This version of the form is not currently in use and is provided for reference only. Download this version of

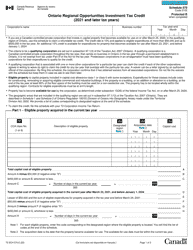

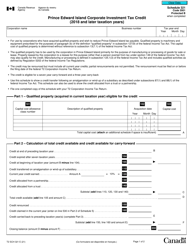

Form T1297

for the current year.

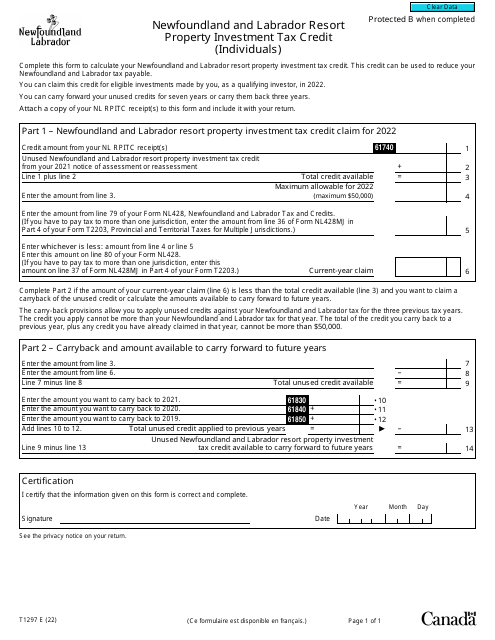

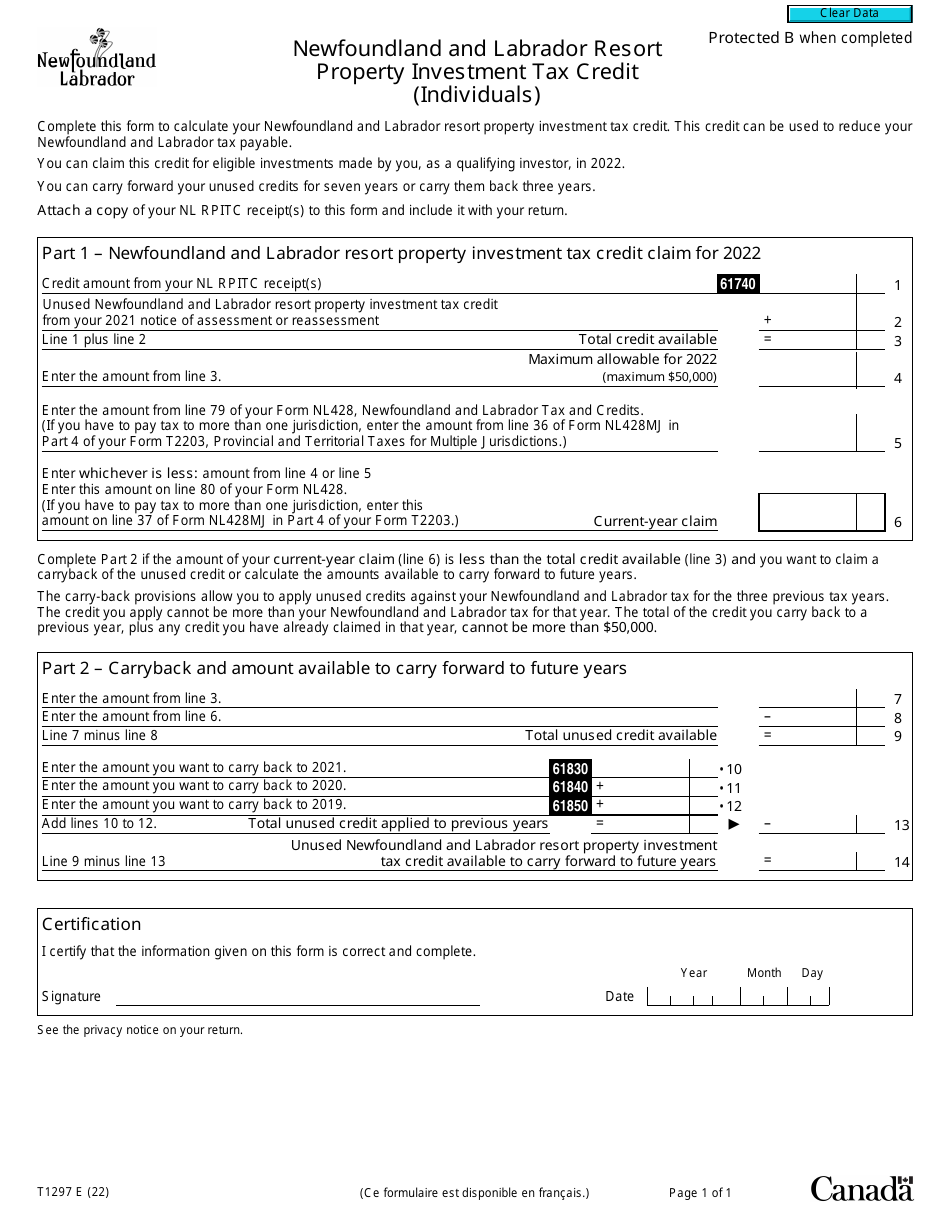

Form T1297 Newfoundland and Labrador Resort Property Investment Tax Credit (Individuals) - Canada

Form T1297 Newfoundland and Labrador Resort PropertyInvestment Tax Credit (Individuals) is used in Canada for claiming a tax credit for individuals who have invested in resort property in Newfoundland and Labrador.

The Form T1297 Newfoundland and Labrador Resort Property Investment Tax Credit (Individuals) is usually filed by individual taxpayers in Canada who are claiming the tax credit for investments in Newfoundland and Labrador resort properties.

FAQ

Q: What is Form T1297?

A: Form T1297 is a specific form used in Canada for claiming the Newfoundland and Labrador Resort Property Investment Tax Credit (Individuals).

Q: What is the Newfoundland and Labrador Resort Property Investment Tax Credit?

A: The Newfoundland and Labrador Resort Property Investment Tax Credit is a tax credit available to individuals who invest in qualified resort properties in Newfoundland and Labrador, Canada.

Q: Who is eligible to claim the tax credit?

A: Individuals who have invested in qualified resort properties in Newfoundland and Labrador may be eligible to claim the tax credit.

Q: What is the purpose of the tax credit?

A: The purpose of the tax credit is to encourage investment in resort properties in Newfoundland and Labrador, which can contribute to the economic development of the region.

Q: How do I claim the tax credit?

A: To claim the tax credit, you must complete Form T1297 and include it with your income tax return. The form requires information about your investment in the qualified resort property.

Q: What expenses qualify for the tax credit?

A: Expenses related to the purchase, construction, or improvement of a qualified resort property may qualify for the tax credit. However, specific eligibility criteria apply.

Q: Is there a maximum amount I can claim for the tax credit?

A: Yes, there is a maximum amount that can be claimed for the tax credit. The specific amount and limitations are outlined in the tax credit legislation.

Q: Do I need to provide supporting documentation for my claim?

A: Yes, you may be required to provide supporting documentation for your claim, such as receipts or proof of investment in the resort property.

Q: When is the deadline to claim the tax credit?

A: The deadline to claim the tax credit is usually the same as the deadline to file your income tax return, which is April 30th of the following year.