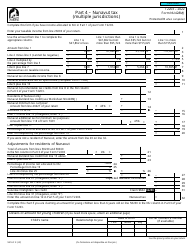

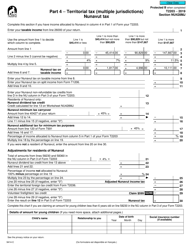

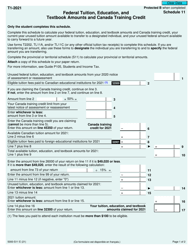

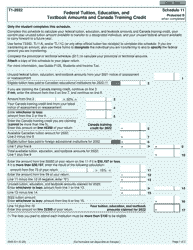

The Form 5014-S11 Schedule NU (S11) Nunavut Tuition, Education, and Textbook Amounts (Large Print) is a Canadian tax document, specifically for residents of Nunavut. This form is used by taxpayers to claim tuition expenses, education-related expenses, and textbook costs in order to reduce their taxable income. Essentially, it helps students or those supporting students to get tax credits for education-related expenses in Nunavut. These amounts can significantly reduce a person's tax burden in a given year, reflecting the Canadian government's efforts to make education more affordable.

Form 5014-S11 Schedule NU(S11) is filed by residents of Nunavut, a territory in Canada. This form relates to tax credits for tuition, education, and textbook amounts. Essentially, this form is for students or individuals paying tuition fees who wish to claim a reduction on their taxes. It's particularly for those residents who have incurred these expenses while living in Nunavut. The "large print" refers to the form layout, which is designed to be easier to read for those with visual impairments.

FAQ

Q: What is Form 5014-S11 Schedule NU(S11) in Canada?

A: Form 5014-S11 Schedule NU(S11) is a tax document in Canada related to Nunavut's Tuition, Education, and Textbook Amounts. It helps calculate and claim the tax credits for tuition, education, and textbooks amounts residents are entitled to as residents of Nunavut.

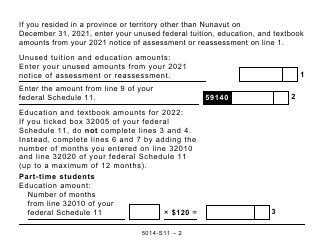

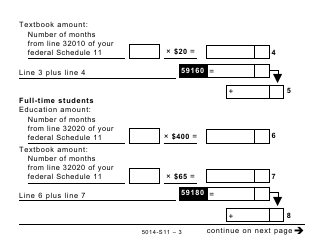

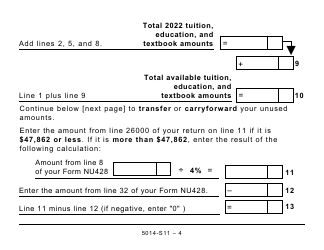

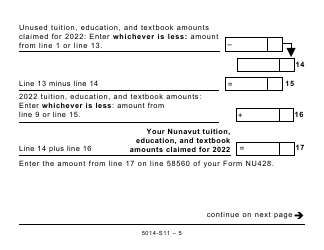

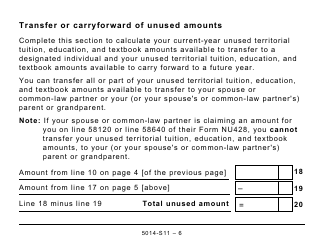

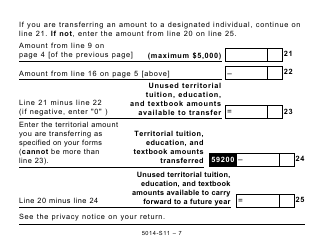

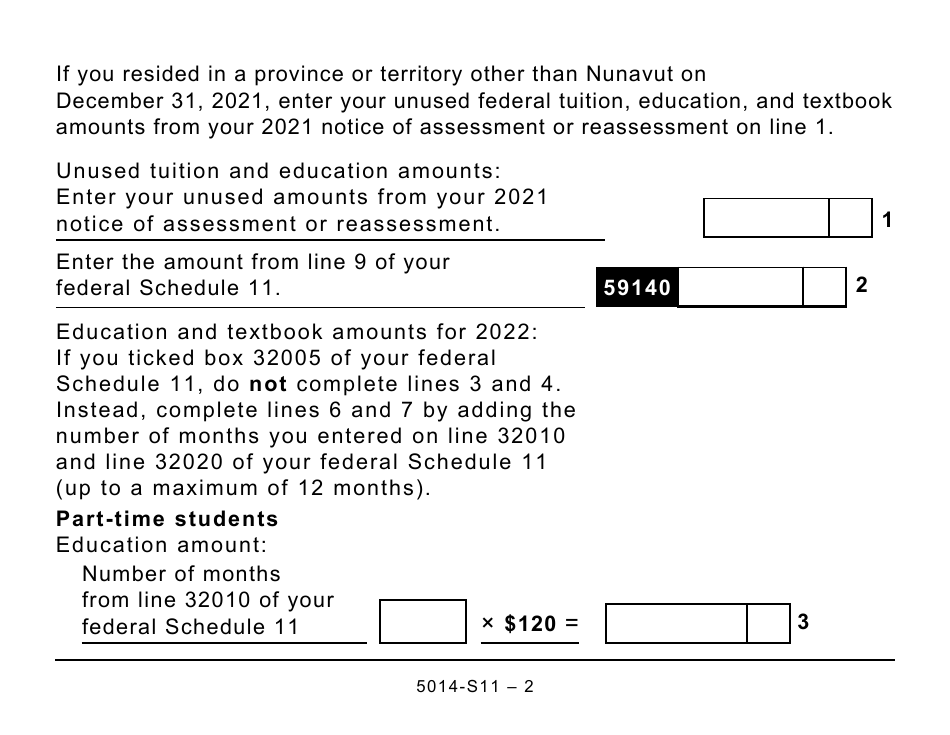

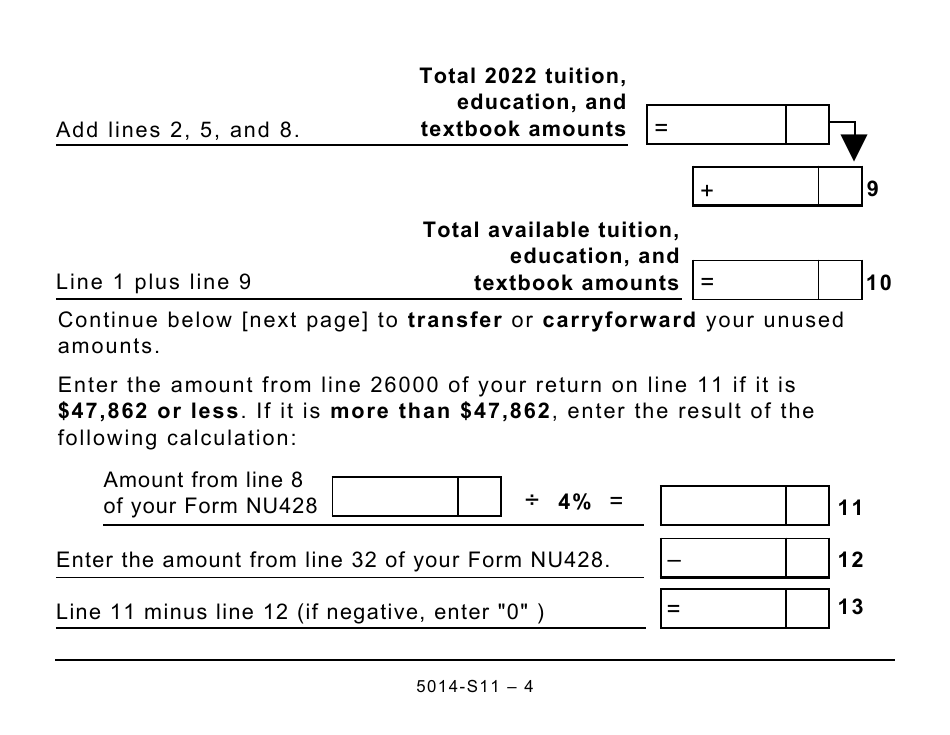

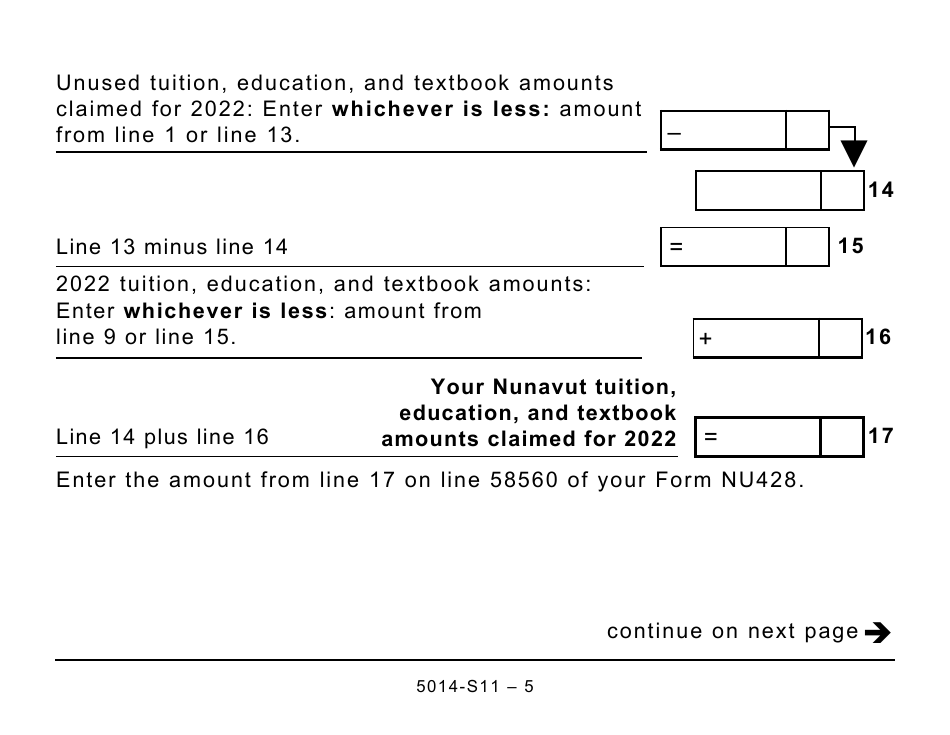

Q: How is the Nunavut Tuition, Education, and Textbook Amounts calculated?

A: The amounts are usually calculated based on expenses paid within the year for tuition, textbooks, and education. The specific calculations are outlined on the form itself and depend on a range of factors such as the level of study, the type of institution, and the nature of the course or program.

Q: Why is Form 5014-S11 Schedule NU(S11) needed?

A: This form is essential for residents of Nunavut who want to claim tax credits for their education-related expenses, such as tuition and textbooks costs. Without this form, these tax credits cannot be claimed on their tax return.

Q: Is the form 5014-S11 Schedule NU(S11) available in large print?

A: Yes, it is available in a large print version to accommodate taxpayers with vision impairments. This document can usually be found on the official Canada Revenue Agency website or any other government tax-related website.

Q: Who can use the Form 5014-S11 Schedule NU(S11)?

A: The form can be used by any resident of Nunavut in Canada who has had qualifying tuition, education, or textbook expenses within the current tax year.

Q: Can U.S. citizens living in Nunavut use Form 5014-S11 Schedule NU(S11)?

A: Yes, but it applies if they have to file a Canadian tax return. The form is related to provincial tax credits in Nunavut, Canada, so any person residing there and paying for education may use these forms.