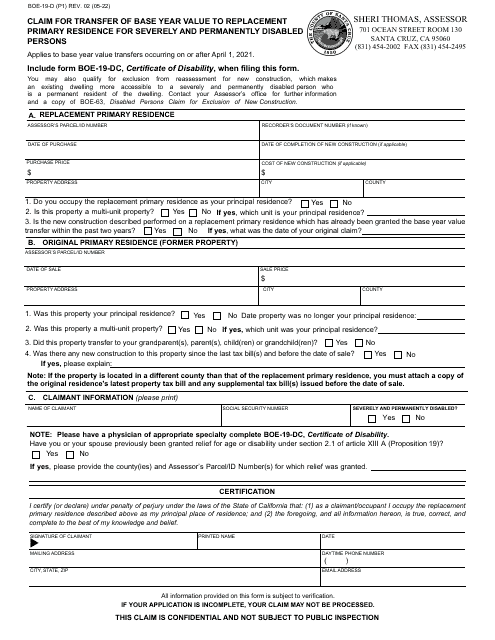

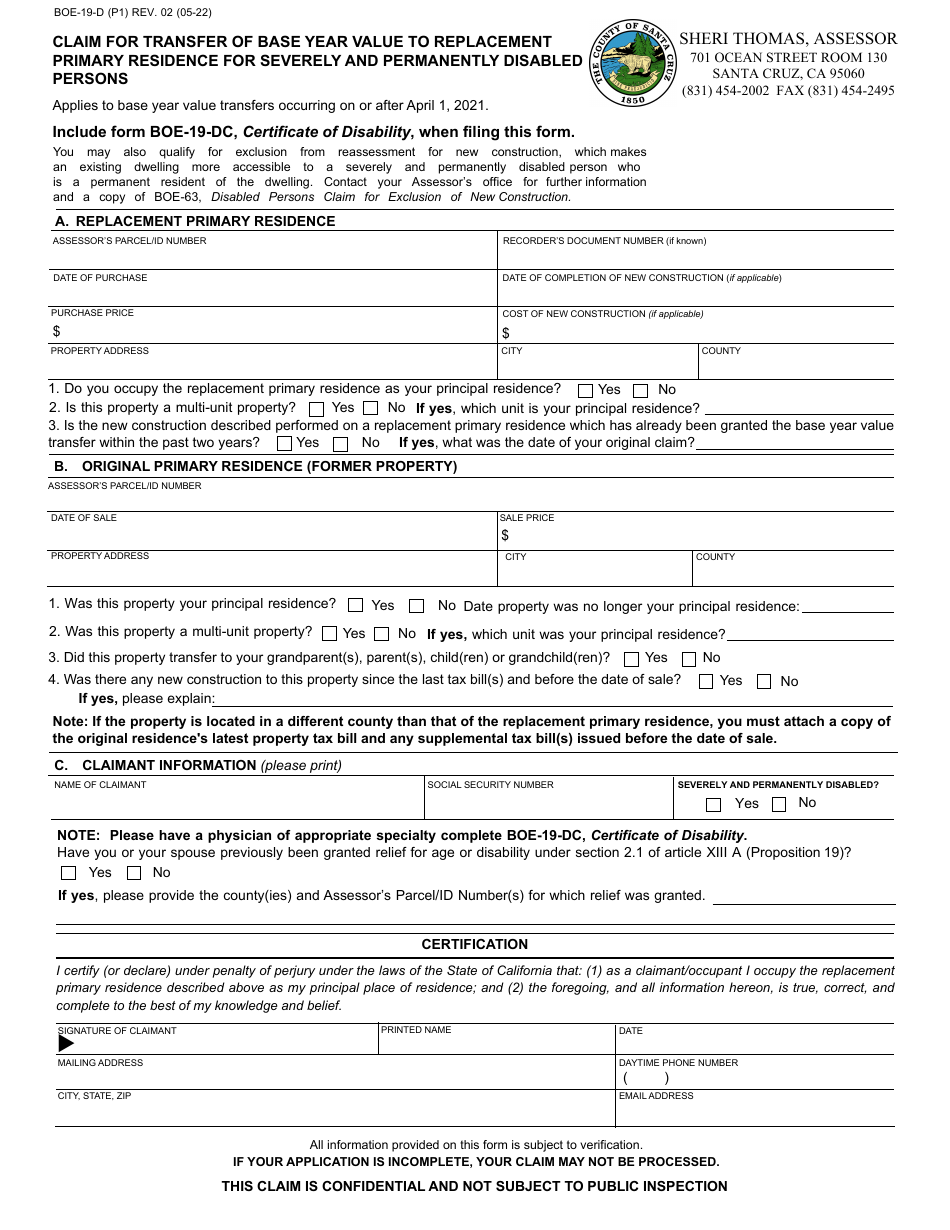

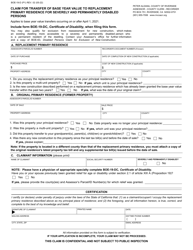

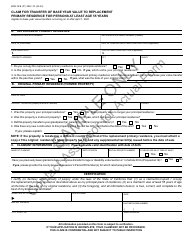

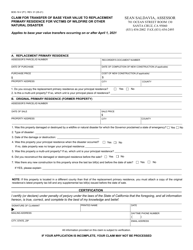

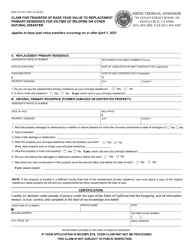

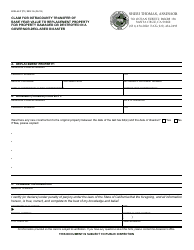

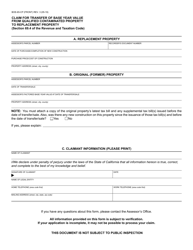

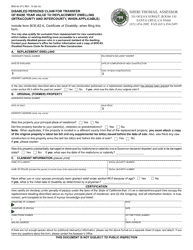

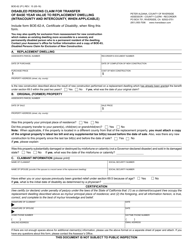

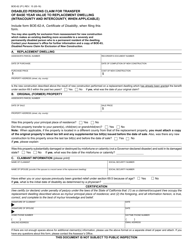

Form BOE-19-D Claim for Transfer of Base Year Value to Replacement Primary Residence for Severely and Permanently Disabled Persons - Santa Cruz County, California

What Is Form BOE-19-D?

This is a legal form that was released by the Assessor's Office - Santa Cruz County, California - a government authority operating within California. The form may be used strictly within Santa Cruz County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-19-D?

A: Form BOE-19-D is a claim for transfer of base year value to replacement primary residence for severely and permanently disabled persons in Santa Cruz County, California.

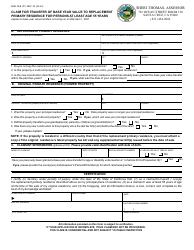

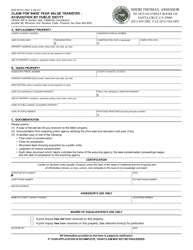

Q: Who is eligible to use Form BOE-19-D?

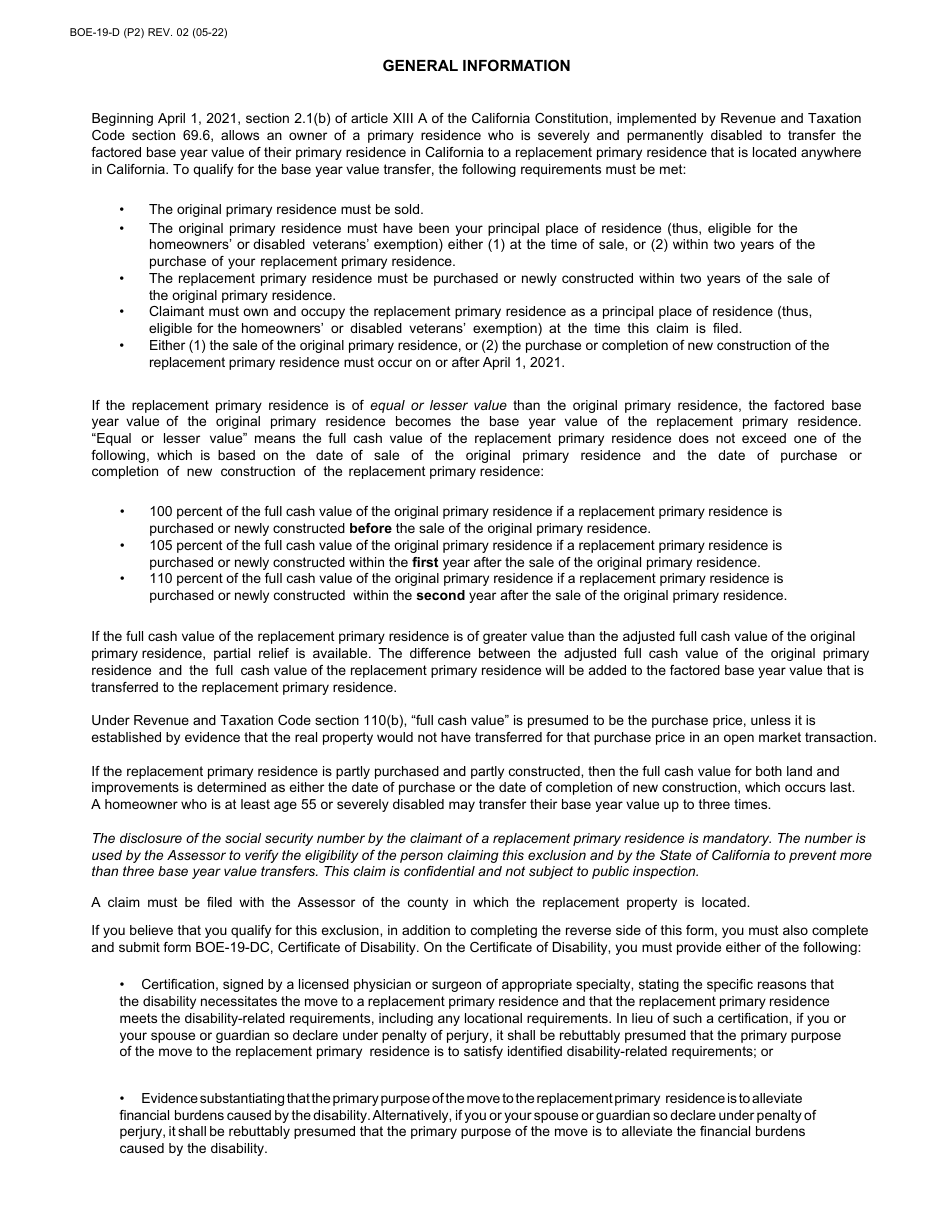

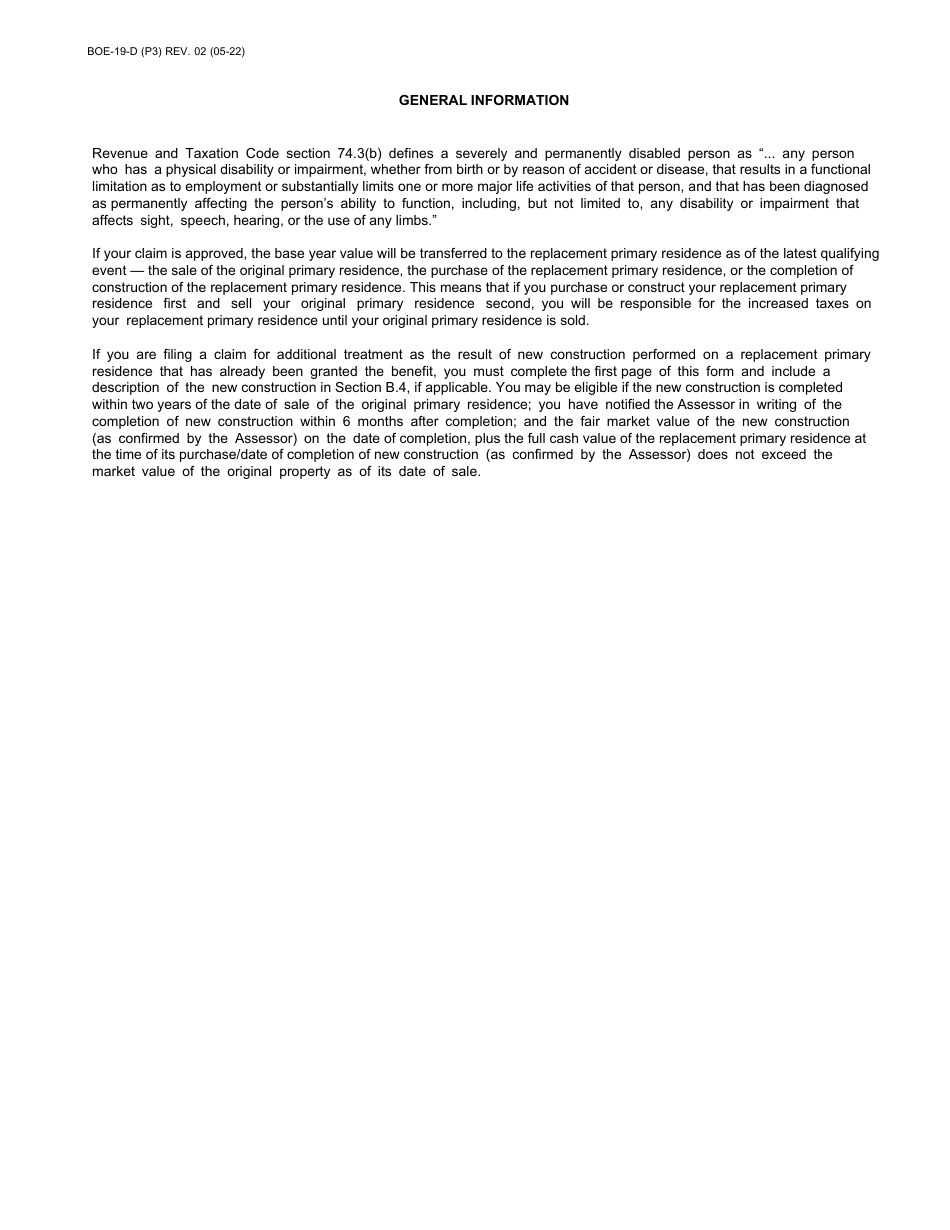

A: Form BOE-19-D is intended for use by severely and permanently disabled persons who are selling their current primary residence and purchasing or constructing a replacement primary residence in Santa Cruz County, California.

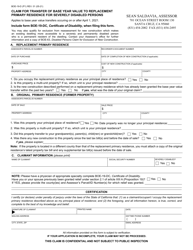

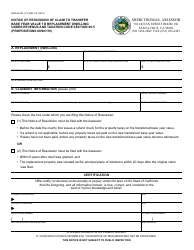

Q: What is the purpose of Form BOE-19-D?

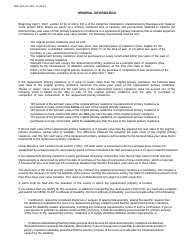

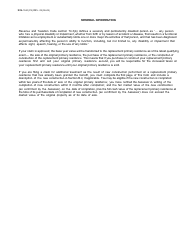

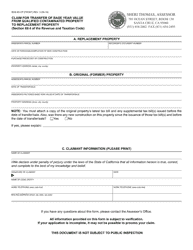

A: The purpose of Form BOE-19-D is to allow eligible disabled persons to transfer the base year value of their current primary residence to a replacement primary residence, thereby potentially maintaining their property tax assessment at a lower level.

Q: What are the requirements to qualify for base year value transfer?

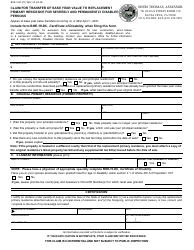

A: To qualify for base year value transfer, an individual must meet the eligibility requirements set forth by the California State Board of Equalization, including being severely and permanently disabled, selling their current primary residence, and purchasing or constructing a replacement primary residence within specified timeframes.

Q: Are there any deadlines for filing Form BOE-19-D?

A: Yes, there are specific deadlines for filing Form BOE-19-D. Generally, the claim must be filed within three years of the date of sale or within two years of the completion of new construction. It is advisable to consult the Santa Cruz County Assessor's Office or the instructions accompanying the form for specific deadlines and requirements.

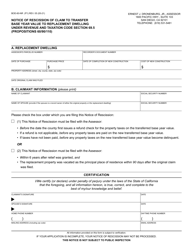

Q: Are there any fees associated with filing Form BOE-19-D?

A: No, there are no fees associated with filing Form BOE-19-D. However, there may be other costs or taxes associated with the sale or purchase of property, so it is recommended to consult with a tax professional or real estate attorney for guidance.

Q: What supporting documentation is required with Form BOE-19-D?

A: Form BOE-19-D requires the submission of certain supporting documentation, which may include proof of disability, documentation of the sale of the current primary residence, and evidence of the purchase or construction of the replacement primary residence. It is important to review the instructions accompanying the form for a complete list of required documentation.

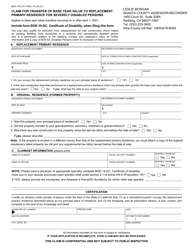

Q: How long does it take to process a Form BOE-19-D claim?

A: The processing time for a Form BOE-19-D claim can vary, but it generally takes several weeks to several months. It is recommended to submit the claim as early as possible to allow for sufficient processing time.

Q: What should I do if I have questions or need assistance with Form BOE-19-D?

A: If you have questions or need assistance with Form BOE-19-D, you should contact the Santa Cruz County Assessor's Office. Their staff will be able to provide guidance and answer any specific questions you may have.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Assessor's Office - Santa Cruz County, California;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-19-D by clicking the link below or browse more documents and templates provided by the Assessor's Office - Santa Cruz County, California.