This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5001-S2 Schedule NL(S2)

for the current year.

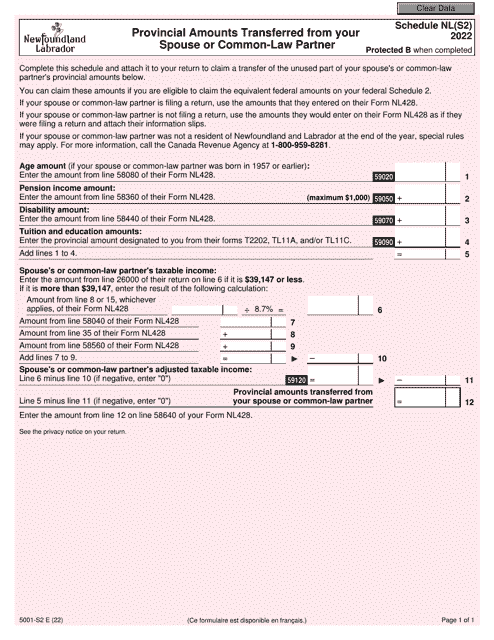

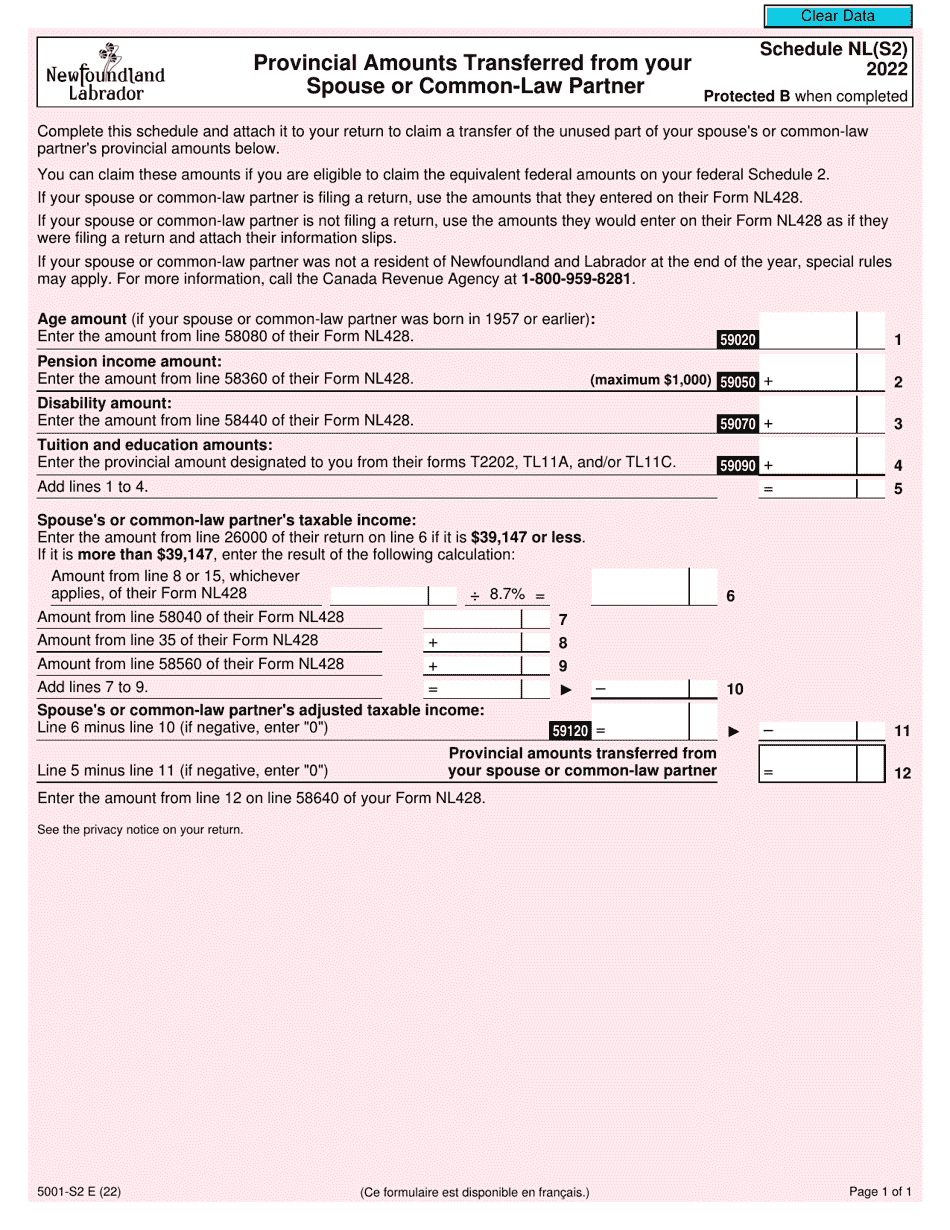

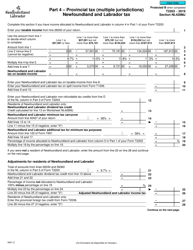

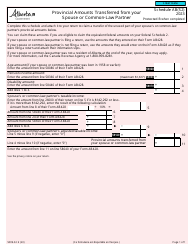

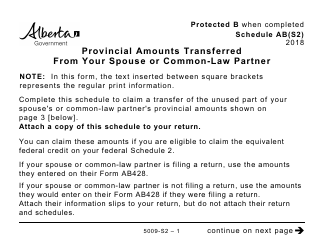

Form 5001-S2 Schedule NL(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner - Canada

Form 5001-S2 Schedule NL(S2) is used in Canada to report the provincial amounts transferred from your spouse or common-law partner for the purpose of calculating your provincial tax credits and deductions. It helps to determine the amount of tax you owe or the refund you are eligible to receive.

The form 5001-S2 Schedule NL(S2) is filed by individuals in the province of Newfoundland and Labrador, Canada, who are transferring provincial amounts from their spouse or common-law partner on their tax return.

FAQ

Q: What is Form 5001-S2?

A: Form 5001-S2 is a tax form used in Canada.

Q: What is Schedule NL(S2)?

A: Schedule NL(S2) is a part of Form 5001-S2 that is used to report provincial amounts transferred from your spouse or common-law partner.

Q: What are provincial amounts?

A: Provincial amounts refer to tax credits or deductions that are specific to a particular province in Canada.

Q: When do I need to use Schedule NL(S2)?

A: You need to use Schedule NL(S2) if you and your spouse or common-law partner have decided to transfer provincial amounts between each other.

Q: Why would I transfer provincial amounts?

A: Transferring provincial amounts can help lower your overall tax liability and maximize your tax savings.

Q: Do I need to fill out Schedule NL(S2) if I'm not transferring any provincial amounts?

A: No, if you're not transferring any provincial amounts, you don't need to fill out Schedule NL(S2).

Q: Are there any eligibility requirements for transferring provincial amounts?

A: Yes, there are eligibility requirements for transferring provincial amounts. You must meet certain criteria set by the CRA.

Q: What should I do if I have questions about filling out Schedule NL(S2)?

A: If you have questions about filling out Schedule NL(S2), you can consult the CRA's official guidance or seek assistance from a tax professional.

Q: Is Schedule NL(S2) the only schedule in Form 5001-S2?

A: No, there are other schedules in Form 5001-S2 that serve different purposes. Schedule NL(S2) specifically deals with provincial amounts transferred from your spouse or common-law partner.