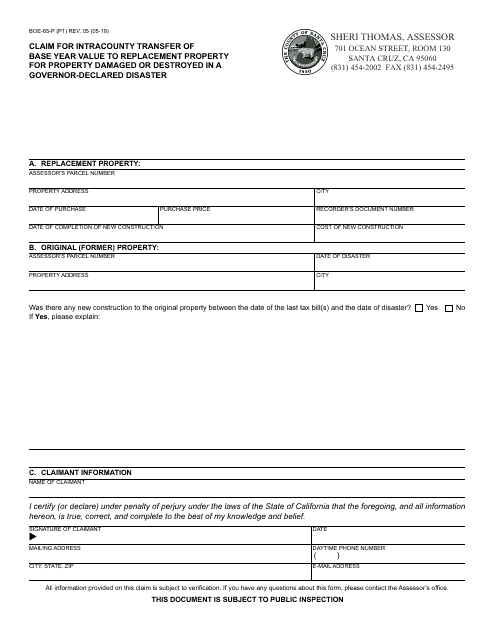

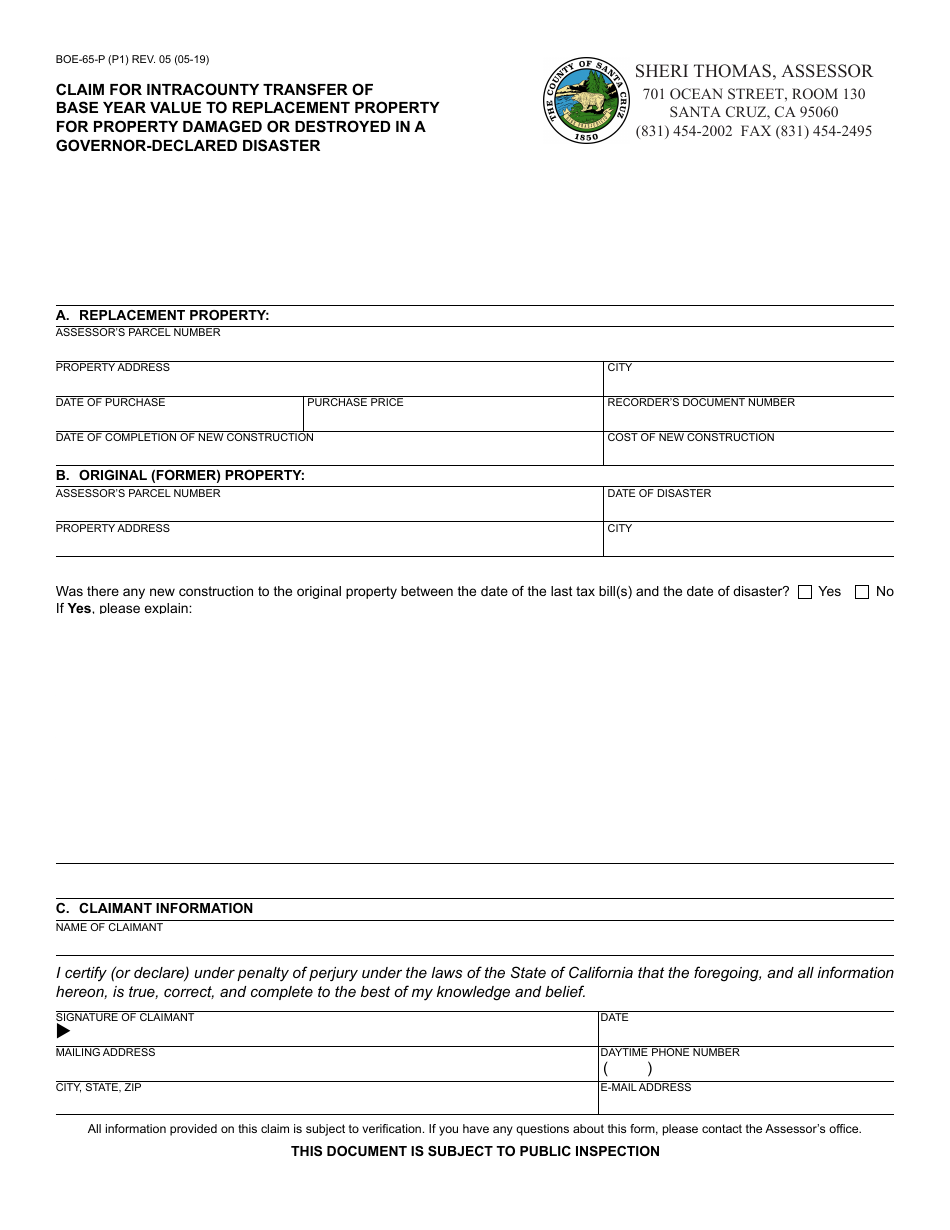

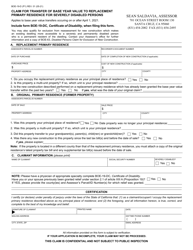

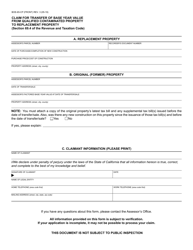

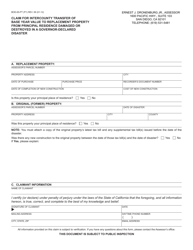

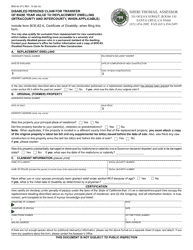

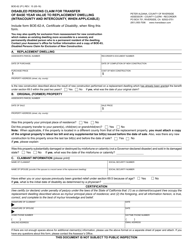

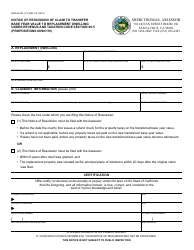

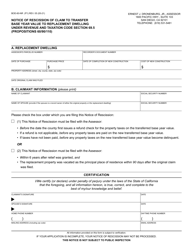

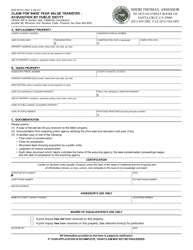

Form BOE-65-P Claim for Intracounty Transfer of Base Year Value to Replacement Property for Property Damaged or Destroyed in a Governor-Declared Disaster - Santa Cruz County, California

What Is Form BOE-65-P?

This is a legal form that was released by the Assessor's Office - Santa Cruz County, California - a government authority operating within California. The form may be used strictly within Santa Cruz County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-65-P?

A: BOE-65-P is a form used for claiming intracounty transfer of base year value to replacement property when property is damaged or destroyed in a governor-declared disaster in Santa Cruz County, California.

Q: What is base year value?

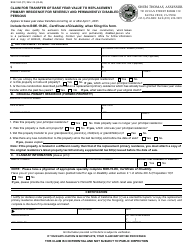

A: Base year value is the assessed value of a property as determined by the assessor in the year of acquisition or completion of new construction.

Q: What is replacement property?

A: Replacement property refers to a property that is acquired or newly constructed as a substitute for a damaged or destroyed property.

Q: What is an intracounty transfer?

A: Intracounty transfer refers to transferring the base year value of a damaged or destroyed property to a replacement property within the same county.

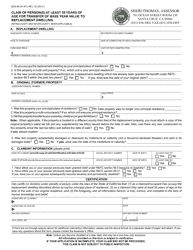

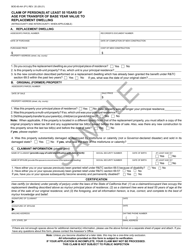

Q: Who can use BOE-65-P?

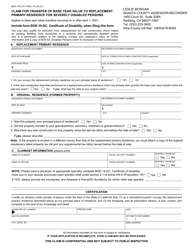

A: Property owners in Santa Cruz County, California, whose property has been damaged or destroyed in a governor-declared disaster can use this form.

Q: What is the purpose of BOE-65-P?

A: The purpose of BOE-65-P is to allow property owners to transfer the base year value of their damaged or destroyed property to a replacement property, which can result in property tax savings.

Q: Is there a deadline for submitting BOE-65-P?

A: Yes, there is a deadline for submitting BOE-65-P. Generally, it must be filed within 12 months of the disaster declaration or within the period specified by the assessor.

Q: Are there any eligibility criteria for filing BOE-65-P?

A: Yes, there are eligibility criteria for filing BOE-65-P. The property must be located in Santa Cruz County, California, and must have been damaged or destroyed in a governor-declared disaster.

Q: What are the benefits of filing BOE-65-P?

A: Filing BOE-65-P can result in your base year value being transferred to a replacement property, which can lead to property tax savings.

Q: What documents are required to be submitted with BOE-65-P?

A: The specific documents required may vary, but generally, you will need to provide evidence of the damage or destruction, such as photos or insurance claims, and documentation related to the replacement property.

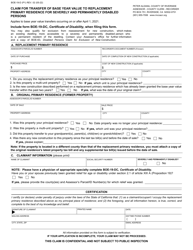

Q: Can I file BOE-65-P for a property outside Santa Cruz County?

A: No, BOE-65-P is specifically for properties in Santa Cruz County, California. You should consult the appropriate resources for the county where your property is located.

Q: Is there a fee for filing BOE-65-P?

A: No, there is no fee for filing BOE-65-P.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Assessor's Office - Santa Cruz County, California;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-65-P by clicking the link below or browse more documents and templates provided by the Assessor's Office - Santa Cruz County, California.