This version of the form is not currently in use and is provided for reference only. Download this version of

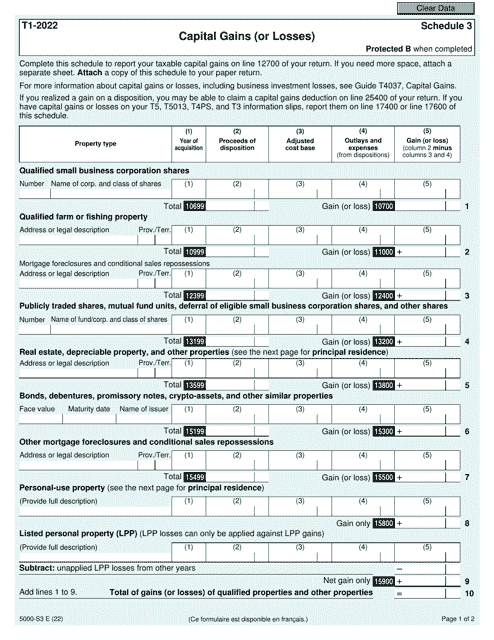

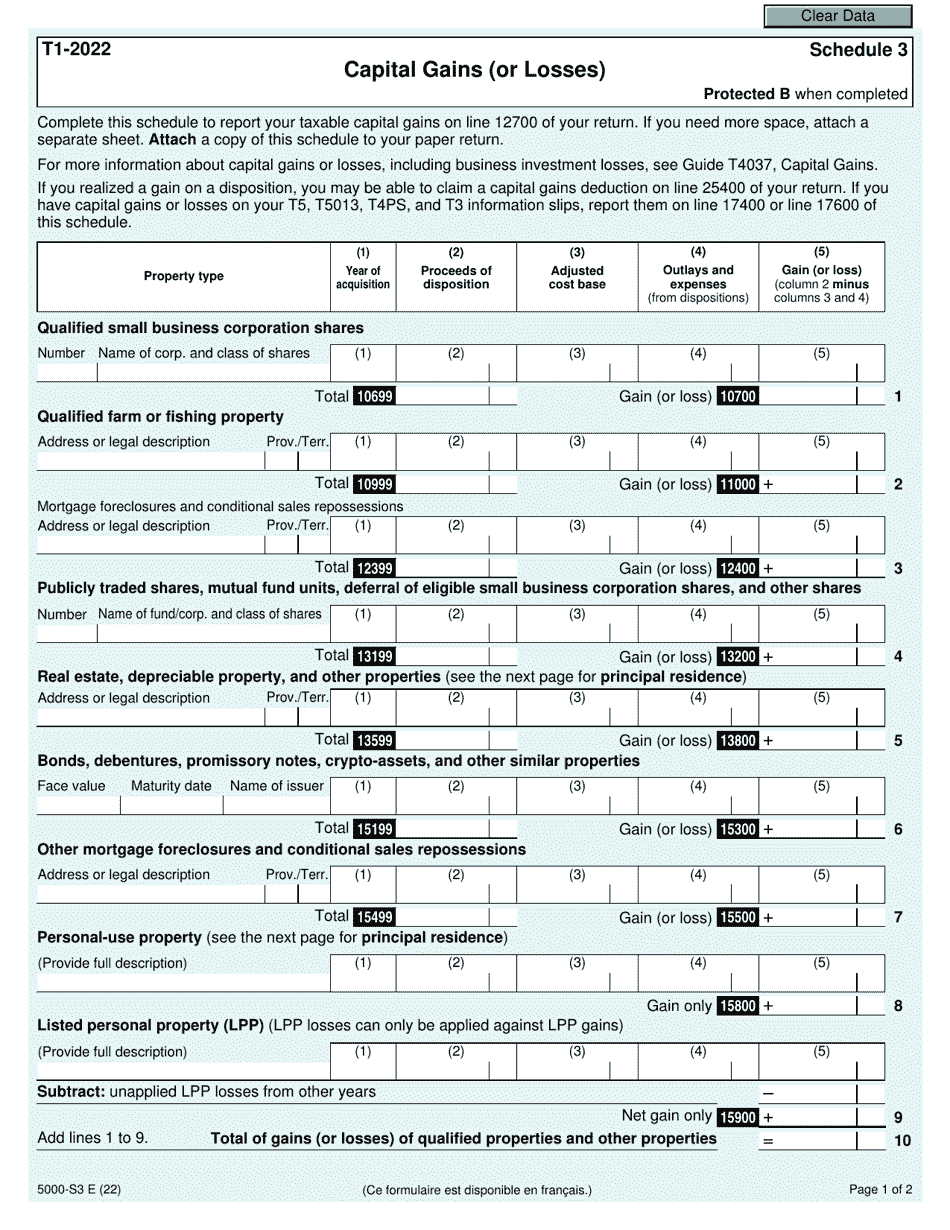

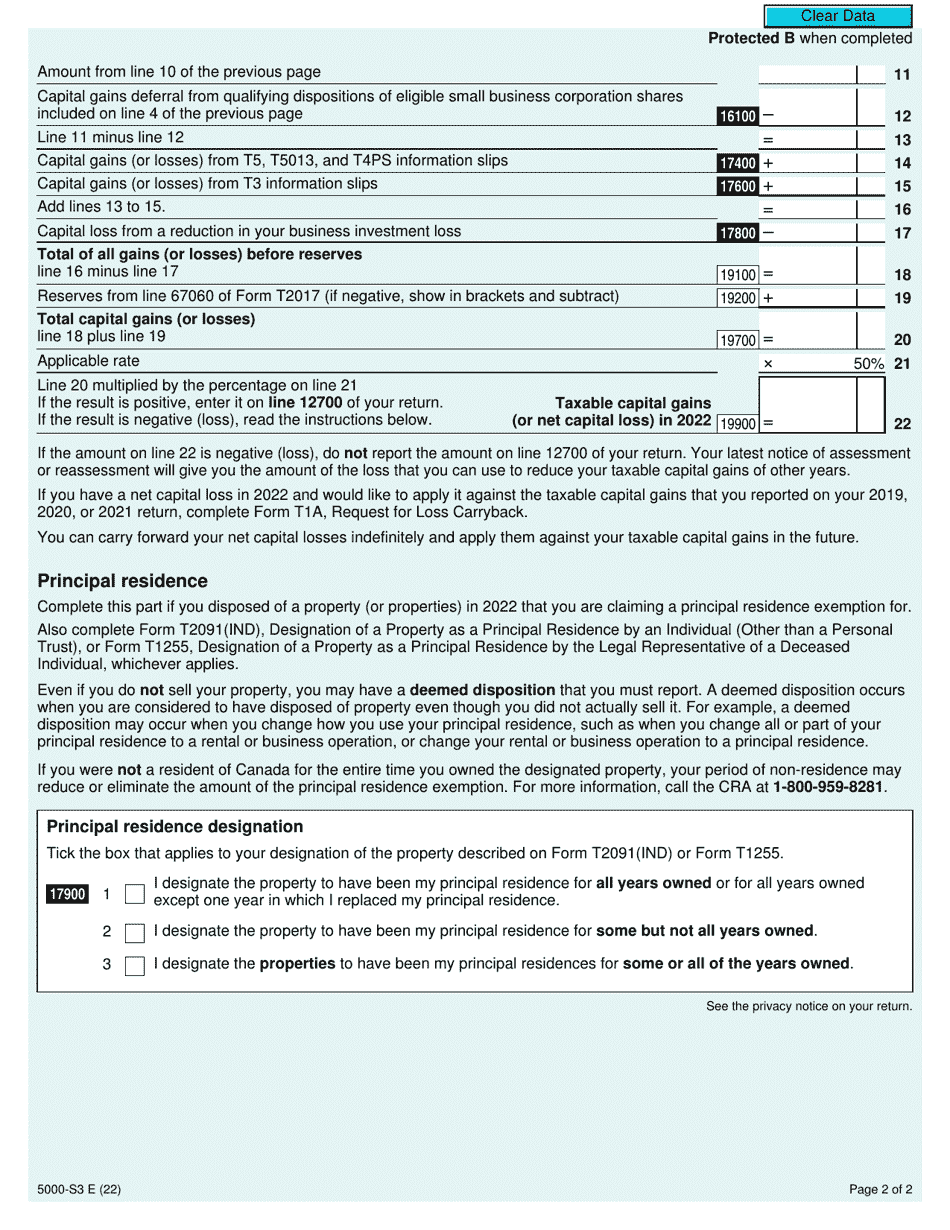

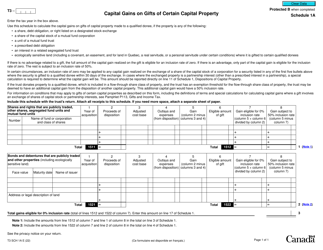

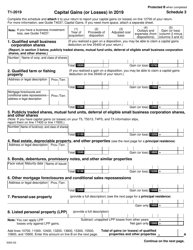

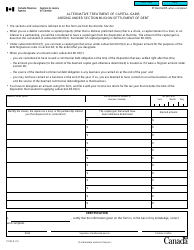

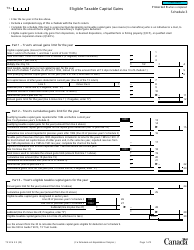

Form 5000-S3 Schedule 3

for the current year.

Form 5000-S3 Schedule 3 Capital Gains (Or Losses) - Canada

Form 5000-S3 Schedule 3 is used in Canada to report capital gains or losses from investments or property. It helps individuals calculate their taxable income and determine any taxes owed.

In Canada, individuals and corporations who have capital gains or losses must file the Form 5000-S3 Schedule 3 with the Canada Revenue Agency (CRA).

FAQ

Q: What is Form 5000-S3?

A: Form 5000-S3 is Schedule 3 for reporting capital gains or losses in Canada.

Q: What are capital gains?

A: Capital gains are the profits made from selling a capital asset, such as stocks, real estate, or businesses.

Q: What are capital losses?

A: Capital losses are the losses incurred from selling a capital asset for less than its original value.

Q: Why do I need to report capital gains or losses?

A: You need to report capital gains or losses for tax purposes to determine if you owe taxes on the gains or if you can deduct losses from other gains.

Q: What information do I need to fill out Schedule 3?

A: You will need details of the capital assets sold, including the date of acquisition and disposition, proceeds of disposition, and adjusted cost base.

Q: How do I calculate capital gains or losses?

A: To calculate capital gains or losses, subtract the adjusted cost base from the proceeds of disposition. If the result is positive, it is a capital gain. If negative, it is a capital loss.

Q: Are there any exemptions or deductions available for capital gains?

A: Yes, there are certain exemptions and deductions available for capital gains, such as the principal residence exemption and the lifetime capital gains deduction.

Q: Are there any penalties for not reporting capital gains or losses?

A: Yes, there can be penalties for not reporting capital gains or losses, including interest charges and potential audits by the CRA.

Q: Can I get help with filling out Form 5000-S3?

A: Yes, you can consult with a tax professional or use tax software to help you fill out Form 5000-S3.