This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2151

for the current year.

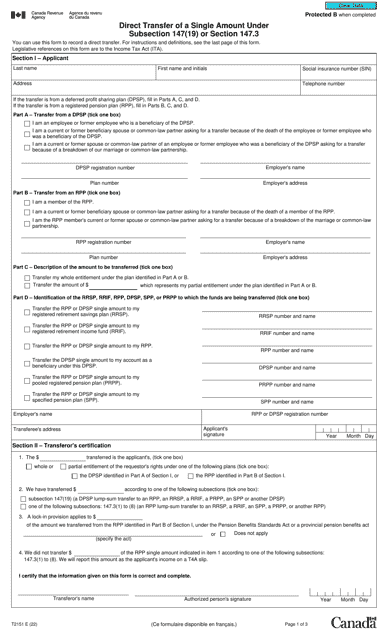

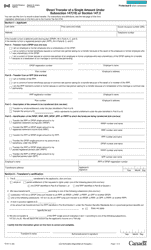

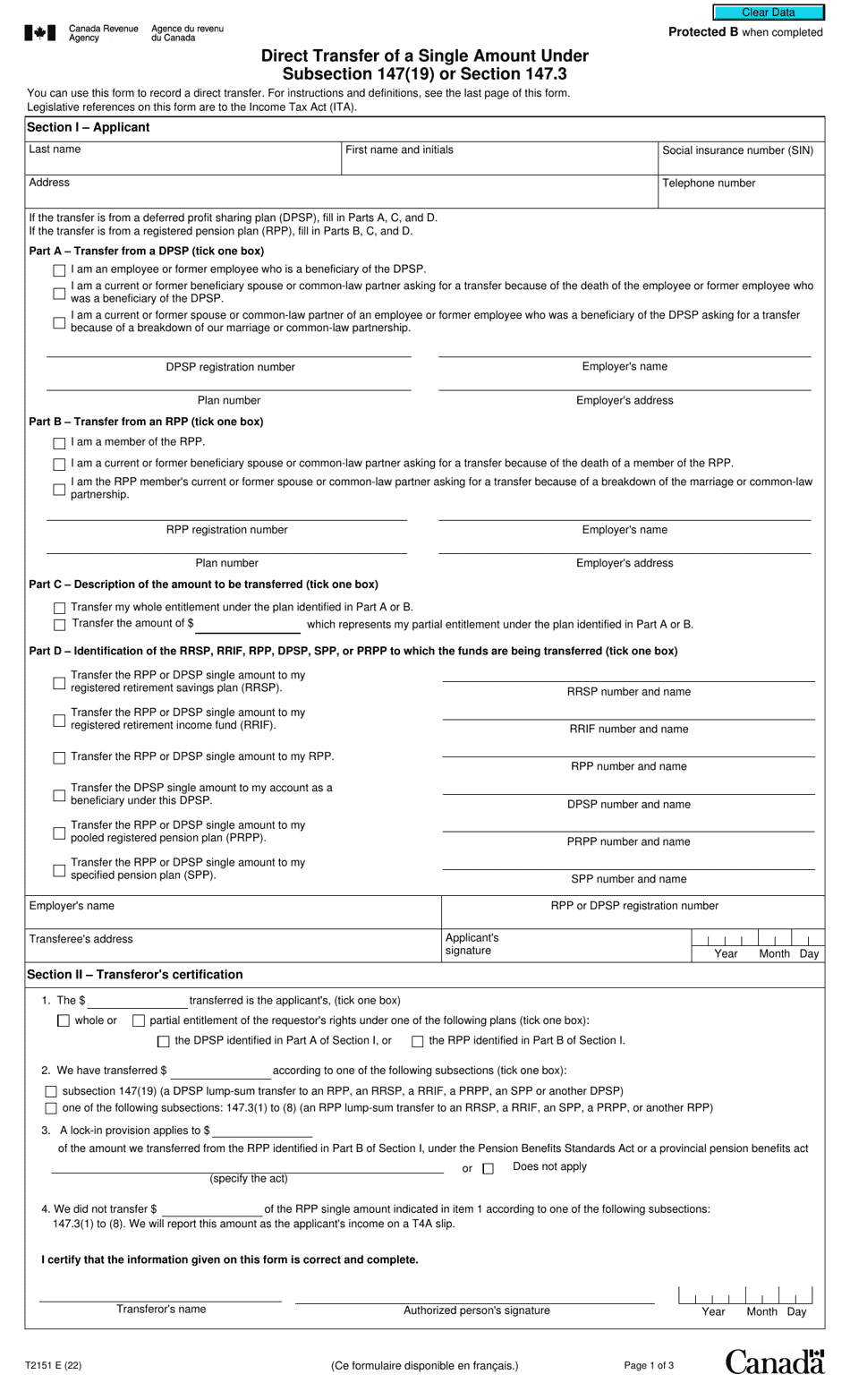

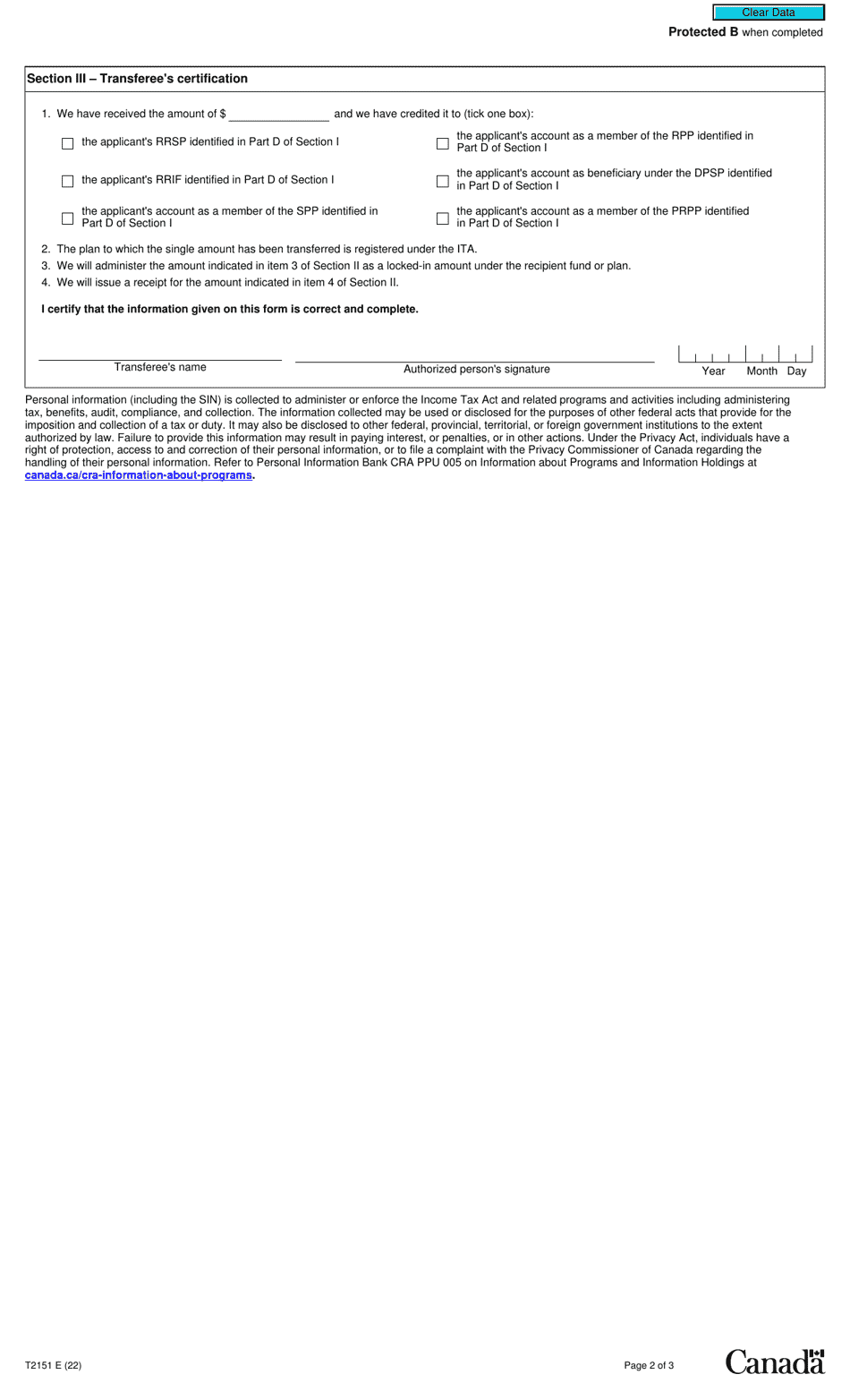

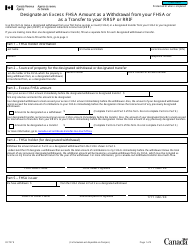

Form T2151 Direct Transfer of a Single Amount Under Subsection 147(19) or Section 147.3 - Canada

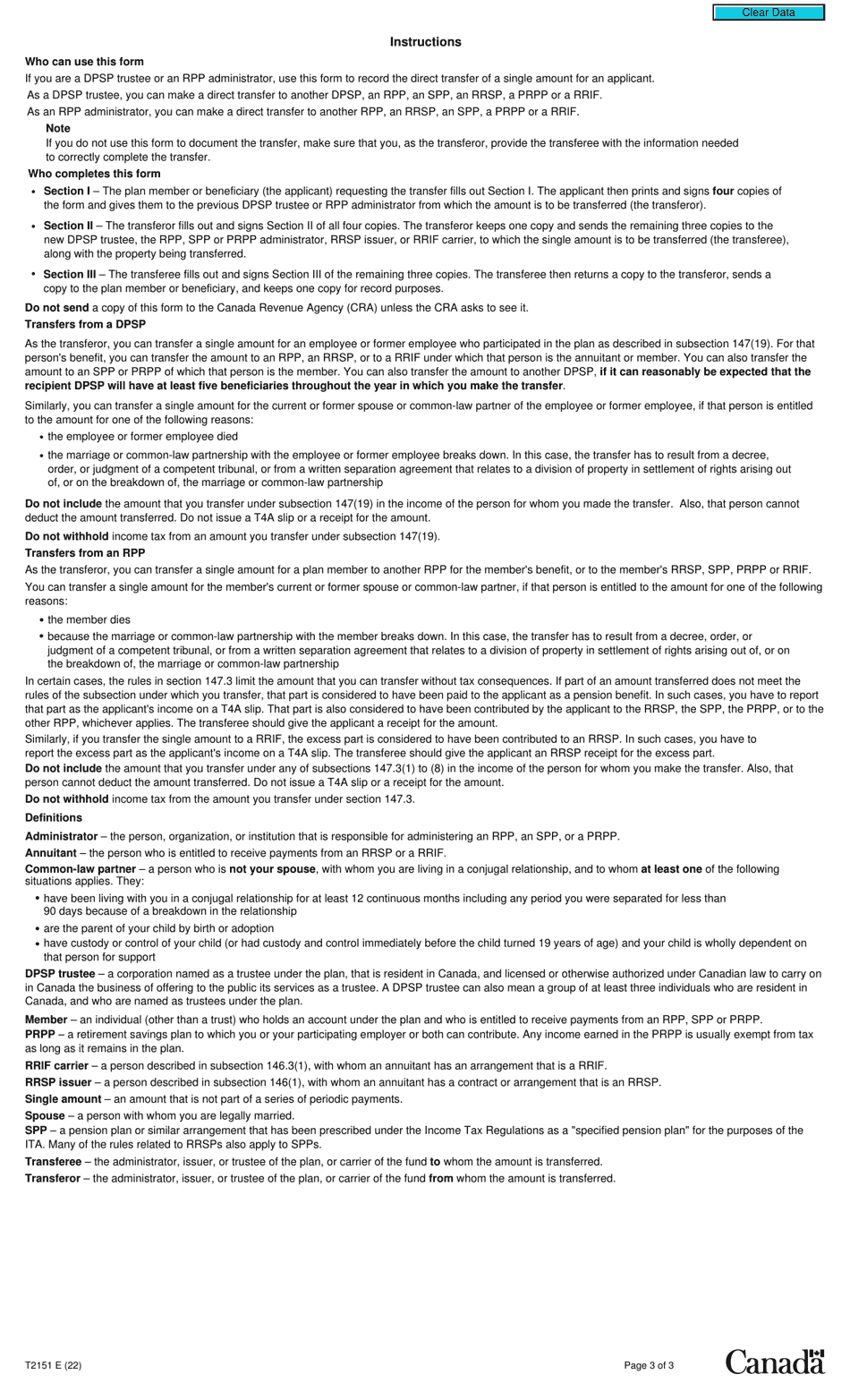

Form T2151, also known as the Direct Transfer of a Single Amount Under Subsection 147(19) or Section 147.3, is used in Canada for transferring funds from one registered retirement savings plan (RRSP) to another RRSP or to a qualifying retirement income fund (QRIF). This form helps facilitate the direct transfer of funds without incurring tax penalties.

The individual or their authorized representative would typically file the Form T2151 for direct transfer of a single amount under Subsection 147(19) or Section 147.3 in Canada.

FAQ

Q: What is Form T2151?

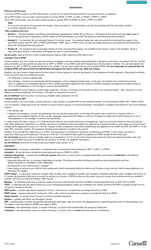

A: Form T2151 is a form used in Canada for the direct transfer of a single amount under subsection 147(19) or section 147.3 of the Canadian Income Tax Act.

Q: What is a direct transfer of a single amount?

A: A direct transfer of a single amount refers to moving funds directly from one registered retirement savings plan (RRSP) or registered retirement income fund (RRIF) to another, without withdrawing or receiving the funds.

Q: What is subsection 147(19) of the Canadian Income Tax Act?

A: Subsection 147(19) of the Canadian Income Tax Act allows for the tax-free transfer of funds from one RRSP or RRIF to another, as long as certain conditions are met.

Q: What is section 147.3 of the Canadian Income Tax Act?

A: Section 147.3 of the Canadian Income Tax Act allows for the tax-free transfer of funds from one registered pension plan (RPP) to another, as long as certain conditions are met.

Q: Why would someone use Form T2151?

A: Someone would use Form T2151 to initiate a direct transfer of a single amount between eligible registered plans without triggering a taxable event.

Q: What information is required on Form T2151?

A: Form T2151 requires information about the transferring and receiving plans, the amount to be transferred, and the taxpayer's personal information.

Q: Are there any fees associated with using Form T2151?

A: There are no specific fees associated with using Form T2151; however, some financial institutions may charge administrative or transfer fees for the direct transfer of a single amount.

Q: Can I use Form T2151 for transfers outside of Canada?

A: Form T2151 is specifically for transfers within Canada, and different rules may apply for transfers to or from foreign countries.

Q: Is Form T2151 the only form needed for a direct transfer of a single amount?

A: In some cases, additional forms or documentation may be required by the transferring and receiving plans. It's best to consult with the financial institution or plan administrator for specific requirements.