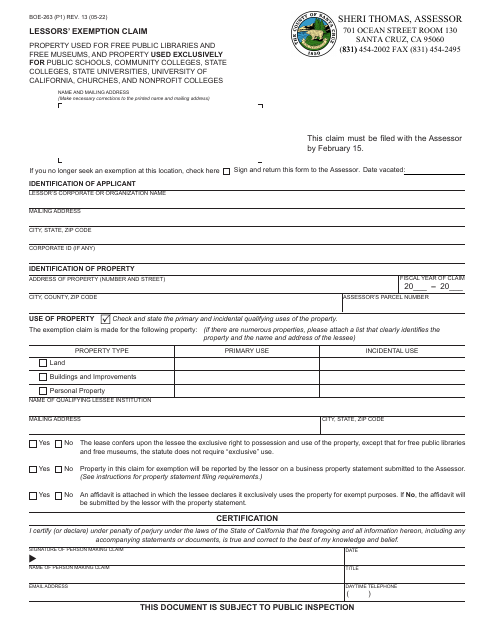

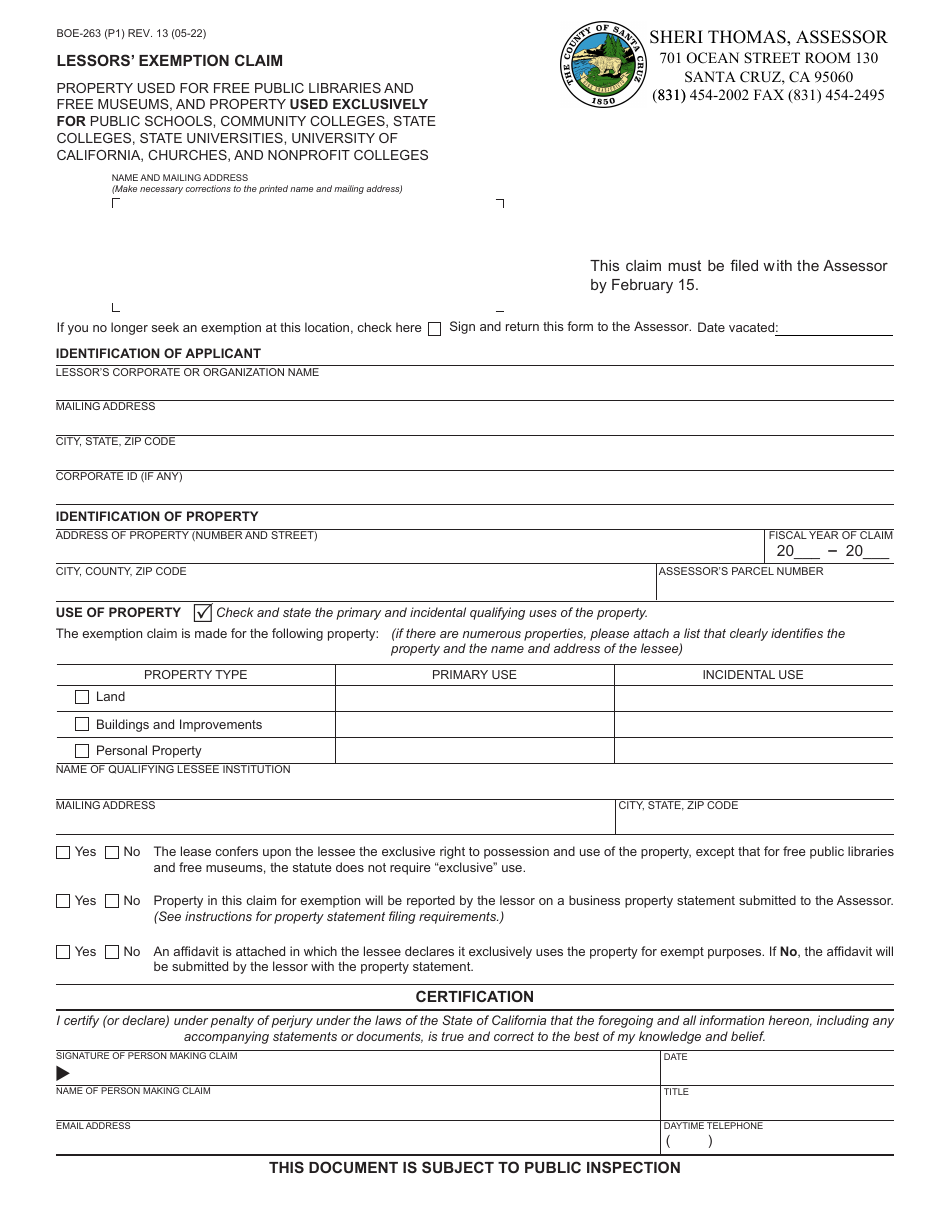

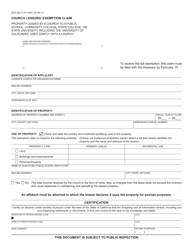

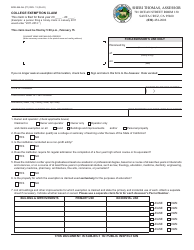

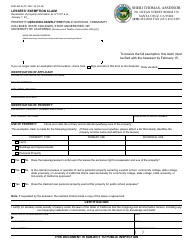

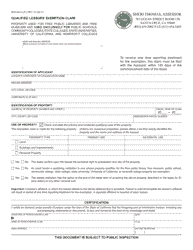

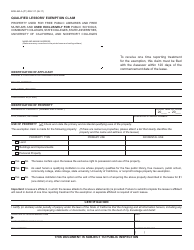

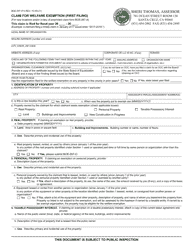

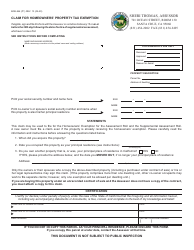

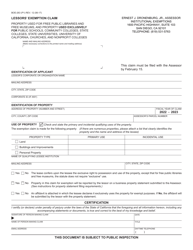

Form BOE-263 Lessors' Exemption Claim - Santa Cruz County, California

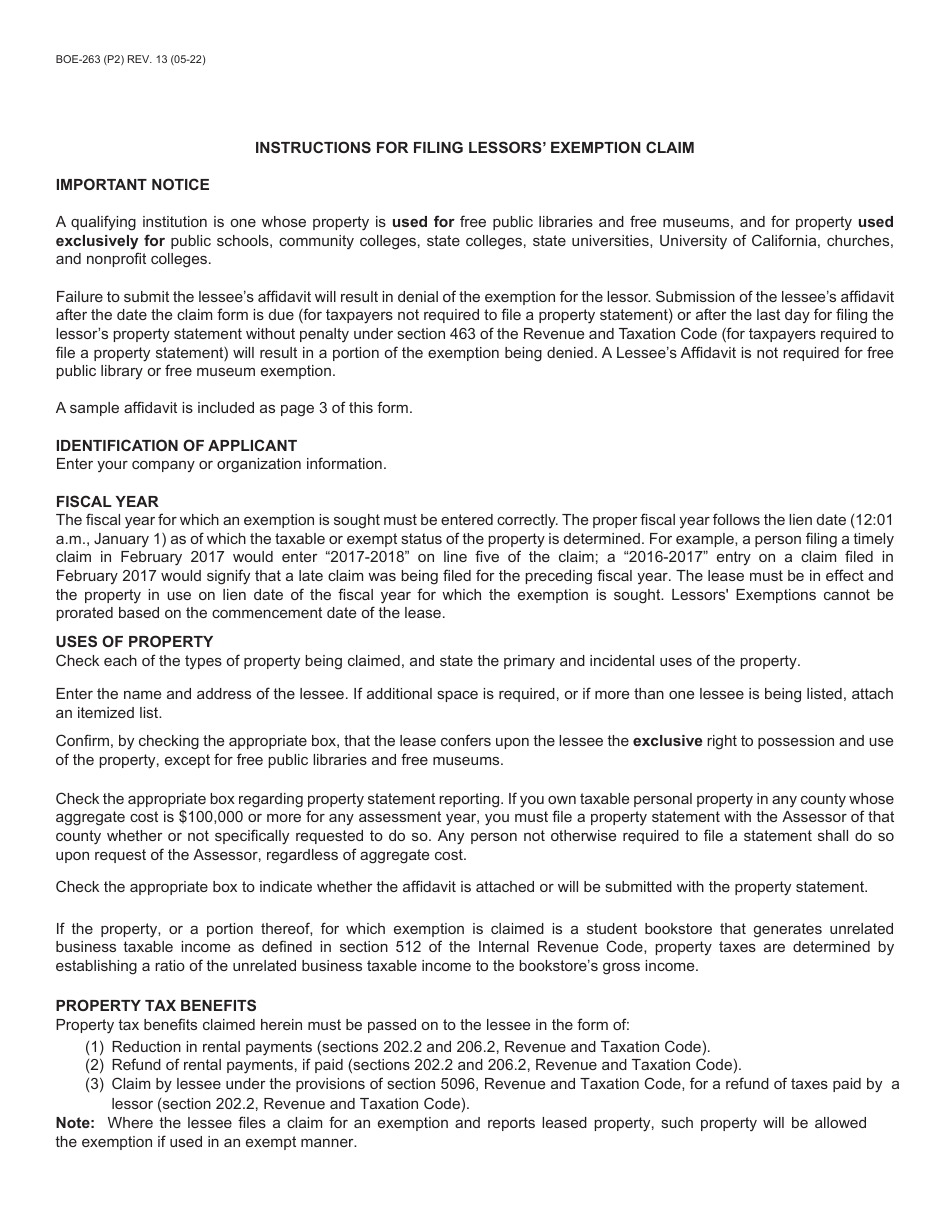

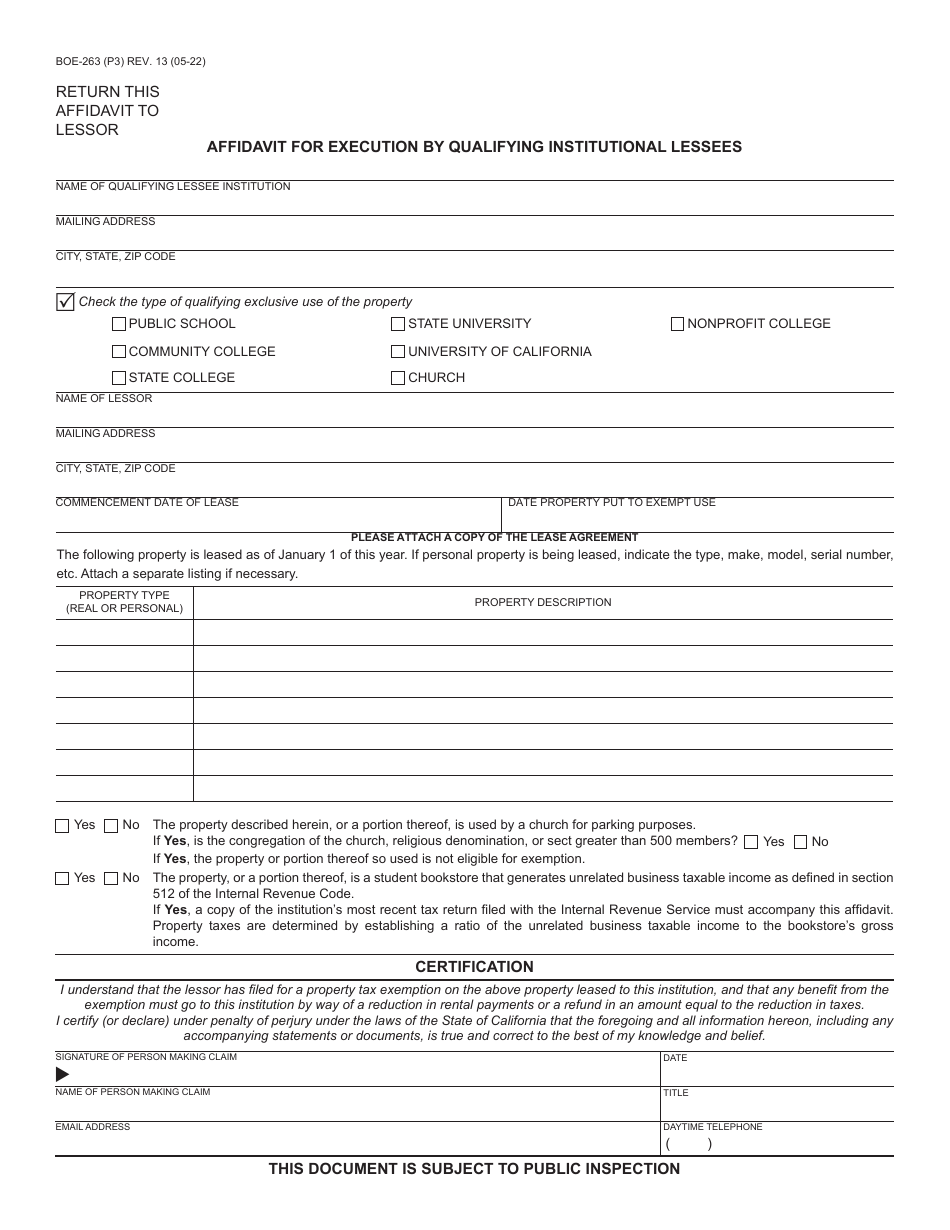

Form BOE-263, otherwise known as the Lessors' Exemption Claim, is a document used in Santa Cruz County, California by property owners who rent their land or buildings to a non-profit organization. This form allows the lessor or property owner to apply for a property tax exemption as long as the lessee or renter uses the property exclusively for charitable, religious, hospital, scientific, or philanthropic purposes. This means that if a non-profit organization is renting the property and uses it entirely for its exempt purposes, the property owner may not have to pay property taxes on it.

The Form BOE-263, also known as the Lessors' Exemption Claim, is filed by lessors in Santa Cruz County, California. This form is typically used by lessors or landlords who lease their property to nonprofit organizations or entities that are used specifically for religious, hospital, scientific, or charitable purposes, and are thus exempt from certain property taxes under California law. The lessor or landlord files this form to claim a property tax exemption based on the usage of the property.

FAQ

Q: What is Form BOE-263?

A: Form BOE-263 is called the Lessors' Exemption Claim, which relates to Santa Cruz County in California, United States. It's a form property owners can fill out to claim an exemption on property taxes if they lease the property to a non-profit, religious, or educational organization that is exempt from paying taxes.

Q: Who can file the Form BOE-263?

A: Form BOE-263 in Santa Cruz County, California can be filed by property owners who lease their property to institutions such as non-profit organizations, religious institutions, or educational establishments that are exempt from taxes under the law in the United States.

Q: When should I file Form BOE-263?

A: You should file the Form BOE-263 for the Lessors' Exemption Claim in Santa Cruz County, California on or before February 15. Please review local county instructions or consult with a professional to make sure you remain in compliance with local regulations.

Q: How do I fill out the BOE-263 form?

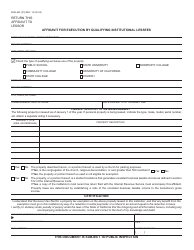

A: On the BOE-263 form, include details such as the name and address of the lessor (property owner), the lessee's information, description of the property, the rental agreement details, and the exempt activities carried on. Sign and date the form before submitting it to the appropriate authority within Santa Cruz County, California.

Q: What if I don't file Form BOE-263?

A: If you do not file Form BOE-263 as a property owner leasing to an exempt organization in Santa Cruz County, California, you may lose out on the tax exemption, and any due property taxes will be your responsibility to pay as per the regulations of your local tax authority. It's advisable to stay diligent in filing your tax documents in order to avoid penalties or excess charges.