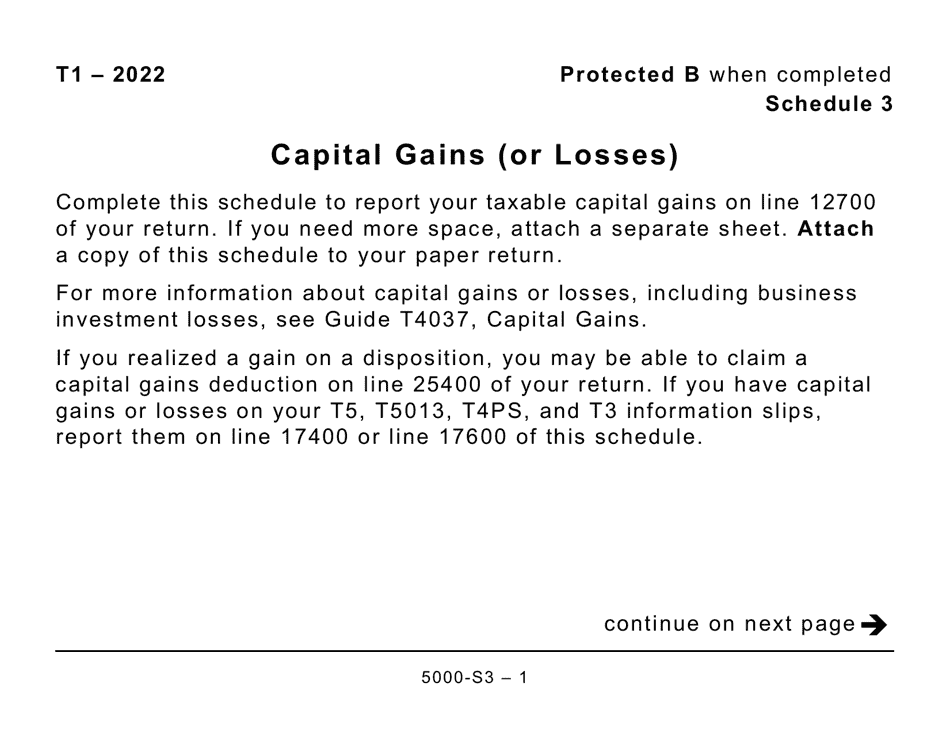

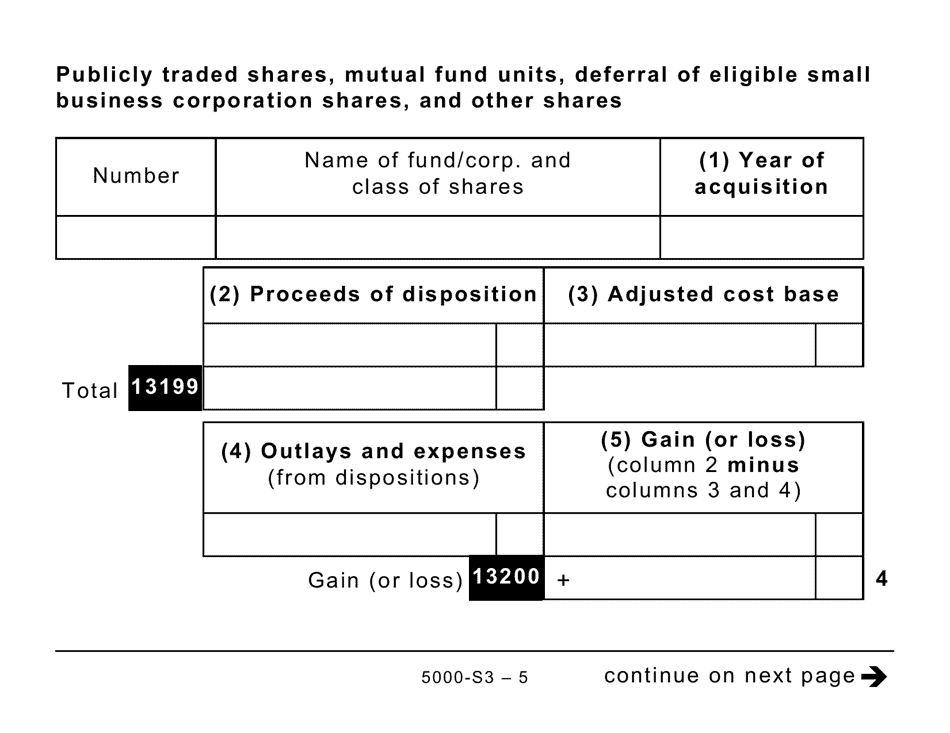

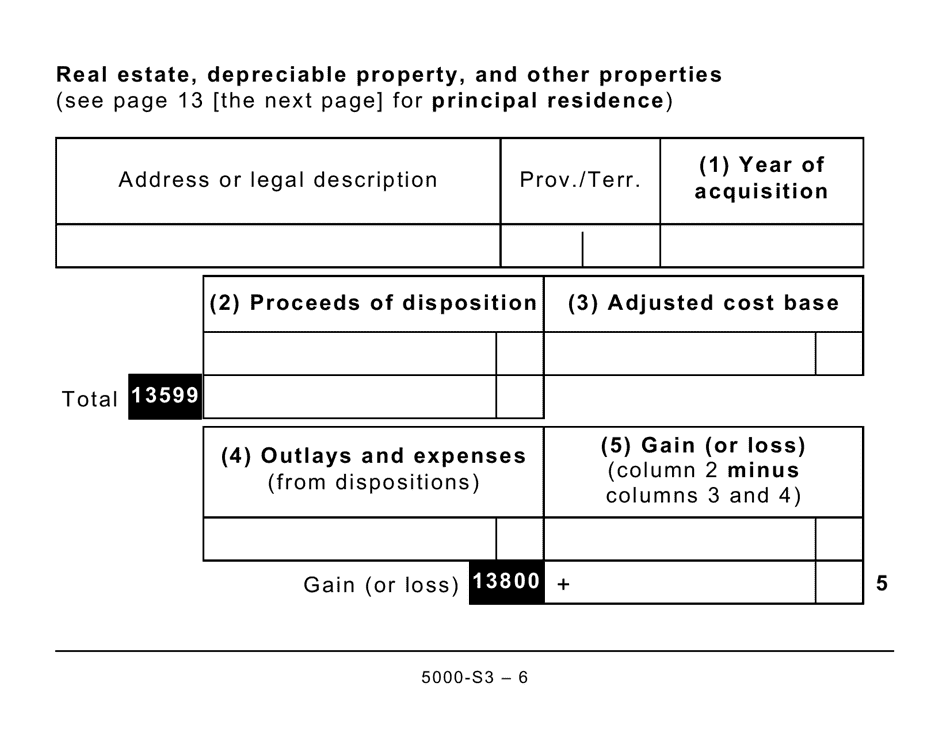

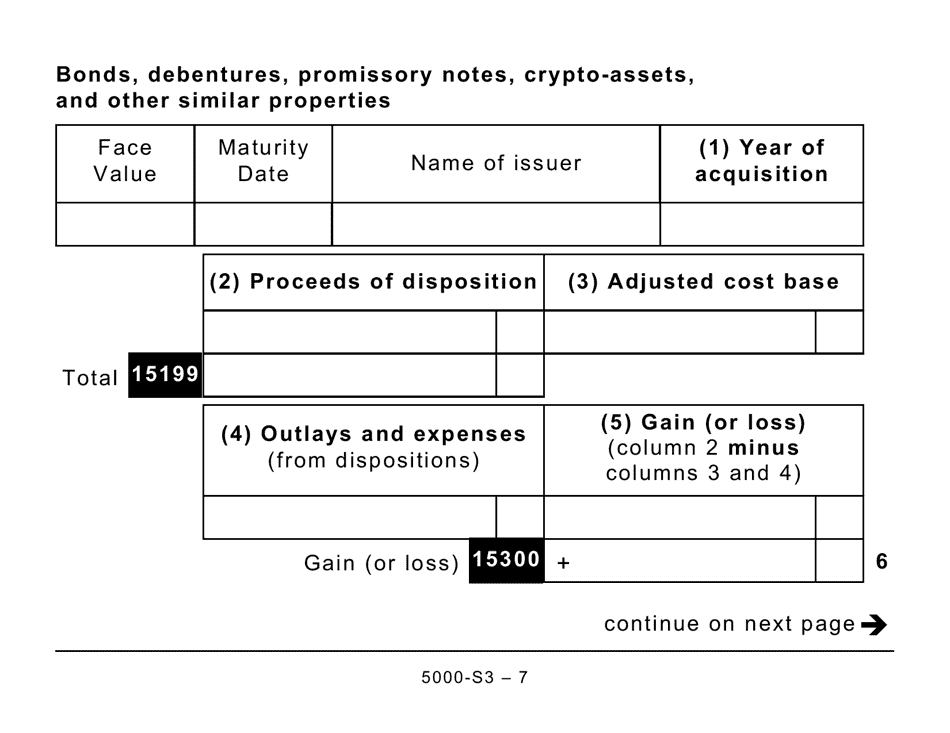

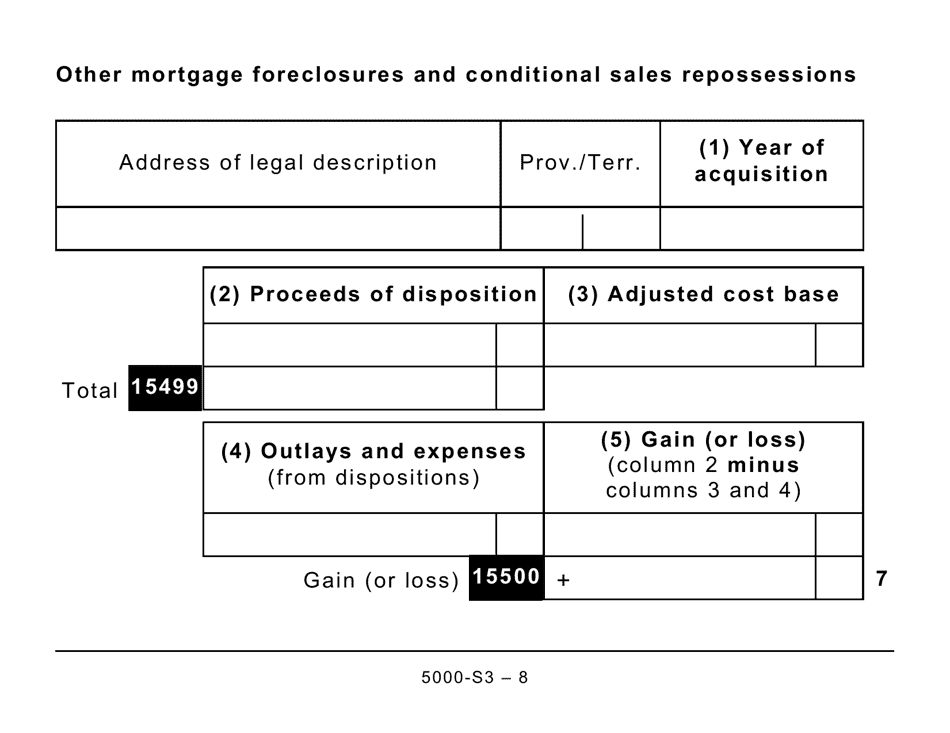

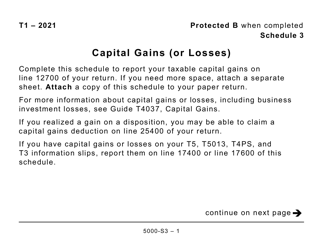

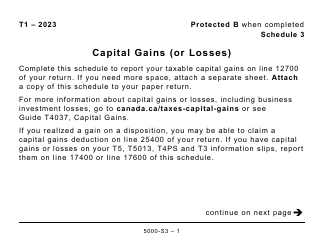

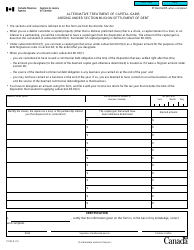

Form 5000-S3 Schedule 3 Capital Gains (Or Losses) - Large Print - Canada

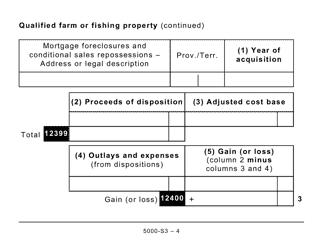

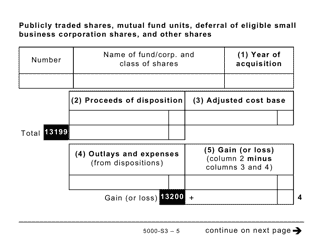

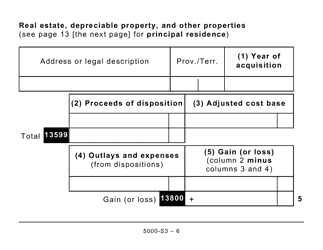

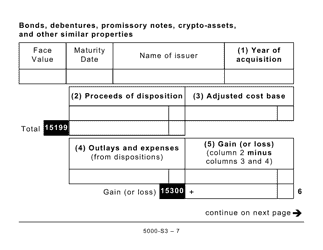

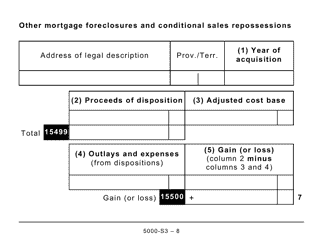

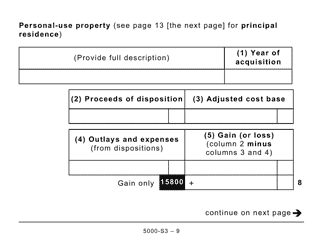

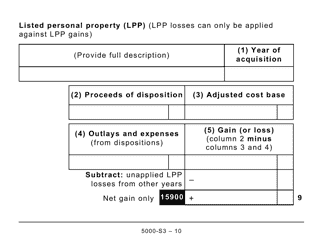

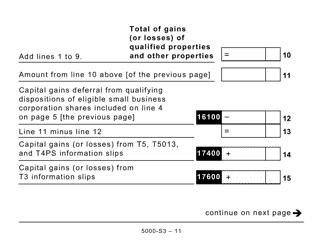

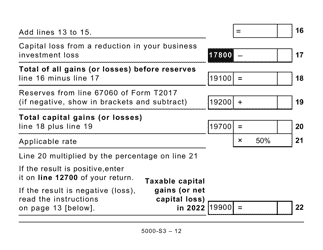

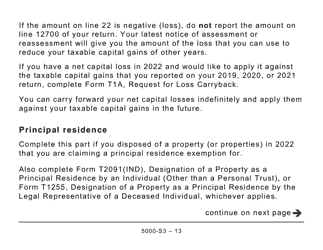

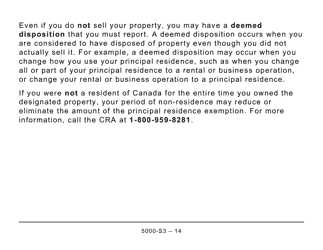

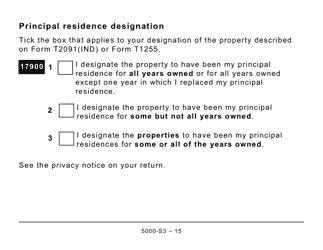

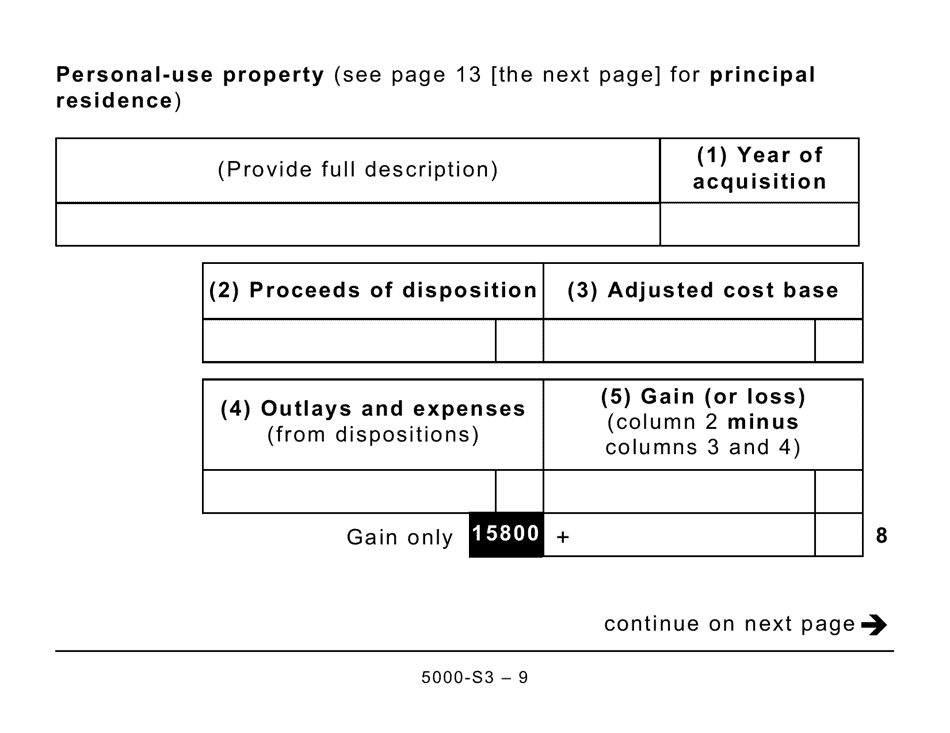

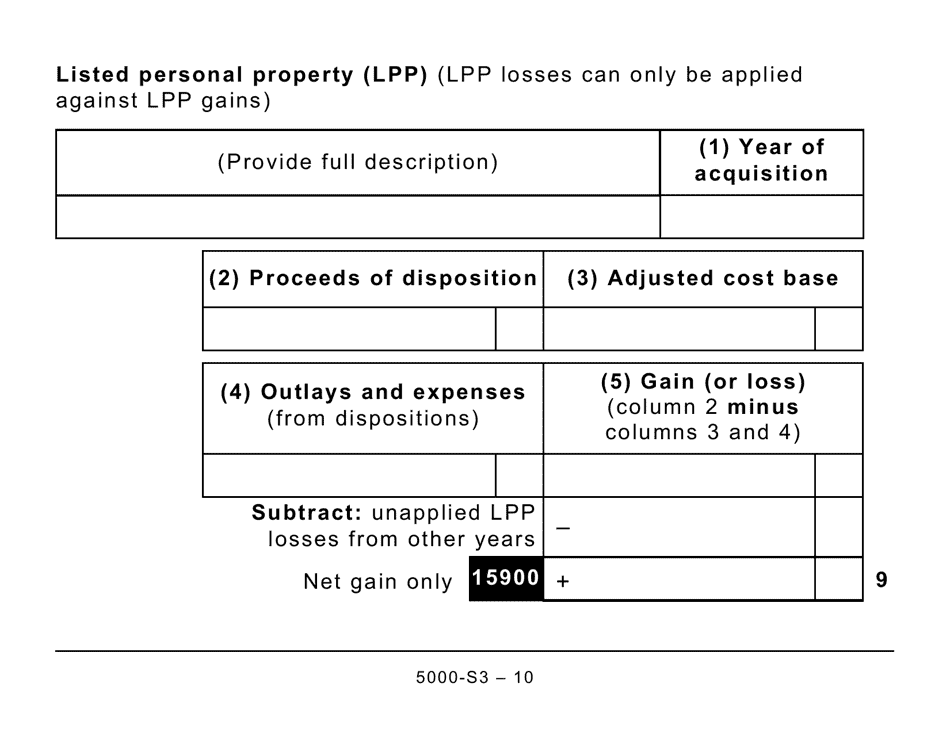

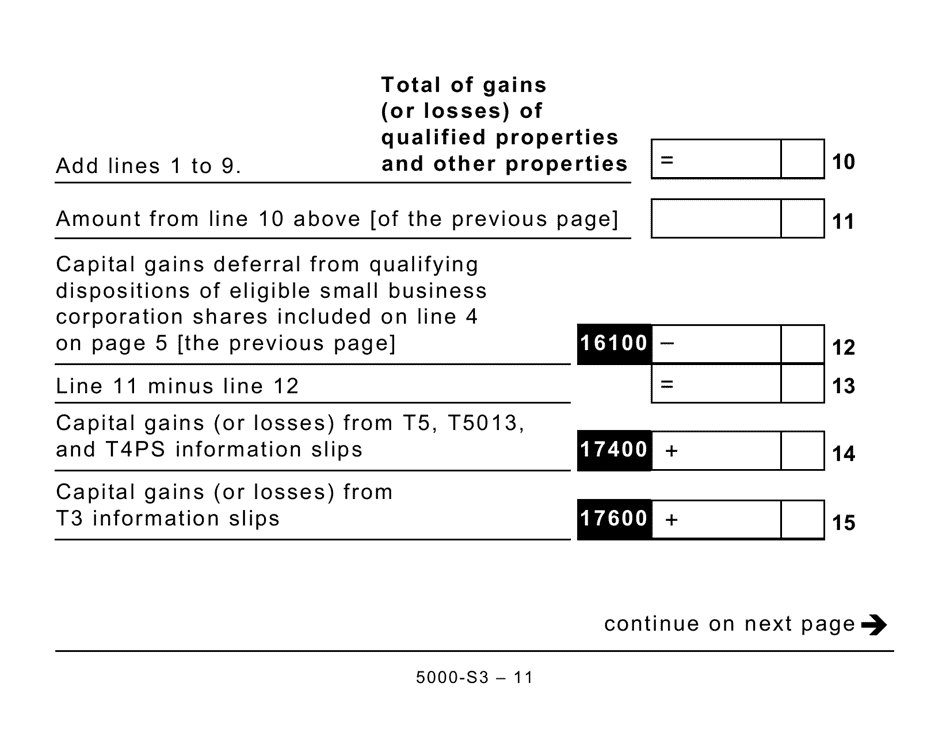

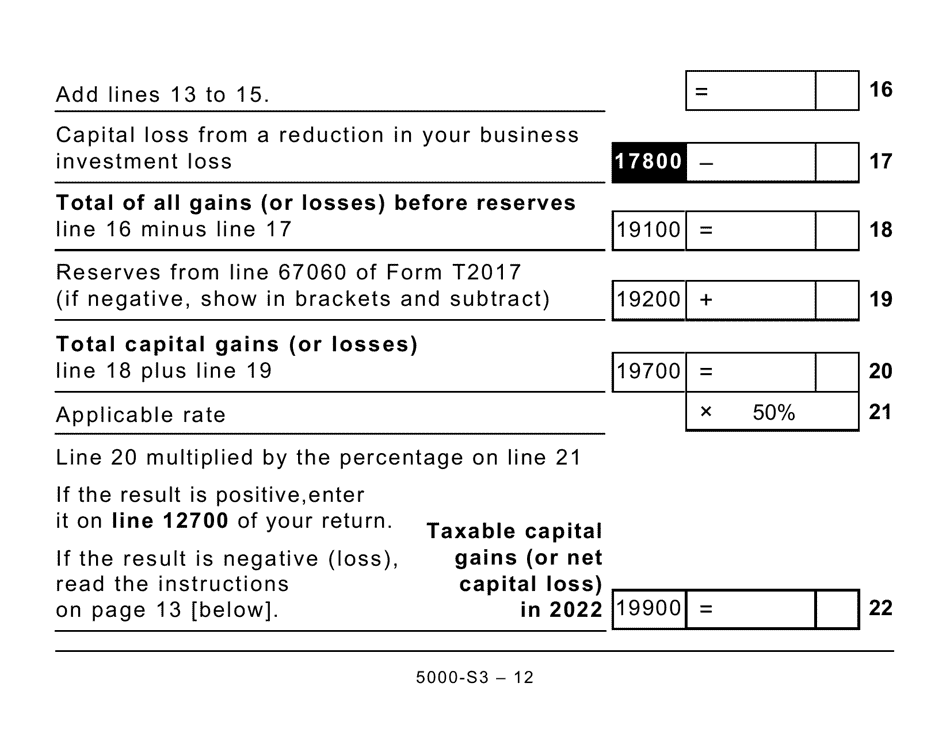

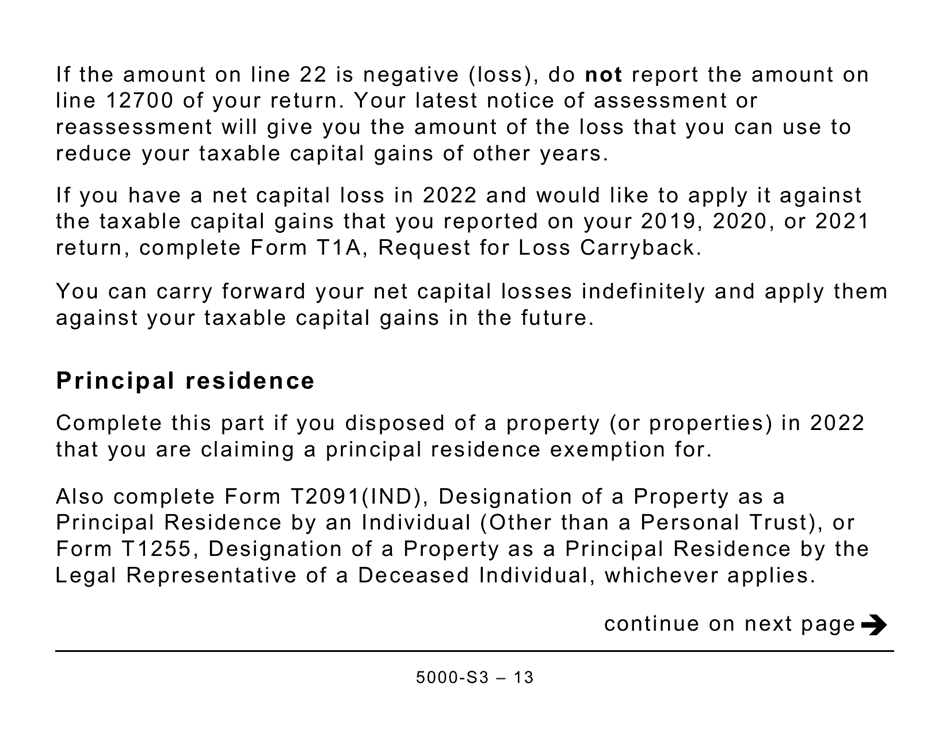

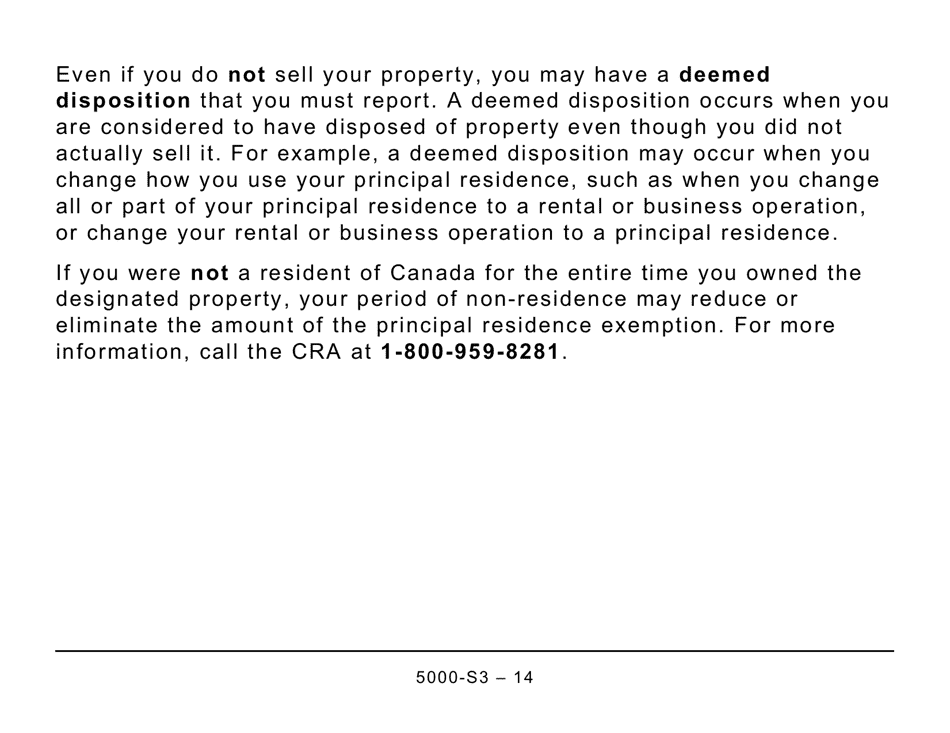

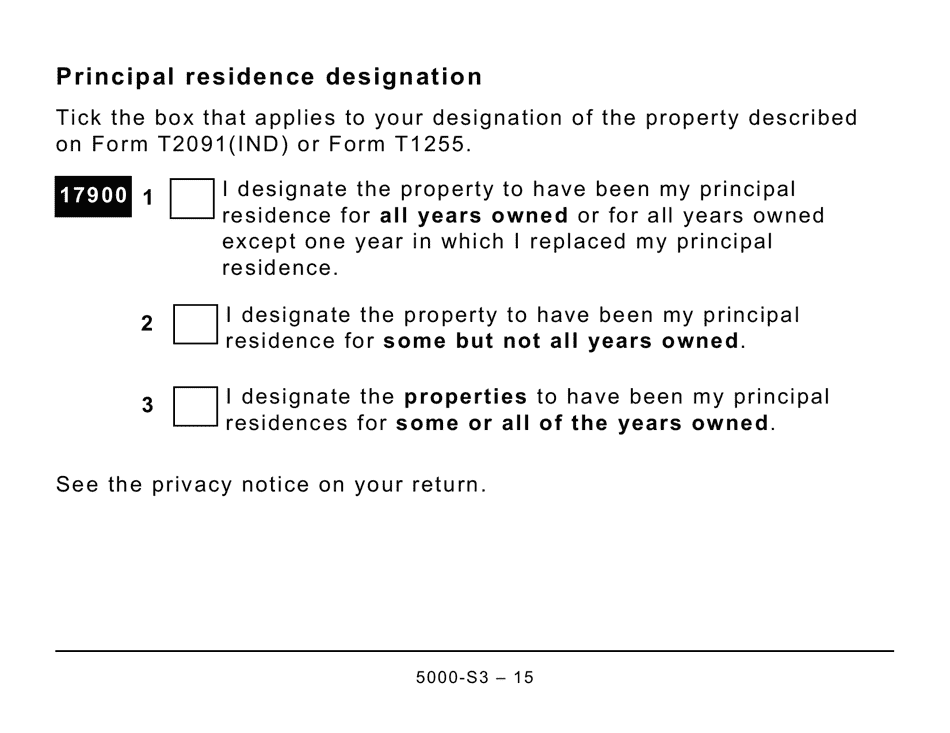

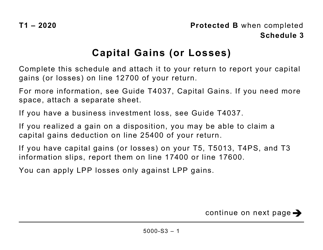

Form 5000-S3 Schedule 3 Capital Gains (Or Losses) - Large Print - Canada is used to report capital gains or losses on investments or property in Canada.

The Form 5000-S3 Schedule 3 Capital Gains (Or Losses) - Large Print in Canada is typically filed by individuals who have incurred capital gains or losses during the tax year.

FAQ

Q: What is Form 5000-S3?

A: Form 5000-S3 is a tax form used in Canada to report capital gains or losses.

Q: Who needs to fill out Form 5000-S3?

A: Individuals or businesses who have realized capital gains or losses during the tax year need to fill out Form 5000-S3.

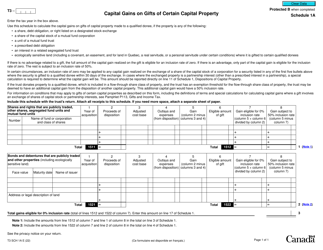

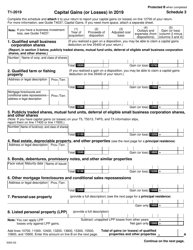

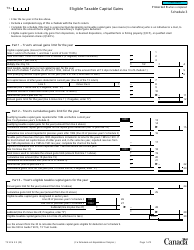

Q: What information do I need to fill out Form 5000-S3?

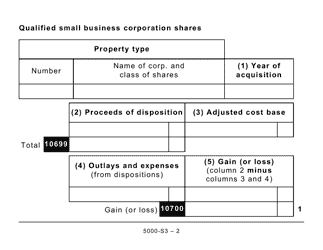

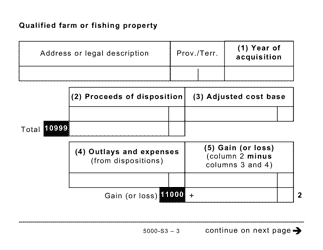

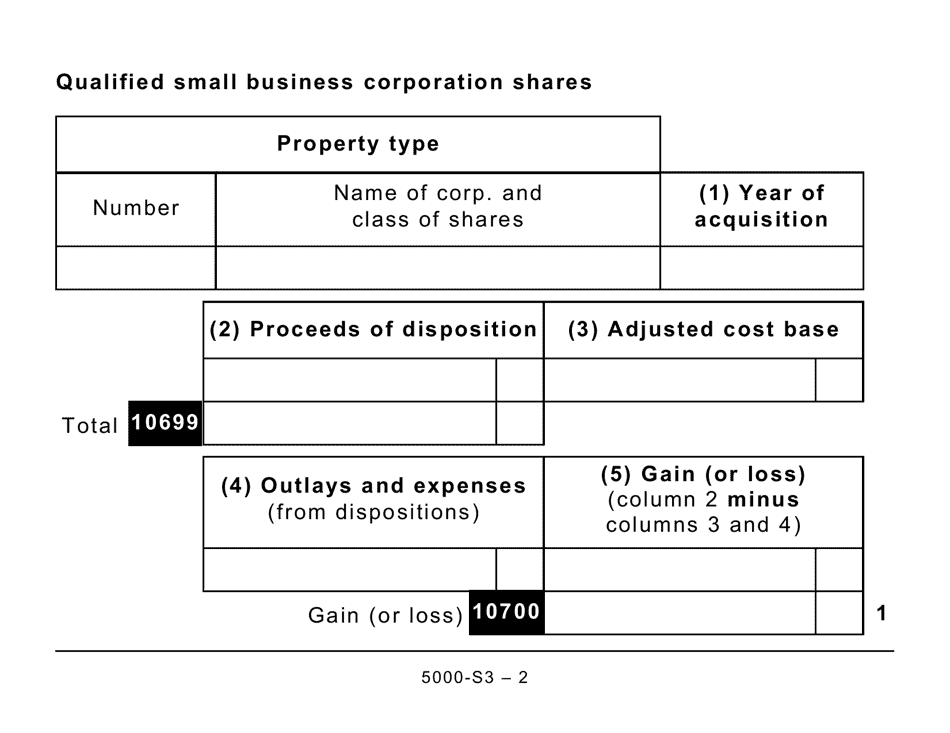

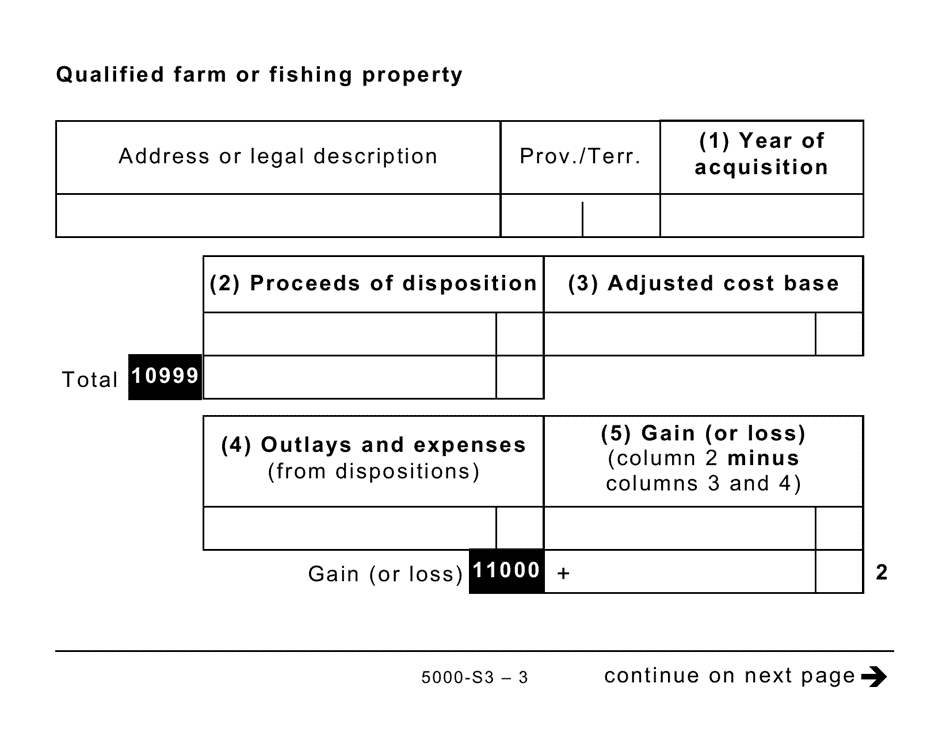

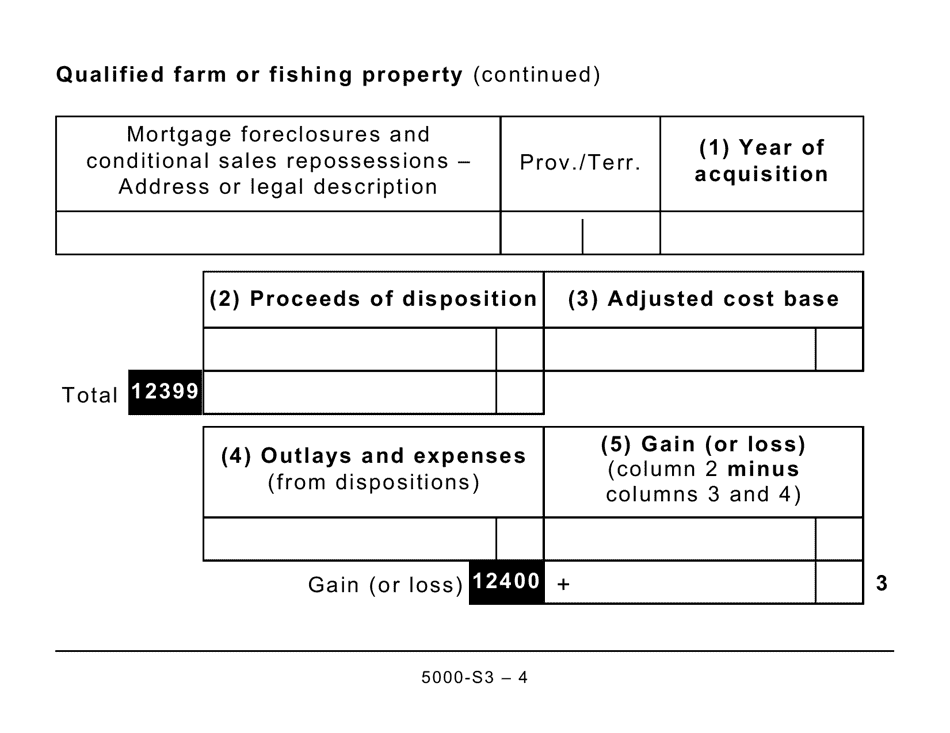

A: To fill out Form 5000-S3, you will need information about the investments or assets you sold, the purchase and sale dates, and the proceeds and costs of the transactions.

Q: Do I need to file Form 5000-S3 if I didn't have any capital gains or losses?

A: No, if you did not have any capital gains or losses during the tax year, you do not need to file Form 5000-S3.

Q: When is the deadline to file Form 5000-S3?

A: The deadline to file Form 5000-S3 is the same as the deadline for filing your income tax return, which is usually April 30th of the following year.

Q: What should I do if I made a mistake on Form 5000-S3?

A: If you made a mistake on Form 5000-S3, you can file an amended return to correct the error.