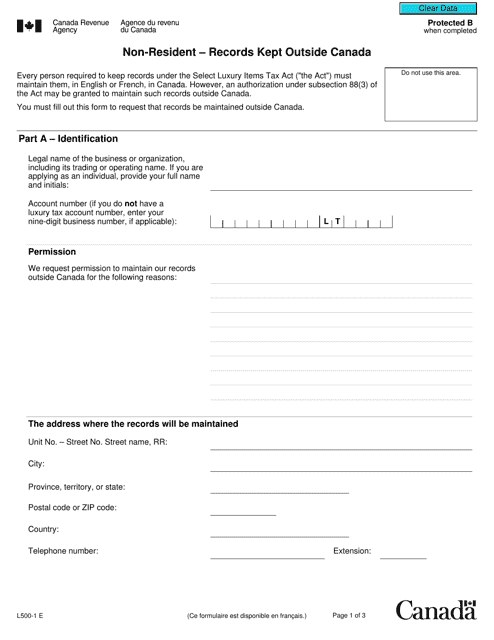

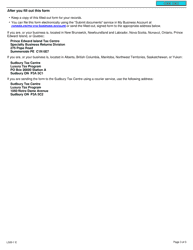

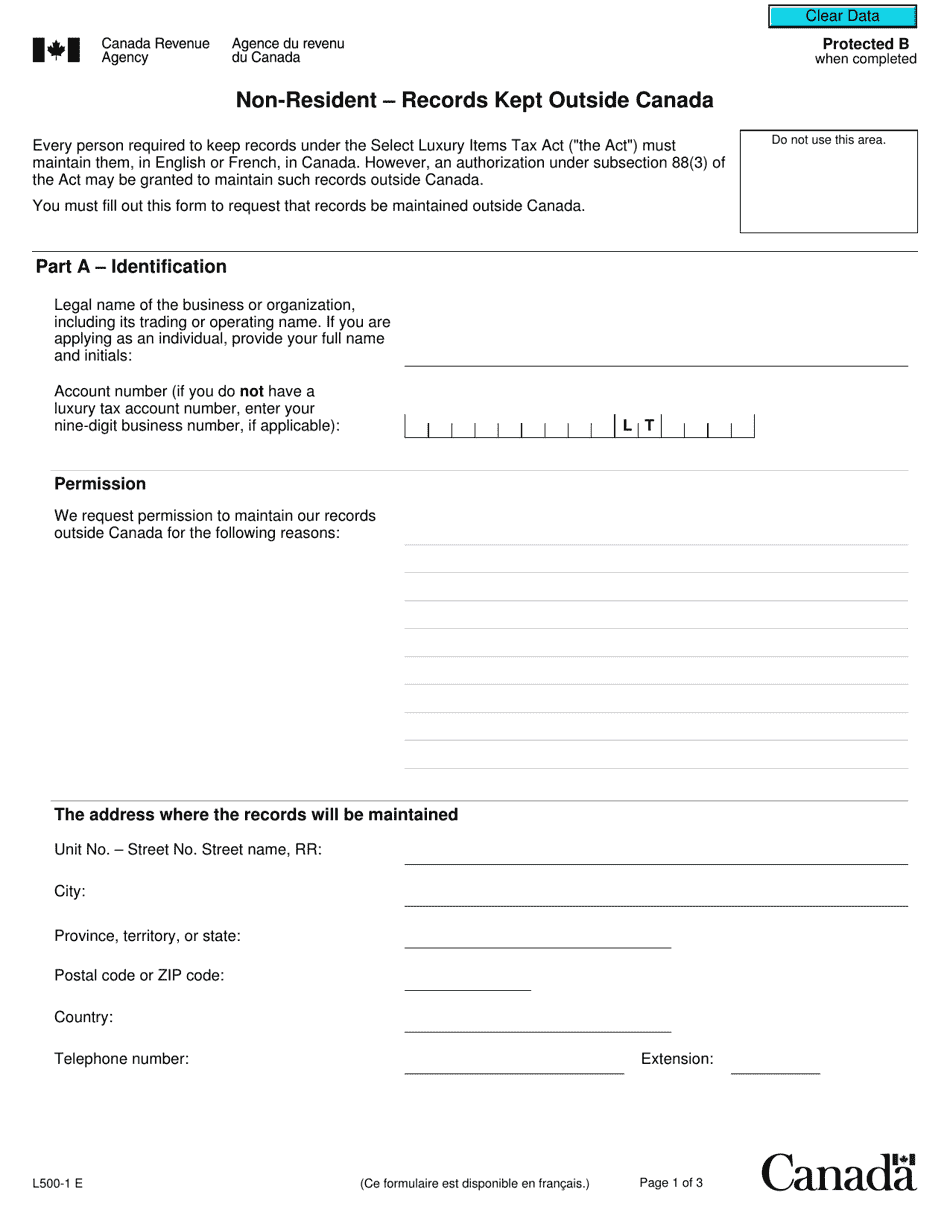

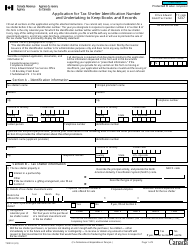

Form L500-1 Non-resident - Records Kept Outside Canada - Canada

Form L500-1 Non-resident - Records Kept Outside Canada is used by non-resident individuals for reporting their income earned in Canada and for keeping records of their financial transactions related to Canadian sources outside of Canada.

FAQ

Q: What is Form L500-1?

A: Form L500-1 is a declaration form for non-resident individuals or corporations who keep their records outside of Canada.

Q: Who needs to file Form L500-1?

A: Non-resident individuals or corporations who keep their records outside of Canada.

Q: What is the purpose of filing Form L500-1?

A: The purpose of filing Form L500-1 is to notify the Canada Revenue Agency (CRA) that the taxpayer's records are kept outside of Canada.

Q: Are there any penalties for not filing Form L500-1?

A: Yes, there are penalties for not filing Form L500-1, which can include fines and potential legal consequences.

Q: What information is required to be included in Form L500-1?

A: Form L500-1 requires information such as the taxpayer's name, address, contact information, and details about where the records are kept.

Q: When is the deadline for filing Form L500-1?

A: The deadline for filing Form L500-1 is typically the same as the deadline for filing the taxpayer's annual tax return.

Q: Do I need to file Form L500-1 every year?

A: No, Form L500-1 only needs to be filed once, unless there are changes to the taxpayer's record-keeping location.

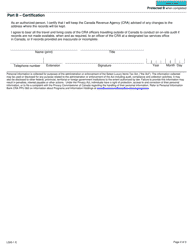

Q: Can I file Form L500-1 on behalf of a corporation?

A: Yes, Form L500-1 can be filed on behalf of a corporation by an authorized representative.